Europe Market Open: APAC followed Wall. St action where USTs slumped and oil climbed

03 Apr 2024, 06:35 by Newsquawk Desk

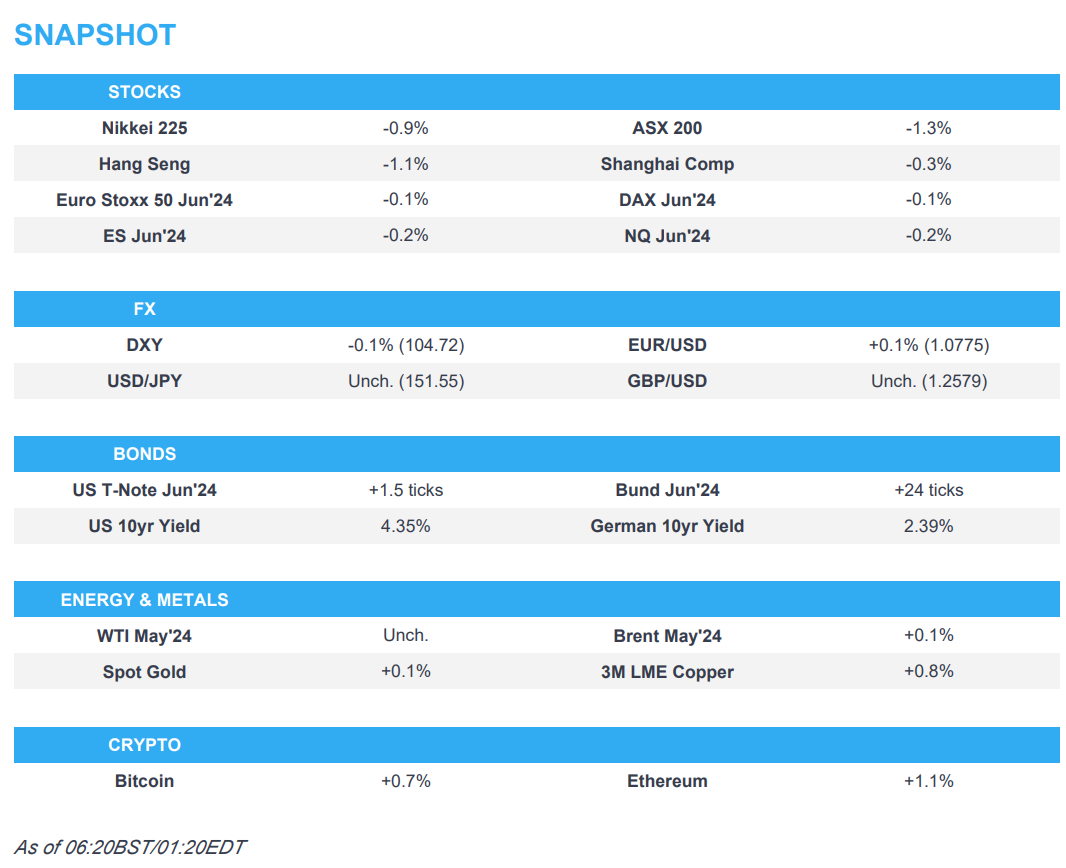

- APAC stocks followed suit to losses in the US where treasuries bear-steepened and oil prices ramped up.

- Fed's Daly said there is no urgency to adjust the rate, Mester doesn't see the case for cutting at the next meeting.

- European equity futures indicate a contained open with the Euro Stoxx 50 future flat after the cash market closed lower by 0.8% on Tuesday.

- DXY remains on a 104 handle with FX markets overall steady, USD/JPY lingers above the 151.50 mark.

- Looking ahead, highlights include EZ CPI, Italian Unemployment Rate, US ADP, ISM Services, OPEC+ JMMC, Comments from Fed’s Powell, Bowman, Goolsbee, Barr & Kugler, Supply from Germany.

US TRADE

EQUITIES

- US stocks were pressured amid various micro factors in the backdrop of an aggressive Treasury bear-steepening following Europe's return and despite soft German inflation figures, as oil prices ripped and Europeans reacted to the long weekend's events. In terms of the headwinds for stocks, Tesla (TSLA) drove the losses in the Nasdaq after poor Q1 delivery figures and semiconductors were another pocket of weakness, while the apparel space was pressured after PVH's (PVH) awful guidance and health insurance names were also slammed after the final Medicare Advantage rate ignited margin concerns.

- SPX -0.72% at 5,205, NDX -0.94% at 18,121, DJIA -1.00% at 39,170, RUT -1.80% at 2,065.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Daly (voter) said they need to see how long to leave rates where they are and inflation is coming down, bumpy and slowly, while there is no urgency to adjust the rate and standing pat is currently the right policy. Daly said three rate cuts this year is a reasonable baseline and there's a real risk of cutting rates too soon but added there is more work to do before being confident inflation is on the right path.

- Fed's Mester (voter) said she still expects the Fed can cut rates later this year but doesn't see the case for cutting at the next meeting and noted that policy is in a good place to navigate risks to the economy, while her forecast is similar to the median. Mester said moving rates down too soon or too quickly without sufficient evidence would risk undoing the progress made which is the bigger risk at the moment, while she now sees the longer run funds rate at 3.0% versus prev. 2.5% where it had been for some time. Mester also said she will not pre-judge meetings but will not rule out a June cut and said three cuts this year are still reasonable.

APAC TRADE

EQUITIES

- APAC stocks followed suit to losses in the US where treasuries bear-steepened and oil prices ramped up.

- ASX 200 was led lower by tech and real estate as the rate-sensitive sectors suffered from firmer yields.

- Nikkei 225 briefly dipped beneath 39,500 with index heavyweight Fast Retailing among the worst hit after lower Uniqlo same-store sales, while Japan also issued a tsunami warning after a powerful earthquake struck Taiwan.

- TAIEX was pressured after Taiwan's most powerful earthquake in 25 years which collapsed at least 26 buildings.

- Hang Seng and Shanghai Comp. conformed to the downbeat mood across the region amid tech weakness and mixed US-China headlines with the US asking South Korea to toughen controls on semiconductor technology exports to China. However, the losses in the mainland were cushioned after an improvement in Caixin Services PMI data and Biden-Xi phone talks.

- US equity futures (ES -0.2%, NQ -0.2%) remained subdued following the prior day's selling on Wall Street.

- European equity futures indicate a contained open with the Euro Stoxx 50 future flat after the cash market closed lower by 0.8% on Tuesday.

FX

- DXY lacked firm direction after failing to sustain the 105.00 level despite slightly higher-than-expected JOLTS data and a monthly expansion in Factory Orders, while the latest Fed speak failed to spur much of a reaction.

- EUR/USD saw muted price action but held on to recent gains ahead of EZ inflation and unemployment data.

- GBP/USD remained contained within a tight range at the 1.2500 handle in the absence of any pertinent drivers.

- USD/JPY traded indecisively on both sides of 151.50 alongside the non-committal mood across the FX space.

- Antipodeans were choppy prior with recent tailwinds from commodities offset by the downbeat risk tone.

- PBoC set USD/CNY mid-point at 7.0949 vs exp. 7.2282 (prev. 7.0957).

- Chile Central Bank cut its benchmark interest rate by 75bps to 6.50%, as expected, with the decision unanimous. Chile Central Bank said the board will continue cutting rates, while the size and timing of rates will consider the trajectory of inflation and the macroeconomic scenario.

FIXED INCOME

- 10-year UST futures attempted to nurse some of the losses from the recent bear-steepening ahead of a plethora of Fed rhetoric.

- Bund futures continued its partial recovery from yesterday's heavy selling and brief dip below the 132.00 level.

- 10-year JGB futures were rangebound amid a lack of major catalysts in Japan and with downside stemmed by BoJ purchases.

COMMODITIES

- Crude futures took a breather after rallying the prior session amid Ukraine drone strikes and broad commodity strength, while the latest private sector inventory data showed larger-than-expected draws for crude, gasoline and distillate stockpiles.

- US Energy Inventory Data (bbls): Crude -2.3mln (exp. -1.5mln), Gasoline -1.5mln (exp. -0.8mln), Distillate -2.5mln (exp. -0.6mln), Cushing -0.8mln.

- Mexico's Pemex requested trading unit PMI to cancel up to 436k bpd of Mexican crude exports in April which would increase the availability of crude for domestic use including for a new refinery, according to a document cited by Reuters.

- US President Biden is reportedly open to ending LNG export pause for Ukraine aid, according to Reuters.

- Russian Deputy PM Novak said gasoline and diesel fuel stocks remain high in Russia.

- Kazakhstan is set to double its pipeline oil exports to China in April amid refinery maintenance, according to Kaztransoil.

- OPEC's JMMC will meet at 12:00BST on April 3rd, according to Energy Intel's Bakr.

- Spot gold marginally extended on recent advances to a fresh record high just shy of USD 2290/oz.

- Copper futures eventually gained amid the rising tide across the commodities complex.

CRYPTO

- Bitcoin gradually edged higher to north of USD 66,000 after recovering from an early dip beneath the USD 65,000 level.

NOTABLE ASIA-PAC HEADLINES

- US Treasury Secretary Yellen is to travel to China on April 3rd-9th to continue economic dialogue with top Chinese officials and is to meet with Vice Premier He Lifeng, the Guangdong province Governor and US business executives in Guangzhou. Furthermore, Yellen is to meet with PBoC's Governor Pan Gongsheng and former Vice President Liu He on April 8th, while she is to underscore global economic consequences of Chinese industrial overcapacity in meetings with Chinese officials.

- A strong earthquake was felt in Taipei and parts of the city experienced a power outage, while the Taiwan Central Weather Administration said the earthquake registered a 7.2 magnitude and was Taiwan's most powerful earthquake in 25 years. Taipei city government said it had not yet received any reports of major damage following the earthquake and it was later reported that Taipei’s MRT resumed operations although there were reports of collapsed buildings in the city of Hualien with people reportedly trapped in the buildings, while Taiwan announced the earthquake caused 26 buildings to collapse.

- Japan issued an evacuation advisory for Okinawa coastal areas and a tsunami warning after the initial announcement of a preliminary magnitude 7.5 earthquake off southwestern Japan but later revised the Taiwan earthquake magnitude up to 7.7 and lifted the tsunami warnings.

DATA RECAP

- Chinese Caixin Services PMI (Mar) 52.7 vs. Exp. 52.7 (Prev. 52.5)

- Chinese Caixin Composite PMI (Mar) 52.7 (Prev. 52.5)

GEOPOLITICS

MIDDLE EAST

- US President Biden criticised Israel for failing to adequately protect civilians and is pushing for an immediate ceasefire as part of a hostage deal, while Biden said he is outraged over the deaths of World Central Kitchen staff in Gaza, according to Bloomberg and AFP.

- Deep divisions between the US and Israel over an operation in Rafah were evident in a virtual meeting between senior officials, according to three sources cited by Axios. Furthermore, the parties agreed there will be separate virtual meetings of four expert working groups in the next 10 days that will focus on different aspects of a possible Rafah operation.

- White House said the US is not involved in any way with the Israeli air strike on Iran's embassy compound in Damascus and there is no evidence Israel hit aid workers deliberately, while it also stated that Iran continues to deliver drones to Russia for use in Ukraine.

OTHER

- Ukrainian President Zelenskiy said after the Tatarstan drone attack, that Ukraine is answering Russian strikes with longer-range responses.

- NATO Foreign Ministers will meet on Wednesday to discuss how to put military support for Ukraine on long-term footing including a proposal for a EUR 100bln five-year military fund, according to Reuters.

- US senior administration official said US President Biden and Chinese President Xi discussed Taiwan, Ukraine and the South China Sea in which President Biden intended the talk to be a “check-in” rather than a summit with concrete outcomes. Furthermore, Biden had planned to raise two issues over China’s aggression in the Pacific which were Taiwan and the South China Sea, while the official added Biden wanted to stress to Xi that China must not continue helping Russia rebuild its military-industrial base and Biden wants Xi to help stop attacks on ships in the Red Sea by asking Iran to rein in Yemen's Houthis.

- North Korea said it successfully test-fired a new mid- to long-range hypersonic missile, while its leader Kim said they completely turned all missiles to solid fuel with warhead control and capable of nuclear weaponisation, according to Yonhap.

- UK FCDO said North Korea's ballistic missile launch on April 2nd is a breach of multiple UN Security Council resolutions and the UK urges North Korea to refrain from further provocations, return to dialogue and take credible steps towards denuclearisation.

- Philippine National Security Council spokesperson said the commitment to maintain the grounded warship in Second Thomas Shoal will always be there and any attempt by China to interfere with resupply missions will be met by the Philippines in a fashion that protects its troops, while the spokesperson added that resupply missions to Second Thomas Shoal will never stop.

EU/UK

NOTABLE HEADLINES

- ECB's Holzmann says he has no in-principle objection to a June rate cut, but wants to see more supportive data. Holzmann added that cutting out-of-sync with the Fed would diminish the impact of easing, whilst also noting that a 3.0% deposit rate could prove too tight over the longer-term, given weak EZ productivity.