Europe Market Open: Sentiment supported by US tailwinds, geopols dominating newsflow

06 May 2024, 06:45 by Newsquawk Desk

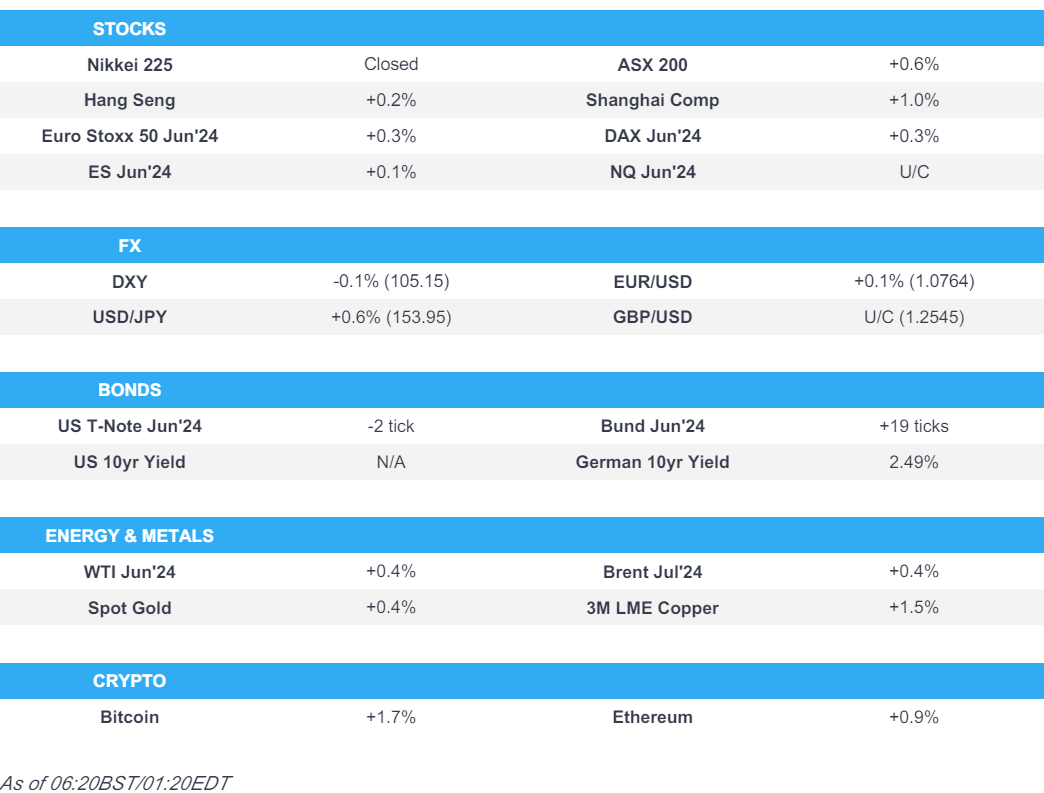

- Positive bias for APAC stocks after the US jobs report but with varied performance on the holiday return

- DXY remains near 105.00 with peers flat/mixed ex-JPY which has seen USD/JPY recoup Friday's losses

- Commodities supported as geopolitical tensions intensify with Gaza talks reportedly near collapsing and civilians being evacuated from Rafah

- Fed speak in focus with Williams & Goolsbee over the weekend, though fixed action limited with Japan away

- Looking ahead, highlights include EZ Services PMI, Sentix Index, Producer Prices, US Employment Trends, Comments from SNB’s Jordan, ECB’s Lagarde, Fed’s Williams & Barkin, Earnings from UniCredit & Volvo Car AB. Note: UK Bank Holiday.

US TRADE

EQUITIES

- US stocks rallied on Friday as the focus was on the data releases in which NFP missed estimates and Average Earnings were softer than expected. This saw expectations of Fed policy easing increase and pressured US yields which further supported tech, with much of the heavy lifting seen in big tech as AAPL shares were underpinned by recent better-than-feared earnings results.

- SPX +1.26% at 5,128, NDX +1.99% at 17,891, DJI +1.18% at 38,676, RUT +0.97% at 2,036.

- Click here for a detailed summary.

NOTABLE HEADLINES/EARNINGS

- Fed’s Williams (voter) said they are committed to getting the job done on bringing down inflation, while he added that an explicit, numerical inflation target is critical for achieving price stability.

- Fed’s Goolsbee (non-voter) said the US rate-path dot plot needs more context and Fed policymakers should communicate the economic rationale for interest-rate-path views, according to Reuters.

APAC TRADE

EQUITIES

- APAC stocks traded with a positive bias after a dovish jobs report from the US but with the upside limited amid holiday-thinned conditions with Japan and South Korea shut for holidays.

- ASX 200 was led higher by continued outperformance in the rate-sensitive sectors, while financials were also underpinned following Westpac's earnings, special dividend and buyback announcement.

- Hang Seng & Shanghai Comp were somewhat varied as Hong Kong stocks took a breather after the recent hot streak and as attention shifted to the mainland where stocks outperformed as they played catch up on their return from the Labour Day Golden Week holidays with property stocks boosted by recent support pledges, while participants also digested Caixin Services PMI data which matched estimates.

- US equity futures were rangebound amid a lack of weekend drivers aside from the geopolitical uncertainty.

- European equity futures indicate a positive open with Euro Stoxx 50 futures up 0.4% after the cash market closed higher by 0.6% on Friday.

FX

- DXY languished near 105.00 after last week's notable NFP miss and softer-than-expected Average Earnings.

- EUR/USD eked slight gains albeit with upside limited after it recently failed to sustain a brief return to 1.0800.

- GBP/USD price action was stuck around 1.2550 with the world's largest FX trading hub shut on Monday.

- USD/JPY recouped Friday's losses and reclaimed the 153.00 status in holiday-thinned conditions.

- Antipodeans struggled to find direction as the RBA kick-started its 2-day policy meeting.

- PBoC set USD/CNY mid-point at 7.0994 vs exp. 7.2127 (prev. 7.1063).

- S&P upgraded Turkey’s rating to 'B+'; Outlook Positive on Friday and cited economic rebalancing.

FIXED INCOME

- 10-year UST futures proceeded sideways after pulling back from the post-NFP peak and with prices contained amid the closure of overnight cash treasuries trade owing to the holiday in Japan.

- Bund futures just about held on to the 131.00 level after paring the majority of spoils from Friday's US data lift.

COMMODITIES

- Crude futures were mildly higher after WTI rebounded from a floor around the USD 78/bbl level with support from geopolitical uncertainty as Gaza truce talks were said to be nearing a collapse, while Saud Arabia also raised its OSPs to Asia and North West Europe.

- Saudi Arabia raised its oil prices for all grades to Asia for June with Arab Light OSP to Asia set at a premium of USD 2.90/bbl vs Oman/Dubai average and OSP to NW Europe set at a premium of USD 2.10/bbl vs ICE Brent, while it set the OSP to the US at a premium of USD 4.75/bbl vs ASCI.

- UAE’s Sharjah announced the discovery of a new gas field which is said to carry ‘promising quantities’, according to a statement cited by Reuters.

- Spot gold marginally strengthened in choppy trade which saw prices oscillate through the USD 2,300/oz level.

- Copper futures were underpinned amid the positive risk tone and return to the market of its largest purchaser.

CRYPTO

- Bitcoin was lacklustre and eventually dipped below the USD 64,000 level.

NOTABLE ASIA-PAC HEADLINES

- PBoC Shanghai is reportedly to support the renewal of large-scale equipment.

- Chinese President Xi said the China-France relationship is a model of peaceful coexistence and win-win cooperation between countries with different systems, while he added they are ready to consolidate the traditional friendship, enhance political mutual trust, build strategic consensus, as well as deepen exchanges and cooperation with France, according to Xinhua.

- EU is lobbying China to exclude agriculture from a series of escalating commercial disputes and called for the ‘strategic sector’ to be protected from trade tensions in the renewable energy and electric vehicle industries, according to FT.

- A magnitude 6.1 earthquake was reported in Seram, Indonesia, according to GFZ.

DATA RECAP

- Chinese Caixin Services PMI (Apr) 52.5 vs. Exp. 52.5 (Prev. 52.7); Composite PMI (Apr) 52.8 (Prev. 52.7)

GEOPOLITICS

MIDDLE EAST

- Israel’s military said the Kerem Shalom Crossing with Gaza is now closed to aid trucks after it came under fire with mortar shelling which killed 3 Israeli soldiers and wounded 12 others from the Givanti and Nahal brigades, while Hamas claimed responsibility for the mortar attack on Kerem Shalom and said it targeted an Israeli army base, according to Reuters.

- Israeli PM Netanyahu said they cannot accept Hamas’s demands for an end to the war and the withdrawal of forces from Gaza, while he noted that ending the Gaza war now would keep Hamas in power and Israel would not accept terms that amount to a capitulation with Israel to keep fighting until its war aims are achieved. It was separately reported that Israel’s Defence Minister said Hamas appears uninterested in a deal meaning strong military action in Gaza’s Rafah could happen very soon, according to Reuters.

- Israeli army is said to have started to evacuate civilians from parts of Rafah, according to Haaretz cited by Walla's Guy Elster. Subsequently, Bloomberg reported that the Israeli military asks some Rafah civilians to move out of the city, according to Bloomberg.

- Hamas’ leader said they are still keen on reaching a comprehensive agreement, while the group said the round of negotiations in Cairo has ended and the delegation will leave to consult with the group’s leadership, according to Reuters. It was separately reported that Hamas agrees that Israel can commit to ending the war in the second stage of the hostage deal not the first, according to Times of Israel via social media platform X.

- CIA chief Burns is to travel to Doha for an emergency meeting with Qatar’s PM as Gaza talks are said to be ‘near to collapse’, while Qatar and the US are to exert maximum pressure on Israel and Hamas to continue negotiations, according to an official briefed on talks cited by Reuters. It was separately reported that Burns will stay in Qatar on Monday and likely travel to Israel this week to meet with Israeli PM Netanyahu, according to an Axios reporter.

- US reportedly put a hold on an ammunition shipment to Israel last week, according to two Israeli officials cited by Axios.

- Iraqi armed factions announced they targeted an Israeli air base in Eilat with drones, according to Al Arabiya.

- Israeli Cabinet decided to close Qatari TV network Al Jazeera’s operations in Gaza, according to a statement cited by Reuters. It was later reported that Israel’s communications ministry said a police raid was conducted at an Al Jazeera premises in Jerusalem.

OTHER

- Russia said it took full control of Ocheretyne village in eastern Ukraine, according to the Defence Ministry, cited by Reuters.

EU/UK

NOTABLE HEADLINES

- UK PM Sunak reportedly cancelled plans for a summer general election after local election defeats with the election anticipated to occur in Autumn, according to The Telegraph.

- UK PM Sunak was warned by Conservative MPs to show some vision and start digging his party out of a hole after a disastrous set of local election results, while it was also reported that the Labour Party comfortably won the London mayoral contest to give Sadiq Khan an unprecedented third term as London Mayor, according to FT.

- ArcelorMittal (MT NA) warned the UK government that one of its main divisions could be forced to exit the UK if an application to close and redevelop a commercial port in south-east England receives approval this week, according to FT.

- ECB's Lane said in an interview with El Confidencial that the April slowdown in services inflation marks significant progress and confidence on inflation is improving, while he added exaggerating the impact of the ECB and Fed divergence is not necessary and Fed decisions have limited impact on the euro area.

- Fitch affirmed Italy at BBB; Outlook Stable and affirmed Denmark at AAA; Outlook Stable on Friday.