Europe Market Open: Choppy performance with catalysts light, numerous speakers ahead

08 May 2024, 06:38 by Newsquawk Desk

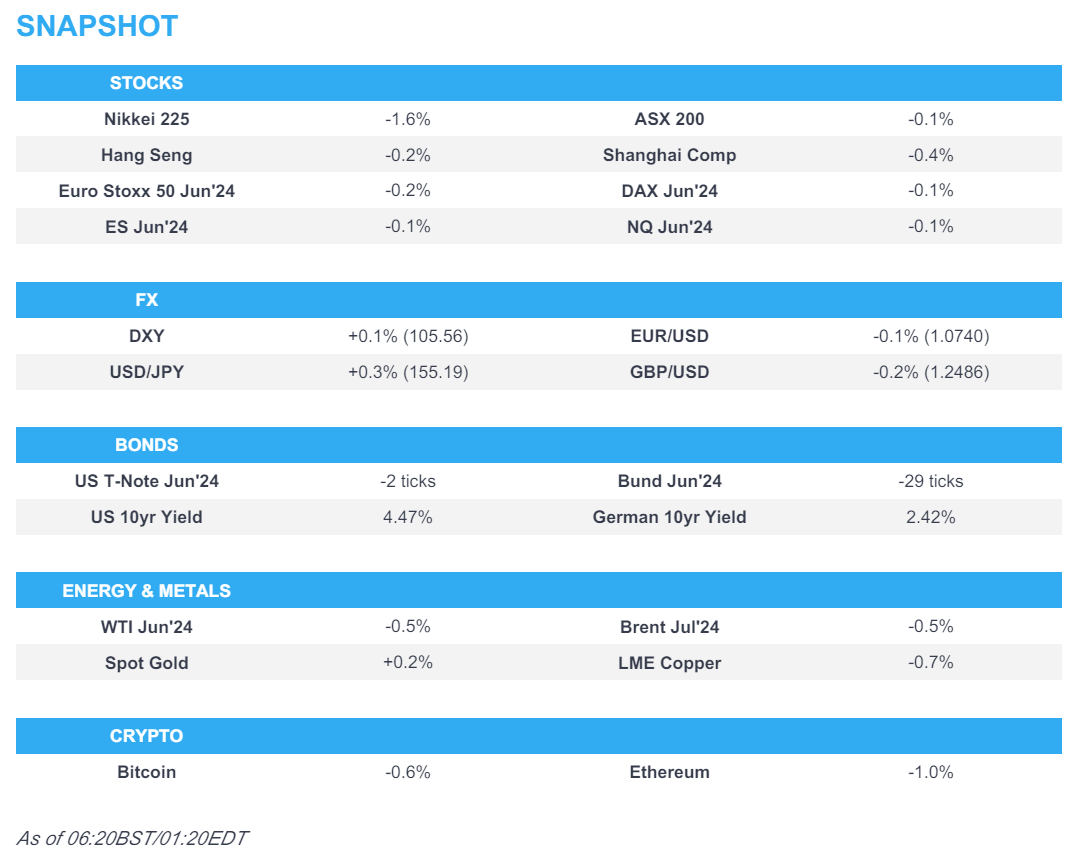

- APAC stocks were mostly lower after the choppy US performance and in the absence of fresh catalysts.

- European equity futures indicate a marginally softer open with Euro Stoxx 50 futures down 0.1% after the cash market closed higher by 1.2% on Tuesday.

- USD is firmer with USD/JPY back above 155, EUR/USD sits below 1.0750 and Cable lost 1.25 status.

- Israeli PM Netanyahu's spokesman said Hamas's proposal is far from Israel's demands and the gaps are large.

- Looking ahead, highlights include German Industrial Orders, US Wholesale Sales, Riksbank Policy Announcement, BoC FSR, Riksbank Press Conference, comments from ECB’s Wunsch & de Cos, Fed’s Cook, Jefferson & Collins, Supply from UK & US.

US TRADE

EQUITIES

- US stocks were rangebound with price action choppy as indices held on to their recent gains but with mixed performances under the surface, while there were no major macro catalysts although a softer Manheim used car vehicle index was the data "highlight" and the US 3yr Treasury auction saw solid demand ahead of the 10yr and 30yr offerings on Wednesday and Thursday, respectively.

- SPX +0.13% at 5,187, NDX -0.01% at 18,091, DJIA +0.08% at 38,884, RUT +0.19% at 2,064.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Kashkari (non-voter) said it is possible housing market resilience means the neutral rate has been pushed higher, at least in the short term and yield curve inversion does suggest policy is tight, while he modestly raised his neutral rate estimate to 2.5% from 2.0%. It was later reported that Kashkari said it is too soon to declare inflation has stalled out and the current level of inflation is not the new normal. Kashkari added the Fed will achieve its 2% inflation target and if the Fed needs to hold rates for an extended period, or hike rates, the Fed will do that but also stated that a rate cut this year is still a possibility, according to a Bloomberg TV interview.

APAC TRADE

EQUITIES

- APAC stocks were mostly lower after the choppy US performance and in the absence of fresh catalysts.

- ASX 200 lacked firm direction with gains in industrials and energy offset by weakness in miners and financials.

- Nikkei 225 underperformed as participants digested earnings including disappointing guidance by Nintendo.

- Hang Seng & Shanghai Comp were ultimately lower amid trade and tech-related frictions after the US revoked export licences that allowed Intel (INTC) and Qualcomm (QCOM) to supply Huawei with semiconductors.

- US equity futures remain lacklustre following the uninspired performance on Wall St.

- European equity futures indicate a marginally softer open with Euro Stoxx 50 futures down 0.1% after the cash market closed higher by 1.2% on Tuesday.

FX

- DXY benefitted alongside advances in USD/JPY but with upside in the buck limited amid light catalysts.

- EUR/USD gradually trickled beneath the 1.0750 level amid a slightly firmer dollar and after mixed EU data.

- GBP/USD extended on the prior day's weakness and breached the 1.2500 level to the downside.

- USD/JPY resumed its advances and returned to the 155.00 territory despite renewed jawboning by officials.

- Antipodeans declined alongside the subdued risk appetite, weaker CNY fix and commodity pressure.

- PBoC set USD/CNY mid-point at 7.1016 vs exp. 7.2202 (prev. 7.1002).

FIXED INCOME

- 10-year UST futures took a breather after bull-flattening yesterday with prices not helped by looming supply.

- Bund futures pulled back from the prior day's best levels ahead of German Industrial Production data.

- 10-year JGB futures faded initial gains with headwinds from weaker results at the 10-year JGB auction.

COMMODITIES

- Crude futures retreated after private sector data showed surprise builds for crude, gasoline and distillates.

- US Private Energy Inventory Data (bbls): Crude +0.5mln (exp. -1.1mln), Cushing +1.3mln, Gasoline +1.5mln (exp. -1.3mln), Distillate +1.7mln (exp. -1.1mln).

- Russian Deputy PM Novak said there are no discussions about an oil output increase at OPEC+.

- Spot gold was choppy and recovered from the early selling pressure seen across the commodities complex.

- Copper futures were subdued amid the uninspiring global risk sentiment.

- Indonesia's President said copper concentrate export permits for Freeport and Amman will be extended with the details of the extension still being calculated, according to Reuters.

CRYPTO

- Bitcoin gradually climbed throughout the session and approached closer to the USD 63,000 level.

NOTABLE ASIA-PAC HEADLINES

- US President Biden’s administration revoked export licences that allowed Intel (INTC) and Qualcomm (QCOM) to supply Huawei with semiconductors as Washington increases the pressure on the Chinese telecoms equipment company, while the move affects the supply of chips for Huawei’s laptop computers and mobile phones, according to FT sources.

- BoJ Governor Ueda said the BoJ will scrutinise the impact of yen moves on the economy in guiding monetary policy and FX moves could have a big impact on the economy and prices, so could warrant a monetary policy response, while he added the BoJ may need to respond via monetary policy if such impact from yen moves affect trend inflation. Ueda said they expect trend inflation to gradually head towards 2% and will adjust monetary policy as appropriate if trend inflation heads toward 2% as projected or if they see a risk of inflation overshooting their forecast. Furthermore, Ueda said they don't see yen moves as having a big impact on trend inflation so far but there is a risk the impact could become more significant in the future and they won't necessarily wait until inflation achieves their forecasts in 1.5 to 2 years to raise rates with the central bank to adjust the degree of monetary support accordingly if trend inflation moves as projected.

- Japanese Finance Minister Suzuki said he is watching FX movements with a sense of urgency and won't comment on forex levels, while he added it is important for currencies to move in a stable manner reflecting fundamentals. Furthermore, he said they will take a thorough response for forex and don't believe that resources for intervention are limited.

GEOPOLITICS

MIDDLE EAST

- Israeli artillery shelling was reported east of Rafah in the southern Gaza strip, according to Al Jazeera.

- Israeli PM Netanyahu's spokesman said Hamas's proposal is far from Israel's demands and the gaps are large. The spokesman added Hamas rejected all previous proposals and does not want an agreement, while Israel will not back down from implementing all the goals of the war, according to Al-Arabiya.

- Hamas delegation arrived in Cairo to follow up on Gaza ceasefire negotiations, according to a statement, while it was also reported that a Hamas official warned if Israel's military aggression continues, there will be no ceasefire.

- Hamas said Cairo talks are the 'last chance' for Israel to recover hostage talks, according to Al Arabiya. Furthermore, a Hamas official said the group set red lines in the ceasefire negotiations that cannot be conceded, according to Sky News Arabia.

- White House thinks the Israeli operation to capture the Rafah crossing doesn't cross President Biden's "red line" that could lead to a shift in US policy towards the Gaza war although the US warned that if it broadens or gets out of control and Israeli forces go into the city of Rafah itself, it will be a breaking point, according to US officials cited by Axios.

- White House's Kirby said the US has been told by Israel the Rafah operation was limited and was designed to cut Hamas’s ability to smuggle weapons and funds into Gaza, while he said talks are starting again on Tuesday in Cairo and the US understands from looking at the text of hostage agreement that the gaps should be able to be closed. Furthermore, Kirby said the US hopes to get a deal on Gaza very soon and everybody is coming to the table.

- US President Biden's administration is reportedly holding shipments of Boeing (BA) manufactured precision bombs to send a political message to Israel, according to Politico. It was later reported that a senior administration official said the US paused a shipment last week of thousands of 2,000-lb and 500-lb bombs to Israel as discussions over a Rafah invasion did not fully address concerns.

- CIA Director Burns plans to travel to Israel on Wednesday for talks with Israeli PM Netanyahu and Israeli officials, according to a source cited by Reuters.

OTHER

- Ukrainians hit a fuel depot in the Russian-controlled city of Luhansk, according to sources via X.

- Russia launched an air attack on Kyiv, according to Ukraine's military. It was later reported that Russia targeted energy facilities in Kyiv, Poltava, Lviv and other regions, according to Ukraine's Energy Minister. Furthermore, Ukraine's largest private electricity company said the Russian attack caused serious damage at three thermal power plants.

- Taiwan's leader is open to dialogue with Beijing on an equal footing, according to Taipei's de facto envoy to the US under President-elect Lai cited by SCMP.

EU/UK

NOTABLE HEADLINES

- The BoE should leave rates unchanged at its meeting on Thursday but consider lowering them in June, according to the Times' shadow MPC.

- UK Home Office announced on Tuesday night that it was aware of a technical issue affecting E-gates across the country, while it was working closely with the Border Force and affected airports to resolve the issue. However, Heathrow Airport later stated that all Border Force systems were now running as usual and it did not expect any issues this morning when the operation starts up.

- French Finance Minister Le Maire said they are considering the possibility of a tax on share buybacks.