US Market Open: Equities firmer, JPY soft and AUD benefits from metals strength whilst crude sinks; US Retail Sales due

15 Apr 2024, 11:08 by Newsquawk Desk

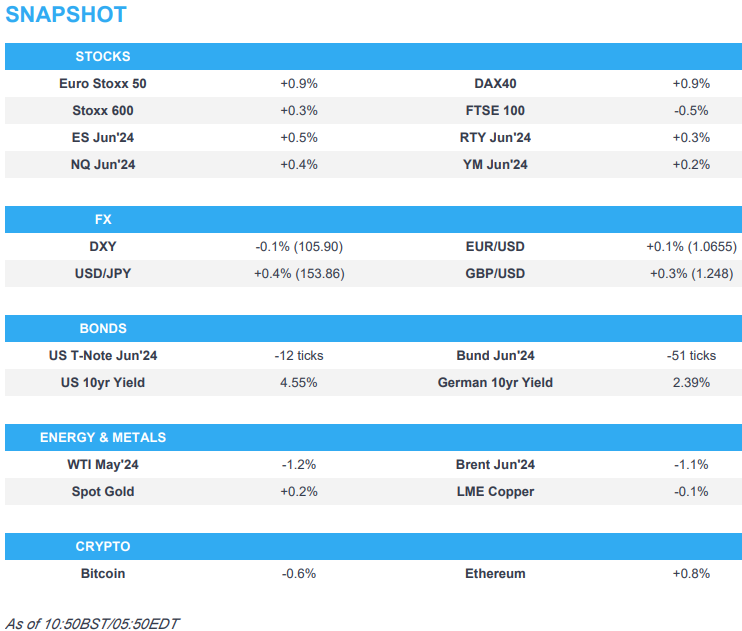

- Equities are firmer though with the FTSE 100 lagging, hampered by broader weakness in the crude complex

- Dollar flat, AUD benefits from metals strength and JPY lags

- Bonds pressured in a continuation of recent price action, Bunds looking to test 132.00

- Crude lower after the Iran attacks were mostly nullified, XAU modestly firmer

- Looking ahead, US Retail Sales, Fed's Williams, BoE’s Breeden & ECB’s Lane & de Cos. Earnings from Goldman Sachs & Charles Schwab.

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (+0.3%), began the session on a firmer footing and continued to edge higher throughout the morning, with participants garnering optimism from the lack of clear pointers to a potential response from Israel, following the recent attack from Iran.

- European sectors hold a positive tilt; Industrials top the pile, as Defensive names benefit from the heightened geopolitical environment over the weekend. Energy is found at the foot of the pile, as the crude complex sinks.

- US Equity Futures (ES +0.5%, NQ +0.6%, RTY +0.6%) are entirely in the green, and directionally in-fitting with the broader sentiment seen in Europe.

- Click here and here for the sessions European pre-market equity newsflow, including earnings.

- Click here for more details.

FX

- USD remains near Friday's highs as the narrative of US exceptionalism has rolled into this week. DXY is yet to make a fresh peak after climbing to a 106.10 summit on Friday.

- EUR is inching gains vs. the USD but minor compared to the damage done last week by the focus on Fed vs. ECB divergence which dragged the pair from a weekly high at 1.0885 to a low of 1.0622.

- Cable attempted to recoup some lost ground which has been prompted by a reassessment of the chronology of Fed vs. BoE rate cuts that was assumed at the start of the year. Currently trading around the upper end of today's range at 1.2490.

- JPY the clear laggard across the majors as relative Fed vs. BoJ policy paths remain the key-driving force as verbal intervention from officials remains ineffective. USD/JPY as high as 153.96 with focus on a breach of 154 and eventual 155 which many have touted as a line in the sand in Tokyo.

- AUD the best performer across the majors with price action in the metals space underpinning the currency.

- PBoC set USD/CNY mid-point at 7.0979 vs exp. 7.2478 (prev. 7.0967).

- Senior Japanese MOF official says they are in frequent and regular talks with the US and other countries' authorities on financial and FX market moves

- Click here for more details.

- Click here for the Option Expiries for today's NY Cut.

FIXED INCOME

- USTs are pressured in a continuation of the late-Friday pullback as the Iran-Israel situation had yet to escalate as much as some feared at that point. USTs hold at their 108-06 trough, below which Friday's 108-00+ base resides before last week's 107-27+ low.

- Bunds have been edging lower throughout the morning, continuing price action seen on Friday; 132.00 to the downside looms, which brings the 10yr yield back towards 2.40%.

- Gilts at lows as the UK benchmark is subject to the above alongside its own divergence with the Fed. Today's base matches Friday's 97.22 trough with the figure below and then support via last week's 96.82 low thereafter.

- Click here for more details.

COMMODITIES

- Crude is softer after the widely-telegraphed Iranian attack on Israel was mostly intercepted, and Israel is yet to retaliate; Brent June slipped from a USD 91.05/bbl peak to levels under USD 90/bbl.

- Precious metals are mostly firmer; XAU and silver see modest gains and the Dollar wanes off its best level while spot palladium trades lacklustre; Spot gold hovers around USD 2,350/oz.

- Mixed trade across base metals with clear outperformance in aluminium and nickel as prices surged in APAC trade after the US banned imports of Russian-origin aluminium, copper and nickel into the US on Friday.

- US banned imports of Russian-origin aluminium, copper and nickel into the US on Friday, while it also limited their use on global metal exchanges in OTC derivatives trading. UK also announced joint action with the US to clamp down on prohibited Russian metal exports with the London Metal Exchange and the Chicago Mercantile Exchange to no longer trade new aluminium, copper and nickel produced by Russia.

- Russia's Rusal (on UK and US sanctions) says actions will have no impact on the Co.'s ability to supply, adding that overall production and quality systems are not effected

- Goldman Sachs expects no immediate supply-demand shock from the LME's ban on Russian metals.

- Click here for more details.

NOTABLE HEADLINES

- UK PM Sunak is resisting advice from allies to set the date for the UK general election, which they said would help him fend off a leadership challenge threat by Conservative Party rebels next month, according to Bloomberg.

- UK Treasury was urged by the British Property Federation industry group to reverse the decision to end stamp-duty relief for multiple dwellings and warned the move will discourage the construction of homes being built in England, according to FT.

- France launched a dispute with the UK over fishing rights after its trawlers were banned from some British waters to protect vulnerable habitats, while its diplomats will meet with UK counterparts this Monday, according to FT.

- ECB’s Villeroy said the ECB is increasingly confident that it is winning the fight against inflation which makes an interest rate cut in June very likely, according to Reuters.

- ECB's Holzmann said on Friday that a rate cut in June is likely but depends on the data and a June rate cut is probable if CPI stays on the current path, while he added the rate cut pace will depend on inflation and wages, according to ORF TV interview.

- ECB's Simkus says rate cut is possible in June and also in July; further trajectory of cuts will depend on July decisions; there is now more than a 50% chance of more than three rate cuts this year. Geopolitical shocks such as an escalation if the Israel-Iran conflict could cancel a June rate cut.

DATA RECAP

- EU Industrial Production YY (Feb) -6.4% vs. Exp. -5.7% (Prev. -6.7%, Rev. -6.6%); Industrial Production MM (Feb) 0.8% vs. Exp. 0.8% (Prev. -3.2%, Rev. -3.0%)

- Polish CPI Final MM (Mar) 0.2% (Prev. 0.2%); CPI Final YY (Mar) 2.0% (Prev. 1.9%)

NOTABLE US HEADLINES

- Apple (AAPL) - Co. reportedly lost its top phone maker spot to Samsung Electronics (005930 KS) after its smartphone shipments dropped about 10% in Q1, according to IDC. (IDC)

- Tesla (TSLA) lays off "more than 10%" of its global workforce, via electrek citing an internal company-wide email. (electrek); Co. on Friday lowered the monthly FSD subscription price to USD 99/month in the US (prev. USD 199/month). Separately, Co. announced to Gigafactory Texas employees that it will shorten the Cybertruck production shift amid rumours that it is preparing a round of layoffs, according to Electrek. (Electrek). Elsewhere, scouts first showroom locations in India ahead of plans to begin sales later this year and looking for new Delhi and Mumbai sites, via Reuters citing sources.

GEOPOLITICS

MIDDLE EAST - EUROPEAN MORNING

- "Israel is considering bringing forward the operation in Rafah from the originally planned date"; "The answer Hamas gave back to the mediators is so unequivocal against a deal", according to sources cited by Israeli Radio correspondent.

- UK Foreign Minister Cameron says more sanctions against Iran will be considered.

- "Iranian Foreign Ministry: We advise the countries supporting (Israel) to warn it against taking any other action against us", via Al Jazeera.

- Israeli war cabinet is to reconvene at 12:00 BST/07:00ET, via Reuters citing a government source.

MIDDLE EAST

- Israel’s military said there were more than 300 projectiles fired by Iran at Israel with some of the launches from Iraq, Yemen and Iran but noted that 99% of them were intercepted and there was very little damage caused, while it said Iran undertook a very grave action that pushes the region towards escalation and Israel’s armed forces retain full functionality and are discussing options for follow-up operations, according to Reuters and CBS News.

- Israel requested an emergency meeting of the UN Security Council to condemn Iran and a senior Israeli official said there will be a significant response to the unprecedented Iranian attack, while it was also reported that Israeli Defence Minister Gallant said Israel has an opportunity to form a strategic alliance against Iran after the attack, according to Reuters.

- Israeli officials said a majority in the Israeli war cabinet favours a response to the Iranian attack but is divided over the timing and the scale, according to Reuters.

- Iranian President Raisi said the operation against Israel was carried out with high accuracy and they displayed the power of their missiles and drones well, while he added the operation targeted military centres and was carried out in full coordination between the field and diplomacy.

- Iran’s mission to the UN said Iran’s military action was in response to Israel’s aggression against Iran’s diplomatic premises in Damascus and that the matter can now be deemed concluded but warned Iran’s response will be considerably more severe should the Israeli regime make another mistake. Furthermore, it stated the conflict is between Iran and Israel, while the US must stay away.

- Iran’s Foreign Ministry said Tehran will not hesitate to take further defensive measures to safeguard its legitimate interests against any military aggressions. In relevant news, Iran’s Foreign Ministry summoned the British, French and German ambassadors, while Iran also sent a message to the US via Switzerland warning that its bases would be targeted if Washington backs Israel’s retaliation, according to Reuters.

- Iran's Revolutionary Guards commander warned if Israel retaliates, Iran’s response will be larger than seen on Saturday night and that Tehran will retaliate against any Israeli attack on its interests. The IRGC also warned any threat from the US and Israel would be met with a reciprocal response from Iran, while it was also reported that Iranian airports cancelled flights until Monday morning.

- G7 leaders condemned Iran’s attack on Israel and reaffirmed the G7's commitment to Israel’s security, while they will continue to work to stabilise the situation and avoid further escalation, as well as demanded that Iran and its proxies cease their attacks, according to Reuters.

- UN Secretary-General Guterres said the Middle East is on the brink and people in the region are facing a real danger of devastating full-scale conflict, while he said now is the time to defuse, de-escalate and for maximum restraint, according to Reuters.

- US President Biden said he condemns these attacks in the strongest possible terms and spoke with Israeli PM Netanyahu to reaffirm America’s ironclad commitment to the security of Israel, according to Reuters. It was also reported that President Biden told Israeli PM Netanyahu the US would oppose any Israeli counterattack against Iran, according to a White House senior official cited by Axios.

- US senior administration official said the US had contact with Iran through Swiss intermediaries ahead of the attack on Israel and sent the US a message after the attack, but noted that Iran did not give a 72-hour warning and its intent was to be highly destructive. Furthermore, the US official said Israel has made it clear it is not looking for a significant escalation with Iran and that G7 leaders discussed sanctions against Iran and designating the IRGC as a terrorist organisation, according to Reuters.

- US Pentagon said forces in the Middle East intercepted dozens of missiles and drones launched from Iran, Iraq, Syria and Yemen. US Defense Secretary Austin called on Iran to de-escalate the situation and the US also called on Iran to immediately halt any further attacks. Furthermore, he said the US does not seek war or conflict with Iran but will not hesitate to protect its forces and support the defence of Israel, while Western intelligence sources stated that most of the Iranian drones and missiles that flew were downed by Israeli and US aerial interceptions, according to Reuters.

- US Deputy Representative to the UN Robert Wood said the UN Security Council has an obligation to not let Iran’s actions go unanswered and the US will explore additional measures to hold Iran accountable at the UN in the coming days, while he added Iran will be held responsible if it or its proxies takes action against the US or further action against Israel, according to Reuters.

- US House is to consider legislation to support Israel next week, according to Republican majority leader Scalise cited by Reuters.

- Jordan said it intercepted flying objects that entered its airspace on Saturday night to ensure the safety of its citizens. It was also reported that Jordanian PM Khasawneh said an escalation in the region would lead to dangerous paths and stressed the need to reduce escalation, while he said the Jordanian army is ready to confront with all of its means any attempt from any party that endangers its security, according to Reuters. It was also reported that Tehran is closely watching Jordan which could become the next target in case of any pro-Israel move, according to a source cited by Fars News Agency.

- Turkish diplomatic source said Iran informed Turkey in advance of its planned military operation against Israel and Iran told the US via Turkey that its operation would only respond to the embassy attack and not go further, while the US conveyed to Iran that its operation must be within certain limits, according to Reuters.

- Israeli PM Netanyahu’s office said Hamas rejected the hostage deal tabled by mediators and that Israel will continue to try to achieve the objectives of the war with Hamas with full force. It was also reported that the Israeli military said it will be calling up two reserve divisions for operations in Gaza over the next few days, according to Reuters.

- UK said it has been working with partners across the region to de-escalation in response to increased Iranian threats and escalation in the Middle East, while it has moved several additional air force jets and refuelling tankers to the region with UK jets to intercept any airborne attacks within range of their existing missions as required, according to Reuters.

- Iran’s state news agency reported that IRGC navy special forces seized a vessel linked to Israel and that the MSC Aries vessel was transferred to Iran’s territorial waters, according to Reuters.

OTHER

- China’s Coast Guard blocked Philippines vessels in an operation on Saturday which occurred just 35 nautical miles from the Philippines’ coastline amid increasing maritime tensions, according to FT.

CRYPTO

- Bitcoin modestly softer, whilst Ethereum posts incremental gains and holding around USD 3.2k.

APAC TRADE

- APAC stocks mostly declined as participants reflected on the geopolitical events over the weekend whereby Iran launched its first direct attack on Israel which was largely intercepted with very little damage caused, while the region also got its first opportunity to react to disappointing Chinese trade data.

- ASX 200 was pressured with underperformance in gold miners and tech, while sentiment was also not helped by the recent surprise contraction of imports by Australia's largest trading partner.

- Nikkei 225 was the worst hit and briefly dipped below 39,000 but recovered some of the losses with the help of a weaker currency.

- Hang Seng and Shanghai Comp. were mixed as the mainland bucked the trend after recent disappointing trade data from China added to the case for policy support measures. Participants now await tomorrow's GDP and activity data, while the PBoC provided no surprises and maintained the 1-year MLF Rate at 2.50%, as expected.

NOTABLE ASIA-PAC HEADLINES

- PBoC announced CNY 100bln in 1-year MLF loans with the rate kept unchanged at 2.50%, as expected

- US Assistant Secretary of State for East Asian and Pacific Affairs Kritenbrink will travel to China between April 14th-16th, according to Reuters.

- Japanese Finance Minister Suzuki reiterated that he is watching FX moves closely and wants to be fully prepared when questioned about forex moves, according to Reuters.

- Indian PM Modi said the BJP 2024 election manifesto focuses on creating jobs and boosting start-ups. Modi added the manifesto promises to bring all Indians above 70 years of age under the free health insurance programme and lift the cap on loans to INR 2mln for non-farming small and micro schemes, while it also promises to launch bullet train projects in the north, south and eastern parts of the country, according to Reuters.

- BoJ is reportedly shifting to a more discretionary approach in setting policy, with less emphasis on inflation, Reuters sources said; "Various data must be scrutinised, not just the inflation outlook," one source said.

- EU is set to launch China probe on medical device procurement, via Bloomberg; could occur as soon as mid-April and result in the EU curtailing access for China to its tenders

DATA RECAP

- Japanese Machinery Orders MM (Feb) 7.7% vs. Exp. 0.8% (Prev. -1.7%); YY (Feb) -1.8% vs. Exp. -6.0% (Prev. -10.9%)