Europe Market Open: APAC stocks were mostly positive following the lack of any major geopolitical escalations over the weekend.

22 Apr 2024, 06:26 by Newsquawk Desk

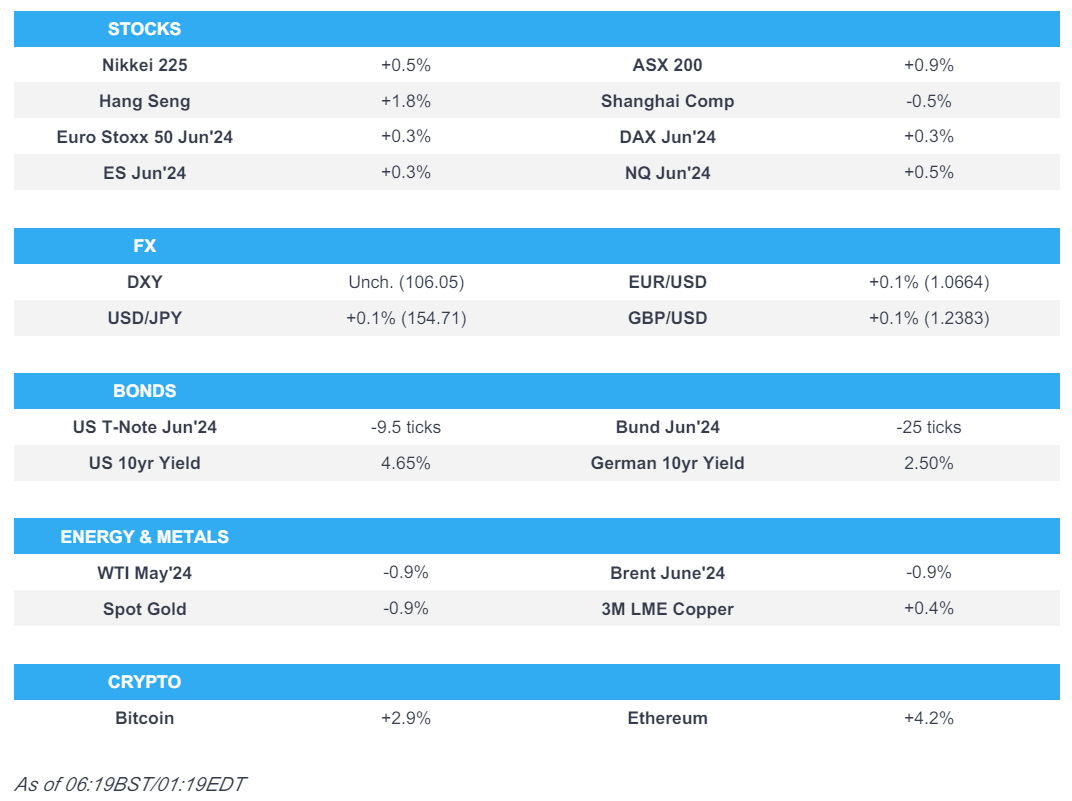

- APAC stocks were mostly positive following the lack of any major geopolitical escalations over the weekend.

- China's benchmark Loan Prime Rates were maintained at their current levels, as expected.

- European equity futures indicate a higher open with the Euro Stoxx 50 future +0.4% after the cash market closed down 0.4% on Friday.

- DXY remains on a 106 handle, risk-sensitive antipodeans outperform, safe-havens JPY and CHF lag.

- Looking ahead, highlights include BoC's Market Participants Survey, Comments from ECB’s Lagarde & Villeroy, Supply from the US.

US TRADE

EQUITIES

- US stocks were mixed on Friday as attention was on geopolitics following Israel's retaliation on Iran which turned out to be limited and with neither seen to escalate the situation further, while the Nasdaq underperformed with notable losses in Nvidia (NVDA) and Netflix (NFLX) shares in which the latter was hit on a slightly disappointing next quarter revenue guidance and stopping to report subscriber count.

- SPX -0.88% at 4,967, NDX -2.05% at 17,037, DJIA +0.56% at 37,986, RUT +0.24% at 1,947.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed Semi-Annual Financial Stability Report was released on Friday which stated persistent inflation and tighter monetary policy remain the most cited potential risk to the financial system, while contacts noted uncertainties in several areas including trade policy, escalating geopolitical tensions and policy uncertainty associated with the upcoming US elections. Furthermore, commercial real estate and banking sector stress was less frequently cited as stability risk than in the Fed's Fall 2023 survey.

APAC TRADE

EQUITIES

- APAC stocks were mostly positive following the lack of any major geopolitical escalations over the weekend.

- ASX 200 was underpinned amid gains in nearly all sectors and with the advances initially led by outperformance mining stocks as copper prices approached closer to the USD 10,000/ton level and with firm gains in South32 following its quarterly output update.

- Nikkei 225 gained but is well off intraday highs after the index briefly wiped out all its earlier spoils before recovering again with price action choppy after last Friday's comments from BoJ Governor Ueda who suggested a hike is very likely if underlying inflation increases.

- Hang Seng and Shanghai Comp. were mixed in which the latter outperformed with strength in biopharma, tech and consumer stocks front-running the gains in the index. Conversely, the mainland lagged amid US-China frictions after the US House passed a bill that could lead to a total TikTok ban, while China's benchmark Loan Prime Rates were maintained at their current levels, as expected.

- US equity futures (ES +0.3%) recovered some of last Friday's losses after risks of an all-out Israel-Iran war were seen to have dissipated.

- European equity futures indicate a higher open with the Euro Stoxx 50 future +0.4% after the cash market closed down 0.4% on Friday.

FX

- DXY tested the 106.00 level to the downside with price action rangebound amid light catalysts and after the Fed entered into a blackout period over the weekend, while the focus for the US this week will be on data including US GDP and PCE figures.

- EUR/USD was marginally positive but with gains capped after ECB speakers continued to flag a June rate cut.

- GBP/USD attempted to nurse some of its recent losses but remained sub-1.2400 with the recovery lacking strength.

- USD/JPY traded rangebound although the pair maintained a firm footing at the 154.00 handle.

- Antipodeans outperformed amid tailwinds from the heightened risk appetite.

- SNB’s Jordan said it is very important that monetary policy remains geared towards price stability rather than being used to finance debt, otherwise it will not end well, while he added that structural reforms are needed to increase competitiveness so that growth can increase which is one of the biggest challenges, according to Reuters.

FIXED INCOME

- 10-year UST futures were pressured amid the improved risk appetite and ahead of supply, while prices have fully reversed the entire haven bid seen on Friday from Israel's response against Iran.

- Bund futures languished at year-to-date lows after retreating beneath the 131.00 level.

- 10-year JGB futures were pressured amid losses in global peers and after comments from BoJ Governor Ueda who continued to suggest that the door was open for further policy adjustment depending on the data.

COMMODITIES

- Crude futures were subdued following the lack of any major geopolitical escalation over the weekend.

- A fire erupted at a crude oil transportation line east of Syria’s Al-Furqlus which firefighters responded to, according to state media.

- Spot gold retreated as the mostly positive risk environment sapped haven demand.

- Copper futures extended on the ongoing rally to trade at their best levels in almost two years and approached just shy of the USD 10,000/ton level before paring most of its earlier gains.

- Chile imposed temporary anti-dumping tariffs on Chinese steel products used in mining to support the local industry, according to Bloomberg.

CRYPTO

- Bitcoin was underpinned alongside the positive risk tone and approached towards the USD 66,000 level, while price action was rangebound over the weekend with a relatively muted reaction seen following the quadrennial halving.

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1 Year (Apr) 3.45% vs. Exp. 3.45% (Prev. 3.45%)

- Chinese Loan Prime Rate 5 Year (Apr) 3.95% vs. Exp. 3.95% (Prev. 3.95%)

- US Secretary of State Blinken will visit China on April 24th-26th to meet officials in Shanghai and Beijing, while Blinken will be joined by top State Department official for Asia Kritenbrink, top narcotics official Robinson and cyberspace and digital policy ambassador Fick. Furthermore, a US official said Blinken will express US intent to have China curtail its support for Russia’s defence industrial base and it was also stated that the US is prepared to take steps against firms acting against US interests, according to Reuters.

- BoJ Governor Ueda said the BoJ will reduce JGB purchases at an unspecified time in the future but the extent of the reduction remains undetermined, while he reiterated to expect accommodative financial conditions to continue for the time being and that they need to take time to consider what to do with their ETF holdings. Ueda said the weighted average of medium and long-term inflation expectations indicates a rising trend but remains slightly below 2% and noted that raising interest rates is very likely if underlying inflation increases. Furthermore, he said the BoJ will proceed cautiously and is watching wages and will see the effect of possible wage increases on prices, especially service prices, while he added that they may change the short-term policy rate depending on the incoming data.

GEOPOLITICS

MIDDLE EAST

- An explosion at a military base in Iraq used by the pro-Iranian militant group Iraqi Mobilization Forces south of Baghdad killed one person and wounded eight people, while the explosion was said to have been caused by an unknown air attack although Iraq’s military reported there were no drones or fighter jets in the area, according to Reuters.

- Five rockets were fired from the northern Iraqi town of Mosul towards a US military base inside of Syria, according to two security sources cited by Reuters. Furthermore, a US official said a coalition fighter destroyed a launcher in self-defence after reports of a failed rocket attack near the coalition base at Rumalyn, Syria.

- Iran-backed Lebanese group Hezbollah said it downed a drone that was attacking locations in southern Lebanon. It was separately reported that Hezbollah targeted two buildings used by enemy soldiers in the settlement of Metula and achieved a direct hit.

- Iran’s Supreme Leader Khamenei thanked the Revolutionary Guards for the April 13th attack on Israel and said the key issue is how Iran displayed its power in attacking Israel not how many missiles were launched or hit their target, while he called on Iranian armed forces to ceaselessly pursue military innovation and learn the ‘enemy’s tactics’, according to state media.

- Iraqi Kataib Hezbollah announced a resumption of operations against US forces citing a lack of progress on US troop withdrawal during the Iraqi PM's Washington visit.

- US is expected to sanction an IDF unit for human rights violations in the West Bank, while Israeli Defence Minister Gallant spoke with US Secretary of State Blinken and urged the US to reconsider the decision to sanction the IDF, according to Axios.

- US State Department said Secretary of State Blinken discussed with Israel's Gantz the need for an immediate ceasefire in Gaza and the release of detainees, according to Reuters.

- German Chancellor Scholz had a telephone call with Israeli PM Netanyahu and stressed the importance of avoiding escalation of regional hostilities, while Scholz explained the decision of the EU to impose further sanctions against Iran, according to Reuters.

- Turkish President Erdogan discussed efforts to reach a ceasefire and deliver humanitarian aid to Gaza with Hamas leader Haniyeh during a meeting in Istanbul, according to Reuters.

- Palestinian Authority President Abbas said they will reconsider bilateral relations with the US after its veto against the Palestinian bid for UN membership, according to Reuters.

OTHER

- US House passed a USD 95bln aid package for Ukraine, Israel and Taiwan, while the bills include legislation on TikTok that would force it to be sold or face a national ban in the US, according to Reuters.

- Ukrainian President Zelensky US aid will send a signal that it will not be a second Afghanistan and that the US will stay with Ukraine, while he said Ukraine will have a chance for victory and needs long-range weapons not to lose people on the front line. Furthermore, he responded that Ukraine is preparing when asked about a possible major offensive by Russia, according to Reuters.

- Ukraine sources said a large-scale drone attack was conducted against Russia which targeted energy facilities that support Russian military-industrial production in which at least three power substations and a fuel depot were hit in the attack, according to Reuters.

- Kremlin spokesman Peskov said the House passage of the Ukraine bill will make the US richer and further ruin Ukraine, resulting in more deaths, while he added the bill’s provision on confiscation of Russian assets will tarnish the image of the US and that Russia will take measures in response, according to Reuters.

- Russian Foreign Ministry said the US is using Ukrainians as cannon fodder and is fighting a hybrid war against Russia, while it added that deeper US immersion in a hybrid war against Russia will turn into a fiasco like its wars in Vietnam or Afghanistan, according to Reuters. In relevant news, the Russian Defence Ministry said Russia took full control over Bohdanivka in the Donetsk region, according to IFAX.

- China’s Foreign Ministry said any attempt to provoke camp confrontation in the South Pacific region does not serve the urgent needs of South Pacific island countries and the region should not become an arena for a major power rivalry, according to Reuters.

- North Korea said it conducted a test firing of missiles on Friday.

EU/UK

NOTABLE HEADLINES

- UK government rejected an EU proposal to negotiate a post-Brexit deal to relax travel and allow young adults to move across the Channel more easily, according to Bloomberg.

- UK Chancellor Hunt is reportedly considering lowering stamp duty in his final autumn statement before the general election, according to The Times; the threshold at which homebuyers pay stamp duty from GBP 250l to GBP 300k.

- BoE's Mann said on Friday that central banks will have to use autonomy effectively, while she noted concerns about the fragmentation impact on inflation and noted that global integration was important in taming inflation.

- ECB’s Villeroy said a June cut will be followed by others at a ‘pragmatic pace’ and tensions in the Middle East will not affect a flagged June rate cut ‘barring surprises’, according to Reuters.

- ECB's Muller said on Friday that he sees a few more rate cuts by year-end after June if the economy is in line with ECB expectations.

- ECB's Nagel said on Friday that a June rate cut is possible if the outlook holds and it is absolutely premature to discuss the path beyond June. Nagel added that the ECB sets policy for the EZ but the US affects the situation and rates must stay restrictive even if cuts start.

- ECB’s Wunsch said on Friday that he does not have a base case although it is very unlikely that the ECB will only cut by 25bps in 2024, while he would not exclude a rate cut in July but it is hard to forecast now and noted the US and Eurozone economies have decoupled. Wunsch also said the July meeting will give a signal on the rate path and ECB decisions will get harder after two rate cuts, as well as commented that an oil spike would impact the timing of rate reductions.

- S&P affirmed Greece at BBB-/A-3; Outlook revised to Positive on ongoing debt stock reduction.

DATA RECAP

- UK Rightmove House Price Index MM (Apr) 1.1% (Prev. 1.5%)

- UK Rightmove House Price Index YY (Apr) 1.7% (Prev. 0.8%)