Europe Market Open: AUD/USD pressured post-RBA, geopols remain in focus

07 May 2024, 06:40 by Newsquawk Desk

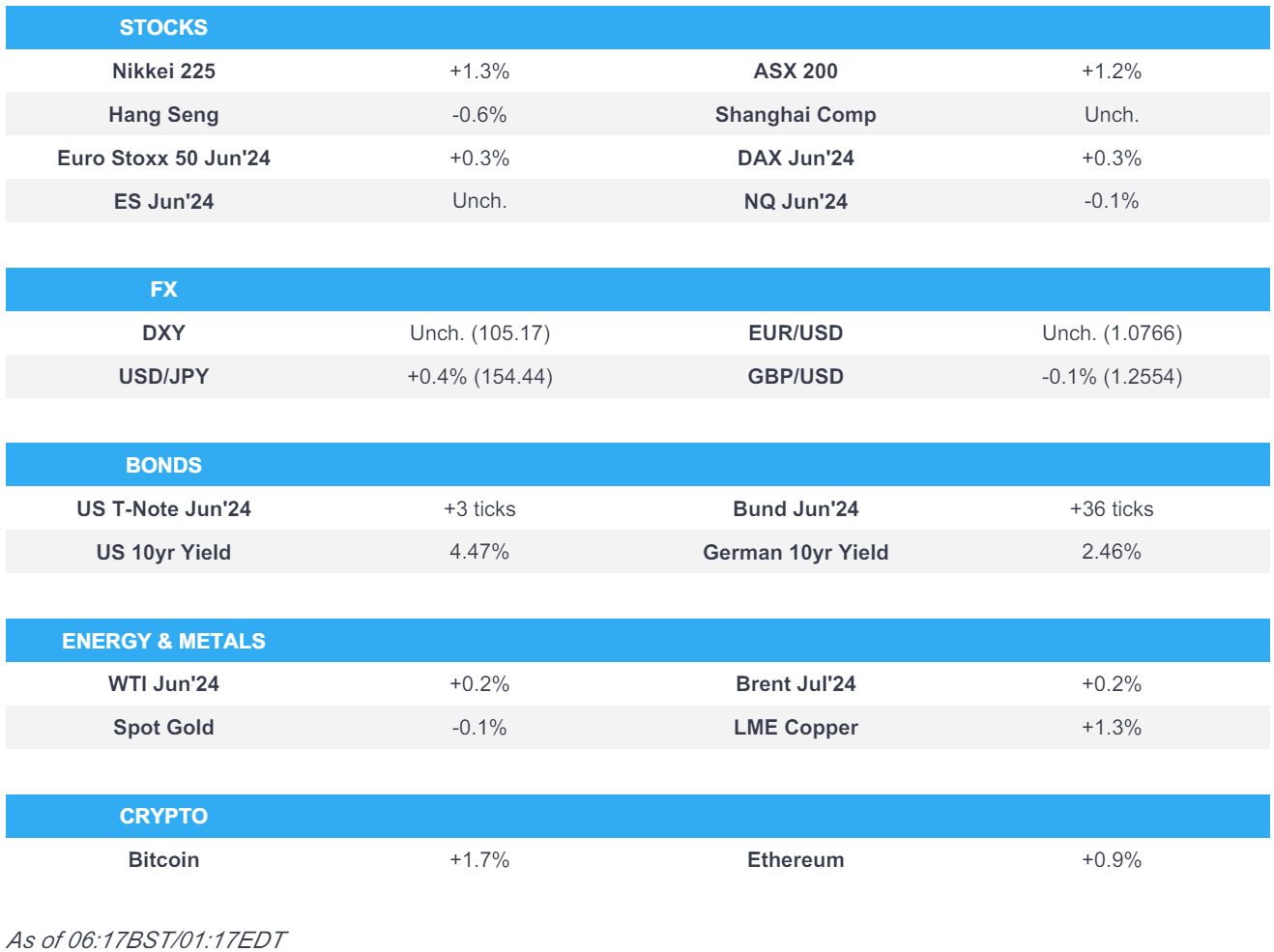

- APAC stocks were mixed as the region only partly sustained the momentum from Wall St where the major indices extended on post-NFP advances amid rate cut hopes, while key markets returned from the long weekend.

- DXY was uneventful, USD/JPY continued to pick itself up from last week's trough and reclaimed the 154.00 status, AUD/USD was pressured after the RBA announcement.

- RBA kept the Cash Rate Target unchanged at 4.35%, as expected, while it reiterated the Board remains resolute in its determination to return inflation to the target and it is not ruling anything in or out; RBA raised its inflation forecasts for 2024 but trimmed forecasts for GDP.

- Israeli military took control of the Palestinian side of the Rafah border with Egypt, according to Bloomberg. Israeli army confirmed it is "conducting large-scale combing operations in the area"

- Looking ahead, highlights include German Industrial Orders, Trade Balance, EZ & UK Construction PMI, US RCM/TIPP Economic Optimism, CBR Policy Announcement, EIA STEO Comments from Fed’s Kashkari & BoC's Rogers, Supply from US, Earnings from BP, Siemens Healthineers, Infineon, Fresenius Medical Care, Deutsche Poste, Infineon, Disney, Occidental Petroleum Corp, Duke Energy, Arista & Mckesson.

- Click here for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks extended on gains amid continued momentum from last week's soft NFP data which increased the chances of the Fed being able to cut this year, while rate-sensitive small-caps outperformed in an indication of the appetite for duration which will be tested at this week's refunding auctions.

- SPX +1.03% at 5,181, NDX +1.13% at 18,094, DJI +0.46% at 38,852, RUT +1.23% at 2,061.

- Click here for a detailed summary.

NOTABLE HEADLINES/EARNINGS

- Fed's Barkin (voter) said inflation data this year is disappointing and the job is not yet done, while he is confident that the current restrictive level of rates can curb demand enough to bring inflation to target and he doesn't see the economy overheating but added the Fed knows how to respond if it does. Barkin also said it still feels like the weight of risks is towards inflation and that metrics of where the neutral rate is have moved up. Furthermore, he said it feels like current policy is restrictive and at this point, is willing to believe rates are restrictive enough.

- Fed's Williams (voter) is seeing job growth moderate and is looking at the totality of economic data, while he said eventually there will be rate cuts and the balance sheet wind down has gone smoothly and hasn't affected markets.

- Fed SLOOS for Q1 noted that a net 15.6% of large and medium US banks tightened C&I loan standards in Q1 (prev. 14.5% in Q4). Furthermore, it noted that regarding loans to businesses, survey respondents reported, on balance, tighter standards and weaker demand for commercial and industrial (C&I) loans to firms of all sizes over the first quarter, while banks reported tighter standards and weaker demand for all commercial real estate (CRE) loan categories.

- Tornado warning was issued for Barsndall, Oklahoma and surrounding areas.

APAC TRADE

EQUITIES

- APAC stocks were mixed as the region only partly sustained the momentum from Wall St where the major indices extended on post-NFP advances amid rate cut hopes, while key markets returned from the long weekend.

- ASX 200 traded higher with a further boost in late trade after the RBA proved to be less hawkish than many feared.

- Nikkei 225 gained on return from holiday as it took its first opportunity to react to last week's NFP report and renewed US rate cut hopes.

- Hang Seng & Shanghai Comp were subdued with the former set to snap its 10-day win streak and longest consecutive run of gains since 2018, while the mainland index took a breather after yesterday's catch-up rally amid a lack of fresh catalysts.

- US equity futures plateaued overnight and remained near the prior day's best levels.

- European equity futures indicate a positive open with Euro Stoxx 50 futures up 0.3% after the cash market closed higher by 0.7% on Monday.

FX

- DXY was uneventful after recently returning from a brief dip beneath the 105.00 level and following mixed Fed rhetoric in which Barkin noted inflation is disappointing and the job is not done yet, while Williams acknowledged that job growth is moderating.

- EUR/USD traded rangebound after stalling yesterday on approach to the 1.0800 level and as ECB officials continued to flag rate cuts.

- GBP/USD price action was contained within a narrow range slightly north of 1.2550 and the nearby 200DMA.

- USD/JPY continued to pick itself up from last week's trough and reclaimed the 154.00 status.

- Antipodeans initially lacked direction amid the mixed risk appetite but with AUD/USD later pressured after the RBA rate decision where many were anticipating a hawkish hold, and although it kept rates unchanged and raised CPI estimates, its forecasts were based on the assumption that the Cash Rate would stay at the current level until mid-2025 which is nine months longer than previously assumed.

- PBoC set USD/CNY mid-point at 7.1002 vs exp. 7.2143 (prev. 7.0994).

FIXED INCOME

- 10-year UST futures struggled for direction with no major data releases scheduled ahead of refunding auctions.

- Bund futures held onto most of the recent spoils above the 131.00 level ahead of German Trade and Factory Orders data.

- 10-year JGB futures gapped higher on return from the 4-day weekend with the BoJ also present in the market for JPY 1.1tln of JGBs.

COMMODITIES

- Crude futures eked mild gains after yesterday's choppy performance amid uncertainty regarding a Gaza truce.

- US Senior Adviser for Energy and Investment Hochstein said the US has sufficient supply in Strategic Petroleum Reserve to address any supply concerns and the Biden administration is monitoring markets, according to Reuters.

- Spot gold traded rangebound amid the absence of fresh drivers but was kept afloat after recent dollar weakness.

- Copper futures failed to sustain early advances and briefly turned negative amid a lacklustre mood in China.

CRYPTO

- Bitcoin saw two-way trade and returned to relatively flat territory with a floor around the USD 63,000 level.

NOTABLE ASIA-PAC HEADLINES

- US will host China's special envoy for climate change Liu Zhenmin in Washington on May 8th-9th, according to the State Department.

- Japanese top FX diplomat Kanda said it is important for currencies to move in a stable manner reflecting fundamentals and the government must take appropriate steps if there's excessive volatility in the FX market, while he added it is usual that they don't comment whether currency intervention was carried out.

- RBA kept the Cash Rate Target unchanged at 4.35%, as expected, while it reiterated the Board remains resolute in its determination to return inflation to the target and it is not ruling anything in or out. RBA stated that returning inflation to the target within a reasonable timeframe remains the board’s highest priority, as well as noted that inflation remains high and is falling more gradually than expected. Furthermore, the RBA raised its inflation forecasts for 2024 but trimmed forecasts for GDP and unemployment, while its forecasts assume that rates will stay at 4.35% until mid-2025 which is nine months longer than previously assumed.

DATA RECAP

- Australian Retail Trade (Q1) -0.4% vs. Exp. -0.2% (Prev. 0.3%, Rev. 0.4%)

GEOPOLITICS

MIDDLE EAST

- Gaza crossings authority said the Israeli army stormed the Rafah crossing, according to Al Arabiya. However, Palestinian media said the Egyptian side informed the crossing's authority that Israeli vehicles are conducting a security operation in the vicinity of the Rafah crossing and will retreat tomorrow. It was later reported Israeli military took control of the Palestinian side of the Rafah border with Egypt, according to Bloomberg.

- Israeli air force struck 50 targets in Rafah Monday, according to IDF spokesperson Hagari. Furthermore, Israeli Army Radio said preparations for the military operation in Rafah continue as planned, according to Sky News Arabia.

- Heavy Israeli raids were reported on the city of Rafah in the southern Gaza Strip, according to Sky News Arabia. There were more than 100 raids on sites in eastern Rafah within several hours, while an Israeli raid targeted a humanitarian aid warehouse near the Rafah crossing.

- Israeli PM’s office said the War Cabinet unanimously decided that Israel will continue the operation in Rafah to exert military pressure on Hamas in order to advance the release of hostages and the other goals of the war, according to Axios.

- The proposal approved by Hamas is unacceptable to Israel and is said to include 'far-reaching' conclusions that Israel does not agree to, according to Al Arabiya citing Israeli sources.

- Israeli source said they do not take Hamas’ response seriously and that it was a “unilateral response”, while the source added that when they receive it, they will study it and respond to it. Israeli Channel 12 also reported that Israel has not yet received confirmation of Hamas’ announcement that it accepts the broad outlines of the ceasefire.

- Israeli political source said Hamas agreed to a “modified” Egyptian proposal which differs from the formula approved by Israel, according to Sky News Arabia. However, an official briefed on the talks said Hamas’s agreement is to the latest proposal Israel made on April 27th, with no changes to major elements, according to Reuters.

- Hamas source told Al-Arabiya the movement agreed to a 3-stage proposal that begins with a 40-day suspension in which the first phase includes a ceasefire and Israel’s withdrawal from the Gaza Valley, as well as the return of the displaced and the exchange of a number of prisoners. Furthermore, the second and third stages include a truce for 42 days for each stage. It was also reported that a Hamas delegation will visit Cairo soon to discuss the ceasefire agreement and the next step, according to a Hamas official cited by Reuters.

- White House said Israeli PM Netanyahu agreed to ensure the Kerem Shalom Crossing is open for humanitarian assistance in a call with US President Biden on Monday. It was separately reported that the Biden administration is concerned the Hamas’ deadly rocket attack over the weekend has led Israel to fast-track its timeline for a military operation in Rafah, according to Politico citing a senior administration official.

- US official familiar with talks said the US is committed to stopping an invasion of Rafah and Israel still plans to proceed, while the official added that Israeli PM Netanyahu and the Israeli War Cabinet have not appeared to negotiate with Hamas in good faith during the latest round, according to Reuters.

- US official said the US has concerns about Israel's unfolding Rafah strikes but it does not appear to represent a major military operation, according to Reuters.

- 100 congressional staff called on US President Biden and members of Congress to demand an immediate halt to the Israeli offensive before it is too late, according to Axios.

- Qatar Foreign Ministry said Hamas sent mediators its reply to the truce proposal on Monday and the reply could be described as "positive", while it was separately reported that the Qatari delegation arrives in Cairo on Tuesday to resume negotiations on a truce agreement in Gaza, according to Sky News Arabia.

- Jordanian Foreign Minister said Israeli PM Netanyahu is jeopardising the ceasefire deal by bombing Rafah, according to Reuters.

OTHER

- EU announced a new Russian sanctions proposal which includes a ban on EU facilities being used to tranship Russian LNG to third countries, as well as a ban on new investment and provisions of goods and services for LNG projects such as Artic LNG and Murmansk LNG. The proposal also includes a ban on using EU ports and locks for vessels that contribute to Russia's ability to wage war against Ukraine, while it seeks further restrictions on the export of chemicals and equipment that boost Russian industry, as well as on import of helium from Russia and adds Voice of Europe, RIA Novosti, Izvestija, and Rossiiskaja Gazeta to the sanctioned media list.

- A US soldier was detained on charges of criminal misconduct in Russia's far eastern city of Vladivostok last week.

- China reportedly hacked the UK Ministry of Defence with MPs to be told on Tuesday of a large data breach targeting service personnel, according to Sky News.

EU/UK

NOTABLE HEADLINES

- Barclaycard said UK April consumer spending fell 4.0% Y/Y (prev. +3.5%) which is the lowest since February 2021.

DATA RECAP

- UK BRC Retail Sales YY (Apr) -4.4% (Prev. 3.2%)

- UK BRC Total Sales Y/Y (Apr) -4.0% (Prev. 3.5%)