Europe Market Open: Cautious trade with mixed data in focus, DXY rangebound

13 May 2024, 06:40 by Newsquawk Desk

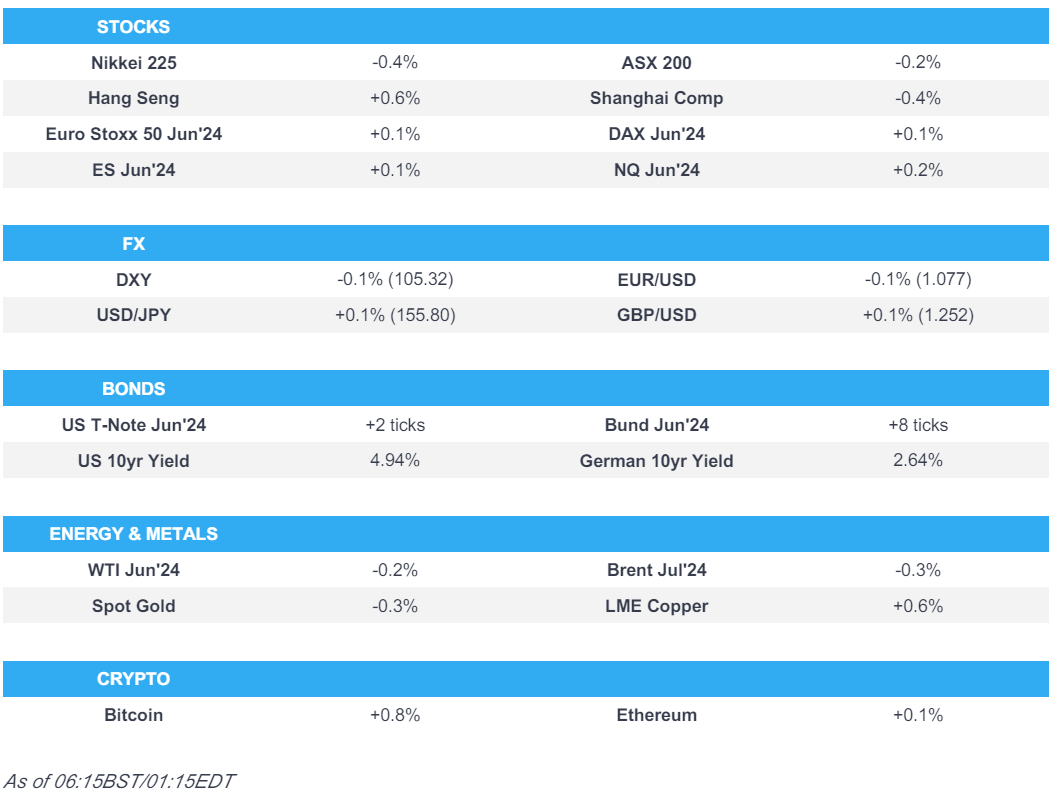

- Cautious APAC trade amid mixed data incl. Chinese CPI but with support from China's ultra-long issuance plans

- DXY rangebound with peers contained, NZD lags after cooler inflation projections

- JGBs pressured as the BoJ adjusted its 5-10yr bond buying operation for today

- Commodities attentive to mixed commentary from the Iraq Oil Minister, metals mixed

- Looking ahead, highlights include NY Fed Survey of Consumer Expectations Survey, Comments from Fed’s Mester & Jefferson, SNB’s Jordan, Earnings from Diploma

- Click here for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks were mixed on Friday in which most indices finished with mild gains but with price action choppy amid headwinds from a plunge in University of Michigan sentiment and a rise in inflation expectations, while treasuries sold off with the complex pressured pre-market after the latest UK GDP data exceeded expectations.

- S&P 500 +0.2%, Nasdaq 100 +0.3%, Dow Jones +0.3%, Russell 2000 -0.6%.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Bowman (voter) said on Friday that if the Fed forecasts unexpected shocks, that would be a case for rate cuts, but she does not see rate cuts warranted this year. Bowman said it will probably be a number of meetings before she is ready to endorse cuts and wants to see a number of months of better inflation data, according to Bloomberg.

- Fed's Goolsbee (non-voter) said on Friday that the 2% inflation target acts as an anchor on expectations and short-run expectations are not what matters, while Goolsbee reiterated data dependence and said given the uptick in inflation, the Fed has to wait and see on policy, according to Reuters.

- Fed's Kashkari (non-voter) said on Friday that the bar is high for another rate hike, but it cannot be ruled out, while he is cautious about how restrictive monetary policy is and is in wait-and-see mode regarding the future of monetary policy, according to CNBC.

- Apple (AAPL) reportedly closes in on a deal with OpenAI to put ChatGPT on the iPhone, according to Bloomberg. It was also reported that an Apple store in New Jersey voted against unionising, while an Apple store in Maryland voted to hold a strike with the date to be determined.

APAC TRADE

EQUITIES

- APAC stocks were mostly cautious after mixed inflation and soft financing data from China over the weekend, although Chinese markets found some solace from China's plans to issue ultra-long treasury bonds.

- ASX 200 was led lower by underperformance in the energy sector and amid a tepid NAB Business survey.

- Nikkei 225 lacked firm direction with price action choppy amid a slew of earnings releases.

- Hang Seng & Shanghai Comp were initially pressured after mixed inflation data and disappointing financing data which showed a rare contraction in Aggregate Financing, while expectations of increased US tariffs on Chinese EVs also provided early headwinds. However, the Hong Kong benchmark then recovered and climbed above the 19,000 level amid tech strength, while the mainland pared the majority of its losses as the attention turned to China's plans to issue ultra-long treasury bonds on May 17th.

- US equity futures traded sideways amid a lack firm commitment ahead of upcoming key data releases.

- European equity futures indicate a flat to incrementally firmer open with Euro Stoxx 50 futures near the unchanged mark after the cash market closed higher by 0.6% on Friday.

FX

- DXY was rangebound after a quiet weekend of newsflow from the US and ahead of this week's key events including US CPI, PPI and Retail Sales data, as well as comments from Fed Chair Powell.

- EUR/USD traded quietly with flash GDP/employment due mid-week the data highlight for the EU.

- GBP/USD kept within a tight range with nearby resistance seen at the 200DMA level of 1.2540.

- USD/JPY returned to flat territory and only briefly wobbled after the BoJ reduced its purchases of 5yr-10yr JGBs.

- Antipodeans softened amid the cautious risk appetite and after the PBoC set a weaker reference rate setting, while NZD/USD was also momentarily pressured by softer New Zealand 2-yr inflation expectations.

- PBoC set USD/CNY mid-point at 7.1030 vs exp. 7.2284 (prev. 7.1011).

FIXED INCOME

- 10-year UST futures traded rangebound after retreating late last week on rising consumer inflation expectations.

- Bund futures got some slight respite from recent selling although the rebound was limited and prices remained sub-131.00.

- 10-year JGB futures were pressured after the BoJ reduced the amount of 5yr-10yr bond purchases to JPY 425bln from JPY 475bln in today's Rinban operations.

COMMODITIES

- Crude futures were lacklustre after last Friday's slump and following mixed messages from Iraq's Oil Minister who initially stated that Iraq had made enough voluntary production cuts and would not agree to any future reduction taken by OPEC, before backtracking.

- Iraqi Oil Minister said on Saturday that Iraq has made enough voluntary production cuts and will not agree to any future reduction taken by OPEC. However, it was reported on Sunday that the Oil Minister said the voluntary oil output cut is subject to agreement between OPEC countries and any negotiable proposals may be presented at the time, while he added they are part of OPEC and it is necessary to comply with any decisions made by the organisation. The state news agency also reported the Oil Minister said Iraq is committed to voluntary output cuts made by OPEC members and is keen on cooperating with members to achieve more stability in global oil markets.

- Iraqi Oil Ministry launched 29 oil and gas projects within the fifth and sixth licensing rounds.

- Qatar set June marine crude OSP at Oman/Dubai plus USD 1.75/bbl and land crude OSP was set at Oman/Dubai plus USD 0.85/bbl, according to a pricing document.

- QatarEnergy is to acquire two new exploration blocks offshore Egypt in which it signed a farm-in agreement with ExxonMobil (XOM) to acquire a 40% participating interest in the exploration blocks.

- Russian Deputy PM Novak said Russia will be able to increase fuel output in the future, according to TASS.

- Spot gold lacked firm direction amid a steady dollar ahead of this week's key data releases from the US.

- Copper futures were initially pressured amid the dampened risk tone and weak financing data from China but then gradually clawed back losses as sentiment in China improved.

CRYPTO

- Bitcoin trickled lower overnight and briefly dipped beneath the USD 61,000 level.

NOTABLE ASIA-PAC HEADLINES

- Chinese authorities kicked off plans to sell USD 140bln of long-dated bonds, according to the FT. It was later reported that China's Finance Ministry is to issue ultra-long treasury bonds on May 17th in which it plans to issue 20yr, 30-year and 50-year treasuries worth CNY 300bln, CNY 600bln and CNY 100bln, respectively, while it plans to complete the issuance of long-term treasury bonds by end-November.

- Country Garden (2007 HK) said it repaid onshore coupons within the grace period, according to Reuters.

- BoJ offered to buy JPY 375bln in 1-3yr JGBs, JPY 425bln in 5-10yr JGBs and JPY 150bln in 10-25yr JGBs (reduced 5yr-10yr purchases from a previous JPY 475bln).

- Australia’s government cut its 2024/2025 real GDP growth forecast to 2% from 2.25% and cut its 2025/2026 growth forecast to 2.25% from 2.50%, while it said inflation could slow to the RBA’s 2%-3% target range by year-end which is sooner than previously expected, according to Reuters.

DATA RECAP

- Chinese CPI MM (Apr) 0.1% vs. Exp. -0.1% (Prev. -1.0%); YY 0.3% vs. Exp. 0.2% (Prev. 0.1%)

- Chinese PPI YY (Apr) -2.5% vs. Exp. -2.3% (Prev. -2.8%)

- Chinese New Yuan Loans (CNY)(Apr) 730B vs Exp. 800B (Prev. 3090B)

- Chinese Aggregate Financing (CNY)(Apr) -200B vs Exp. 1000B (Prev. 4870B)

- Chinese Money Supply M2 YY (Apr) 7.2% vs Exp. 8.3% (Prev. 8.3%)

- Australian NAB Business Confidence (Apr) 1.0 (Prev. 1.0); Conditions (Apr) 7.0 (Prev. 9.0)

- New Zealand 2-year Inflation Forecast (Q2) Q1 2.33% (Prev. 2.5%); 1-year Inflation Forecast (Q2) Q1 2.73% (Prev. 3.22%)

GEOPOLITICS

MIDDLE EAST

- Israel’s IDF said it ordered residents of additional east Rafah areas to evacuate and head to the humanitarian zone in Al-Mawasi, according to Reuters.

- Israeli military spokesperson said Hamas has been trying to re-establish military capabilities in Gaza’s Jabalia and Israel is trying to prevent that, while it announced that Israeli forces in Gaza’s Zeitun killed 30 Palestinian militants. It was separately reported that Israel's military opened a new crossing into the Gaza Strip in coordination with the US government for humanitarian aid, according to Reuters.

- US State Department said Secretary of State Blinken stressed to Israeli Defence Minister Gallant the urgent need to protect civilians and aid workers in Gaza and urged to ensure humanitarian access to Gaza, while Blinken reaffirmed to Gallant US opposition to a major ground military operation in Rafah, according to Al Jazeera and Sky News Arabia.

OTHER

- Ukrainian President Zelensky said battles are ongoing at seven border villages in Kharkiv and the Donetsk situation is particularly tense, while Ukraine’s military chief said fighting is ongoing and warned of a difficult situation in the Kharkiv region, according to Reuters.

- Ukrainian shelling killed at least 9 people and injured more than a dozen in an apartment block collapse in Russia’s Belgorod, according to Reuters.

- Russian President Putin conducted a surprise reshuffle of top security officials whereby he removed Patrushev as head of the Security Council who will be moved to a new job and proposed that Defence Minister Shoigu become the new head of the Security Council, while he proposed economic adviser Belousov to become the new Defence Minister, according to FT.

- Russian Defence Ministry said its forces have taken five settlements in Ukraine’s Kharkiv region.

EU/UK

NOTABLE HEADLINES

- UK PM Sunak is set to declare the UK stands 'at a crossroads' as he readies the Tories ahead of an election, according to FT.

- Socialists were ahead in the Catalan regional election with 41 seats out of the 135-seat chamber and separatists Junts were second with 36 seats after 91% of votes were counted, according to Reuters.

- S&P affirmed Poland at A-; Outlook Stable.