US Market Open: Sentiment hit after Israel strikes Iran, though has pared as Iran downplays the attacks; Crude now lower

19 Apr 2024, 11:15 by Newsquawk Desk

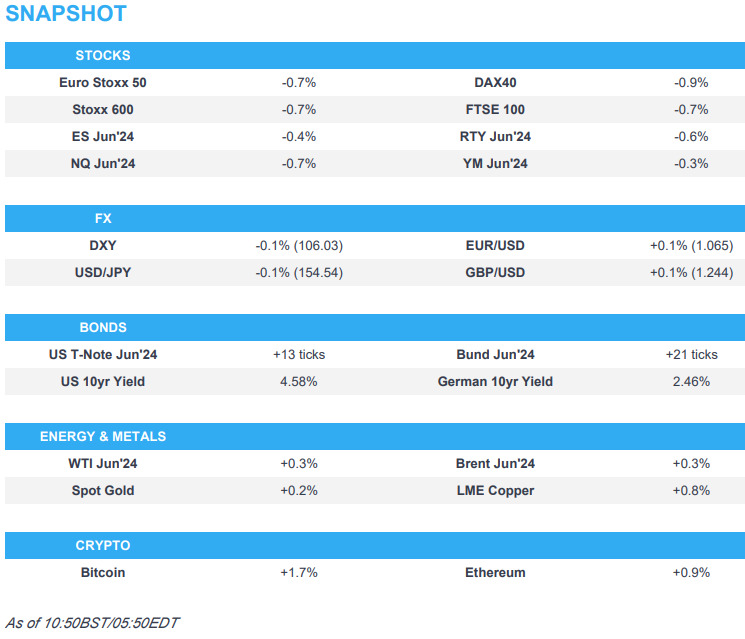

- Equities are entirely in the red, though well off worst levels following geopolitical events overnight

- Israel conducted an operation against Iran which an Iranian official said was on a military airbase near Isfahan. However, Iran's Press TV later denied reports of a foreign attack in Iranian cities including Isfahan

- Dollar lower and around 106.00, safe-haven status benefits CHF, whilst Antipodeans lag

- Bonds are modestly firmer, though has pared the majority of the overnight advances

- Crude soared overnight after Israel attacked an Iranian military base, though gave back gains after Iran downplayed the events

- Looking ahead, BoE’s Ramsden & Fed's Goolsbee, Earnings from SLB, American Express & PG

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (-0.6%) are entirely in the red, with sentiment hit after Israel conducted an operation against Iran on a military airbase near Isfahan; though Iran later downplayed the attack, which helped to lift sentiment off worst levels, with contracts continuing to pare losses in otherwise quiet newsflow.

- European sectors hold a strong negative tilt; Industrials is found at the foot of the pile, with Schneider Electric (-1.9%) leading the losses. Autos are also lagging, after Nissan downgraded its guidance citing lower sales volume.

- US Equity Futures (ES -0.6%, NQ -0.8%, RTY 0.7%) are entirely in the red, though very much off worst levels seen overnight, sparked by the Israeli attacks on Iran. As for stock specifics, Netflix (-6.1%) is lower in the pre-market despite reporting strong headline metrics; however, the Co’s Q2 guidance fell short of expectations.

- Click here and here for the sessions European pre-market equity newsflow.

- Click here for more details.

FX

- USD is mixed vs peers, with the Dollar softer against safe-havens JPY and CHF but out-muscling risk-sensitive AUD and NZD. DXY went as high as 106.35 before scaling back gains.

- EUR is firmer vs. the USD after recovering geopolitically-inspired losses overnight which dragged the pair to a 1.0611 trough; currently off lows at 1.065.

- Yen slightly firmer vs. the USD despite softer-than-expected Japanese inflation metrics overnight. Safe-haven status is likely playing a role here but ultimately the pair remains on a 154 handle after delving as low as 153.60.

- Antipodeans are both lower vs. the USD and suffering in the current risk environment. AUD/USD printed a fresh YTD trough at 0.6362, though has since pared.

- CBRT Survey: End 2024 CPI 44.16% (prev. 44.19%), 12-month CPI 35.17% (prev. 36.7%), 2024 GDP 3.3% (prev. 3.3%), end-2024 USD/TRY 40.0098 (prev. 40.5344). 12-month Repo Rate 38.18% (prev. 36.96%)

- Click here for more details.

FIXED INCOME

- USTs have pulled back from overnight geopolitics-induced highs of 108-22+ with newsflow otherwise limited and the docket sparse as we approach the Fed blackout. USTs climbed over 20 ticks during the initial reporting of an Israel strike on Iran, before peaking and beginning to pullback as Iran downplayed the attacks.

- Gilts gapped higher by 20 ticks as the benchmark reacted to overnight developments, though USTs had already pared much of their move by this point hence the somewhat modest open. Further dovish-impetus drawn from another broadly unchanged UK Retail Sales M/M print. Gilts currently around the mid-point of 96.68-97.01 parameters.

- Bund price action has mimicked that of USTs, with little regional catalysts to spark a reaction. Currently just into the green and at the mid-point of the week's 130.97-132.55 range with the 10yr yield similarly holding a few bps shy of the 2.50% mark.

- Click here for more details.

COMMODITIES

- Brent futures rose as much as 4.2% on fears nuclear sites in Iran have been targeted, although as details emerged, the event proved to be much milder than initially reported, and thus crude future backtracked most of the upside. Currently higher by USD 0.50/bbl intraday, with Brent holding around USD 87.60/bbl.

- Precious metals are mixed trade across precious metals with spot gold well off best levels amid an unwind of the geopolitical risk premium after Israel's strike on Iran was found to be limited in nature whilst Iran has no immediate plans to retaliate.

- Base metals are mostly firmer amid the pullback in the Dollar and recovery in risk after Israel's attack on Iran was seemingly non-escalatory. Meanwhile, mainland Chinese markets were somewhat unfazed by geopolitics overnight vs regional peers.

- Commerzbank says for H2, expects Brent price level of USD 90-95/bbl; raises copper, sees year-end USD 9.8k/ton (prev. USD 9.2k).

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- ECB's Vujcic said so far FX market has been very calm about the risk of Fed-ECB divergence.

- ECB's Kazaks says it is too soon to declare victory on inflation, economy isn't strong by confidence is improving. ECB takes the Fed into account.

- German government expects GDP to grow 0.3% in 2024 (prev. forecast of 0.2%), according to Reuters sources; sees inflation at 2.4% (prev. 2.8%).

- US President Biden weighs more than USD 1bln in new arms for Israel; Considering supply tank shells, mortars and vehicles, via WSJ

DATA RECAP

- UK Retail Sales MM (Mar) 0.0% vs. Exp. 0.3% (Prev. 0.0%, Rev. 0.1%); YY (Mar) 0.8% vs. Exp. 1.0% (Prev. -0.4%, Rev. -0.3%)

- German Producer Prices MM (Mar) 0.2% vs. Exp. 0.1% (Prev. -0.4%); YY (Mar) -2.9% vs. Exp. -3.2% (Prev. -4.1%)

NOTABLE US HEADLINES

- Fed's Bostic (voter) said inflation is too high and they still have a ways to go on inflation, while the pathway to 2% will be slower than people expect and bumpy. Bostic added inflation is going where the Fed wants it to go but it is slow and he reiterated they won't be able to cut rates until towards the end of the year. Bostic separately commented that the Fed is on its path to the inflation target and he is grateful progress is being made on inflation and that the economy continues to grow. Bostic also noted that policy is currently restrictive and the Fed can be patient, while he reiterated that he sees one cut this year.

- Fed's Kashkari (non-voter) said once inflation is heading back to the 2% target, the Fed can cut rates but added that they could potentially wait until 2025 to cut rates, while he stated they need to be patient until they are convinced that inflation is falling and noted the resilience of the housing market has been a surprise, according to a Fox News interview.

EARNINGS

- Netflix Inc (NFLX) Q1 2024 (USD): EPS 5.28 (exp. 4.52), Revenue 9.37bln (exp. 9.28bln), Q1 Subscriber Additions 9.33mln (exp. 5.11mln). Guides Q2 EPS USD 4.68 (exp. 4.54). Guides Q2 revenue USD 9.49bln (exp. 9.51bln). Guides Q2 Subscriber Additions to be lower in Q2 vs Q1 due to typical seasonality (exp. 3.51mln). Guides Q2 operating margin 26.6% (exp. 25.4%).Will stop reporting quarterly member ship number and ARM starting from Q1 2025 earnings. Shares -6.1% pre-market

- L'Oreal shares gained as much as 4.2% in the European session after strong results and making note of strong growth in China.

GEOPOLITICS

MIDDLE EAST - EUROPEAN MORNING

- IAEA confirms that there was no damage to Iranian nuclear facilities.

- Senior Iranian Official says there is no plan for an immediate retaliation; no clarification on who is behind the incident.

- Israel's Channel 12 says "Army and security services estimate that the attack on Iran is over, but Israel maintains high alert", via Al Jazeera Breaking.

- "Jerusalem Post: Israeli planes fired long-range missiles targeting a facility belonging to Iranian forces in Isfahan", according to Sky News Arabia.

MIDDLE EAST

- Israel conducted an operation against Iran which an Iranian official said was on a military airbase near Isfahan. However, Iran's press TV later cited informed sources denying reports of a foreign attack in Iranian cities including Isfahan, according to Reuters.

- Initial reports on social media platform X noted explosions were heard near the city of Isfahan and Natanz in Central Iran where there are nuclear facilities, while Iranian state TV noted 'big explosions' were heard near Isfahan and there were also reports of Israeli strikes in southern Syria and Israeli warplane activity in Iraq. Furthermore, Iran International noted several flights were diverted over the Iranian airspace amid reports of an Israeli attack against a site in Iran and it was also reported that Israel told the US on Thursday it planned to conduct its response against Iran in 24-48 hours. However, it was later reported the explosions in Isfahan were drones being shot down and there were no ground explosions, while a US official noted that Israel conducted a strike on Iran but did not target nuclear facilities.

- Iran's senior commander Mihandoust said 'noise heard in Isfahan overnight was caused by air defence targeting one suspicious object', while he added 'there was no damage caused', according to Reuters.

- Iranian Foreign Minister told the UN Security Council that Iran "had no other option" but to attack Israel, while he added Iran's defence and countermeasures have concluded and Israel must be compelled to stop any further military adventurism against their interests. Furthermore, he warned if there is any use of force by Israel or violation of Iran's sovereignty, Iran's response will be decisive and proper to make Israel regret its actions.

- Senior Iranian Guards Commander said Tehran could review its nuclear doctrine and that nuclear sites are in "total security", while he added "Our hands are on the trigger, Israel's nuclear facilities have been identified". Furthermore, he said they are ready to launch powerful missiles to destroy designated targets in Israel and warned if Israel dares to hit their nuclear sites, they will surely hit back.

- US blocked the Palestinian request for full UN membership, while Israel's Foreign Minister said the 'shameful proposal' was rejected at the UN Security Council and he commended the US for vetoing the proposal. It was also reported that the Palestinian Presidency said it condemns the US veto of full Palestinian membership and Egypt said it regrets the inability of the UN Security Council to pass a resolution enabling Palestine to become a full member of the UN.

OTHER

- Ukrainian PM Shmyhal said he welcomes progress on USD 61bln in US aid to Ukraine and is optimistic that the aid bill will soon be supported in the House, while he had important discussions with top US officials about using frozen Russian assets to benefit Ukraine and expect results this year.

- German Chancellor Scholz said NATO partners could deliver a further six patriot systems to Ukraine and Germany at the front.

- FBI Director Wray said Chinese government-linked hackers have burrowed into US critical infrastructure and are waiting for the right moment to deal a devastating blow, according to Reuters.

- North Korea's Deputy Foreign Minister held talks with Belarusian counterparts to improve cooperation, according to KCNA.

CRYPTO

- Bitcoin back on a firmer footing and towards USD 65k, ahead of the widely anticipated "halving" expected later today/tomorrow.

APAC TRADE

- APAC stocks were lower across the board as the initial tech-related selling stemming from Wall St was exacerbated by reports of explosions in Iran following an Israeli operation although stocks are off today's worst levels as Iran downplayed and later denied the attack.

- ASX 200 was pressured with losses led by underperformance in tech and amid the bout of geopolitical-related turmoil.

- Nikkei 225 suffered intraday losses of around 3% and briefly dipped beneath the 37,000 level.

- Hang Seng and Shanghai Comp. were lower but with losses only mild compared to the regional counterparts especially the mainland which was largely unfazed by the various geopolitical headlines and disinformation.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda said there is a chance weak Yen may affect trend inflation and if so, could lead to a policy shift.

- Nissan (7201 JT) downgrades guidance: revises 2023/24 forecasts (JPY): Net 370bln (prev. 390bln), Operating 530bln (prev. 620bln); revision lower due to lower sales volume from and various cost reliefs made to suppliers e.g. inflation & other factors.

- Japanese Cabinet Secretary Hayashi says continue to closely monitor impact from oil prices on Japanese economy with a sense of urgency.

- South Korean regulator chief says will closely monitor markets and prepare to deploy market stabilising measures as needed

DATA RECAP

- Japanese National CPI YY (Mar) 2.7% vs. Exp. 2.9% (Prev. 2.8%); National CPI Ex. Fresh Food YY (Mar) 2.6% vs. Exp. 2.6% (Prev. 2.8%); Ex. Fresh Food & Energy YY (Mar) 2.9% vs. Exp. 3.0% (Prev. 3.2%)