Europe Market Open: Hot US ISM Manufacturing PMI saw Fed rate cut bets trim, German CPI ahead

02 Apr 2024, 06:25 by Newsquawk Desk

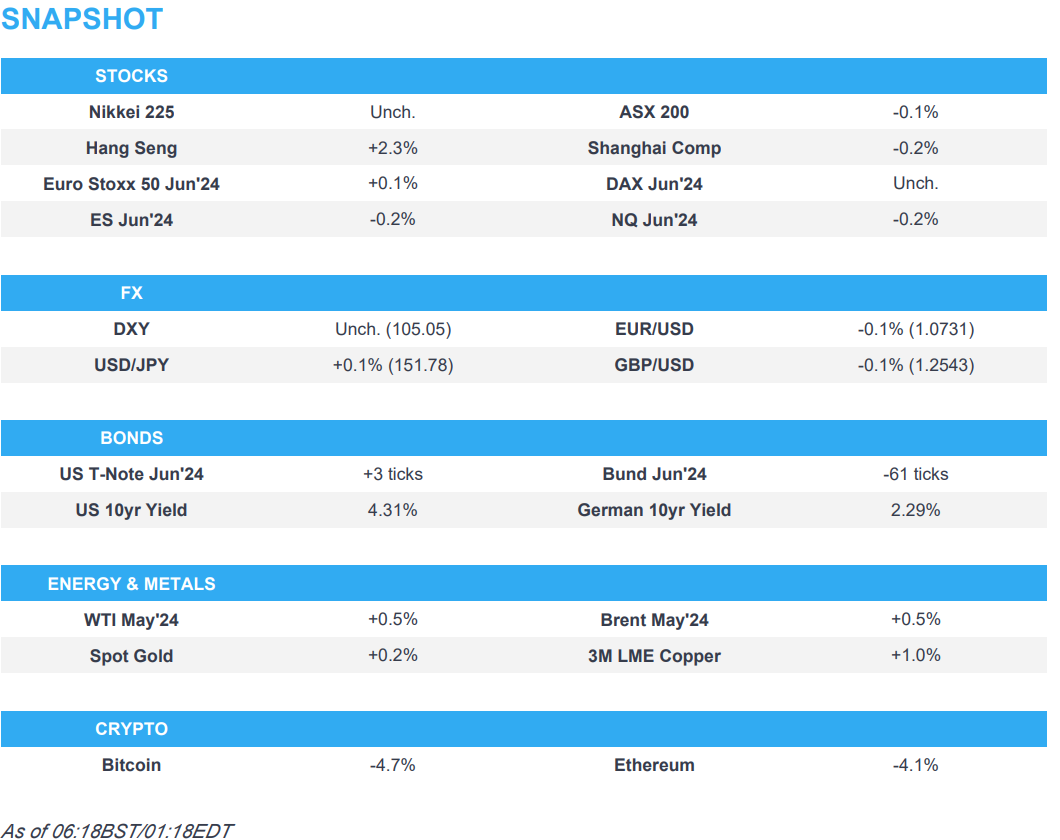

- APAC stocks were mixed after the weak performance on Wall St where hot ISM Manufacturing PMI saw markets trim Fed rate cut bets.

- European equity futures indicate a contained open with the Euro Stoxx 50 future little changed after the cash market closed flat on Thursday.

- DXY sits on a 105 handle, EUR/USD slipped below 1.08, USD/JPY extended upside and Cable gave back the 1.26 handle.

- Crude futures remained afloat after recently gaining on the back of US and Chinese PMI data and amid geopolitical tensions.

- Looking ahead, highlights include EZ and UK final Manufacturing PMI, German regional and national CPI, US Durable Goods, JOLTS Job Openings, ECB Survey of Consumer Expectations, Comments from Fed’s Bowman, Williams, Mester & Daly, Supply from Germany.

US TRADE

EQUITIES

- US stocks were largely sold with underperformance in the rate-sensitive sectors of the market after a hot ISM manufacturing survey unwound Fed cut expectations in which the market priced around 65bps of Fed cuts this year vs 70bps+ before the data and the first fully priced cut was pushed back to September from July. Treasuries were heavily pressured amid the hot ISM data, the passing of month-end buying and a healthy slew of corporate debt deals.

- SPX -0.20% at 5,244, NDX +0.21% at 18,293, DJI -0.60% at 39,567, RUT -1.02% at 2,103.

- Click here for a detailed summary.

DATA RECAP

- US S&P Global Manufacturing PMI Final (Mar) 51.9 (Prev. 52.5)

- US ISM Manufacturing PMI (Mar) 50.3 vs. Exp. 48.4 (Prev. 47.8)

- US ISM Manufacturing Prices Paid (Mar) 55.8 vs. Exp. 52.7 (Prev. 52.5)

- US ISM Manufacturing New Orders Index (Mar) 51.4 (Prev. 49.2)

- US ISM Manufacturing Employment Index (Mar) 47.4 (Prev. 45.9)

- US Construction Spending MM (Feb) -0.3% vs. Exp. 0.7% (Prev. -0.2%)

- Atlanta Fed GDPNow (Q1) 2.8% (prev. 2.3% on March 29th)

APAC TRADE

EQUITIES

- APAC stocks were mixed with price action mostly rangebound after the weak performance on Wall St where hot ISM Manufacturing PMI data saw markets trim Fed rate cut bets.

- ASX 200 initially printed a fresh record high but then pared its gains as strength in the commodity-related industries was offset by losses in the consumer-related sectors, while RBA Minutes did little to spur price action.

- Nikkei 225 was choppy and failed to sustain a brief foray back above the 40,000 status.

- Hang Seng and Shanghai Comp. were mixed in which the Hong Kong benchmark outperformed as it played catch up on return from the Easter holiday closures, while the mainland was indecisive after a tepid PBoC liquidity operation.

- US equity futures remained lacklustre after suffering from the hot ISM data and a rise in yields.

- European equity futures indicate a contained open with the Euro Stoxx 50 future little changed after the cash market closed flat on Thursday.

FX

- DXY held on to the prior day's gains after climbing above the 105.00 level in the aftermath of the firmer-than-expected ISM data which also showed an acceleration in the Prices Paid component.

- EUR/USD prodded yesterday's lows after sliding on the dollar strength and recent failure to breach 1.0800.

- GBP/USD languished at its weakest level in nearly 2 months after giving back the 1.2600 status.

- USD/JPY mildly extends on its gains north of 151.50 after the recent upside in US yields.

- Antipodeans were choppy after recent selling against the dollar, while RBA minutes and the announcement by RBA Assistant Governor Kent to switch to a new system for monetary policy implementation, whereby the central bank will shift to having ample reserves, had little impact on AUD/USD.

- PBoC set USD/CNY mid-point at 7.0957 vs exp. 7.2433 (prev. 7.0938).

FIXED INCOME

- 10-year UST futures just about reclaimed the 110.00 status and they nursed some of yesterday's heavy losses which were due to hot ISM data and the passing of month-end buying.

- Bund futures gapped beneath the 133.00 level on return from the extended weekend as it tracked the losses in its US counterpart, while participants now look ahead to German CPI data and a Schatz auction.

- 10-year JGB futures faded some of Monday's late selling and returned to relatively flat territory, while prices failed to benefit from the increased demand and higher accepted prices in the latest 10-year auction.

COMMODITIES

- Crude futures remained afloat after recently gaining on the back of US and Chinese PMI data and amid geopolitical tensions with Iran vowing to retaliate to an Israeli strike on the Iranian consulate in Syria which killed IRGC commander Mohammad Reza Zahedi.

- Venezuela oil exports reportedly hit a 4-year peak as US sanctions deadline looms, according to Reuters citing shipping data and documents.

- Spot gold was contained as the dollar held onto the spoils from the recent hot ISM data.

- Copper futures traded mixed with CME futures choppy, while London copper futures were underpinned as they took their first opportunity to react to recent US and China manufacturing surveys.

CRYPTO

- Bitcoin was pressured and tested USD 67,000 to the downside after sliding from the USD 69,000 level.

NOTABLE ASIA-PAC HEADLINES

- Japanese Finance Minister Suzuki reiterated it is important for currencies to move in a stable manner reflecting fundamentals and rapid FX moves are undesirable, while he won't rule out any steps to respond to disorderly FX moves and is closely watching FX moves with a high sense of urgency but made no comment on FX intervention.

- RBA Minutes from the March 18th-19th meeting stated members agreed it is appropriate to leave rates unchanged and there was no mention in the minutes that the board considered the option to raise rates, while the Board agreed it is difficult to either rule in or out future changes in cash rate. RBA Minutes stated the economic outlook is uncertain but risks seemed broadly balanced and it would take "some time" before the board could be confident inflation is returning to the target, as well as noted that upside risks to inflation had not yet materialised and consumption was very weak.

- RBA Assistant Governor Kent said the RBA intends to change the way it provides liquidity to the banking system in which it is to adopt an ample reserves system for monetary policy and will use open market repo operations at a price near the Cash Rate target, while it will commence a public consultation and liaison with participants shortly. RBA's Kent also stated that the outlook for inflation and policy is uncertain.

DATA RECAP

- Chinese Manufacturing PMI (Mar) 50.8 vs Exp. 49.9 (Prev. 49.1)

- Chinese Non-Manufacturing PMI (Mar) 53.0 vs Exp. 51.3 (Prev. 51.4)

- Chinese Composite PMI (Mar) 52.7 (Prev. 50.7)

- Chinese Caixin Manufacturing PMI Final (Mar) 51.1 vs. Exp. 51.0 (Prev. 50.9)

GEOPOLITICS

MIDDLE EAST

- Israeli airstrike on the Iranian consulate in Damascus killed at least 7 people including the leader of the Iranian Revolutionary Guard Corps Quds Force Mohammad Reza Zahedi.

- Iran's Ambassador to Syria said Tehran's response will be harsh. It was also reported that Iranian Foreign Minister Amirabdollahian said the Israeli attack on the Iranian consulate in Damascus is "a breach of all international conventions" and Tehran holds Israel responsible for the consequences of the attack, according to state media.

- Iran said it preserves the right to take reciprocal actions against the Israeli attack in Damascus on the Iranian consulate and Tehran will decide on the type of response and punishment against the aggressor, according to state media. It was separately reported that Lebanese Hezbollah said Israel will be punished for its attack on Syria, according to Al Arabiya.

- US told Iran it had no involvement or advanced knowledge of the Israeli strike on a diplomatic compound in Syria, according to Axios citing a US official.

- Israeli shelling on a car of the World Central Kitchen organization in Gaza caused the death of 4 foreigners, according to Al Jazeera.

- White House said US and Israeli teams had a constructive engagement on Rafah on Monday and agreed that they share the objective to see Hamas defeated in Rafah. US expressed its concerns with various courses of action in Rafah, while the Israeli side agreed to take the concerns into account and to have follow-up discussions between experts on Rafah with follow-up discussions to include an in-person strategic consultative group meeting as early as next week, according to Reuters.

- US President Biden’s administration is reportedly considering the approval of a USD 18bln sale of aircraft and other munitions to Israel including F-15 jets.

OTHER

- North Korea fired a suspected ballistic missile which was reported to have fallen shortly after and appeared to have landed outside of Japan's exclusive economic zone.

- Japanese PM Kishida said Japan launched a protest against North Korea's missile launch and that North Korean missile launch affects not only peace and stability in the region but also the international community, while it was separately reported that the US military condemned North Korea's missile launch.

- South Korean President Yoon said North Korea will try to sow confusion in South Korea ahead of the election, while it was also reported that South Korea imposed sanctions on two Russian organisations and two Russian individuals linked to North Korea's missile program.

EU/UK

NOTABLE HEADLINES

- UK BRC Shop Price Inflation (Mar) Y/Y 1.3% vs. Exp. 2.2% (prev. 2.5%); lowest level in more than two years.