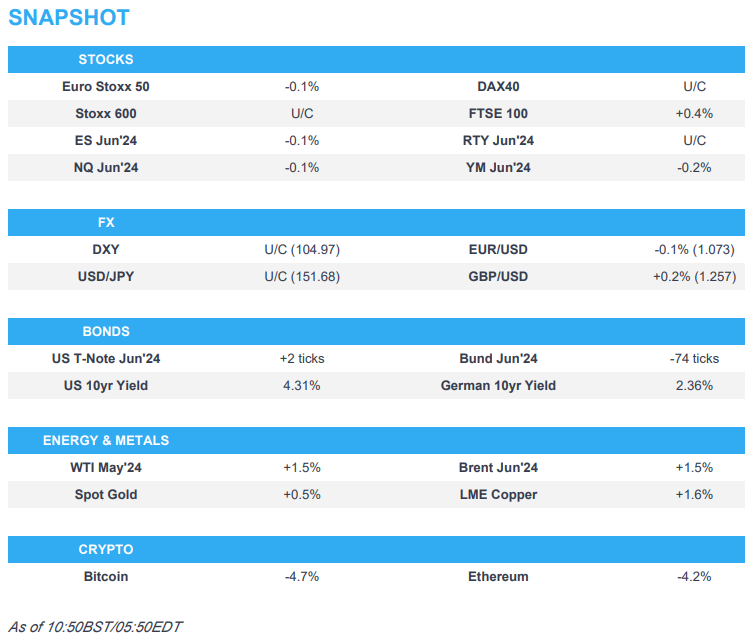

US Market Open: Equities mixed, DXY around 105 and Crude bid following US/Chinese PMIs & geopols; US JOLTS & Fed speak due

02 Apr 2024, 11:15 by Newsquawk Desk

- Equities are mixed, with clear outperformance in the Energy/Basic Resources names amid broader strength in the underlying commodity prices

- Dollar is flat and holds around 105, AUD outperforms given the rally in metals prices

- Bonds are mixed, USTs are flat and hold near post-ISM lows, whilst Bunds play catch up; a modest dovish reaction was seen following German state CPIs

- Commodities are entirely in the green, Crude benefits from heightened geopolitical tensions and constructive US/Chinese PMIs

- Looking ahead, German national CPI, US Durable Goods, JOLTS Job Openings, Comments from Fed’s Bowman, Williams, Mester & Daly.

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (+0.1%) began the session on a firm footing and rose further at the open before the upside eventually petered out. A modest dovish reaction was seen following the German State CPIs, though this faded as indices succumbed to broader but equally as modest pressure.

- European sectors hold a slight negative tilt; Basic Resources and Energy are the clear outperformers, propped up by broader strength in underlying commodity prices. Real Estate lags, hampered by the higher yield environment.

- US Equity Futures (ES -0.1%, NQ -0.1%, RTY U/C) are slightly lower continuing the losses seen in the prior session (sparked by the hot US ISM Manufacturing data). Crypto-exposed stocks are lower in the pre-market after an over 5% drop in Bitcoin.

- Click here and here for the sessions European pre-market equity newsflow, including earnings.

- Click here for more details.

FX

- DXY is holding around 105 following yesterday's hot ISM manufacturing print. DXY has been as high as 105.10 with not much in the way of resistance until the 14th November high at 105.73.

- EUR is softer vs. the USD after taking a beating yesterday. Today, weakness has been assisted by soft ECB inflation survey and regional German CPI. EUR/USD has been as low as 1.0725 with the 15th Feb low at 1.0723.

- JPY is steady vs. the USD after advancing to a 151.80 peak overnight but fell short of testing the YTD high at 151.97. It remains the case that a more dovish Fed story is required to reverse the fortunes of the pair.

- Antipodeans are both firmer vs. the USD but AUD more so alongside the rally in metals prices. AUD/USD back on a 0.65 handle but still below yesterday's peak at 0.6538.

- PBoC set USD/CNY mid-point at 7.0957 vs exp. 7.2433 (prev. 7.0938).

- Click here for more details.

- Click here for Major FX Expiry details.

FIXED INCOME

- USTs are near yesterday's US ISM Manufacturing induced lows at 110-00; a slight uptick was seen after the EZ PMIs/German state CPIs, though focus will remain on a busy data docket and a number of Fed speakers.

- Bunds are bearish, as the region reacted to Monday's US ISM data, taking Bunds to a low of 132.47; following the EZ SCE/German regional CPIs, Bunds edged higher, towards a peak of 132.95, though has since pared much of the upside.

- Gilt price action is in-fitting with Bunds, though with much of the initial upside on the EZ-data unwound following the upward revision to UK Manufacturing PMI which brought the measure back into expansionary territory. Gilts have been as low as 98.85, and should the downside continue, 98.68 (6th March) could be in play.

- Germany sells EUR 3.71bln vs exp. EUR 4.5bln 2.50% 2026 Schatz: b/c 2.3x (prev. 2.64x), average yield 2.84% (prev. 2.80%), retention 17.56% (prev. 18.96%)

- Click here for more details.

COMMODITIES

- A positive session for the crude complex as tailwinds from the revision higher in Chinese and EZ Manufacturing PMIs, strong US ISM Manufacturing PMI, and escalating geopolitics counter the headwinds from the pushback in US rate cut pricing; Brent currently around USD 88.80/bbl.

- Precious metals are firmer across the board despite the stronger Dollar but amidst a slew of geopolitical update; XAU hit a fresh record high at USD 2.265.49/oz yesterday with the yellow metal in a USD 2,247-2,262.69/oz range thus far.

- Base metals are also higher across the board despite the price action in the Dollar this morning, with the complex likely moving to the slew of constructive Manufacturing PMIs from China, the US, and across the EZ.

- Venezuela oil exports reportedly hit a 4-year peak as US sanctions deadline looms, according to Reuters citing shipping data and documents.

- Barclays says "we are now entering a period for the LNG market where we see it as demand-constrained"; says a demand-constrained LNG market is also set to constrain prices.

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- ECB Consumer Inflation Expectations survey (Feb) - 12-months ahead 3.1% (prev. 3.3%); 3-year ahead 2.5% (prev. 2.5%); Economic growth expectations for the next 12 months remained unchanged at -1.1%.

EZ DATA RECAP

- German North Rhine-Westphalia State CPI YY (Mar) 2.3% (Prev. 2.6%); core Y/Y 3.2% vs. prev. 3.4%, M/M 0.5%; German regional inflation numbers came in cooler than the prior and within proximity to expectations for the mainland release at 13:00BST. Overall, the reaction was a modestly dovish one.

- German HCOB Manufacturing PMI (Mar) 41.9 vs. Exp. 41.6 (Prev. 41.6)

- Spanish HCOB Manufacturing PMI (Mar) 51.4 vs. Exp. 51.0 (Prev. 51.5)

- French HCOB Manufacturing PMI (Mar) 46.2 vs. Exp. 45.8 (Prev. 45.8)

- Italian HCOB Manufacturing PMI (Mar) 50.4 vs. Exp. 48.8 (Prev. 48.7)

- EU HCOB Manufacturing Final PMI (Mar) 46.1 vs. Exp. 45.7 (Prev. 45.7)

OTHER DATA POINTS

- UK S&P Global Manufacturing PMI (Mar) 50.3 vs. Exp. 49.9 (Prev. 49.9)

- UK Mortgage Approvals (Feb) 60.383k vs. Exp. 56.5k (Prev. 55.227k, Rev. 56.087k); BOE Consumer Credit (Feb) 1.378B GB vs. Exp. 1.6B GB (Prev. 1.877B GB, Rev. 1.77B GB); M4 Money Supply (Feb) 0.5% (Prev. -0.1%); Mortgage Lending (Feb) 1.51B GB vs. Exp. -0.15B GB (Prev. -1.086B GB, Rev. -1.073B GB)

- UK BRC Shop Price Inflation (Mar) Y/Y 1.3% vs. Exp. 2.2% (prev. 2.5%); lowest level in more than two years.

- UK Nationwide house price MM (Mar) -0.2% vs. Exp. 0.3% (Prev. 0.7%); Nationwide house price YY (Mar) 1.6% vs. Exp. 2.4% (Prev. 1.2%)

- Swiss Manufacturing PMI (Mar) 45.2 vs. Exp. 44.9 (Prev. 44.0)

- Swiss Retail Sales YY (Feb) -0.2% (Prev. 0.3%)

NOTABLE US HEADLINES

- Alphabet (GOOG) Google will destroy billions of data records to settle a lawsuit claiming it secretly tracked the internet use of people who thought they were browsing privately, Reuters reports. The accord is valued at more than USD 5bln, and as high as USD 7.8bln, the report noted, but Google is paying no damages; users may sue the company individually for damages.

- PVH Corp (PVH): Q4 adj. EPS 3.72 (exp. 3.53), Q4 revenue USD 2.49bln (exp. 2.42bln). Board authorised a USD 2bln increase to its stock repurchase programme. Sees Q1 EPS approximately USD 2.15 (exp. 2.61), and sees Q1 revenue declining approximately 11% Y/Y (exp. -3.7%). For the FY, sees EPS between 10.75-11.00 (exp. 12.01), and sees FY revenue declining between 6-7% (exp. -0.9%). Shares -22.5% pre-market.

- Tesla (TSLA) sold 89.06k China-made vehicles in March (vs 60.36k in February 2024; vs 88.8k in March 2023)

GEOPOLITICS

MIDDLE EAST

- US told Iran it had no involvement or advanced knowledge of the Israeli strike on a diplomatic compound in Syria, according to Axios citing a US official.

- Israeli shelling on a car of the World Central Kitchen organization in Gaza caused the death of 4 foreigners, according to Al Jazeera.

- White House said US and Israeli teams had a constructive engagement on Rafah on Monday and agreed that they share the objective to see Hamas defeated in Rafah. US expressed its concerns with various courses of action in Rafah, while the Israeli side agreed to take the concerns into account and to have follow-up discussions between experts on Rafah with follow-up discussions to include an in-person strategic consultative group meeting as early as next week, according to Reuters.

- US President Biden’s administration is reportedly considering the approval of a USD 18bln sale of aircraft and other munitions to Israel including F-15 jets.

- "Israeli media quoting official: The atmosphere of the truce talks in Cairo is positive and will continue", according to Al Arabiya

OTHER

- North Korea fired a suspected ballistic missile which was reported to have fallen shortly after and appeared to have landed outside of Japan's exclusive economic zone.

- Japanese PM Kishida said Japan launched a protest against North Korea's missile launch and that North Korean missile launch affects not only peace and stability in the region but also the international community, while it was separately reported that the US military condemned North Korea's missile launch.

- South Korean President Yoon said North Korea will try to sow confusion in South Korea ahead of the election, while it was also reported that South Korea imposed sanctions on two Russian organisations and two Russian individuals linked to North Korea's missile program.

- Attempted drone attack on an oil refinery within Russia's Nizhnekamsk, via Tass; attack was thwarted, no damage occurred.

- Ukrainian intelligence source says attacks on Russian refineries will continue in order to reduce Russia's oil revenue, according to Reuters

CRYPTO

- Bitcoin continues the weakness from overnight, with the coin now as low as USD 65.8k on the session.

APAC TRADE

- APAC stocks were mixed with price action mostly rangebound after the weak performance on Wall St where hot ISM Manufacturing PMI data saw markets trim Fed rate cut bets.

- ASX 200 initially printed a fresh record high but then pared its gains as strength in the commodity-related industries was offset by losses in the consumer-related sectors, while RBA Minutes did little to spur price action.

- Nikkei 225 was choppy and failed to sustain a brief foray back above the 40,000 status.

- Hang Seng and Shanghai Comp. were mixed in which the Hong Kong benchmark outperformed as it played catch up on return from the Easter holiday closures, while the mainland was indecisive after a tepid PBoC liquidity operation.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Suzuki reiterated it is important for currencies to move in a stable manner reflecting fundamentals and rapid FX moves are undesirable, while he won't rule out any steps to respond to disorderly FX moves and is closely watching FX moves with a high sense of urgency but made no comment on FX intervention.

- RBA Minutes from the March 18th-19th meeting stated members agreed it is appropriate to leave rates unchanged and there was no mention in the minutes that the board considered the option to raise rates, while the Board agreed it is difficult to either rule in or out future changes in cash rate. RBA Minutes stated the economic outlook is uncertain but risks seemed broadly balanced and it would take "some time" before the board could be confident inflation is returning to the target, as well as noted that upside risks to inflation had not yet materialised and consumption was very weak.

- RBA Assistant Governor Kent said the RBA intends to change the way it provides liquidity to the banking system in which it is to adopt an ample reserves system for monetary policy and will use open market repo operations at a price near the Cash Rate target, while it will commence a public consultation and liaison with participants shortly. RBA's Kent also stated that the outlook for inflation and policy is uncertain.

DATA RECAP

- Chinese Manufacturing PMI (Mar) 50.8 vs Exp. 49.9 (Prev. 49.1); Non-Manufacturing PMI (Mar) 53.0 vs Exp. 51.3 (Prev. 51.4); Composite PMI (Mar) 52.7 (Prev. 50.7); Caixin Manufacturing PMI Final (Mar) 51.1 vs. Exp. 51.0 (Prev. 50.9)