US Market Open: US equity futures lower, Gilts pressured ahead of the BoE and USD/JPY nears 156

09 May 2024, 11:19 by Newsquawk Desk

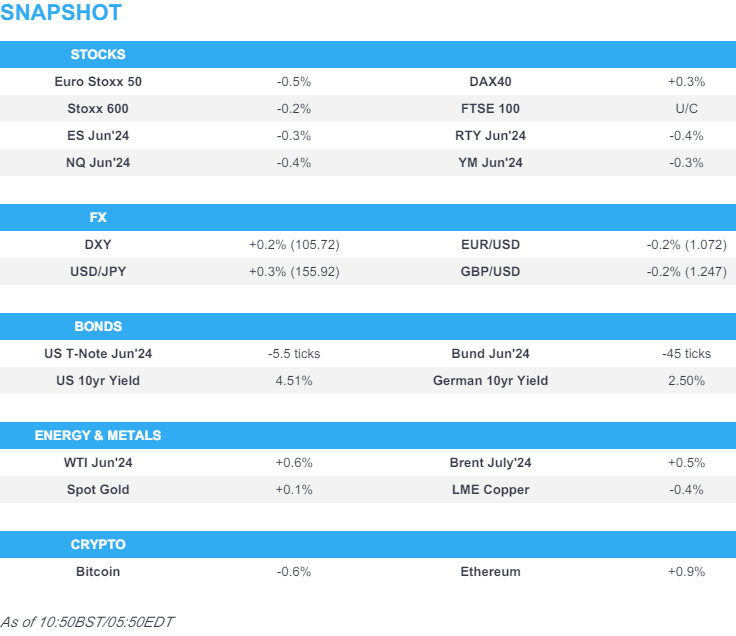

- European equities are mixed, Stateside futures lower with slight underperformance in the RTY

- Dollar is firmer, G10s in the red and USD/JPY now just shy of 156.00

- Bonds pressured in a continuation of recent action; Gilts underperform slightly ahead of the BoE

- Crude is firmer, XAU flat and base metals mostly lower

- Looking ahead, US IJC, NZ Manufacturing PMI, BoE Policy Announcement, BoE DMP, Banxico Policy Announcement, Comments from Fed's Daly, BoE’s Bailey & Pill, ECB’s Cipollone & de Guindos

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (-0.2%) are mixed and unable to find direction, taking lead from an indecisive session in APAC trade with newsflow somewhat light thus far on account of Ascension Day.

- European sectors are mixed and with the breadth of the market fairly narrow, though with the exception of Autos, which has been weighed on by Mercedes-Benz (-5.5%). Energy is found at the top of the pile, propped up by broader strength in crude prices.

- US Equity Futures (ES -0.2%, NQ -0.3%, RTY -0.5%) are in the red, with slight underperformance in the RTY continuing the weakness seen in the prior session. In terms of stock specifics, Arm (-9%) is lower in the pre-market, despite beating on top/bottom line, though its guidance failed to impress investors & Tesla (-1.5%) on reports around China job reductions.

- Goldman Sachs raises 12-month FTSE 100 cash target to 8,800 from 8,200 (last close 8,354)

- Click here and here for the sessions European pre-market equity newsflow.

- Click here for more details.

FX

- USD is firmer vs. all peers in quiet newsflow with the DXY eclipsing yesterday's 105.64 best. Interim resistance ahead of the 106 mark comes via the 2nd May high at 105.89.

- EUR is once again on the backfoot vs. the USD in a third consecutive session of losses. Currently trading within a 1.0751-27 range.

- Pound is softer vs. the broadly stronger USD but flat vs. the EUR. BoE looming large for the pair with markets on the lookout for any hints of a move in June. If this materialises, yesterday's low sits at 1.2468 with the MTD low just below at 1.2466. To the upside, 1.25 would be the immediate target with the 200DMA at 1.2542.

- JPY unaffected by ongoing jawboning from Japanese officials and is the marginal laggard across the majors. 155.84 the session high thus far for USD/JPY.

- Antipodeans are both relatively contained vs. the USD with macro drivers on the light side. AUD/USD is consolidating around its 100DMA after two sessions of losses and respecting yesterday's 0.6557-99 range. NZD/USD a touch softer.

- PBoC set USD/CNY mid-point at 7.1028 vs exp. 7.2238 (prev. 7.1016).

- Brazil Central Bank cut the Selic rate by 25bps to 10.50%, as expected, whereby 5 members voted in favour of a 25bps cut and 4 members voted for a 50bps reduction. The committee unanimously judged that the uncertain global scenario and the domestic scenario, marked by resilient economic activity and de-anchored expectations, require greater caution. It also stated that monetary policy should continue being contractionary until the consolidation of both the disinflation process and the anchoring of expectations around the targets.

- Click here for more details.

- Click here for OpEx details.

FIXED INCOME

- USTs are softer, in a continuation of the general bearish tone that was in place yesterday and one that appears to be driven by a pause-for-breath from the post-NFP move, lack of geopolitical escalation, relatively average 10yr before today's 30yr and an increase in corporate issuance activity.

- Gilts are pressured ahead of the BoE policy announcement. Gilts are toward the 97.50 trough and are underperforming EGBs somewhat, underperformance that appears to be a function of the UK catching up to the relatively average US 10yr auction late on Tuesday.

- Bunds are softer, with action and drivers perhaps a touch thinner thus far on account of Ascension Day. Bunds down to a 130.90 base which marks a new low for the week and has taken the 10yr yield back to the 2.50% mark

- Click here for more details.

COMMODITIES

- Firmer trade across energy contracts after futures settled with modest gains on Wednesday amid tailwinds from crude stocks drawing more than anticipated. Brent Jul'24 sits at the upper end of a USD 83.71-84.25/bbl range.

- Mixed trade across precious metals with spot silver the outperformer, spot palladium the laggard, and spot gold flat. XAU is contained to a current USD 2,307.59-2,319.85/oz intraday range, within yesterday's USD 2,303.75-2,321.53/oz range.

- Base metals have turned lower since European traders entered the fray amid the cautious risk tone coupled with a rising Dollar.

- Iraq sets the June 2024 Basrah medium crude OSP to Asia at USD +1.00/bbl vs Oman/Dubai, via SOMO; to North and South America at -0.65/bbl vs ASCO; to Europe at -3.35/bbl vs dated Brent

- Click here for more details.

DATA RECAP

- UK RICS Housing Survey (Apr) -5.0 vs. Exp. -2.0 (Prev. -4.0, Rev. -5.0)

EARNINGS

- Arm Holdings Inc (ARM) - Q4 2024 (USD): Adj. EPS 0.36 (exp. 0.30), Revenue 928mln (exp. 875.6mln). GUIDANCE: Q1 revenue 875-925mln (exp. 857.5mln). Q1 adj. EPS 0.32-0.36 (exp. 0.31). FY25 adj. EPS 1.45-1.65 (exp. 1.54). FY25 revenue 3.8-4.1bln (exp. 3.99bln). Shares -8.5% pre-market

- Airbnb Inc (ABNB) - Q1 2024 (USD): EPS 0.41 (exp. 0.24), Revenue 2.14bln (exp. 2.06bln). Gross booking value USD 22.9bln (exp. 22.32bln). Adj. EBITDA USD 424mln (exp. 326.3mln). Sees Q2 rev. USD 2.68bln-2.74bln (exp. 2.74bln). Shares -7.5% pre-market

NOTABLE US HEADLINES

- US GOP Rep. Greene pushed for a vote to remove House Speaker Johnson which prompted House Majority Leader Scalise to introduce a motion to shelve the effort to oust Speaker Johnson, while the House then voted 359 to 43 to prevent Johnson's removal.

- Tesla (TSLA) escalates China job cuts with more layoffs this week, via Bloomberg. Shares -1.5% pre-market

GEOPOLITICS

MIDDLE EAST - EUROPEAN MORNING

- Yemeni Houthis targeted two ships with rockets in the Gulf of Aden yesterday, according to the spokesperson.

- "Israel Broadcasting Corporation quoting a military source: Israel must reconsider its military plans in Rafah after Biden's statements", according to Sky News Arabia

MIDDLE EAST

- US President Biden said if Israel goes into Rafah, he won't supply them with weapons and artillery shells, while he added that Israel will not get their support if they go into those population centres and that bombs the US had supplied to Israel and now paused have been used to kill civilians. Biden also commented that Israel has not gone over the red line yet, while he is working with Arab states that are prepared to build Gaza and prepared to help transition to a two-state solution.

- Hamas senior official said the movement sticks to its approval of the truce proposal.

- Egyptian media said Israel deleted the phrase 'permanent ceasefire' and kept it 'sustainable', while Hamas, Islamic Jihad and Popular Front are participating in negotiations and are open to maturing and succeeding the Egyptian effort to reach a deal. Furthermore, work is underway to overcome the controversial points during the negotiations, which will be completed on Thursday, according to Asharq News.

- Israeli senior officials warned their US counterparts that the Biden administration's decision to pause a weapons shipment to Israel could jeopardise hostage negotiations, according to two sources briefed on the issue told Axios' Ravid.

- Syria shot down Israeli missiles fired from Golan Heights towards Damascus's surroundings.

- Adviser to Iran's Supreme Leader said Tehran will have to change its nuclear doctrine if its existence is threatened and has the capability to build a nuclear weapon, according to SNN.

OTHER

- Ukraine drone attack sparked a fire and damaged oil tanks at a refinery in Russia's Krasnodar, according to regional officials.

- Russian President Putin says tactical nuclear weapon drills are planned, according to Interfax.

- Russia's Gazprom says its Salavat plant was attacked by a drone but the plant is working normally, according to Ria

CRYPTO

- Bitcoin softer on the session and holds just shy of USD 61k, whilst Ethereum unable to climb back above USD 3k.

APAC TRADE

- APAC stocks were mixed as the region took its cue from the indecisive performance stateside owing to mixed earnings and as markets await the next major catalysts, while the somewhat mixed but improved Chinese trade data had little impact.

- ASX 200 was dragged lower by underperformance in consumer stocks and financials with the latter pressured after Australia's largest lender CBA reported a decline in profits.

- Nikkei 225 recovered from an early dip with trade contained as participants digested BoJ rhetoric and soft wages.

- Hang Seng & Shanghai Comp were underpinned amid resilience in the tech sector and after China's eastern city of Hangzhou lifted all home purchase restrictions, although there were headwinds from default concerns as Country Garden Holdings (2007 HK) failed to make coupon payments on a yuan-denominated bond due today but still has a grace period.

NOTABLE ASIA-PAC HEADLINES

- PBoC said it could either buy or sell treasury bonds in the secondary market depending on market conditions, as such trades can be used to manage liquidity, according to Reuters.

- China's eastern city of Hangzhou lifted all home purchase restrictions, according to its housing authority.

- Country Garden Holdings (2007 HK) said it cannot make payments on a yuan-denominated bond, while it aims to pay onshore coupons due today and additional interests by May 13th. Furthermore, it stated that if it fails to make payments within the grace period, China Bond Insurance Co. will undertake credit enhancement obligations and it is still raising funds due to sales recovery lagging expectations.

- US Commerce Secretary Raimondo said the US could ban Chinese-connected vehicles or impose guardrails, while it was separately reported that US Senator Brown is seeking a US ban on all Chinese internet-connected vehicles, according to Bloomberg.

- Hong Kong and Saudi Arabia are exploring an ETF to track Hong Kong stock indices, while Hong Kong is working with several financial institutions to develop the ETF and the government is considering establishing an economic and trade office in Riyadh.

- BoJ Summary of Opinions from the April meeting noted that a member stated if trend inflation accelerates, the BoJ will adjust the degree of monetary easing but an accommodative financial environment is likely to continue for the time being and a member said if forecasts under quarterly report are met, interest rates might rise to levels higher than markets currently price in. It was also stated that one option would be to hike rates moderately in accordance with economic, price and financial developments to avoid a shock from an abrupt policy shift. Furthermore, a member said they must hike rates at an appropriate time as the likelihood of achieving forecasts heightens and a member said the BoJ must deepen the debate on the timing and pace of a future rate hike.

- BoJ Governor Ueda said a low real rate supports the economy and inflation, while he added that they need to monitor FX and oil for real wages. Ueda also stated the BoJ could adjust the degree of monetary accommodation via rate hikes if trend inflation accelerates gradually, as well as noted that a sharp, one-sided yen fall is undesirable and bad for the economy. Furthermore, he reiterated if FX volatility affects or risks affecting trend inflation, the BoJ must respond with monetary policy and will scrutinise the recent weak yen in guiding monetary policy.

- Japanese Finance Minister Suzuki said it is important for currencies to move in a stable manner reflecting fundamentals and rapid FX moves are undesirable, while they are closely watching FX moves and will take thorough response in forex. Suzuki also stated they will take all necessary measures and continue to analyse the FX impact on the economy and livelihoods and take appropriate action.

- Japanese top currency diplomat Kanda said no comment on intervention and if necessary, they will take appropriate action and are ready for currency intervention at any time, while he added that comments about Japan's limitations are wrong when asked about FX intervention reserves.

- Nissan (7201 JT) FY23/24 (JPY): Net Profits 426.65bln (+92.3% Y/Y), Operating Profit 568.72bln (+50.8%), Recurring Profits 702.16bln (+36.2%); Sees FY24 global retail sales at 3.7mln and North America sales of 1.43mln.

- China is said to be considering a proposal to exempt individual investors from paying dividend taxes on Hong Kong stocks bought via Stock Connect, Bloomberg sources say

DATA RECAP

- Chinese Trade Balance (USD) (Apr) 72.35B vs. Exp. 77.5B (Prev. 58.55B)

- Chinese Exports YY (USD) (Apr) 1.5% vs. Exp. 1.5% (Prev. -7.5%); Imports 8.4% vs. Exp. 4.8% (Prev. -1.9%)

- Chinese Trade Balance (CNY) (Apr) 513.5B (Prev. 415.9B)

- Chinese Exports YY (CNY) (Apr) 5.1% (Prev. -3.8%); Imports 12.2% (Prev. 2.0%)

- Japanese Overall Labour Cash Earnings YY (Mar) 0.6% vs. Exp. 1.5% (Prev. 1.8%)