Europe Market Open: EUR contained post ECB & sources, APAC cautious into Chinese trade

12 Apr 2024, 06:35 by Newsquawk Desk

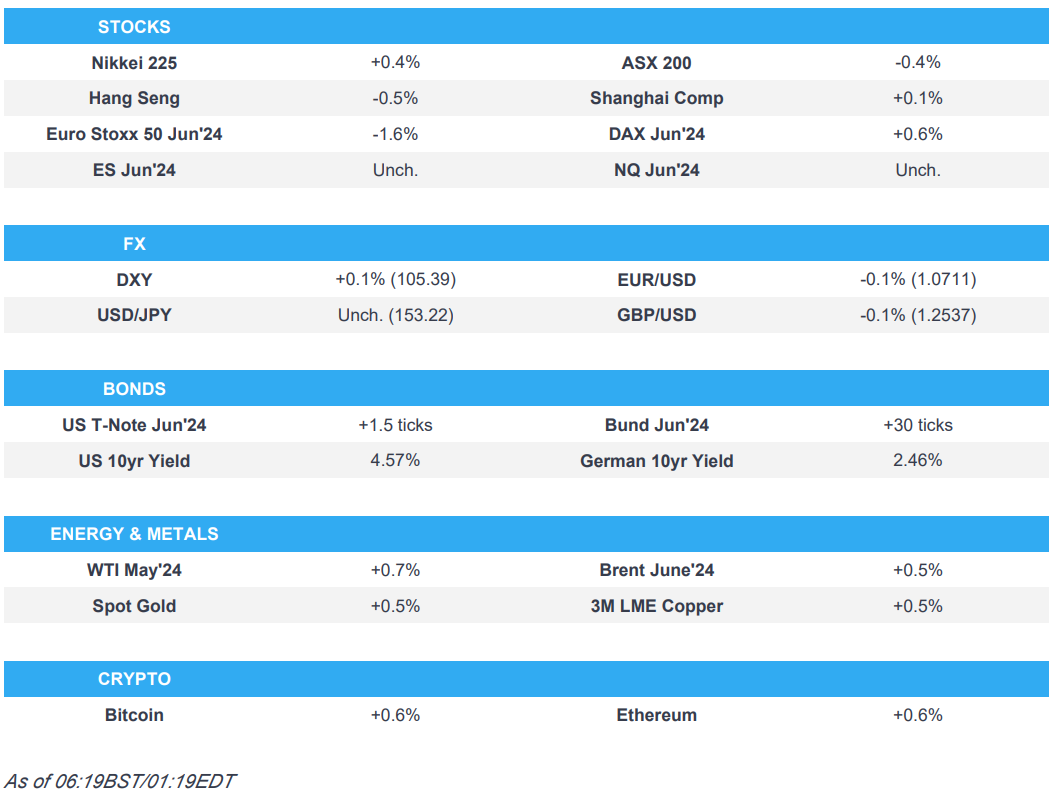

- APAC stocks traded mixed despite the gains on Wall St, with participants in the region cautious as they awaited the latest Chinese trade data.

- DXY was flat after mixed inflationary signals, EUR/USD remained lacklustre post-ECB, and USD/JPY took a breather and held on to the 153.00 status.

- ECB sources said as many as five officials needed extra convicting to hold back from rate cuts at Thursday's meeting and stronger-than-expected inflation data out of the US made policymakers more cautious.

- Israel is prepared for an Iranian strike from its territory in the next 48 hours, according to WSJ.

- European equity futures indicate a firmer open with the Euro Stoxx 50 future +0.7% after the cash market closed down 0.7% on Thursday.

- Looking ahead, highlights include UK GDP, Swedish CPIF, US Uni. of Michigan (Prelim.), BoE Forecast Review, Comments from ECB's Elderson, Fed’s Collins, Schmid, Bostic & Daly, Earnings from Blackrock, Wells Fargo, JNJ & Citi.

- Click here for the Newsquawk Week Ahead.

US TRADE

EQUITIES

- US stocks rallied in which big tech and NDX led the charge as participants geared up for earnings with notable strength in Apple amid reports about its new M4 chip products being in the works, while Nvidia (NVDA) also notched firm gains (+4.1%) with overall risk sentiment helped by tailwinds from the ECB, and soft PPI data.

- SPX +0.74% at 5,199, NDX +1.65% at 18,307, DJI -0.01% at 38,459, RUT +0.70% at 2,042.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Collins (non-voter) said recent data argues against an imminent need to change rates and she still expects rate cuts this year but it may take more time for the economy to moderate as needed. Collins said the economic strength may argue fewer rate cuts and disinflation is likely to continue to be uneven, while recent inflation data hasn't changed the view about the outlook and the economy’s strength may mean Fed policy is not as restrictive as thought.

- US Treasury's Shambaugh said they see trends toward disinflation, even if inflation has not come down quite as fast as expected.

- BofA and Deutsche Bank expect only one interest rate cut by the Fed this year in December, while HSBC expects 75bps of rate cuts by the Fed in 2024 and for the Federal Reserve to start cutting interest rates by 25bps in June.

APAC TRADE

EQUITIES

- APAC stocks traded mixed despite the gains on Wall St where softer-than-expected PPI eased some inflationary fears, while participants in the region were also cautious as they awaited the latest Chinese trade data.

- ASX 200 marginally declined as weakness in consumer-related sectors overshadowed the gains in gold miners.

- Nikkei 225 was underpinned on the back of a weaker currency and despite the selling pressure in Fast Retailing.

- Hang Seng and Shanghai Comp. were somewhat varied with underperformance in Hong Kong amid broad selling after the local benchmark index pulled back from the 17,000 level, while the mainland struggled for direction leading into the Chinese trade data.

- US equity futures plateaued following yesterday's PPI-induced inflationary reprieve.

- European equity futures indicate a firmer open with the Euro Stoxx 50 future +0.7% after the cash market closed down 0.7% on Thursday.

FX

- DXY was flat after mixed inflationary signals with PPI data helping ease some of the post-CPI inflationary fears.

- EUR/USD remained lacklustre after softening post-ECB but with losses stemmed by a floor around 1.0700.

- GBP/USD traded sideways following yesterday's choppy mood and ahead of monthly GDP and activity data.

- USD/JPY took a breather and held on to the 153.00 status which kept participants on intervention watch.

- Antipodeans were contained amid the mixed risk appetite and as markets braced for Chinese trade data.

- PBoC set USD/CNY mid-point at 7.0967 vs exp. 7.2365 (prev. 7.0968).

FIXED INCOME

- 10-year UST futures bounced off lows with an overnight floor at the 108.00 level but with price action contained after mixed inflation signals and as Fed speakers continued to suggest a lack of urgency to cut rates.

- Bund futures clawed back some of their recent losses with the help of dovish-leaning ECB source reports.

- 10-year JGB futures were rangebound and failed to benefit from the BoJ's presence in the market for nearly JPY 1.3tln of JGBs.

COMMODITIES

- Crude futures traded with mild gains amid the ongoing threat of Iran retaliating against Israel although prices remain well within yesterday's parameters after the recent choppy performance.

- US President Biden plans a sweeping effort to block Arctic oil drilling in which half of National Petroleum Reserve-Alaska could be off-limits with the initiative set to be finalised within days, according to Bloomberg.

- Spot gold continued its upward momentum and printed a fresh record high of around USD 2,395/oz.

- Shanghai Gold Exchange will raise margin requirements for some gold futures contracts to 9% from 8% effective from the settlement on April 15th and will raise daily trading limits for some gold futures contracts to 8% from 7%.

- Copper futures were choppy with price action rangebound as participants awaited the latest Chinese trade data and after an agreement to lift the blockade at MMG's Las Bambas copper mine.

- MMG 's (1208 HK) Las Bambas copper mine in Peru and protestors reached a deal on lifting the road blockade near the mine, according to sources cited by Reuters.

CRYPTO

- Bitcoin steadily gained during Asia trade and approached closer towards the USD 71,000 level.

NOTABLE ASIA-PAC HEADLINES

- US Senate Banking Committee Chair Brown urged for President Biden to permanently ban EVs produced by Chinese companies, according to a letter cited by Reuters.

- Japanese Finance Minister Suzuki said a weak yen has pros and cons, as well as noted that a weak yen could push up import prices and have a negative impact on consumers and firms. Suzuki reiterated that rapid FX moves are undesirable and that he is closely watching FX moves with a high sense of urgency, while he also repeated it is desirable for FX to move stably reflecting fundamentals and he won't rule out any steps to respond to disorderly FX moves.

- Nomura said despite a notably tougher tone from officials since late March as the Yen hovered above the 152 mark, there is no sense that they're going to intervene anytime soon, according to Nikkei.

- Bank of Korea kept its base rate unchanged at 3.50%, as expected, with the decision made unanimously, while it stated that it is premature to be confident that inflation will converge on the target level and it will maintain a restrictive policy stance for a sufficient period. BoK said it would monitor various factors including inflation slowdown, as well as financial stability and economic growth risks but noted the growth forecast is to be consistent with its earlier forecast or could be higher. BoK Governor Rhee said one in seven board members said the door for a rate cut should be open for the next three months and all 7 members said it is hard to predict policy decisions for H2. Furthermore, Rhee said the board is open to a rate cut if CPI slows in H2 although rate cuts might be difficult this year should inflation remain sticky and they have not signalled for a rate cut.

- Monetary Authority of Singapore maintained the width, centre and slope of the SGD NEER policy band, as expected. MAS said current monetary policy settings remain appropriate, while it added that the Singapore economy is expected to strengthen and that prospects for the Singapore economy should improve over the course of 2024.

DATA RECAP

- Singapore GDP QQ (Q1 P) 0.1% vs Exp. 0.6% (prev. 1.2%)

- Singapore GDP YY (Q1 P) 2.7% vs Exp. 2.9% (prev. 2.2%)

GEOPOLITICS

MIDDLE EAST

- Israel is prepared for an Iranian strike from its territory in the next 48 hours, according to WSJ. Israeli army said Iran is preparing its proxies in the region to attack them, according to Al Arabiya.

- Israeli Defence Minister Gallant told US Defense Secretary Austin that a direct Iranian attack on Israeli territory would compel Israel to respond in an appropriate way against Iran, according to Axios.

- IsraelWarRoom posted on X that Iran postponed an attack against Israel at the last minute due to American warnings, but it is still expected.

- Iran reportedly signalled to Washington it will respond to Israel's attack on its Syrian embassy in a way that aims to avoid major escalation and it will not act hastily, according to Reuters citing Iranian sources. Furthermore, a source familiar with US intelligence was not aware of the message conveyed but said Iran has been very clear its response would be controlled and non-escalatory, and planned to use regional proxies to launch a number of attacks on Israel.

- White House said US support for Israel remains ironclad on threats from Iran and its proxies, while it communicated to Iran that the US had no involvement in the Damascus strike and said it does not want the conflict to spread.

- US President Biden's administration officials judge that Iran is planning a larger-than-usual aerial attack on Israel in the coming days which will likely feature a mix of missiles and drone strikes, according to two US officials cited by Politico.

- US official said the US expects an attack by Iran against Israel which they think will be calibrated to be bigger than usual but not so big it would draw the US into war, while US officials have also been in touch with regional partners to discuss efforts to manage and ultimately reduce further risks of escalation.

- US said it had restricted its employees in Israel and their family members from personal travel outside the greater Tel Aviv, Jerusalem and Be'er Sheva areas amid Iran's threats of retaliation against Israel.

- US State Department said that they continue to be concerned about the risk of escalation in the Middle East, specifically after the threats Iran made towards Israel. Furthermore, Secretary of State Blinken has spoken to foreign ministers of Turkey, China, and Saudi Arabia in the past 24 hours to make clear that escalation is not in anyone's interest.

- Hamas Leader Haniyeh denied that his sons who were killed in Israeli strikes were fighters, while he responded that he places the interests of the Palestinian people ahead of everything when asked if the killing of his sons will impact ceasefire and hostage talks, according to Reuters.

- US State Department senior official said a robust conversation with Iraq is likely to lead to a second US-Iraq joint security cooperation dialogue later this year.

OTHER

- Russian President Putin told news agencies that Russia was obliged to strike Ukrainian energy sites in response to Kyiv's attacks on Russia's energy infrastructure.

- US President Biden warned that any attack on Philippine vessels in the South China Sea would invoke their mutual defence treaty.

- China's top legislator Zhao Leji and North Korean counterpart discussed promoting exchange and cooperation in all fields, according to KCNA.

EU/UK

NOTABLE HEADLINES

- BoE's Greene said the UK has shown signs of coming out of recession, while she added that wage growth is still far too high and is an indication of second-round effects.

- ECB sources said policymakers still expect to cut rates in June but some think the case for pausing at their following meeting is becoming stronger given a continued rebound in US inflation, according to Reuters. Sources stated that doves are looking for cuts in June and July amid a benign labour market and although the July decision was not explicitly debated, some policymakers argued that a delayed start to the Fed's own cutting cycle warranted caution from the ECB. Furthermore, policymakers said every wage indicator is pointing in the right direction, growth is weak, and inflation has clearly cooled, warranting a cut in the record-high 4% deposit rate.

- ECB sources said as many as five officials needed extra convicting to hold back from rate cuts at Thursday's meeting and stronger-than-expected inflation data out of the US made policymakers more cautious. Furthermore, consensus appeared to be building that the first phase of the cutting cycle will involve taking the deposit rate down by around 100bps from its current 4% level, according to Bloomberg.