Europe Market Open: Lack of drivers left APAC performance mixed; Central Bank speakers ahead

25 Mar 2024, 06:33 by Newsquawk Desk

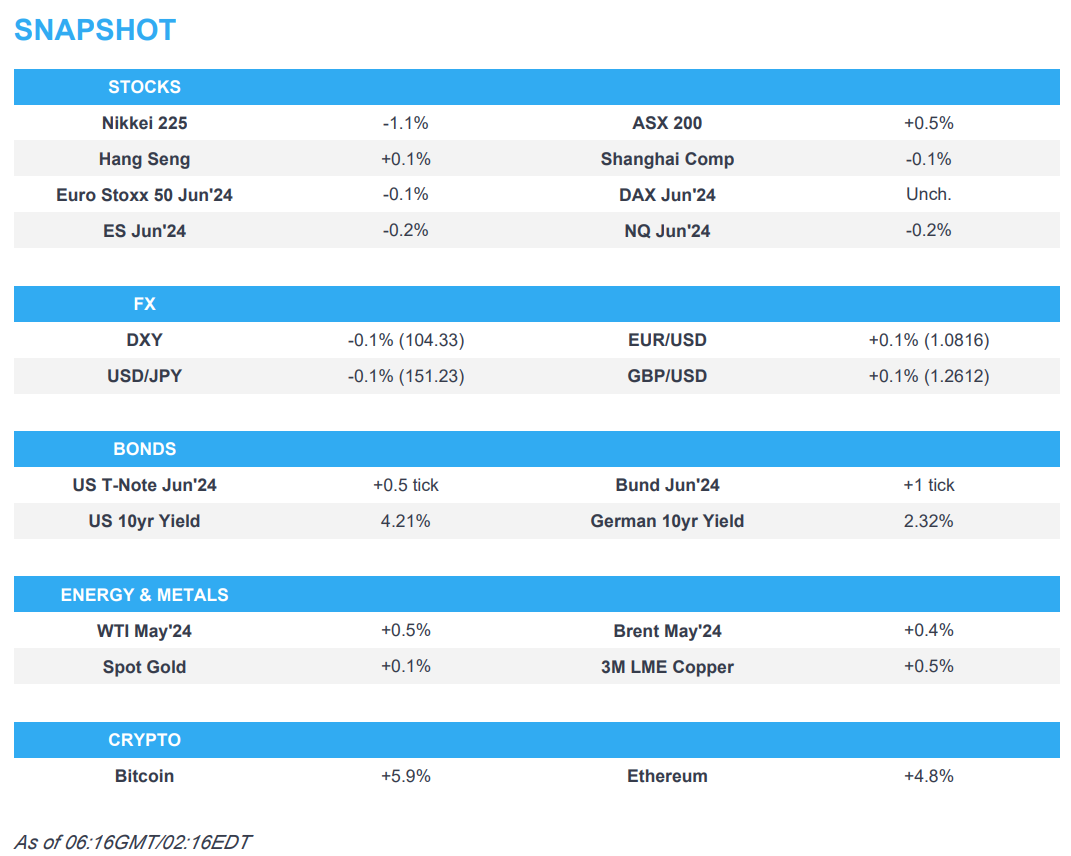

- APAC stocks traded mixed amid a lack of major macro drivers heading into month-end and a slew of data releases.

- Fed’s Bostic (voter) adjusted his projection to one rate cut this year and at a later start vs. previous view of two cuts.

- European equity futures indicate a flat open with the Euro Stoxx 50 future unchanged after the cash market closed down 0.4% on Friday.

- DXY is a touch softer, EUR/USD found support at 1.08, Cable is back on a 1.26 handle, USD/JPY tested 151 to the downside.

- Looking ahead, highlights include comments from ECB’s Lagarde, Fed’s Bostic & BoE’s Mann, supply from US.

US TRADE

EQUITIES

- US stocks finished mostly lower on Friday with price action choppy amid a lack of tier 1 US data to go off and as questions were raised on the state of the consumer on the back of poor reports from Nike (NKE) and Lululemon (LULU). while some large-cap tech names outperformed in which Apple (AAPL) pared some of Thursday's big losses post-DoJ lawsuit.

- SPX -0.14% at 5,234, NDX +0.10% at 18,339, DJI -0.77% at 39,476, RUT -1.27% at 2,072.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Fed’s Bostic (voter) said on Friday that there is no silver bullet answer on why the economy is doing so well but immigration and productivity are likely playing a role, while he added that data so far indicates inflation will fall slower and he adjusted his projection to one rate cut this year and at a later start vs. previous view of two cuts. Furthermore, he stated that the base case remains for no more hikes and noted they should begin tapering relatively soon but do not have a time in mind yet, according to Reuters.

- US Senate passed a USD 1.2tln government funding bill which President Biden signed to avert a government shutdown, according to the White House.

APAC TRADE

EQUITIES

- APAC stocks traded mixed amid a lack of major macro drivers heading into month-end and a slew of data releases.

- ASX 200 finished higher with early outperformance in property and tech owing to softer yields.

- Nikkei 225 pulled back from record highs as investors booked profits amid some mild yen strength.

- Hang Seng and Shanghai Comp. were initially indecisive as participants digested recent earnings releases, although eventually strengthened after the slew of rhetoric from Chinese officials including Premier Li who noted relatively big room for macro policy.

- US equity futures lacked direction in the absence of any fresh macro catalysts to spur trade.

- European equity futures indicate a flat open with the Euro Stoxx 50 future unchanged after the cash market closed down 0.4% on Friday.

FX

- DXY marginally softened amid headwinds from a firmer yuan and in a catalyst-light start to a data-packed week.

- EUR/USD mildly rebounded off recent lows after it found support at the 1.0800 level.

- GBP/USD reclaimed the 1.2600 handle which was facilitated by a bounce from the nearby 200DMA (1.2590).

- USD/JPY briefly tested 151.00 to the downside after renewed jawboning by Japan's top currency diplomat Kanda.

- Antipodeans were underpinned early in the session alongside CNY strength after the PBoC set a firmer fix.

- PBoC set USD/CNY mid-point at 7.0996 vs exp. 7.2267 (prev. 7.1004).

- Chinese major state-owned banks were seen selling dollars for yuan in the onshore FX market to stabilise the Chinese currency, according to sources cited by Reuters

FIXED INCOME

- 10-year UST futures were rangebound after the lack of major macro developments over the weekend.

- Bund futures gave back mild early gains but remained above the 133.00 level after Friday's advances.

- 10-year JGB futures kept afloat following the recent gains in global peers but with upside capped by an enhanced liquidity auction.

COMMODITIES

- Crude futures were marginally firmer amid a slightly softer dollar and the ongoing geopolitical climate.

- Iraq Oil Ministry blamed foreign companies operating in Iraqi Kurdistan for a delay in the restart of crude exports from the region, while it added that OPEC and secondary sources reports show crude production between 200k-225k bpd in the region without the knowledge or approval of the ministry, according to Reuters.

- Russian Defence Ministry said Russia struck Ukraine’s electric power and gas-producing facilities, according to IFX, while it was also reported that a Russian missile strike hit a Ukrainian underground gas storage site, according to Naftogaz.

- Spot gold edged higher in a mild rebound from Friday's trough but with trade contained ahead of a slew of data releases this week including the Fed's preferred inflation gauge.

- Copper futures clawed back some of last week's losses after finding support around the USD 4.00/lb level.

CRYPTO

- Bitcoin was choppy but ultimately gained after recovering from a brief dip beneath the USD 67,000 level.

NOTABLE ASIA-PAC HEADLINES

- Chinese Premier Li said China’s economic rebound momentum continues to consolidate and strengthen with economic development off to a good start judging by the first two months and though the economy sees some fluctuations, the long-term trend of the economy turning for the better won’t be changed. Premier Li said they will carefully study the issues of market access, match of supply and demand, as well as cross-border data flows, while there will be some regulations in some of these areas soon. Furthermore, Li said China will strive to boost domestic demand and that there is relatively big room for macro policy, according to Reuters.

- China’s Finance Minister said the government is confident and capable of achieving full-year economic and development goals, while China will prioritise support for sci-tech innovation and manufacturing development and allocate more fiscal resources to ensure employment, according to Reuters.

- China's Industry Minister said they will accelerate new industrialisation, promote continuous optimisation and upgrading of industrial supply chains, while they will accelerate the modernisation of the industrial system, fully abolish restrictions on foreign investment access in the manufacturing sector, and deepen in-depth cooperation with enterprises from all countries.

- China NDRC head said the state planner will implement a batch of major sci-tech projects based on the development of new productive forces, while it will crack down on monopolies and unfair competition activity, as well as publish a new version of a negative list for market access, according to Reuters.

- China's Vice Commerce Minister said they will further expand high-level opening up to the outside world and create more market opportunities by opening up for development, while China will continue to tap and unleash the potential of domestic demand, providing more trade and investment opportunities.

- China’s Commerce Minister met with Micron’s (MU) president and said that they welcome the Co. to expand its footprint in the Chinese market and ramp up investment projects while firmly obeying China’s laws and regulations, while China’s Commerce Minister also met with the chairmen of AMD (AMD), Exxon (XOM) and Medtronic (MDT), according to Reuters.

- China blocked the use of Intel (INTC) and AMD (AMD) chips in government computers.

- US Treasury Secretary Yellen will travel to China in April, according to POLITICO.

- US Secretary of State Blinken said the US expresses deep concern over Hong Kong’s security law.

- BoJ January meeting minutes noted that members said the likelihood of reaching the price goal was gradually rising and members discussed the positive and side effects of the Bank's unconventional monetary policy. Members also agreed that Japan's economy had recovered moderately and shared the recognition that, although exports and production had been affected by the slowdown in the pace of recovery in overseas economies, they had been more or less flat.

- Japan's top currency diplomat Kanda said they have been closely watching FX moves with a high sense of urgency and will take appropriate steps to respond to an excessive weakening of the yen without excluding any measures, while he added the current yen weakness does not reflect fundamentals and is due to speculation.

GEOPOLITICS

MIDDLE-EAST

- A leading Hamas source said Israeli media leaks about concessions and compromises offered to Hamas are miserable propaganda aiming to cover up its intransigence and evade responsibility for obstructing the agreement in front of the families of its prisoners, according to Al Jazeera.

- US Vice President Harris said an Israeli assault on Rafah ‘would be a huge mistake’ and she did not rule out 'consequences' if Israel invades Rafah, according to an interview with ABC News.

- UN Secretary-General Guterres visited Rafah and said it is time for an immediate humanitarian ceasefire, while he added there is a clear international consensus that any ground intervention in Rafah will cause a humanitarian catastrophe.

- UKMTO said a vessel was struck by an unidentified projectile 23NM west of Yemen’s Mukha and the resulting fire was extinguished by the crew, while the crew were reported safe.

MOSCOW TERROR ATTACK

- The death toll from the Moscow concert hall attack on Friday was at least 137, while Russian President Putin declared a day of mourning on Sunday and said all attackers have been found and detained, according to Reuters.

- Russia’s FSB said the perpetrators of the Moscow attack were heading towards the Russia-Ukraine border and had contacts on the - Ukrainian side, according to IFAX. There were also comments from Russian lawmaker Kartapolov who said there should be a clear answer on the battlefield if Ukraine is found to be behind the Moscow attack, according to RIA.

- Ukrainian President Zelensky said Russian President Putin and others seek to divert blame for the Moscow concert massacre and that Putin could use the terrorists he sent to their deaths in Ukraine to stop terrorism in Russia.

- US National Security Council spokesperson said the US government shared information with Russia earlier this month about a planned attack on Moscow, while the spokesperson added that Ukraine has no involvement in the attack on Russia and Islamic State bears sole responsibility for the attack. It was also reported that Islamic State released footage of the attack on the concert hall.

- France raised its security alert after the attack on Moscow, according to reports citing the French PM.

OTHER

- Ukraine’s military said it hit two Russian large landing ships, as well as a communications centre and infrastructure used by Russia’s Black Sea fleet during strikes on Crimea.

- Russia violated Poland’s airspace with a cruise missile attack on western Ukraine, while it was later reported that Russia’s air strike hit a Ukrainian facility in the western Lviv region and took control of the village of Krasnoye in the Donetsk region, according to IFAX.

- Russia scrambled a MiG-31 jet after US bombers approached near the Russian border over the Barents Sea, according to RIA.

- Gunmen reportedly stormed a police station in the Armenian capital of Yerevan, according to TASS.

- China's coastguard used water cannons against Philippine ships in the South China Sea, while China’s Defence Ministry warned the Philippines against provocative actions and to stop infringing and making any remarks that may lead to the intensification of conflicts and escalation of the situation. Furthermore, the Defence Ministry said China will continue to take decisive measures to firmly safeguard its territorial sovereignty and maritime rights and interests if the Philippines repeatedly challenges China’s bottom lines.

- Philippines' Foreign Ministry summoned the Chinese Embassy's Charge D’Affaires and protested against aggressive actions by China's Coast Guard and maritime militia against rotation and resupply mission over the weekend, while it added that China has no right to be in Second Thomas Shoal and demanded that Chinese vessels leave the vicinity of Second Thomas Shoal and the Philippine Exclusive Economic Zone immediately.

- US State Department said the US stands with the Philippines and condemns dangerous actions by China in the South China Sea. This was after China said it took control measures on Philippine vessels that ‘intruded’ into the Second Thomas Shoal waters on March 23rd.

- US and Japan plan the biggest upgrade to security pact in more than 60 years, according to FT. It was also separately reported that the US military command in Japan will be revamped, while Japan's Chief Cabinet Secretary Hayashi said they are discussing ways to strengthen military cooperation with the US amid a move to a joint command structure in Japan but nothing decided yet.

- North Korean leader Kim visited a tank unit and called for airtight combat readiness. It was also reported that North Korean leader Kim's sister said bilateral relations depend on Japan's political decision and that Japanese PM Kishida showed intention to meet with North Korea's leader recently, according to KCNA.

EU/UK

NOTABLE HEADLINES

- UK Chancellor Hunt said the Conservative Party will keep the triple lock for pension increases in its election manifesto, according to Reuters.

- BoE announced Q2 QT schedule on Friday in which it will sell short-dated Gilts across four auctions of GBP 800mln and will sell medium-dated Gilts across four auctions of GBP 750mln, while it will sell long-dated Gilts across three auctions of GBP 600mln with its total sales at GBP 8bln in Q2.

- ECB's Centeno said on Friday that policy must and will follow the inflation reality and they are at the end of this inflationary process.