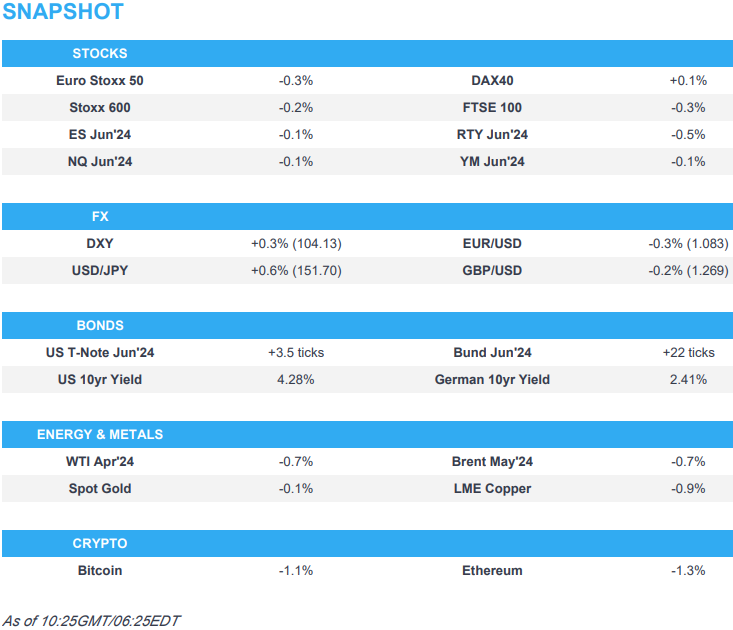

US Market Open: Equities softer, DXY firmer benefiting from a weaker Yen, Bonds bullish post-UK CPI; FOMC due

20 Mar 2024, 10:31 by Newsquawk Desk

- European equities are mostly lower, with the CAC 40 dragged down by Luxury names after Kering issued a profit warning; US equity futures modestly softer

- DXY firmer, taking impetus from the weaker Yen; USD/JPY above 151.70

- Bonds hold a bullish bias following softer UK CPI, as attention turns to the FOMC

- Crude and base metals are softer owing to the firmer Dollar and tentative risk tone

- Looking ahead, Australian PMIs, FOMC, CNB, BCB Policy Announcements, BoC Minutes, Comments from Fed Chair Powell, ECB's Schnabel, Earnings from General Mills & PDD

EUROPEAN TRADE

EQUITIES

- European bourses, Stoxx600 (-0.2%) are mostly lower, with clear underperformance in the CAC 40 (-0.8%), with Luxury names hampered by Kering (-14.4%).

- European sectors are mostly lower; Consumer Products and Services is slumped at the foot of the pile after Kering issued a profit warning, which has weighed on peers such as LVMH (-2.9%)/Hermes (-1.9%).

- US equity futures (ES -0.1%, NQ -0.1%, RTY -0.5%) are softer, with clear underperformance in the RTY, as it pares back yesterday's gains; Intel (+2.2% pre-market) gains after being awarded approx. USD 20bln in grants by the Biden Administration.

- Click here and here for the sessions European pre-market equity newsflow, including earnings.

- Click here for more details.

FX

- Dollar is firmer vs. peers as JPY weakness provides support and has led DXY above yesterday's peak at 104.05 (vs current 104.12). Resistance comes via the March high at 104.29. Fate for USD is likely to be sealed by today's FOMC meeting.

- EUR is weighed on by the broadly firmer USD with not much in the way of fresh EZ-specific updates as comments from Lagarde reiterate recent remarks. EUR/USD trough yesterday was 1.0834 with 200DMA just above at 1.0838.

- GBP is softer vs. USD but flat against EUR following slightly softer-than-expected UK inflation metrics. Cable has been as low as 1.2690 but is yet to test its 50DMA to the downside at 1.2684.

- Another session of losses for JPY as yesterday's BoJ hike fails to stop the rot in the absence of a dovish turn from the Fed. USD/JPY has been as high as 151.58 with technicians highlighting the 2023 high at 151.91 and 2022 high at 151.94. Continued upside will prompt speculation of intervention.

- Antipodeans are both softer vs. the USD. AUD/USD is holding above yesterday's 0.6563 trough, whilst NZD/USD has extended downside to print a fresh YTD low at 0.6031.

- PBoC set USD/CNY mid-point at 7.0968 vs exp. 7.1967 (prev. 7.0985).

- Click here for more details.

FIXED INCOME

- Gilts gapped higher by 24 ticks to 98.97 after the region's softer-than-expected CPI numbers. Gilts continued to advance higher reaching a 99.30 peak, before fading the move back towards 99.00.

- Bunds hold a bullish tilt, given the UK data. Thereafter, nothing fundamentally new from ECB's Lagarde who kept the emphasis on June. Price action generally mirrors Gilts, with Bunds printing a high at 132.34, before eventually fading the move.

- UST price action is in-fitting with the above but slightly more contained overall. USTs remain around the 110-08 mark after Tuesday's particularly strong 20yr auction with newsflow since thin and the narrative honing in on the FOMC.

- Click here for more details.

COMMODITIES

- A subdued session for crude thus far, amid the broadly risk-averse mood coupled with a stronger Dollar, with the complex giving back some of its recent gains despite the heightened geopolitical tensions and slightly bullish private inventory data.

- Precious metals upside has been capped by the firmer Dollar with participants on standby for the FOMC release, dot plots, and press conference. XAU holds around 2,150/oz within a USD 2,154.55-2,160.30/oz range.

- Base metals are mixed with price action largely dictated by the Greenback and amid the cautious risk sentiment. Price action in Europe has been contained thus far.

- Peru copper production declined 1.2% Y/Y in January to 205,375 metric tons, according to the Mines and Energy Ministry.

- Russian Energy Minister Shulginov says the situation on domestic fuel market is under constant surveillance; measures are being taken to keep gasoline surplus.

- Norway's Prelim (Feb) oil production 1.897mln BPD (prev. 1.829mln M/M); Gas production 10.4bln CU metres (prev. 11.71bln cu meters M/M).

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- ECB President Lagarde: "Building confidence in the path ahead"; "when it comes to the data that is relevant for our policy decisions, we will know a bit more by April and a lot more by June.". "Three domestic factors that will be to ensuring that the inflation path evolves as we project: 1. Wage Growth, 2. Profit Margins 3. Productivity Growth"; Echoes rhetoric from the prior ECB meeting.

- EU Council and Parliament provisionally agreed to renew the suspension of import duties and quotas on Ukrainian exports to the EU until June 2025, according to Reuters.

DATA RECAP

- UK CPI YY (Feb) 3.4% vs. Exp. 3.5% (Prev. 4.0%); All Services 6.1% (prev. 6.5%); Marginally softer metrics, though not enough to shift the dial away from the Table Mountain approach. Market Pricing: Incrementally pricing in cuts; August now fully priced. Dec -70bps (prev. -66bps).

- UK Core CPI MM (Feb) 0.6% vs. Exp. 0.7% (Prev. -0.9%); UK Core CPI YY (Feb) 4.5% vs. Exp. 4.6% (Prev. 5.1%); UK CPI MM (Feb) 0.6% vs. Exp. 0.7% (Prev. -0.6%)

- UK PPI Output Prices MM NSA (Feb) 0.3% vs. Exp. 0.1% (Prev. -0.2%); UK PPI Output Prices YY NSA (Feb) 0.4% vs. Exp. -0.1% (Prev. -0.6%, Rev. -0.3%); UK PPI Input Prices MM NSA (Feb) -0.4% vs. Exp. 0.2% (Prev. -0.8%, Rev. -0.1%); UK PPI Input Prices YY NSA (Feb) -2.7% vs. Exp. -2.7% (Prev. -3.3%, Rev. -2.8%); UK RPI YY (Feb) 4.5% vs. Exp. 4.5% (Prev. 4.9%); UK RPI MM (Feb) 0.8% vs. Exp. 0.7% (Prev. -0.3%); UK PPI Core Output YY NSA (Feb) 0.3% (Prev. -0.4%, Rev. -0.3%); UK PPI Core Output MM NSA (Feb) 0.2% (Prev. 0.2%, Rev. 0.3%)

- UK RPIX YY (Feb) 3.5% (Prev. 3.8%); RPI-X (Retail Prices) MM (Feb) 0.7% (Prev. -0.4%)

- UK ONS House Price Index (Jan) -0.6% vs. prev. -2.2%

- German Producer Prices MM (Feb) -0.4% vs. Exp. -0.1% (Prev. 0.2%); Producer Prices YY (Feb) -4.1% vs. Exp. -3.8% (Prev. -4.4%)

- Italian Industrial Output YY WDA (Jan) -3.4% (Prev. -2.1%, Rev. -1.5%); Italian Industrial Output MM SA (Jan) -1.2% vs. Exp. -0.5% (Prev. 1.1%, Rev. 1.2%)

EM DATA

- South African Core Inflation YY (Feb) 5.0% vs. Exp. 4.8% (Prev. 4.6%); Core Inflation MM (Feb) 1.2% vs. Exp. 1.1% (Prev. 0.3%)

- South African CPI YY (Feb) 5.6% vs. Exp. 5.5% (Prev. 5.3%); CPI MM (Feb) 1.0% vs. Exp. 0.9% (Prev. 0.1%)

NOTABLE US HEADLINES

- Alphabet's (GOOG) Google hit with a EUR 250mln fine by the French regulator, according to AFP.

- Biden administration has awarded Intel (INTC) almost USD 20bln in grants and loans to subsidize chip production in the US; INTC +4.5% pre-market

- Boeing (BA) CFO says FAA undertaking tougher audit than before; says made decision to constrain 737 production below 38 per month; will not rush or go too fast

GEOPOLITICS

MIDDLE EAST

- US President Biden said the war in Gaza has caused terrible suffering to the Palestinian people and they will continue to lead international efforts to deliver more humanitarian aid to the people of Gaza people, while it was also reported that Defense Secretary Austin will host his Israeli counterpart next week for a bilateral meeting.

- UK Foreign Secretary Cameron said hostages held by Hamas in Gaza must be released and the most important thing now is a pause in fighting to get hostages out and aid in. Cameron stated it is crucial to turn a pause in fighting into a permanent, sustainable ceasefire and that a ceasefire can only be achieved with conditions being fulfilled, while he added they must get Hamas leaders out of Gaza and dismantle their network to ensure a ceasefire lasts, according to a Reuters interview.

- "Israeli media: Blinken to visit Israel on Friday", according to Sky News Arabia.

- "Agreement on truce in Gaza is not imminent, but there is slow progress in the negotiations", according to Al Arabiya citing sources

OTHER

- China's embassy in the Philippines said US Secretary of State Blinken's remarks about the South China Sea ignored facts and groundlessly accused China regarding its activities in the South China Sea. Furthermore, it stated that remarks once again threatened China with the 'so-called' US-Philippine Mutual Defence Treaty obligations which China firmly opposes, while China advises the US not to stir up trouble or take sides on the South China Sea issue.

- Taiwan's Foreign Minister said China has built "enormous" military bases on three islands surrounding Taiwan's main holding in the South China Sea, according to Reuters.

- US Air Force said it conducted a successful hypersonic weapons test, according to Reuters.

- North Korea leader Kim guided a solid fuel engine test for a new intermediate-range hypersonic missile, according to KCNA.

CRYPTO

- Bitcoin (-1.1%) fell below USD 61k overnight, though now sits around USD 63k in what has been a volatile session thus far.

APAC TRADE

- APAC stocks traded cautiously and mostly rangebound ahead of the FOMC and with Japanese markets closed.

- ASX 200 struggled for direction as strength in energy was offset by losses in the tech and consumer sectors.

- KOSPI outperformed as South Korea plans to cut corporate and dividend income tax to encourage a higher shareholder return, while index heavyweight Samsung Electronics (005930 KS) rose over 5% and was helped by reports that NVIDIA looks to procure high-bandwidth memory chips from the Co.

- Hang Seng and Shanghai Comp. were indecisive as participants digested the latest earnings releases, while Prada (1913 HK) shares slipped in early trade after Gucci owner Kering (KER FP) issued a luxury sector warning amid Asia-Pacific weakness, while the mainland was kept afloat following the lack of surprises from the PBoC's benchmark LPRs which were maintained at their current levels

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1Y (Mar) 3.45% vs. Exp. 3.45% (Prev. 3.45%)

- Chinese Loan Prime Rate 5Y (Mar) 3.95% vs. Exp. 3.95% (Prev. 3.95%)

- PBoC reshuffled its Monetary Policy Committee which now includes China securities regulator head Wu Qing and PBoC Vice Governor Xuan Changneng, while the committee also has two new academic members, Huang Yiping from Peking University and Huang Haizhou from Tsinghua University.

- Chinese Foreign Minister Wang Yi said in a meeting with his Australian counterpart that their economies are highly complementary and have great potential, while he stressed that since relations are on the right track, they must not hesitate, deviate or turn back. Furthermore, Wang said regarding China's sovereignty, dignity and legitimate concerns, that they hope that the Australian side will continue to abide by commitments it has made, as well as respect and properly handle them.

- Australian Foreign Minister Wong said she discussed a range of shared interests with her Chinese counterpart and welcomes progress in the removal of trade impediments with China. Wong added she discussed volatility in nickel markets with China and raised concerns about human rights, including in Xinjiang, Tibet, and Hong Kong, while they will seek to manage differences with China wisely.

- China's embassy in the UK commented regarding UK Foreign Secretary Cameron's remarks on Hong Kong's new law and urged the British side to stop making groundless accusations against the legislation of Article 23, while it added that Hong Kong affairs are purely China's internal affairs and the British side is not qualified to make irresponsible remarks.

- US is said to consider sanctioning Huawei's chipmaking network which could be added to the entity list, while the companies that could be blacklisted over links with Huawei include chipmakers Qingdao Si’en, Swaysure, and Shenzhen Pensun Technology, according to Bloomberg.

- Tencent (700 HK/TCEHY) - Q4 (CNY): Revenue 155.20bln (exp. 157.42bln). FY Adj. Net 157.7bln (exp. 152.97bln). FY-end combined MAU of Weixin and WeChat 1.343bln (prev. 1.313bln); Recommended final dividend of HKD 3.40/shr.

- Tencent (700 HK/TCEHY) President says Chinese gaming regulator has approved many licenses since December to show support for the industry; says Q1 video games revenue will be weaker Y/Y.

Source: Newsquawk