US Market Open: Equities & Bonds bid, focus turns to advancements in Rafah which has lifted crude; Fed speak due

06 May 2024, 11:30 by Newsquawk Desk

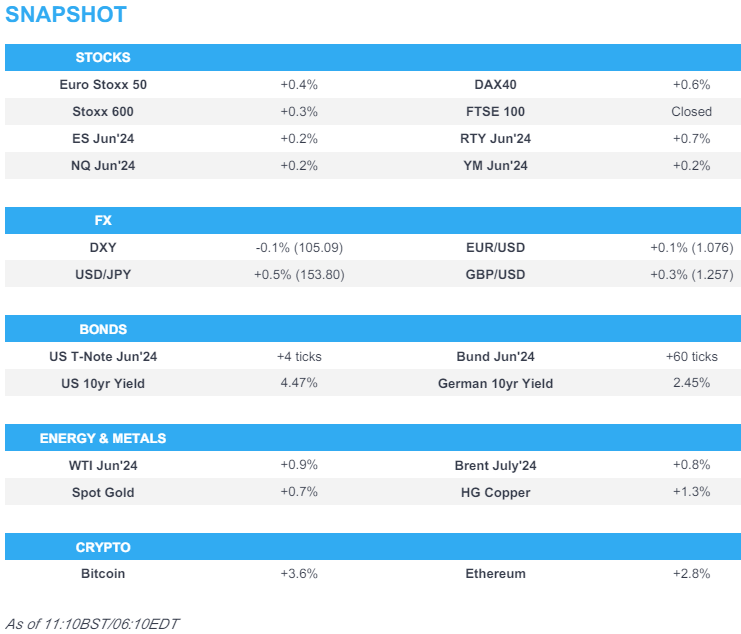

- Equities are entirely in the green; Apple -1.1% is lower pre-market after Berkshire Hathaway decreased its stake in Q1

- DXY is flat, EUR unreactive to PMIs & USD/JPY holds just under 154.00

- Bonds are modestly firmer, with initial upside in Bunds trimmed slightly by large upward revisions to EZ PMIs

- Crude is firmer with Rafah in focus, XAU is bid and base metals benefit from the risk tone

- Looking ahead, US Employment Trends, Comments from SNB’s Jordan, ECB’s Lagarde, Fed’s Williams & Barkin. UK markets closed for Bank Holiday Monday.

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (+0.3%) are entirely in the green, albeit modestly so, taking impetus from a positive APAC session. EZ Final PMIs were generally revised higher, though ultimately sparked little reaction in the equities complex. Note: The FTSE 100 is shut on account of the UK Bank Holiday.

- European sectors are mostly firmer, though with the breadth of the market fairly narrow. Insurance takes the top spot, alongside Energy. The latter is benefitting from broader strength in the crude complex given the recent updates around Rafah.

- US Equity Futures (ES +0.2%, NQ +0.2%, RTY +0.5%) are entirely in the green, building on the strength seen on Friday. Apple (-1.1%) is lower pre-market after Berkshire Hathaway declared it had decreased its stake in the Co. in Q1 and in a breather from Friday's post-earnings strength.

- Click here and here for the sessions European pre-market equity newsflow.

- Click here for more details.

FX

- DXY is modestly softer and within a very tight 105.02-20 range, should selling pressure intensify, the 105.00 mark could be brought into focus.

- EUR is marginally firmer/flat vs the Dollar, though losing in the EUR/GBP cross. Price action today has been contained within a tight 1.0756-75 range, well within the prior session’s bounds. EZ final PMIs today were generally revised higher, albeit slightly, and provided little lasting move in the EUR.

- GBP is slightly firmer against the Dollar, despite UK equities/gilt markets closed on account of the region's bank holiday and with catalyst light. Currently trading just off session highs of 1.2584.

- JPY is by far the biggest underperformer vs the Dollar, going as high as 154.00, paring much of Friday’s USD/JPY losses, amid holiday-thinned conditions with Japan away.

- Antipodeans are both marginally firmer vs USD, though very much within a contained range as catalysts remain thin. Over in China, the Caixin PMI were in-line with expectations which helped to lift sentiment on the region's return from holiday.

- PBoC set USD/CNY mid-point at 7.0994 vs exp. 7.2127 (prev. 7.1063).

- S&P upgraded Turkey’s rating to 'B+'; Outlook Positive on Friday and cited economic rebalancing.

- Click here for more details.

FIXED INCOME

- Bunds are bid with specific drivers limited, though upside was trimmed by unusually large upward revisions to the French and then EZ Final PMIs though the internal commentary around German continues to point to stagnation/incremental growth. Current 130.98-131.62 parameters surpassed Friday's best by a handful of ticks with little of note thereafter until 132.00.

- USTs are a touch firmer, in-fitting with EGBs, but with magnitudes thin given the UK Bank Holiday and Japan's absence; docket ahead a touch busier with Fed's Barkin & Williams due after the latest Employment Trend numbers.

- Click here for more details.

COMMODITIES

- Crude benchmarks are bid with geopols in focus. WTI and Brent have been grinding higher throughout the morning as the geopolitical narrative around Rafah continues to gradually escalate. Most recent developments have civilians being evacuated and the Israeli Finance Minister saying the army must enter Rafah today.

- Supported on geopols; XAU to a USD 2324/oz peak but one that leaves it over USD 20/oz shy of last week's best but with the USD 2339/oz 21-DMA the first point of resistance.

- Base metals are bid on China's return to the market with the metal following suit to APAC performance where the region was propped up by Friday's NFP-tailwinds and in-line Chinese PMIs.

- Saudi Arabia raised its oil prices for all grades to Asia for June with Arab Light OSP to Asia set at a premium of USD 2.90/bbl vs Oman/Dubai average and OSP to NW Europe set at a premium of USD 2.10/bbl vs ICE Brent, while it set the OSP to the US at a premium of USD 4.75/bbl vs ASCI.

- UAE’s Sharjah announced the discovery of a new gas field which is said to carry ‘promising quantities’, according to a statement cited by Reuters.

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- UK PM Sunak reportedly cancelled plans for a summer general election after local election defeats with the election anticipated to occur in Autumn, according to The Telegraph.

- UK PM Sunak was warned by Conservative MPs to show some vision and start digging his party out of a hole after a disastrous set of local election results, while it was also reported that the Labour Party comfortably won the London mayoral contest to give Sadiq Khan an unprecedented third term as London Mayor, according to FT.

- ArcelorMittal (MT NA) warned the UK government that one of its main divisions could be forced to exit the UK if an application to close and redevelop a commercial port in south-east England receives approval this week, according to FT.

- ECB's Lane said in an interview with El Confidencial that the April slowdown in services inflation marks significant progress and confidence on inflation is improving, while he added exaggerating the impact of the ECB and Fed divergence is not necessary and Fed decisions have limited impact on the euro area.

- Fitch affirmed Italy at BBB; Outlook Stable and affirmed Denmark at AAA; Outlook Stable on Friday.

DATA RECAP

- EU HCOB Composite Final PMI (Apr) 51.7 vs. Exp. 51.4 (Prev. 51.4); HCOB Services Final PMI (Apr) 53.3 vs. Exp. 52.9 (Prev. 52.9)

- German HCOB Composite Final PMI (Apr) 50.6 vs. Exp. 50.6 (Prev. 50.5); HCOB Services PMI (Apr) 53.2 vs. Exp. 53.3 (Prev. 53.3)

- French HCOB Services PMI (Apr) 51.3 vs. Exp. 50.5 (Prev. 50.5); HCOB Composite PMI (Apr) 50.5 (Prev. 49.9)

- Italian HCOB Composite PMI (Apr) 52.6 (Prev. 53.5); HCOB Services PMI (Apr) 54.3 vs. Exp. 54.0 (Prev. 54.6)

- EU Sentix Index (May) -3.6 vs. Exp. -5.0 (Prev. -5.9)

- EU Producer Prices YY (Mar) -7.8% vs. Exp. -7.7% (Prev. -8.3%, Rev. -8.5%); Producer Prices MM (Mar) -0.4% vs. Exp. -0.4% (Prev. -1.0%, Rev. -1.1%)

NOTABLE US HEADLINES

- Fed’s Williams (voter) said they are committed to getting the job done on bringing down inflation, while he added that an explicit, numerical inflation target is critical for achieving price stability.

- Fed’s Goolsbee (non-voter) said the US rate-path dot plot needs more context and Fed policymakers should communicate the economic rationale for interest-rate-path views, according to Reuters.

- Berkshire Hathaway (BRK.B) Berkshire Hathaway reported Q1 operating profit surged 39% Y/Y to USD 11.22bln. EPS was 5.88 (exp. 4.27), led by a +185% Y/Y increase in insurance underwriting earnings. Q1 net earnings fell 64% Y/Y to USD 12.7bln, and Q1 revenue was USD 89.9bln (exp. 85.9bln).

- Apple (AAPL), Berkshire Hathaway (BRK.B) Berkshire Hathaway decreased its substantial Apple stake in Q1, now valued at USD 135.4bln, a 13% reduction, CNBC reports.

- Paramount Global (PARA), Apollo Global Management, Sony Group (SONY) The USD 26bln offer from Apollo Global and Sony Group this week threw a wrench in talks between Paramount Global and film producer David Ellison, Bloomberg reports.

GEOPOLITICS

MIDDLE EAST - EUROPEAN MORNING

- Israeli forces are now launching raids east of Rafah, via Sky News

- Israel military says not going to put a timeframe on the Rafah evacuation and will make "operation assessments"

- Israeli military says evacuating Rafah as part of a "limited scope" operation

- The Israeli army has ordered civilians in several parts of Rafah to leave the city as it begins an invasion of the southern city, via journalist Soylu

- Israeli Defence Minister, speaking with US Defence Secretary Austin, that action in Rafah is required due to Hamas' refusal of hostage-release proposals

- Senior Hamas Official says to Reuters that Israel's Rafah evacuation order is a "dangerous escalation that will have consequences"; Hamas may withdraw from truce talks due to Rafah operations.

MIDDLE EAST

- Israel’s military said the Kerem Shalom Crossing with Gaza is now closed to aid trucks after it came under fire with mortar shelling which killed 3 Israeli soldiers and wounded 12 others from the Givanti and Nahal brigades, while Hamas claimed responsibility for the mortar attack on Kerem Shalom and said it targeted an Israeli army base, according to Reuters.

- Israeli PM Netanyahu said they cannot accept Hamas’s demands for an end to the war and the withdrawal of forces from Gaza, while he noted that ending the Gaza war now would keep Hamas in power and Israel would not accept terms that amount to a capitulation with Israel to keep fighting until its war aims are achieved. It was separately reported that Israel’s Defence Minister said Hamas appears uninterested in a deal meaning strong military action in Gaza’s Rafah could happen very soon, according to Reuters.

- Israeli army is said to have started to evacuate civilians from parts of Rafah, according to Haaretz cited by Walla's Guy Elster. Subsequently, Bloomberg reported that the Israeli military asks some Rafah civilians to move out of the city, according to Bloomberg.

- Hamas’ leader said they are still keen on reaching a comprehensive agreement, while the group said the round of negotiations in Cairo has ended and the delegation will leave to consult with the group’s leadership, according to Reuters. It was separately reported that Hamas agrees that Israel can commit to ending the war in the second stage of the hostage deal not the first, according to Times of Israel via social media platform X.

- CIA chief Burns is to travel to Doha for an emergency meeting with Qatar’s PM as Gaza talks are said to be ‘near to collapse’, while Qatar and the US are to exert maximum pressure on Israel and Hamas to continue negotiations, according to an official briefed on talks cited by Reuters. It was separately reported that Burns will stay in Qatar on Monday and likely travel to Israel this week to meet with Israeli PM Netanyahu, according to an Axios reporter.

- US reportedly put a hold on an ammunition shipment to Israel last week, according to two Israeli officials cited by Axios.

- Iraqi armed factions announced they targeted an Israeli air base in Eilat with drones, according to Al Arabiya.

- Israeli Cabinet decided to close Qatari TV network Al Jazeera’s operations in Gaza, according to a statement cited by Reuters. It was later reported that Israel’s communications ministry said a police raid was conducted at an Al Jazeera premises in Jerusalem.

OTHER

- Russia said it took full control of Ocheretyne village in eastern Ukraine, according to the Defence Ministry, cited by Reuters.

- Russian Defence Ministry says preparations are beginning for the commencement of a missile exercises in the southern district, incl. aviation & navy forces

CRYPTO

- Bitcoin is back on a firmer footing and now holds just above USD 65k, whilst Ethereum hovers around USD 3.2k.

- The next potential objective/resistance level for Bitcoin is at USD 67,200 and that represents a 61.8% correction of the 73,797-56,527 fall, via market contacts.

APAC TRADE

- APAC stocks traded with a positive bias after a dovish jobs report from the US but with the upside limited amid holiday-thinned conditions with Japan and South Korea shut for holidays.

- ASX 200 was led higher by continued outperformance in the rate-sensitive sectors, while financials were also underpinned following Westpac's earnings, special dividend and buyback announcement.

- Hang Seng & Shanghai Comp were somewhat varied as Hong Kong stocks took a breather after the recent hot streak and as attention shifted to the mainland where stocks outperformed as they played catch up on their return from the Labour Day Golden Week holidays with property stocks boosted by recent support pledges, while participants also digested Caixin Services PMI data which matched estimates.

NOTABLE ASIA-PAC HEADLINES

- PBoC Shanghai is reportedly to support the renewal of large-scale equipment.

- Chinese President Xi said the China-France relationship is a model of peaceful coexistence and win-win cooperation between countries with different systems, while he added they are ready to consolidate the traditional friendship, enhance political mutual trust, build strategic consensus, as well as deepen exchanges and cooperation with France, according to Xinhua.

- EU is lobbying China to exclude agriculture from a series of escalating commercial disputes and called for the ‘strategic sector’ to be protected from trade tensions in the renewable energy and electric vehicle industries, according to FT.

- A magnitude 6.1 earthquake was reported in Seram, Indonesia, according to GFZ.

APAC DATA RECAP

- Chinese Caixin Services PMI (Apr) 52.5 vs. Exp. 52.5 (Prev. 52.7); Composite PMI (Apr) 52.8 (Prev. 52.7)