Europe Market Open: Mixed APAC trade as Wall St. momentum waned; Central Bank speak ahead

22 Mar 2024, 06:20 by Newsquawk Desk

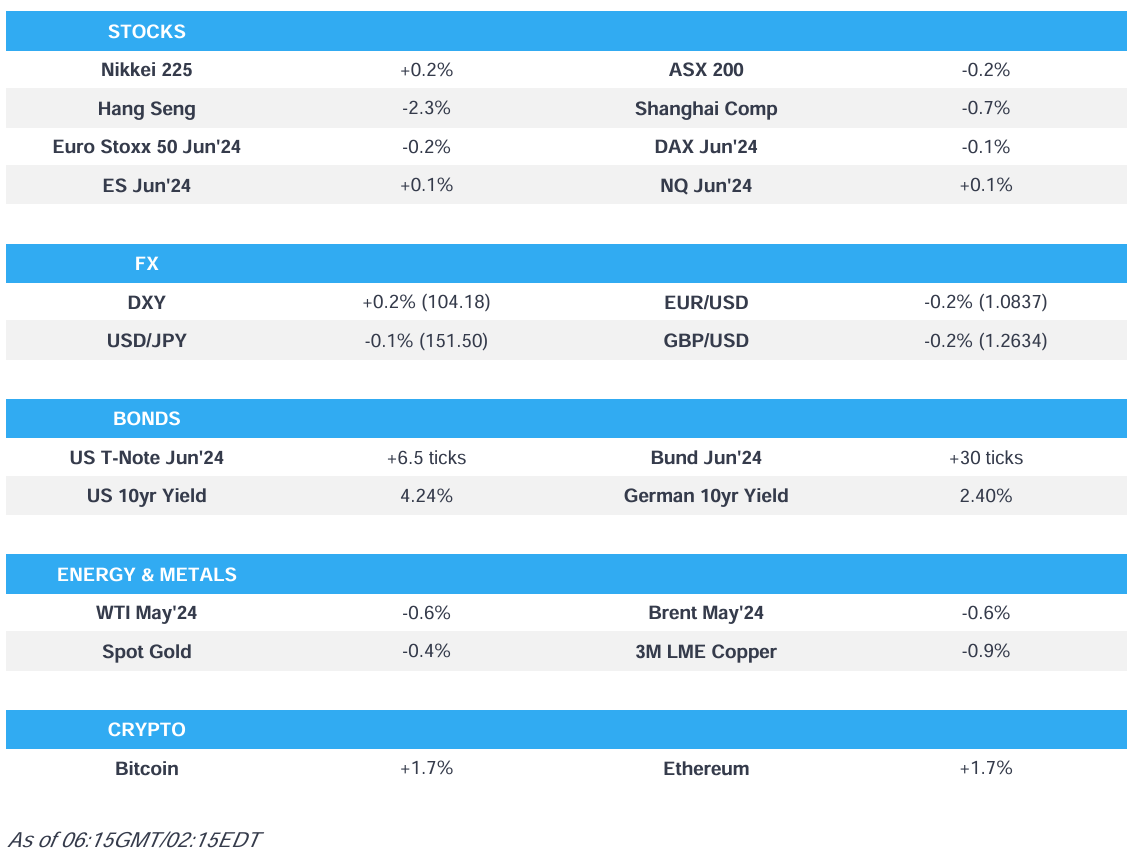

- APAC stocks were ultimately mixed after momentum from the fresh record highs on Wall Street waned, Hang Seng and Shanghai Comp. suffered.

- DXY extends on gains above 104.00 after recent firm US data and pressure in Asia-Pac counterparts, USD/JPY traded indecisively.

- The latest Japanese CPI data was mostly softer-than-expected but the Core reading matched estimates at a four-month high.

- BoE Governor Bailey said rate cuts were in play at future BoE meetings amid signs tighter policy quelled the risk of a wage-price spiral, according to FT.

- Looking ahead, highlights include UK Retail Sales, German Ifo, Canadian Retail Sales, Japan’s Rengo (2nd tally), comments from ECB’s Lane, Fed’s Powell, Barr & Bostic.

US TRADE

EQUITIES

- US stocks edged higher and the S&P 500, DJIA and Nasdaq 100 all posted fresh all-time highs in early trade but finished off their best levels on what was a day dominated by central bank updates. There was also a slew of hot data releases stateside including below-forecast jobless claims, a smaller fall than expected in the Philly Fed survey, ebullient existing home sales, and a mixed set of Flash PMIs, while Apple (AAPL) provided a headwind and its shares dropped by more than 4% after the DoJ filed a landmark antitrust lawsuit against the Co.

- SPX +0.32% at 5,242, NDX +0.44% at 18,320, DJI +0.68% at 39,781, RUT +1.14% at 2,098.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President Biden is set to award billions to decarbonise US heavy industries, according to Bloomberg.

- Former US President Trump is reportedly eyeing Senator Rubio as a potential VP pick, according to NBC News.

APAC TRADE

EQUITIES

- APAC stocks were ultimately mixed after momentum from the fresh record highs on Wall Street waned.

- ASX 200 closed with mild losses with the index weighed on by underperformance in miners amid declines in underlying commodity prices, while the RBA's Financial Stability Review noted conditions are to remain challenging for households and businesses.

- Nikkei 225 swung between gains and losses in which it initially climbed above 41,000 for the first time but then faltered and briefly wiped out all its gains as participants digested somewhat mixed inflation data which was mostly softer-than-expected but the Core reading matched estimates at a four-month high.

- Hang Seng and Shanghai Comp. suffered amid weak earnings from the likes of CK Asset Holdings, CK Hutchison, CNOOC and Ping An, while tech slumped after a US Commerce Department official said SMIC may have violated US export controls to produce chips for Huawei.

- US equity futures took a breather after marginally pulling back from Wall St's record levels.

- European equity futures indicate a lower open with the Euro Stoxx 50 future -0.2% after the cash market closed up 1.0% on Thursday.

FX

- DXY extends on gains above 104.00 after recent firm US data and pressure in Asia-Pac counterparts.

- EUR/USD tickled further beneath the 1.0900 territory after the dollar resurgence and mixed European PMIs.

- GBP/USD remained subdued after post-BoE selling, while Governor Bailey noted all meetings are in play.

- USD/JPY traded indecisively after the latest CPI data and despite an early advance to 4-month highs.

- Antipodeans declined amid the downbeat mood in China, commodity pressure and yuan depreciation.

- PBoC set USD/CNY mid-point at 7.1004 vs exp. 7.2147 (prev. 7.0942).

- China's major state-owned banks were seen to be selling dollars for yuan in the onshore FX market to slow yuan declines, according to sources cited by Reuters.

- Banxico cut its rate by 25bps to 11.00%, as expected, while the decision was not unanimous as Espinosa voted to keep rates unchanged. Banxico said it will make its decisions depending on available information in the next monetary policy meeting and the balance of risks for the trajectory of inflation within the forecast horizon remains biased to the upside.

FIXED INCOME

- 10-year UST futures gradually retraced some of yesterday's data-triggered selling.

- Bund futures revisited the prior day's highs amid the soured overnight risk tone.

- 10-year JGB futures price action was contained after mixed signals from Japan's inflation data but with downside stemmed by the BoJ's presence in the market for over JPY 1.4tln.

COMMODITIES

- Crude futures remained subdued after yesterday's retreat which coincided with a firmer dollar.

- US has reportedly urged Ukraine to halt strikes against Russian oil refineries, according to FT.

- Spot gold mildly extended its pullback from the USD 2,200/oz level amid commodity weakness.

- Copper futures declined owing to the soured mood and broad selling in Asian commodity futures.

CRYPTO

- Bitcoin was choppy but ultimately strengthened to test the USD 66,000 level to the upside.

NOTABLE ASIA-PAC HEADLINES

- BoJ Governor Ueda reiterated that the BoJ's JGB holdings will remain at current levels for the time being and they would like to eventually decrease their JGB buying but will take a wait-and-see stance for the time being. Ueda added that the latest decision is based on the understanding that they will leave it to markets to determine long-term rate moves.

- RBA Financial Stability Review stated conditions are to remain challenging this year for households and businesses, as well as noted that households have trimmed spending and are underpinned by a strong jobs market and savings buffers.

DATA RECAP

- Japanese National CPI YY (Feb) 2.8% vs. Exp. 2.9% (Prev. 2.2%)

- Japanese National CPI Ex. Fresh Food YY (Feb) 2.8% vs. Exp. 2.8% (Prev. 2.0%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Feb) 3.2% vs. Exp. 3.3% (Prev. 3.5%)

GEOPOLITICS

MIDDLE-EAST

- US will reportedly bring a resolution today calling for an immediate ceasefire in Gaza as part of a hostage deal for a vote in the UN Security Council, according to Reuters citing a spokesperson.

- US military said it destroyed one unmanned surface vessel and two anti-ship ballistic missiles launched by Houthis in Yemen.

- Houthi official told Reuters they have provided assurances to China and Russia that their vessels will pass safely through the Red Sea.

OTHER

- Ballistic missiles were reportedly fired from Crimea towards Zaporizhzhia and explosions were heard, according to a source via social media platform X.

- EU is actively exploring how to work around an EU treaty clause prohibiting arms purchases from the union's budget amid efforts to increase financing for defence and Ukraine, according to FT. It was separately reported that the EU Commission head prepared a proposal to raise tariffs on Russian and Belarusian imports of some grains.

- China's special envoy for Eurasian affairs said the Russian side appreciates the diplomacy efforts taken by the Chinese side and produced their own take on peace talks, while the side reiterated its willingness and position on holding serious talks on this crisis. China's envoy also stated that Russia and Ukraine are keeping to their positions and have huge differences when it comes to peace talks but both sides believe that this crisis will be solved through peace talks, according to Reuters.

- China's embassy in the Philippines said the Taiwan question is not and should never become an issue between China and the Philippines, while it added any attempt to implicate the Taiwan question in maritime disputes between China and the Philippines is dangerous.

EU/UK

NOTABLE HEADLINES

- BoE Governor Bailey said rate cuts were "in play" at future BoE meetings amid signs tighter policy quelled the risk of a wage-price spiral, according to FT.

DATA RECAP

- UK GfK Consumer Confidence (Mar) -21.0 vs. Exp. -19.0 (Prev. -21.0)