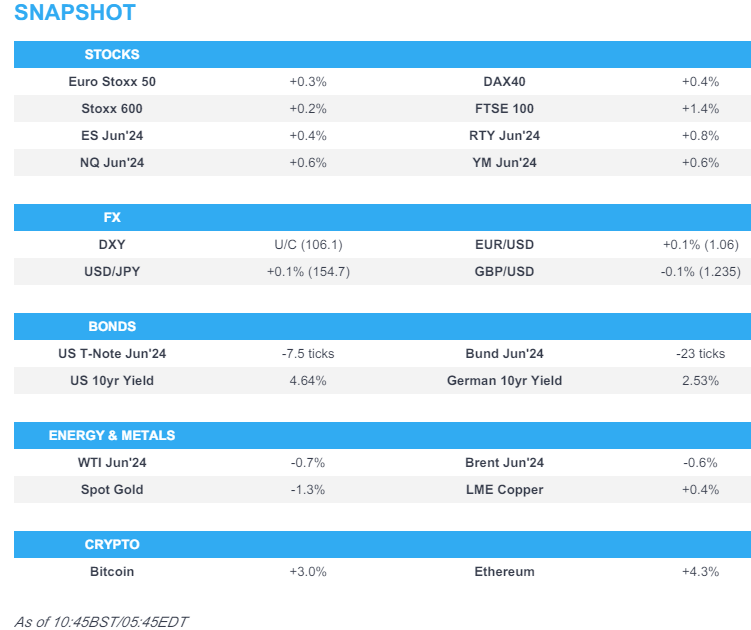

US Market Open: Equities firmer and Antipodeans benefit from the positive risk appetite, Crude softer but off worst levels; ECB's Lagarde due

22 Apr 2024, 11:15 by Newsquawk Desk

- European bourses trade mixed; Stateside futures are entirely in the green; US “Big 6” downgraded at UBS

- Dollar is flat, Antipodeans benefit from positive risk appetite, whilst safe-havens are modestly suffer

- Bonds are pressured and contained within a tight range

- Crude is subdued given the lack of geopolitical escalation over the weekend; XAU is softer and at session lows

- Looking ahead, BoC's Market Participants Survey, Comments from ECB’s Lagarde, Supply from the US, Earnings from SAP, Renault, Verizon & Cleveland-Cliffs

EUROPEAN TRADE

EQUITIES

- European bourses are mixed, Stoxx 600 (+0.2%), having initially opened with a clear positive bias. In catalyst-thin trade, equities have ebbed lower, and off best levels, though generally hold a positive bias.

- European sectors are mostly positive; Retail is found at the top of the pile after Jefferies upgraded several Cos from within the sector. Autos are the clear underperformer, after Tesla (-3.2% pre-market) cut prices for some of its models, as such, European peers are suffering.

- US Equity Futures (ES +0.4%, NQ +0.5%, RTY +0.6%) are entirely in the green, with the NQ and ES attempting to pare back some of the hefty losses seen in the prior session. Elsewhere, UBS downgraded Apple (AAPL), Amazon (AMZN), Alphabet (GOOG), Meta (META), Microsoft (MSFT) and Nvidia (NVDA) to Neutral from Overweight.

- Click here and here for the sessions European pre-market equity newsflow.

- Click here for more details.

FX

- Mixed performance for the USD; softer vs. risk-sensitive peers but faring better vs. traditional havens. DXY has been able to hold above the 106 mark and stick within Friday's 105.84-106.34 parameters.

- EUR is flat vs. the USD with the pair pivoting around the 1.0650 mark and respecting Friday's 1.0610-1.0677 range.

- JPY is steady vs. the USD with comments from BoJ Governor Ueda overnight unable to help the Yen gain ground against the Dollar. As such, USD/JPY continues to eye the multi-year peak at 154.78.

- Antipodeans are both firmer vs. the USD amid the more favourable risk environment. AUD/USD has gained a firmer footing above the 0.64 mark, advancing to a high of 0.6455 after printing a YTD low at 0.6362 on Friday.

- SNB’s Jordan said it is very important that monetary policy remains geared towards price stability rather than being used to finance debt, otherwise it will not end well, while he added that structural reforms are needed to increase competitiveness so that growth can increase which is one of the biggest challenges, according to Reuters.

- Click here for more details.

- Click here for NY Option Expiry details.

FIXED INCOME

- USTs have been contained within a 107.25-17+ range, given the lack of geopolitical escalations over the weekend. From a yield perspective, 4.696% remains the recent peak for the US 10-year with a current level of circa 4.65%.

- Bund price action has followed USTs; the benchmark hit a fresh YTD trough earlier in the session at 130.64, before scaling back losses. German 10-year yield now at levels not seen since last November, and eyes 2.55%.

- Gilts are leading peers as the fallout from dovish comments by BoE Deputy Governor Ramsden continues to reverberate around the market with the central banker confident that inflation is returning to target; Gilts are trading on either side of 97.00 mark with a session high of 97.13 eclipsing Friday's peak at 97.05.

- Click here for more details.

COMMODITIES

- Crude is softer but off worst levels as a lack of major geopolitical escalations over the weekend unwinds geopolitical premium in the complex. Brent Jun'24 slipped from a USD 87.15/bbl high to a USD 85.79/bbl intraday trough before trimming overnight losses.

- The geopolitical unwind is also reflected in precious metals prices amid a lack of escalation over the weekend; XAU declined from a USD 2,392/oz high to a USD 2,351.60/oz intraday low.

- Mixed trade across base metals within relatively tight ranges, in fitting with the price action seen in the greenback.

- UBS said it is targeting an increase in Brent to USD 91/bbl by mid-year; continues to see the oil market as being undersupplied.

- Nornickel said the Co. plans to gain access to Chinese battery technology and produce them in Russia

- Chile imposed temporary anti-dumping tariffs on Chinese steel products used in mining to support the local industry, according to Bloomberg.

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- UK government rejected an EU proposal to negotiate a post-Brexit deal to relax travel and allow young adults to move across the Channel more easily, according to Bloomberg.

- UK Chancellor Hunt is reportedly considering lowering stamp duty in his final autumn statement before the general election, according to The Times; the threshold at which homebuyers pay stamp duty from GBP 250l to GBP 300k.

- S&P affirmed Greece at BBB-/A-3; Outlook revised to Positive on ongoing debt stock reduction.

- ECB governors reportedly fear that publishing rate forecasts, or Fed-style "dot plot", would invite pressure from governments to gauge if the ECB was serving its domestic agenda, according to Reuters sources. A few governors are open to discussing the proposal at the next review due to start next year.

- The Swiss National Bank is raising the minimum reserve requirement for domestic banks from 2.5% to 4%, and to this end is amending the National Bank Ordinance as of 1 July 2024; will not affect the current monetary policy stance.

DATA RECAP

- UK Rightmove House Price Index MM (Apr) 1.1% (Prev. 1.5%); Rightmove House Price Index YY (Apr) 1.7% (Prev. 0.8%)

NOTABLE US HEADLINES

- UBS downgraded Apple (AAPL), Amazon (AMZN), Alphabet (GOOG), Meta (META), Microsoft (MSFT) and Nvidia (NVDA) to Neutral from Overweight.

- Tesla (TSLA) cut prices across its entire line up in China, with prices for the locally-produced Model 3 and Model Y have been cut by around 4%-6% and imported Model S and Model X have been cut by as much as 22%, while Tesla also cut prices in US, Germany, Europe, Middle East and Africa. Tesla has also cut the price of FSD to USD 8k from USD 12k. Furthermore, CEO Musk has postponed his planned trip to India, citing “very heavy” obligations at Tesla. (Newswires/BBC/CNN) Note, TSLA earnings are due on Tuesday after the Wall Street close.

GEOPOLITICS

MIDDLE EAST - EUROPEAN MORNING

- "Another attack on US forces in the region in the last hours, now on Al Assad base in Iraq", according to Walla News' Elster.

- Iran said nuclear weapons have no place in its nuclear doctrine.

MIDDLE EAST

- An explosion at a military base in Iraq used by the pro-Iranian militant group Iraqi Mobilization Forces south of Baghdad killed one person and wounded eight people, while the explosion was said to have been caused by an unknown air attack although Iraq’s military reported there were no drones or fighter jets in the area, according to Reuters.

- Five rockets were fired from the northern Iraqi town of Mosul towards a US military base inside of Syria, according to two security sources cited by Reuters. Furthermore, a US official said a coalition fighter destroyed a launcher in self-defence after reports of a failed rocket attack near the coalition base at Rumalyn, Syria.

- Iran-backed Lebanese group Hezbollah said it downed a drone that was attacking locations in southern Lebanon. It was separately reported that Hezbollah targeted two buildings used by enemy soldiers in the settlement of Metula and achieved a direct hit.

- Iran’s Supreme Leader Khamenei thanked the Revolutionary Guards for the April 13th attack on Israel and said the key issue is how Iran displayed its power in attacking Israel not how many missiles were launched or hit their target, while he called on Iranian armed forces to ceaselessly pursue military innovation and learn the ‘enemy’s tactics’, according to state media.

- Iraqi Kataib Hezbollah announced a resumption of operations against US forces citing a lack of progress on US troop withdrawal during the Iraqi PM's Washington visit.

- US is expected to sanction an IDF unit for human rights violations in the West Bank, while Israeli Defence Minister Gallant spoke with US Secretary of State Blinken and urged the US to reconsider the decision to sanction the IDF, according to Axios.

- US State Department said Secretary of State Blinken discussed with Israel's Gantz the need for an immediate ceasefire in Gaza and the release of detainees, according to Reuters.

- German Chancellor Scholz had a telephone call with Israeli PM Netanyahu and stressed the importance of avoiding escalation of regional hostilities, while Scholz explained the decision of the EU to impose further sanctions against Iran, according to Reuters.

- Turkish President Erdogan discussed efforts to reach a ceasefire and deliver humanitarian aid to Gaza with Hamas leader Haniyeh during a meeting in Istanbul, according to Reuters.

- Palestinian Authority President Abbas said they will reconsider bilateral relations with the US after its veto against the Palestinian bid for UN membership, according to Reuters.

OTHER

- US House passed a USD 95bln aid package for Ukraine, Israel and Taiwan, while the bills include legislation on TikTok that would force it to be sold or face a national ban in the US, according to Reuters.

- Ukrainian President Zelensky US aid will send a signal that it will not be a second Afghanistan and that the US will stay with Ukraine, while he said Ukraine will have a chance for victory and needs long-range weapons not to lose people on the front line. Furthermore, he responded that Ukraine is preparing when asked about a possible major offensive by Russia, according to Reuters.

- Ukraine sources said a large-scale drone attack was conducted against Russia which targeted energy facilities that support Russian military-industrial production in which at least three power substations and a fuel depot were hit in the attack, according to Reuters.

- Kremlin spokesman Peskov said the House passage of the Ukraine bill will make the US richer and further ruin Ukraine, resulting in more deaths, while he added the bill’s provision on confiscation of Russian assets will tarnish the image of the US and that Russia will take measures in response, according to Reuters.

- Russian Foreign Ministry said the US is using Ukrainians as cannon fodder and is fighting a hybrid war against Russia, while it added that deeper US immersion in a hybrid war against Russia will turn into a fiasco like its wars in Vietnam or Afghanistan, according to Reuters. In relevant news, the Russian Defence Ministry said Russia took full control over Bohdanivka in the Donetsk region, according to IFAX.

- China’s Foreign Ministry said any attempt to provoke camp confrontation in the South Pacific region does not serve the urgent needs of South Pacific island countries and the region should not become an arena for a major power rivalry, according to Reuters.

- North Korea said it conducted a test firing of missiles on Friday.

- North Korea fired would could be a ballistic missile on Monday, via Japanese Government; missile flew towards the sea off the East coast, according to South Korean military; missile believed to have fallen outside of Japan's Exclusive Economic Zone (EEZ).

- Poland is "ready" to have nuclear weapons on its territory, according to the President cited by AFP. Russia's Kremlin on reports Poland is ready to host US nuclear weapons, said "our military will analyst this and take the necessary steps".

CRYPTO

- Bitcoin climbs higher post-halving and now holds just above USD 66k; Ethereum also firmer and back at 3.2k.

APAC TRADE

- APAC stocks were mostly positive following the lack of any major geopolitical escalations over the weekend.

- ASX 200 was underpinned amid gains in nearly all sectors and with the advances initially led by outperformance mining stocks as copper prices approached closer to the USD 10,000/ton level and with firm gains in South32 following its quarterly output update.

- Nikkei 225 gained but is well off intraday highs after the index briefly wiped out all its earlier spoils before recovering again with price action choppy after last Friday's comments from BoJ Governor Ueda who suggested a hike is very likely if underlying inflation increases.

- Hang Seng and Shanghai Comp. were mixed in which the latter outperformed with strength in biopharma, tech and consumer stocks front-running the gains in the index. Conversely, the mainland lagged amid US-China frictions after the US House passed a bill that could lead to a total TikTok ban, while China's benchmark Loan Prime Rates were maintained at their current levels, as expected.

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1 Year (Apr) 3.45% vs. Exp. 3.45% (Prev. 3.45%)

- Chinese Loan Prime Rate 5 Year (Apr) 3.95% vs. Exp. 3.95% (Prev. 3.95%)

- US Secretary of State Blinken will visit China on April 24th-26th to meet officials in Shanghai and Beijing, while Blinken will be joined by top State Department official for Asia Kritenbrink, top narcotics official Robinson and cyberspace and digital policy ambassador Fick. Furthermore, a US official said Blinken will express US intent to have China curtail its support for Russia’s defence industrial base and it was also stated that the US is prepared to take steps against firms acting against US interests, according to Reuters.

- BoJ Governor Ueda said the BoJ will reduce JGB purchases at an unspecified time in the future but the extent of the reduction remains undetermined, while he reiterated to expect accommodative financial conditions to continue for the time being and that they need to take time to consider what to do with their ETF holdings. Ueda said the weighted average of medium and long-term inflation expectations indicates a rising trend but remains slightly below 2% and noted that raising interest rates is very likely if underlying inflation increases. Furthermore, he said the BoJ will proceed cautiously and is watching wages and will see the effect of possible wage increases on prices, especially service prices, while he added that they may change the short-term policy rate depending on the incoming data.

- Earthquake has been felt in the Taiwanese capital of Taipei, according to witnesses cited by Reuters; reports suggest it could be a 4.2 magnitude earthquake.