Europe Market Open: Choppy but contained action ahead of supply & ECB's Lane

26 Mar 2024, 06:30 by Newsquawk Desk

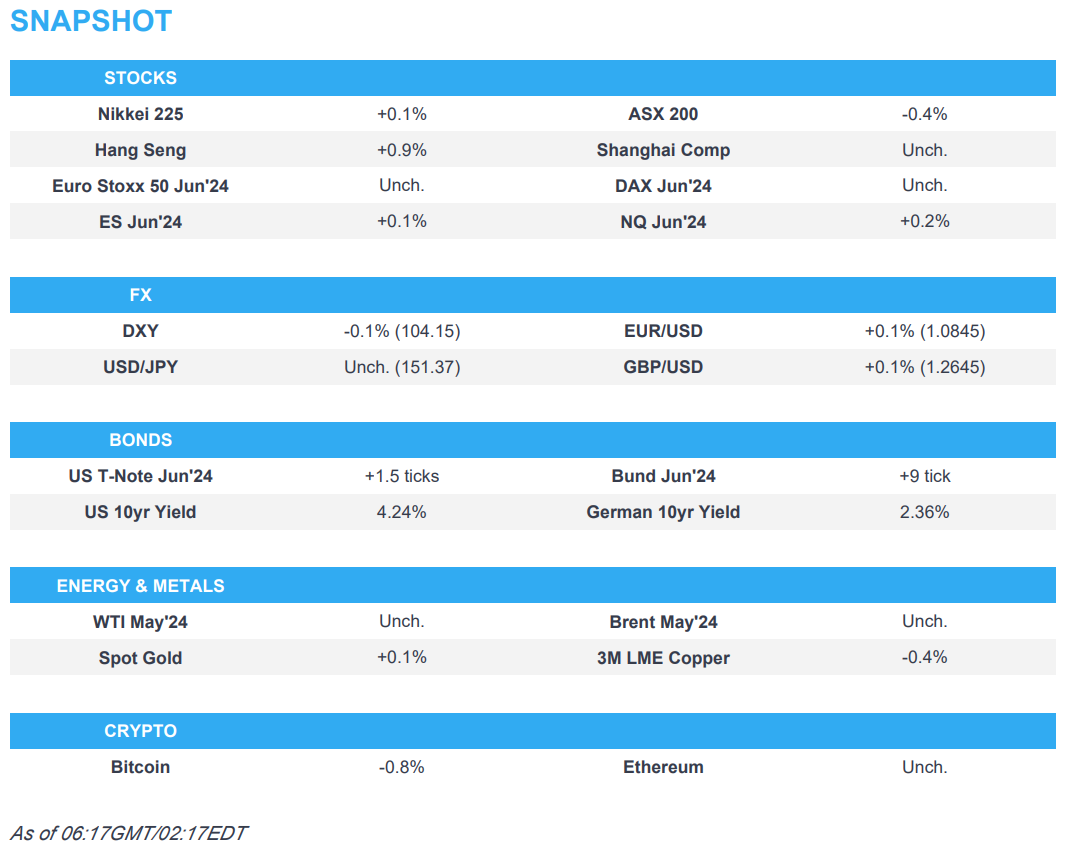

- APAC stocks were choppy after a similarly subdued handover from Wall St.

- European equity futures indicate a contained open with the Euro Stoxx 50 future flat after the cash market closed up 0.3% on Monday.

- FX markets are steady, DXY holds above 104, PBoC delivered another firmer-than-expected CNY fix.

- Crude is flat but holding onto recent gains, Bunds attempted to recoup recently lost ground.

- Looking ahead, highlights include US Durable Goods, Philly Fed Non-manufacturing Business Outlook, Richmond Fed Survey, Comments from RBNZ’s Conway, BoC’s Rogers and ECB’s Lane, Supply from Netherlands, UK, Germany & US

US TRADE

EQUITIES

- US stocks were mostly lower but finished off their worst levels with early pressure in tech after chip names AMD and Intel were initially hit by reports of China phasing out US microprocessors from government PCs and servers, while the EU was also reported to open investigations into big tech names. Nonetheless, the Nasdaq clawed back most of the earlier losses and the Russell 2000 closed in the green with outperformance seen in the energy sector amid higher oil prices.

- SPX -0.31% at 5,218, NDX -0.34% at 18,227, DJIA -0.14% at 39,313, RUT +0.10% at 2,074.

- Click here for a detailed summary.

APAC TRADE

EQUITIES

- APAC stocks were choppy after a similarly subdued handover from Wall St owing to early tech headwinds and ahead of month-end.

- ASX 200 declined as tech losses clouded over the outperformance in the energy sector, while weaker Consumer Confidence added to the glum mood.

- Nikkei 225 swung between gains and losses amid an indecisive currency and inconclusive Services PPI data.

- Hang Seng and Shanghai Comp. saw two-way price action with earnings releases in focus, while the mainland failed to sustain early optimism from the PBoC's more forceful liquidity operation.

- US equity futures were rangebound after the recent choppy performance stateside and mixed sentiment in Asia.

- European equity futures indicate a contained open with the Euro Stoxx 50 future flat after the cash market closed up 0.3% on Monday.

FX

- DXY was uneventful amid a lack of drivers early in the week and after recent comments from Fed officials did little to shift the dial despite a hawkish Bostic who reiterated his new view of just one rate cut this year.

- EUR/USD remained afloat after yesterday's dollar weakness and a rebound from a trough near 1.0800.

- GBP/USD traded steadily after a recent rebound but with upside capped by resistance around 1.2650.

- USD/JPY slightly pulled back after stalling around the 151.50 level and was unmoved by Services PPI data.

- Antipodeans conformed to the flat picture despite early support following a firmer CNY-reference rate setting.

- PBoC set USD/CNY mid-point at 7.0943 vs exp. 7.2037 (prev. 7.0996).

FIXED INCOME

- 10-year UST futures nursed some recent losses after retreating ahead of supply and this week's key events.

- Bund futures attempted to reclaim recently lost ground but with the rebound limited ahead of German issuance.

- 10-year JGB futures were indecisive after Japanese Services PPI matched the prior reading and amid the absence of additional BoJ JGB purchases.

COMMODITIES

- Crude futures were flat overnight but held on to most of their recent gains amid rising geopolitical tensions and after reports that Russia told oil companies to cut output to 9mln BPD by the end of June which is in line with its OPEC+ pledges.

- Head of Venezuela's opposition coalition said it was not possible to register a candidate for the presidential election.

- Spot gold traded sideways with participants lacking commitment in the absence of fresh macro drivers.

- Copper futures remained subdued alongside the somewhat mixed risk appetite in Asia.

- Brazilian miner Vale said it was selected by the US government to begin negotiations for financing related to an iron ore briquette plant and it will negotiate for an award of up to USD 282.9mln for the US project.

CRYPTO

- Bitcoin remains firm after briefly climbing above the USD 71,000 level yesterday.

NOTABLE ASIA-PAC HEADLINES

- Chinese Vice President Han said it is important to promote economic globalisation and smooth global industrial and supply chains, while they will accelerate the development of new productive forces and provide stability and security for the global economy.

- Japanese Finance Minister Suzuki said it is important for currencies to move in a stable manner reflecting fundamentals and rapid FX moves are undesirable, while he won't rule out any steps to respond to disorderly FX moves.

DATA RECAP

- Japanese Services PPI (Feb) 2.10% (Prev. 2.10%)

- Australian Westpac Consumer Confidence Index (Mar) 84.4 (Prev. 86.0)

- Australian Westpac Consumer Confidence MM (Mar) -1.8% (Prev. 6.2%)

GEOPOLITICS

MIDDLE-EAST

- US Secretary of State Blinken underscored to Israel's Defence Minister Gallant that alternatives exist to a ground invasion of Rafah that would both better ensure Israel's security and protect Palestinian civilians, while it was also reported that White House's Sullivan had a constructive discussion with Israel's Gallant.

- US State Department said it is surprising and unfortunate that the Israeli delegation decided not to come after US abstention on the UN resolution, while it added that a full-scale invasion of Rafah would be a mistake and this type of invasion would weaken Israel's security.

- US official said talks on Gaza ceasefire and hostages made progress this weekend, while an Israeli offensive in Rafah does not appear imminent and there is still time to work things out. The official added that the US will look for another opportunity to talk to the Israeli delegation following the cancellation of a visit to Washington this week.

- Hamas said it informed mediators it will stick to its original position for a comprehensive ceasefire including the withdrawal of Israeli troops from Gaza, return of the displaced and a 'real' exchange of prisoners, according to Reuters.

OTHER

- Russian President Putin said the terrorist attack was committed by radical Islamists, while he added they know who committed the crime and want to know who ordered it. Putin said the terrorist attack is part of the Kyiv regime's attacks on Russia and Russia is interested in who the attack benefits.

- New Zealand Foreign Minister Peters confirmed that New Zealand’s concerns about cyber activity have been conveyed directly to the Chinese government and he directed senior foreign ministry officials to speak to the Chinese ambassador, according to Reuters.

EU/UK

NOTABLE HEADLINES

- UK MPs warned that pension rules risk 'finishing off' the remaining defined-benefit plans and noted concerns that the new funding regime would require schemes to de-risk inappropriately, according to FT.