Europe Market Open: Geopolitics intensified & APAC digested China data; earnings & speakers ahead

15 Apr 2024, 06:34 by Newsquawk Desk

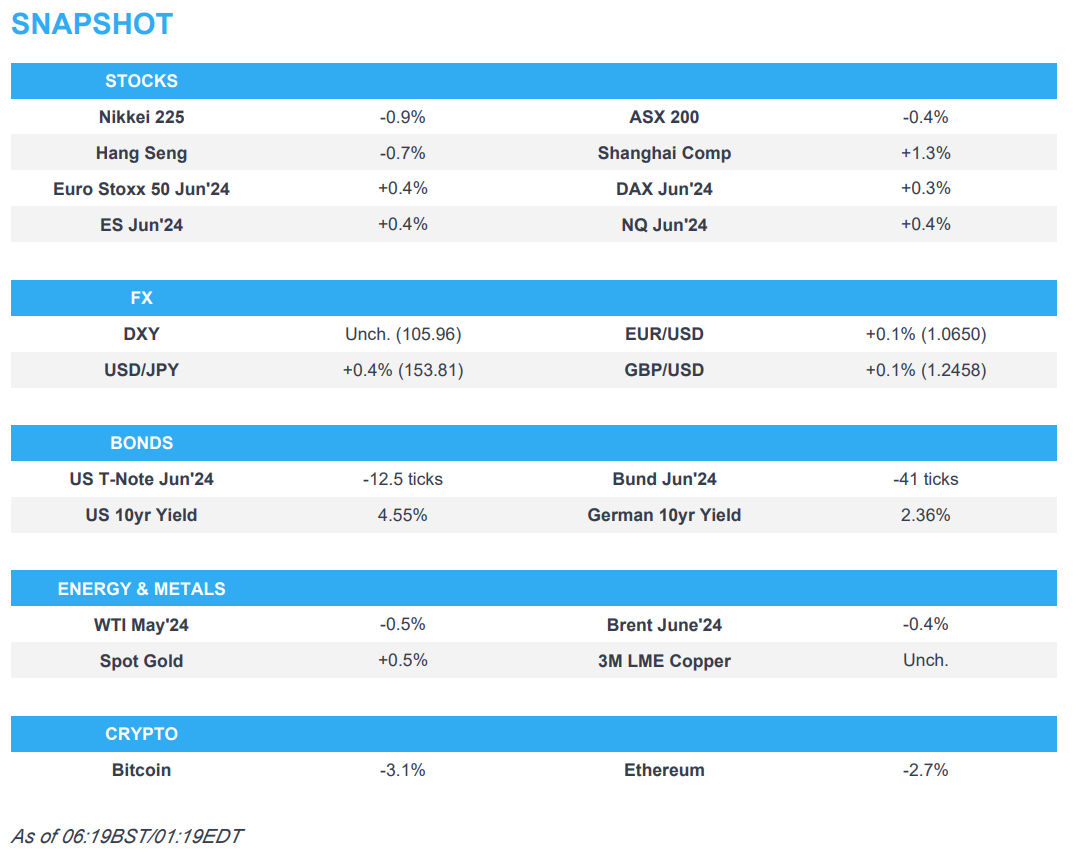

- APAC stocks mostly declined as participants reflected on the geopolitical events over the weekend and disappointing Chinese trade data.

- Iran launched its first direct attack on Israel which was largely intercepted with very little damage caused.

- European equity futures indicate a marginally higher open with the Euro Stoxx 50 future +0.4% after the cash market closed down 0.2% on Friday.

- DXY is pivoting around the 106 mark, JPY remains on the backfoot vs. the USD, EUR/USD and Cable sit on 1.06 and 1.24 handles respectively.

- Looking ahead, highlights include US Retail Sales, ECB Survey of Monetary Analysts, Comments from Fed’s Logan, BoE’s Breeden & ECB’s Lane, Earnings from Goldman Sachs & Charles Schwab.

US TRADE

EQUITIES

- US stocks declined on Friday as Iran fears and poor bank earnings weighed on sentiment heading into the weekend with small caps suffering the most, while Treasuries saw firm gains and clawed back some of the week's losses amid the Iran concerns and risk aversion.

- SPX -1.46% at 5,123, NDX -1.66% at 18,003, DJIA -1.24% at 37,983, RUT -1.93% at 2,003.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed Bostic (voter) said on Friday that he is not in a hurry to cut interest rates and reaffirmed the outlook for one rate cut towards the end of the year. Bostic said inflation will keep easing but slower than would like and is ready to pay attention and adjust the outlook as needed.

- Fed Daly (voter) said on Friday that with the recent CPI report, it is a good time to remind people that the Fed is not data-point dependent and is looking at full complement, while she added that the labour market is strong and inflation is not falling as rapidly as last year. Daly said there is absolutely no urgency to adjust the policy rate and they will maintain the policy stance as long as necessary.

- Fed's Goolsbee (non-voter) said on Friday that the US is in an environment of "cross currents" and the Fed must get inflation back down to target, according to Fox Business.

- Fed's Schmid (non-voter) said on Friday that the current stance of US monetary policy is appropriate and urges patience on interest rates until clear that inflation is ebbing to 2%, while he said they have to get inflation right and let policy work, while there is reason to think rates will stay higher for longer.

- WSJ's Timiraos noted on Friday via social media platform X that the March core PCE index probably rose 0.27%, citing forecasters who translate the CPI and PPI, while he added this would lower the 12-month rate to 2.7% from 2.8% in February and the 6-month annualised rate which jumped to 2.9% in February, would tick down to 2.8%.

APAC TRADE

EQUITIES

- APAC stocks mostly declined as participants reflected on the geopolitical events over the weekend whereby Iran launched its first direct attack on Israel which was largely intercepted with very little damage caused, while the region also got its first opportunity to react to disappointing Chinese trade data.

- ASX 200 was pressured with underperformance in gold miners and tech, while sentiment was also not helped by the recent surprise contraction of imports by Australia's largest trading partner.

- Nikkei 225 was the worst hit and briefly dipped below 39,000 but recovered some of the losses with the help of a weaker currency.

- Hang Seng and Shanghai Comp. were mixed as the mainland bucked the trend after recent disappointing trade data from China added to the case for policy support measures. Participants now await tomorrow's GDP and activity data, while the PBoC provided no surprises and maintained the 1-year MLF Rate at 2.50%, as expected.

- US equity futures (ES +0.4%) showed composure after Friday's heavy selling and took solace from the lack of devastation from Iran's attack.

- European equity futures indicate a marginally higher open with the Euro Stoxx 50 future +0.4% after the cash market closed down 0.2% on Friday.

FX

- DXY traded indecisively around 106.00 amid quiet US news flow and as the focus centred on geopolitics.

- EUR/USD got some mild respite after last week's selling but languished firmly beneath the 1.0700 handle.

- GBP/USD traded sideways with overnight price action stuck around the 1.2450 level.

- USD/JPY further extended on its highest levels since 1990 amid a widening of yield US-Japan differentials.

- Antipodeans attempted to nurse some of last week's losses albeit with the recovery limited by the recent weak Chinese trade data and deterioration in New Zealand's services industry.

- PBoC set USD/CNY mid-point at 7.0979 vs exp. 7.2478 (prev. 7.0967).

FIXED INCOME

- 10-year UST futures were pressured as yields continued to edge higher after light US-specific catalysts from over the weekend, while comments from Fed officials on Friday continued to suggest patience and that the Fed is in no hurry to cut rates.

- Bund futures marginally extended on their pullback from the 133.00 level following Friday's initial surge.

- 10-year JGB futures traded rangebound with mild upside capped by the lack of additional BoJ purchases and after Machinery Orders topped forecasts.

COMMODITIES

- Crude futures were choppy and failed to benefit from the unprecedented Iranian attack on Israel as participants second-guessed Israel's potential response and whether this would lead to further escalation in the region.

- Spot gold was boosted at the open with a seemingly early haven bid in the precious metal before it reversed most of the gains.

- Copper futures were underpinned but have since eased back from today's best levels amid the risk aversion, while aluminium prices surged by their most intraday since 1987 after the US and UK announced to clamp down on trading of Russian metals.

- US banned imports of Russian-origin aluminium, copper and nickel into the US on Friday, while it also limited their use on global metal exchanges in OTC derivatives trading. UK also announced joint action with the US to clamp down on prohibited Russian metal exports with the London Metal Exchange and the Chicago Mercantile Exchange to no longer trade new aluminium, copper and nickel produced by Russia.

CRYPTO

- Bitcoin remained subdued after prices slipped beneath the USD 66,000 level during the weekend.

NOTABLE ASIA-PAC HEADLINES

- PBoC announced CNY 100bln in 1-year MLF loans with the rate kept unchanged at 2.50%, as expected

- US Assistant Secretary of State for East Asian and Pacific Affairs Kritenbrink will travel to China between April 14th-16th, according to Reuters.

- Japanese Finance Minister Suzuki reiterated that he is watching FX moves closely and wants to be fully prepared when questioned about forex moves, according to Reuters.

- Indian PM Modi said the BJP 2024 election manifesto focuses on creating jobs and boosting start-ups. Modi added the manifesto promises to bring all Indians above 70 years of age under the free health insurance programme and lift the cap on loans to INR 2mln for non-farming small and micro schemes, while it also promises to launch bullet train projects in the north, south and eastern parts of the country, according to Reuters.

DATA RECAP

- Japanese Machinery Orders MM (Feb) 7.7% vs. Exp. 0.8% (Prev. -1.7%)

- Japanese Machinery Orders YY (Feb) -1.8% vs. Exp. -6.0% (Prev. -10.9%)

GEOPOLITICS

MIDDLE EAST

- Israel’s military said there were more than 300 projectiles fired by Iran at Israel with some of the launches from Iraq, Yemen and Iran but noted that 99% of them were intercepted and there was very little damage caused, while it said Iran undertook a very grave action that pushes the region towards escalation and Israel’s armed forces retain full functionality and are discussing options for follow-up operations, according to Reuters and CBS News.

- Israel requested an emergency meeting of the UN Security Council to condemn Iran and a senior Israeli official said there will be a significant response to the unprecedented Iranian attack, while it was also reported that Israeli Defence Minister Gallant said Israel has an opportunity to form a strategic alliance against Iran after the attack, according to Reuters.

- Israeli officials said a majority in the Israeli war cabinet favours a response to the Iranian attack but is divided over the timing and the scale, according to Reuters.

- Iranian President Raisi said the operation against Israel was carried out with high accuracy and they displayed the power of their missiles and drones well, while he added the operation targeted military centres and was carried out in full coordination between the field and diplomacy.

- Iran’s mission to the UN said Iran’s military action was in response to Israel’s aggression against Iran’s diplomatic premises in Damascus and that the matter can now be deemed concluded but warned Iran’s response will be considerably more severe should the Israeli regime make another mistake. Furthermore, it stated the conflict is between Iran and Israel, while the US must stay away.

- Iran’s Foreign Ministry said Tehran will not hesitate to take further defensive measures to safeguard its legitimate interests against any military aggressions. In relevant news, Iran’s Foreign Ministry summoned the British, French and German ambassadors, while Iran also sent a message to the US via Switzerland warning that its bases would be targeted if Washington backs Israel’s retaliation, according to Reuters.

- Iran's Revolutionary Guards commander warned if Israel retaliates, Iran’s response will be larger than seen on Saturday night and that Tehran will retaliate against any Israeli attack on its interests. The IRGC also warned any threat from the US and Israel would be met with a reciprocal response from Iran, while it was also reported that Iranian airports cancelled flights until Monday morning.

- G7 leaders condemned Iran’s attack on Israel and reaffirmed the G7's commitment to Israel’s security, while they will continue to work to stabilise the situation and avoid further escalation, as well as demanded that Iran and its proxies cease their attacks, according to Reuters.

- UN Secretary-General Guterres said the Middle East is on the brink and people in the region are facing a real danger of devastating full-scale conflict, while he said now is the time to defuse, de-escalate and for maximum restraint, according to Reuters.

- US President Biden said he condemns these attacks in the strongest possible terms and spoke with Israeli PM Netanyahu to reaffirm America’s ironclad commitment to the security of Israel, according to Reuters. It was also reported that President Biden told Israeli PM Netanyahu the US would oppose any Israeli counterattack against Iran, according to a White House senior official cited by Axios.

- US senior administration official said the US had contact with Iran through Swiss intermediaries ahead of the attack on Israel and sent the US a message after the attack, but noted that Iran did not give a 72-hour warning and its intent was to be highly destructive. Furthermore, the US official said Israel has made it clear it is not looking for a significant escalation with Iran and that G7 leaders discussed sanctions against Iran and designating the IRGC as a terrorist organisation, according to Reuters.

- US Pentagon said forces in the Middle East intercepted dozens of missiles and drones launched from Iran, Iraq, Syria and Yemen. US Defense Secretary Austin called on Iran to de-escalate the situation and the US also called on Iran to immediately halt any further attacks. Furthermore, he said the US does not seek war or conflict with Iran but will not hesitate to protect its forces and support the defence of Israel, while Western intelligence sources stated that most of the Iranian drones and missiles that flew were downed by Israeli and US aerial interceptions, according to Reuters.

- US Deputy Representative to the UN Robert Wood said the UN Security Council has an obligation to not let Iran’s actions go unanswered and the US will explore additional measures to hold Iran accountable at the UN in the coming days, while he added Iran will be held responsible if it or its proxies takes action against the US or further action against Israel, according to Reuters.

- US House is to consider legislation to support Israel next week, according to Republican majority leader Scalise cited by Reuters.

- Jordan said it intercepted flying objects that entered its airspace on Saturday night to ensure the safety of its citizens. It was also reported that Jordanian PM Khasawneh said an escalation in the region would lead to dangerous paths and stressed the need to reduce escalation, while he said the Jordanian army is ready to confront with all of its means any attempt from any party that endangers its security, according to Reuters. It was also reported that Tehran is closely watching Jordan which could become the next target in case of any pro-Israel move, according to a source cited by Fars News Agency.

- Turkish diplomatic source said Iran informed Turkey in advance of its planned military operation against Israel and Iran told the US via Turkey that its operation would only respond to the embassy attack and not go further, while the US conveyed to Iran that its operation must be within certain limits, according to Reuters.

- Israeli PM Netanyahu’s office said Hamas rejected the hostage deal tabled by mediators and that Israel will continue to try to achieve the objectives of the war with Hamas with full force. It was also reported that the Israeli military said it will be calling up two reserve divisions for operations in Gaza over the next few days, according to Reuters.

- UK said it has been working with partners across the region to de-escalation in response to increased Iranian threats and escalation in the Middle East, while it has moved several additional air force jets and refuelling tankers to the region with UK jets to intercept any airborne attacks within range of their existing missions as required, according to Reuters.

- Iran’s state news agency reported that IRGC navy special forces seized a vessel linked to Israel and that the MSC Aries vessel was transferred to Iran’s territorial waters, according to Reuters.

OTHER

- China’s Coast Guard blocked Philippines vessels in an operation on Saturday which occurred just 35 nautical miles from the Philippines’ coastline amid increasing maritime tensions, according to FT.

EU/UK

NOTABLE HEADLINES

- UK PM Sunak is resisting advice from allies to set the date for the UK general election, which they said would help him fend off a leadership challenge threat by Conservative Party rebels next month, according to Bloomberg.

- UK Treasury was urged by the British Property Federation industry group to reverse the decision to end stamp-duty relief for multiple dwellings and warned the move will discourage the construction of homes being built in England, according to FT.

- France launched a dispute with the UK over fishing rights after its trawlers were banned from some British waters to protect vulnerable habitats, while its diplomats will meet with UK counterparts this Monday, according to FT.

- ECB’s Villeroy said the ECB is increasingly confident that it is winning the fight against inflation which makes an interest rate cut in June very likely, according to Reuters.

- ECB's Holzmann said on Friday that a rate cut in June is likely but depends on the data and a June rate cut is probable if CPI stays on the current path, while he added the rate cut pace will depend on inflation and wages, according to ORF TV interview.