US Market Open: Equities firmer, GBP benefits post-GDP ahead of a slew of Fed speakers & ECB Minutes

10 May 2024, 10:58 by Newsquawk Desk

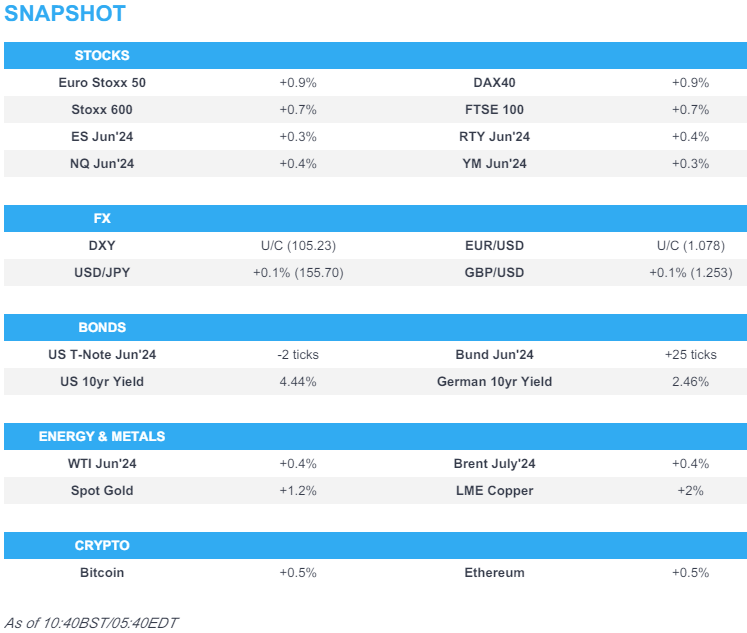

- European bourses extend to session highs, whilst US futures post modest gains

- Dollar is flat & GBP marginally outperforms post-GDP

- USTs are flat, EGBs bid though to a lesser degree than Gilts, which have shrugged off hawkish GDP data

- Crude is firmer with specifics light, XAU extends to highs and base metals benefit from the risk tone

- Looking ahead, Canadian Jobs Data, BoC SLOOS, Chinese Money Supply, Comments from ECB’s Elderson, BoE’s Pill, Fed’s Goolsbee, Bowman, Logan, Kashkari & Barr.

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (+0.7%) are entirely in the green, taking the lead from a mostly positive APAC session. Both the FTSE 100 and the DAX 40 made fresh ATHs today.

- European sectors hold a strong positive tilt, with the exception of Autos and Media, with the former continuing the losses seen in the prior session. Utilities takes the top spot, lifted by post-earning strength in Enel (+3.6%) and EDP (+2.5%).

- US Equity Futures (ES +0.3%, NQ +0.3%, RTY +0.4%) are entirely in the green, albeit modestly so, attempting to build on yesterday’s advances.

- Click here and here for the sessions European pre-market equity newsflow.

- Click here for more details.

FX

- Steady trade for the USD after yesterday's data-induced losses dragged DXY to a low of 105.20. Uni. of Michigan is the main data highlight but is very much in the shadow of next week's CPI print. If DXY trundles lower once again, support ahead of the 105 mark comes via the 7th May low at 105.03.

- EUR is steady vs. the USD with EZ drivers once again lacking in today's session. EUR/USD made an incremental high at 1.0786 but catalysts today for a push beyond 1.08 are not obvious. ECB Minutes due at 12:30 BST / 07:30 EDT.

- GBP is the marginal best performer across the majors following hotter-than-expected UK GDP metrics which sent GBP/USD higher from 1.2519 to a 1.2540 peak before running into resistance at the 200DMA.

- USD/JPY's ascent has once again continued after a brief blip yesterday in a week that has seen jawboning from officials fail to stop the rot. The next inflection point will likely be US CPI data.

- Antipodeans are both marginally softer vs. the USD after benefitting yesterday from the dollar's post-data selling pressure. AUD/USD remains on a 0.66 handle in quiet newsflow with the monthly high at 0.6647.

- NOK: A slightly hotter than expected CPI which has sparked some modest NOK strength, sending EUR/NOK lower from 11.6940 to 1.6820.

- PBoC set USD/CNY mid-point at 7.1011 vs exp. 7.2102 (prev. 7.1028).

- CNB Minutes (May): Easing process could be paused/terminated at any point at still restrictive levels. Holub & Frait mentioned the possibility of 75bp of easing, ultimately went for 50bp

- Click here for more details.

- Click here for OpEx details.

FIXED INCOME

- USTs are flat with specifics light thus far though the docket ahead is packed with multiple Fed speakers. USTs are holding at 109-03+ matching yesterday's auction-driven high but still a handful of ticks shy of the WTD peak at 109-09.

- Gilts gapped higher by 15 ticks despite hawkish direction from the strong UK GDP numbers earlier in the morning. Upside which has continued and extended to a 98.29 fresh WTD high as markets digest the BoE beginning to thread-the-needle to a first cut in the near term.

- Bunds are bid but to a slightly lesser degree than Gilts with specifics light thus far. Upside which has paused at a 131.40 peak shy of 131.63-86 from earlier in the week.

- Italy sells EUR 9.25bln vs exp. EUR 7.5-9.25bln 2.95% 2027, 1.10% 2027, 3.45% 2031, 5.00% 2040, 2.15% 2072 BTP.

- Orders for Italy's BTP Valore reach EUR 11bln (circa. EUR 10bln on Thursday). Books close at 12:00BST

- Click here for more details.

COMMODITIES

- Crude benchmarks in the green but only modestly so as markets await an update to the Israel-Hamas situation after hostage negotiations ended and Israel pledged to continued with its operation in Rafah. Brent July off best levels and currently resides around USD 84.20/bbl.

- Precious metals are supported and seemingly benefitting from the modestly bullish tone for fixed income thus far. XAU up to a USD 2370/oz peak thus far, eclipsing the 21-DMA of USD 2337/oz with ease and bringing USD 2400/oz and then USD 2431/oz into view.

- Base metals are firmer, lifted by the broader risk tone and somewhat softer Dollar; though Aluminium is the standout laggard after a sizeable LME stock update of +424k (prev. -2.75k).

- Saudi's crude oil supply to China to fall by 5.8mln/bbl in June vs May, via Reuters citing sources.

- LME Stocks: Aluminium +424k (prev. -2.75k)

- Click here for more details.

DATA RECAP

- UK GDP Estimate MM (Mar) 0.4% vs. Exp. 0.10% (Prev. 0.10%, Rev. 0.2%); YY 0.7% vs. Exp. 0.30% (Prev. -0.20%, Rev. 0.0%). Click here for more details.

- UK GDP Prelim QQ (Q1) 0.6% vs. Exp. 0.4% (Prev. -0.3%); YY 0.2% (Prev. -0.2%)

- Italian Industrial Output MM SA (Mar) -0.5% vs. Exp. 0.3% (Prev. 0.1%); Industrial Output YY WDA (Mar) -3.5% (Prev. -3.1%)

- *Norwegian Core Inflation YY (Apr) 4.4% vs. Exp. 4.3% (Prev. 4.5%)**; Consumer Price Index YY (Apr) 3.6% vs. Exp. 3.5% (Prev. 3.9%)

- Hungarian CPI YY (Apr) 3.7% vs. Exp. 3.7% (Prev. 3.6%)

NOTABLE EUROPEAN HEADLINES

- UBS expects the BoE to start cutting interest rates in June (prev. expected Aug)

- Over one in two firms with Germany's residential construction sector reported a lack of orders in April, via Ifo; 55.2% (prev. 56.2%) reported this

NOTABLE US HEADLINES

- China CPCA said China sold 1.55mln passenger cars in April, -5.8% Y/Y; Tesla (TSLA) exported 30,746 China-made vehicles in Apr

- US Treasury Secretary Yellen said inflation has come down substantially but is not where it needs to be, according to a Marketplace interview.

- White House is poised to nominate Kristin Johnson to fill a top role at the Treasury overseeing banks, according to Bloomberg citing sources.

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said they have destroyed 20 of Hamas's 24 battalions so far and hopes he and US President Biden can overcome disagreements, while he added that they have to defeat Hamas in Rafah.

- Israel's army reportedly carried out bombing operations on buildings east of Rafah in the southern Gaza Strip, according to Al Jazeera.

- US State Department said Secretary of State Blinken confirmed to his Egyptian counterpart US President Biden's "clear" position not to support the Rafah operation, according to Al Arabiya.

- US Secretary of State Blinken is expected to submit Israel conduct report to Congress today and is expected to criticise Israel but say it isn't breaking weapons terms, according to Axios.

- Group of 20 US Senators introduced a bill that would restrict funding to the UN or any organisation that gives the Palestinian Authority higher than observer status, according to Asharq News.

CRYPTO

- Bitcoin is incrementally firmer and resides just below USD 63k, whilst Ethereum reclaims USD 3k.

APAC TRADE

- APAC stocks mostly tracked the gains in the US where a rise in initial jobless claims spurred a dovish reaction.

- ASX 200 was led by energy, telecoms and financials but with gains capped amid mixed consumer stocks.

- Nikkei 225 rallied at the open but then slipped from intraday highs with participants reflecting on Household Spending data, US-China and tensions and amid a busy day of earnings releases for Japan.

- Hang Seng & Shanghai Comp traded mixed with Hong Kong stocks surging on reports China is considering a proposal to exempt individual investors from paying dividend taxes on Hong Kong stocks bought via the Stock Connect, while the mainland faded its initial gains with the US reportedly set to impose tariffs on China EVs and key sectors after a review which could be announced as soon as next week.

NOTABLE ASIA-PAC HEADLINES

- US is set to impose tariffs on China EVs and key sectors after its Section 301 review as early as next week, according to Bloomberg.

- China is unlikely to lift home purchase restrictions completely, according to CCTV.

- Honda (7267 JT) FY (JPY): Pretax profit 1.64tln, +86.7% Y/Y, Op. Profit 1.38tln, +77% Y/Y; says it will buy back of up to 3.7% of own shares worth JPY 300bln.

- Earthquake felt in Taiwan's capital Taipei; magnitude 5.7, via EMSC.

- China Auto Industry CPCA says market sluggishness was worse than expected while some automakers still derived to produce and resulted in rising inventories at dealerships

DATA RECAP

- Japanese All Household Spending MM (Mar) 1.2% vs. Exp. -0.3% (Prev. 1.4%); YY -1.2% vs. Exp. -2.4% (Prev. -0.5%)