Europe Market Open: Israel's Netanyahu said a Rafah invasion in Gaza date has been set

09 Apr 2024, 06:35 by Newsquawk Desk

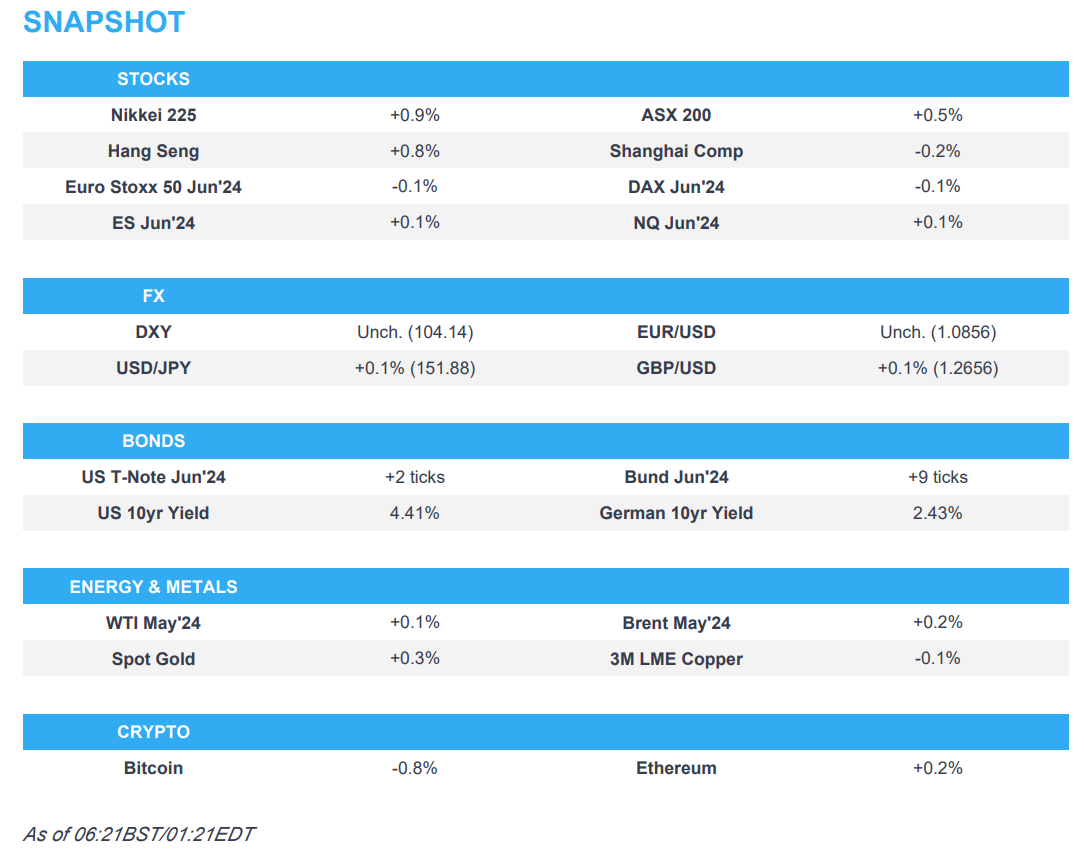

- APAC stocks traded mostly higher but with price action relatively rangebound with global markets lacking major catalysts.

- European equity futures indicate a lower open with the Euro Stoxx 50 future -0.2% after the cash market closed up 0.6% on Monday.

- FX markets are contained with DXY holding above the 104 mark, USD/JPY continues to eye the YTD peak and 152 level.

- Israeli Prime Minister Netanyahu said that a date has been set for a Rafah invasion in Gaza.

- Looking ahead, highlights include Supply from the UK, Germany & US.

US TRADE

EQUITIES

- US stocks finished flat with price action calm before the potential storm as participants await key risk events including US CPI on Wednesday and with several central bank decisions from the ECB, BoC and RBNZ, while the FOMC Minutes are scheduled mid-week and earnings season also kick-starts later in the week. As such, the major indices were little changed although the Russell 2000 outperformed.

- SPX -0.04% at 5,202, NDX -0.05% at 18,100, DJIA -0.03% at 38,892, RUT +0.50% at 2,073.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Goolsbee (non-voter) said Fed’s lender of last resort system is functioning well and the economy was on a golden path in 2023, while he added the economy remains strong and jobs data confirms that.

- Fed's Kashkari (non-voter) said can't stop short in the inflation fight with inflation around 3% and need to get to 2%, while he added the base case is that inflation will continue to fall.

APAC TRADE

EQUITIES

- APAC stocks traded mostly higher but with price action relatively rangebound with global markets lacking any major catalysts ahead of upcoming risk events.

- ASX 200 was led by miners but with gains capped after weak consumer sentiment and a mixed business survey.

- Nikkei 225 continued to benefit from recent currency weakness with USD/JPY lying in wait for a retest of 152.00.

- Hang Seng and Shanghai Comp. were varied with the Hong Kong benchmark lifted although the psychologically key 17,000 level continued to elude. Conversely, the mainland lagged after another tepid PBoC liquidity operation, while Premier Li recently noted uncertainty and complexity in the external environment are rising.

- US equity futures price action was muted after the flat performance on Wall St as participants await key events.

- European equity futures indicate a lower open with the Euro Stoxx 50 future -0.2% after the cash market closed up 0.6% on Monday.

FX

- DXY lacked direction with trade quiet so far this week as markets await tomorrow's US CPI and FOMC Minutes.

- EUR/USD sat above 1.0850 but with advances capped amid a lack of drivers and with the 100DMA nearby.

- GBP/USD was flat despite stronger BRC Retail Sales with price action restricted beneath the 50- and 100-DMAs.

- USD/JPY traded sideways and remained in proximity to make another attempt at the 152.00 level.

- Antipodeans were rangebound with slight outperformance in NZD ahead of tomorrow's RBNZ meeting.

- PBoC set USD/CNY mid-point at 7.0956 vs exp. 7.2248 (prev. 7.0947).

FIXED INCOME

- 10-year UST futures eked slight gains ahead of key releases including US CPI and as supply looms.

- Bund futures marginally gained albeit with further upside limited as participants await a Bobl auction.

- 10-year JGB futures remained contained amid a lack of data releases and with headwinds from a weaker 5-year JGB auction.

COMMODITIES

- Crude futures were contained after yesterday's indecisiveness and conflicting geopolitical reports.

- Mexico's Pemex is reportedly planning to cut at least 330k BPD of crude exports in May, according to sources via Reuters.

- UK, Germany, Belgium, Netherlands, Denmark and Norway signed a declaration to protect infrastructure in the North Sea.

- Spot gold traded rangebound and briefly re-approached closer to the USD 2,350/oz level before stalling.

- Copper futures took a breather after Monday's positive but choppy mood and with sentiment in China subdued.

CRYPTO

- Bitcoin was marginally lower as it continued to pull back after yesterday's brief foray above the USD 72,000 level.

NOTABLE ASIA-PAC HEADLINES

- French Finance Minister Le Maire and China's Commerce Minister agreed to set up an economic event to rebalance China-France relations, while China’s Commerce Minister said the Chinese probe on cognac and the EU probe on electric cars are not linked.

- HKMA said Hong Kong is considering deepening some of the Connect schemes between Hong Kong and Mainland China.

- BoJ Governor Ueda said Japan's economy is showing some weakness but is recovering moderately and the chance of solid wage growth this year is heightening, while he added the BoJ expects accommodative monetary conditions to continue for the time being and it is important to maintain accommodative monetary conditions as trend inflation is yet to hit 2%. Ueda said if the economy and price developments proceed as projected now, they need to think about reducing the degree of monetary support but added whether this will happen will depend on upcoming data and there is no pre-set idea now on how and when they will adjust interest rate levels. Ueda added that even after March policy shift, expect interest rates to stay low and real interest rates to remain at deeply negative territory. Ueda reiterated that if FX moves have impact on economy and prices in a way that is hard to ignore, we will of course respond with monetary policy.

DATA RECAP

- Australian Westpac Consumer Sentiment Index (Apr) 82.4 (Prev. 84.4)

- Australian Westpac Consumer Sentiment M/M (Apr) -2.4% (Prev. -1.8%)

- Australian NAB Business Confidence (Mar) 1.0 (Prev. 0.0)

- Australian NAB Business Conditions (Mar) 9.0 (Prev. 10.0)

GEOPOLITICS

MIDDLE EAST

- Israeli Prime Minister Netanyahu said that a date has been set for a Rafah invasion in Gaza.

- US State Department said the US has not been briefed on a date for Israel's Rafah invasion.

- Hamas rejected the latest Israeli ceasefire proposal, according to Hamas official Ali Baraka. Furthermore, Hamas said Israeli position during last round of negotiations in Cairo remains stubborn and did not meet any demands of Palestinians, while it is still studying Israel's proposal and will inform mediators of its response, according to a statement.

- White House said CIA Director Burns was in Cairo over the weekend for hostage negotiations where a proposal was presented to Hamas and they are waiting on a response. Furthermore, it said there is no date set for new Rafah talks and that the Israelis assured them that there would be no major military operation in Rafah before holding a meeting about it to exchange ideas. White House also earlier commented that there were no indications of an imminent major ground operation in Rafah and that more than 300 trucks entered Gaza on Sunday which is progress.

- US Pentagon said Defense Secretary Austin expressed commitment to support an unconditional return of hostages and hopes for a cessation of hostilities through negotiations. Austin also expressed hope that the ongoing negotiations between Israel and Hamas will lead to a truce and he affirmed unwavering US support for defending Israel in light of threats from Iran and its network of proxies, according to Al Jazeera and Al Arabiya.

- US intelligence assesses that Iran has urged several of its proxy militia groups to simultaneously launch a large-scale attack against Israel, using drones and missiles, while they could attack as soon as this week, according to sources cited by CNN. Furthermore, sources familiar with US intelligence said an Iranian attack would likely be carried out by proxy forces in the region, rather than by Iran directly, and one of the sources noted the threat is very clear and credible with the pieces in place to conduct the attack and Iran are just waiting for the right time.

- Missiles have been launched from Syria towards the southern Golan Heights, according to Deir Ezzor 24’s Omar Abu Layla.

- Iraqi armed faction said they bombed a vital target in Ashkelon in southern Israel and another target in the past 72 hours, according to Al Arabiya.

- Turkey vowed to take measures against Israel over Gaza aid drops after Israel rejected a request from Turkey to airdrop aid into Gaza, according to Bloomberg.

- US military said it destroyed air defence and drone systems of Houthi forces in an area of the Red Sea, while there were no injuries or damage to US, coalition or commercial ships.

OTHER

- Russia's ambassador to the IAEA posted on X that Russia has requested an extraordinary session of the IAEA's board of governors on "recent attacks and provocations" of Ukraine on the Zaporizhzhia nuclear power plant.

- Australia's PM Albanese said Japan is a natural candidate to cooperate on stage two of the AUKUS security pact but added there are no plans to expand AUKUS membership beyond Britain, Australia and the US. There were prior reports that China was 'gravely concerned' as Australia, US, UK confirmed that Japan was being considered for AUKUS.

- Chinese military newspaper said Japan is showing 'obvious offensive characteristics' with its new Okinawa missile unit, according to SCMP.

EU/UK

NOTABLE HEADLINES

- Barclays said UK March consumer spending rose 1.9% vs prev. 1.9% increase in February and was the joint-smallest increase since September 2022, according to Reuters.

DATA RECAP

- UK BRC Retail Sales YY (Mar) 3.2% (Prev. 1.0%)

- UK BRC Total Sales Y/Y (Mar) 3.5% (Prev. 1.1%)