Europe Market Open: Fed's Waller & BoE's Haskel said there is no rush to cut

28 Mar 2024, 06:25 by Newsquawk Desk

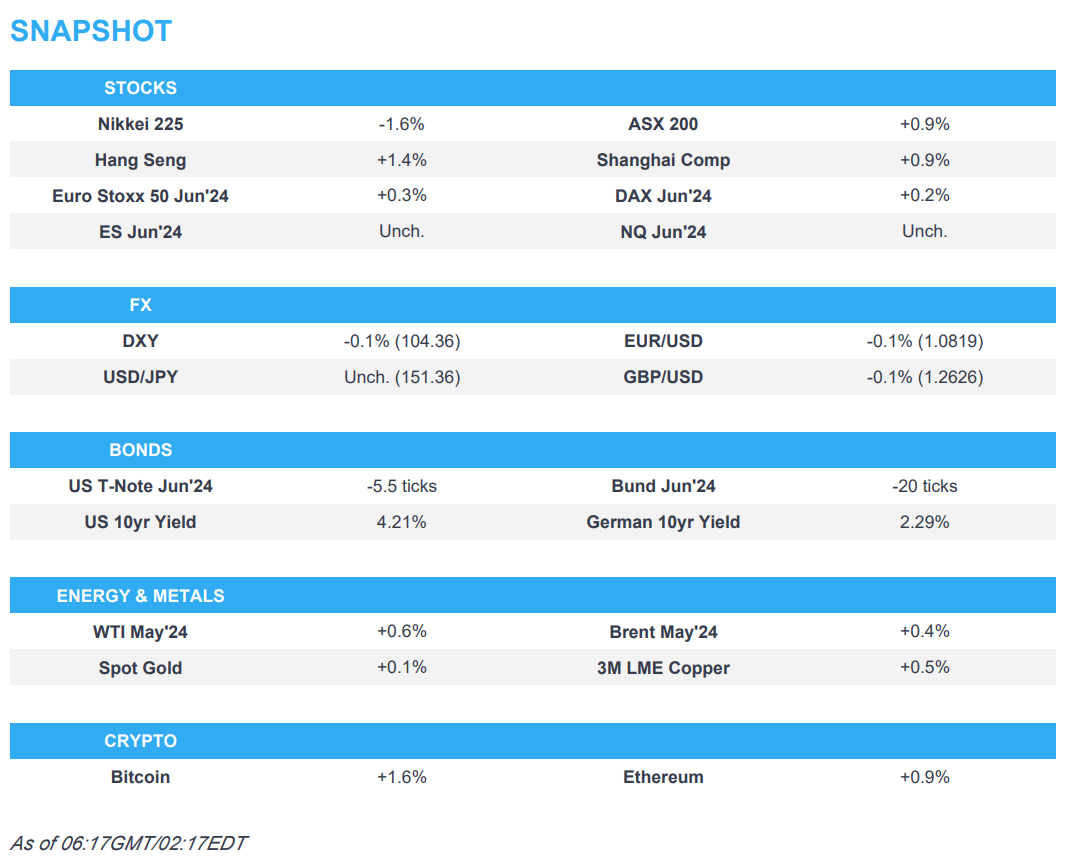

- APAC stocks partially sustained the momentum from the late ramp-up on Wall St heading into quarter-end.

- Fed's Waller said still no rush to cut rates and the Fed may need to maintain the current rate target for longer than expected.

- European equity futures indicate a positive open with the Euro Stoxx 50 future +0.3% after the cash market closed up 0.4% on Wednesday.

- DXY is contained on a 104 handle, EUR/USD is holding above 1.08 and USD/JPY remains on a 151 handle.

- BoE's Haskel warned against rushing to cut rates and thinks that rate cuts should be "a long way off", according to the FT.

- Looking ahead, highlights include German Retail Sales, UK GDP (Q4 2nd reading), German Unemployment, US GDP (F), IJC, UoM Inflation Expectations (F), Japanese Tokyo CPI & Unemployment Rate, Comments from ECB’s Knot, BoE’s Mann & RBNZ's Orr.

US TRADE

EQUITIES

- US stocks finished higher thanks to a late-session rip into the close with month-end selling not as large as expected and perhaps indicative of the bulk of it being in the rear-view ahead of the long weekend, while there was no tier-one data or major catalysts to set the tone heading into comments in the evening from Fed's Waller at the Economic Club of NY. Treasuries rallied further and bull-flattened in thin trade with a strong 7-year auction marking the low in yields for the session.

- SPX +0.86% at 5,248, NDX +0.39% at 18,280, DJIA +1.22% at 39,760, RUT +2.13% at 2,114.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed's Waller (voter, hawk) said still no rush to cut rates in the current economy and the Fed may need to maintain the current rate target for longer than expected, while he needs to see more inflation progress before supporting a rate cut and needs at least a couple of months of data to be sure inflation is heading to 2%. Waller said he still expects the Fed to cut rates later this year but added the economy’s strength gives the Fed space to take stock of the data and data suggests fewer rate cuts possible this year.

- S&P affirmed the US at AA+; Outlook Stable, while it stated the US outlook remains stable indicating its expectation of continued economic resiliency, as well as proactive and effective monetary policy execution. S&P said the stable outlook reflects the US's institutional checks & balances, and free flow of info contributing to stability and predictability in economic policies but added that ratings are constrained by fiscal weaknesses such as high net general government debt and deficits.

APAC TRADE

EQUITIES

- APAC stocks partially sustained the momentum from the late ramp-up on Wall St heading into quarter-end.

- ASX 200 rose to a fresh record high with the broad-based gains in the index led by strength in the mining industry.

- Nikkei 225 was pressured after the JPY bounced back from 33-year lows amid intervention risks.

- Hang Seng and Shanghai Comp. were underpinned by tech strength and after another firm PBoC liquidity operation, while China's 3rd highest-ranked official Zhao Leji stated at the Boao Forum that China's economy will provide a strong driving force for a world recovery and that China will reduce the 'negative list' for foreign investors.

- US equity futures took a breather after yesterday's late bids which saw the Emini S&P and Emini Dow futures return to above the 5,300 and 40,000 levels, respectively.

- European equity futures indicate a positive open with the Euro Stoxx 50 future +0.3% after the cash market closed up 0.4% on Wednesday.

FX

- DXY traded rangebound and was only briefly supported by the hawkish comments from Fed's Waller.

- EUR/USD lacked firm direction after recent varied data releases failed to spur the single currency.

- GBP/USD remained indecisive despite comments from BoE's Haskel that rate cuts should be "a long way off".

- USD/JPY was contained as JPY composed itself after a recent slip to 33-year lows raised intervention risks.

- Antipodeans were choppy amid the mixed risk appetite and with headwinds from disappointing Australian Retail Sales and a deterioration in New Zealand's Business Confidence.

- PBoC set USD/CNY mid-point at 7.0948 vs exp. 7.2259 (prev. 7.0946).

- SNB Vice Chairman Schlegel said the central bank looks at the exchange rate closely and intervenes in the forex market when necessary, while he added they have no set goal for the CHF rate and demand for the currency has come from Swiss investors.

FIXED INCOME

- 10-year UST futures pulled back after yesterday's bull-flattening and with pressure from Fed's Waller.

- Bund futures faded some of their recent gains ahead of a slew of data releases from both sides of the Atlantic.

- 10-year JGB futures were choppy but ultimately gained with the BoJ in the market for over JPY 1.1tln of JGBs.

COMMODITIES

- Crude futures were mildly higher after yesterday's rebound but with upside capped as Israel agreed to reschedule talks with the US on Rafah and PM Netanyahu could send a delegation to the US as soon as next week.

- Spot gold traded uneventfully after stalling just shy of the USD 2,200/oz level.

- Copper futures eventually strengthened alongside the outperformance of its largest buyer China

- China smelter group refrained from setting a copper TC/RC guide price for Q2, according to sources cited by Reuters.

CRYPTO

- Bitcoin was choppy and briefly dipped beneath the USD 69,000 level before clawing back all of its losses and more.

NOTABLE ASIA-PAC HEADLINES

- China's top legislator Zhao Leji said at the Boao Forum that Asian countries should inject a strong impetus for world economic growth and that China's economy will provide a strong driving force for world recovery. Zhao also stated that they oppose trade protection and decoupling, while he added that China is willing to collaborate with other countries on tech innovation and will reduce the 'negative list' for foreign investors.

- China's Commerce Minister discussed with Dutch counterpart lithography machines and strengthening semiconductor industry cooperation, while the Commerce Minister stated that China hopes the Netherlands will uphold the spirit of the contract, support companies in fulfilling their contractual obligations, and ensure the normal conduct of lithography machine trade.

- BoJ Summary of Opinions from the March 18th-19th meeting stated that a member said YCC, negative rate and other massive stimulus tools have accomplished their roles and that the BoJ must guide monetary policy using short-term rate as main policy means in accordance with economic, price and financial developments. Furthermore, a member said shifting to 'normal' monetary easing is possible without causing short-term shocks and may have a positive impact on the economy in the medium- and long-term perspective, while a member warned that changing policy now could delay achievement of the BoJ's price target.

DATA RECAP

- Australian Retail Sales MM (Feb F) 0.3% vs. Exp. 0.4% (Prev. 1.1%)

- New Zealand ANZ Business Confidence (Mar) 22.9 (Prev. 34.7)

- New Zealand ANZ Own Activity (Mar) 22.5 (Prev. 29.5)

GEOPOLITICS

- Israeli official said PM Netanyahu is considering sending his high-level delegation to Washington as early as next week, while the White House said the Israeli PM's office agreed to reschedule a meeting with the US on Rafah and the US is working to set a date for the meeting.

- US military said it destroyed four long-range drones launched by Iranian-backed Houthis in Yemen, according to Reuters.

- Israeli air strike killed five people in southern Lebanon including Hezbollah fighters, according to Reuters sources.

EU/UK

NOTABLE HEADLINES

- BoE's Haskel warned against rushing to cut rates and thinks that rate cuts should be "a long way off", according to FT.

- UK car output in February rose 14.6% Y/Y to 79,907 units, according to the Society of Motor Manu