Europe Market Open: Cautious trade into the FOMC; Kering issued a profit warning

20 Mar 2024, 06:28 by Newsquawk Desk

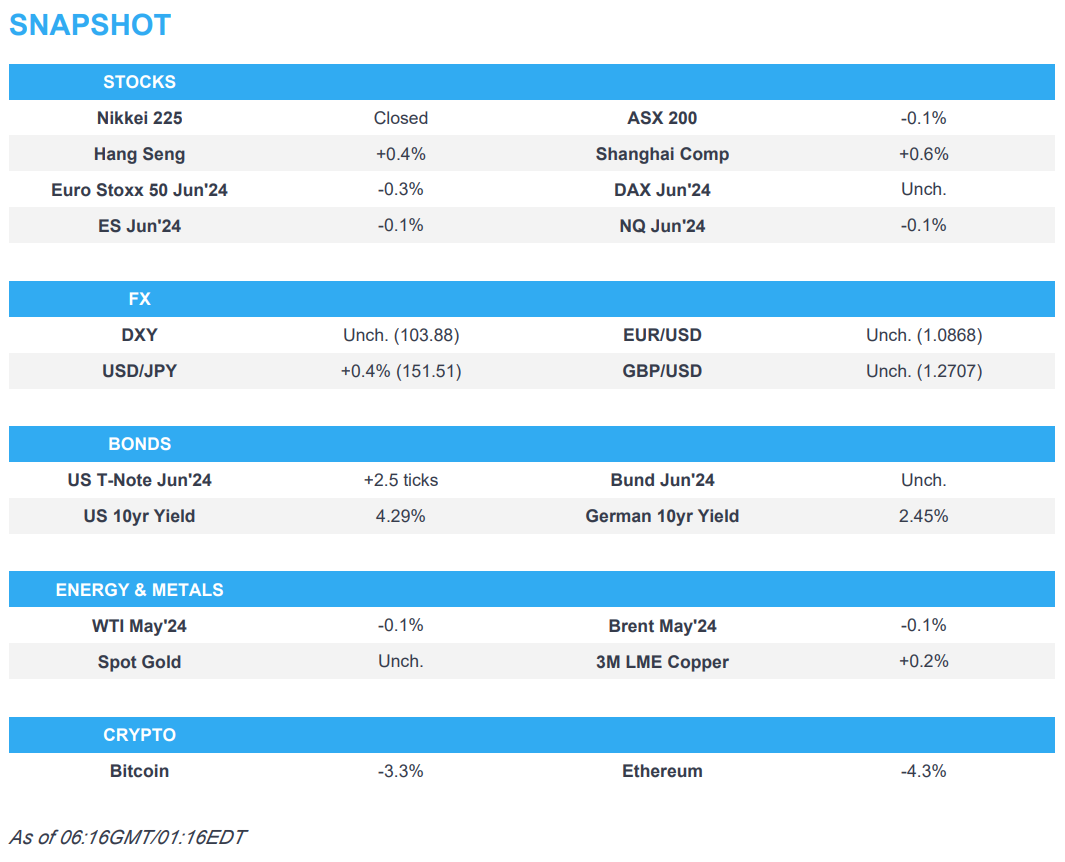

- APAC stocks traded cautiously and mostly rangebound ahead of the FOMC and with Japanese markets closed.

- European equity futures indicate a lower open with the Euro Stoxx 50 future -0.4% after the cash market closed up 0.5% on Tuesday.

- In the luxury sector, Kering has warned of a 20% plunge in Q1 Gucci sales.

- DXY is contained below the 104 mark, JPY lags with USD/JPY above 151.50, GBP eyes UK CPI metrics.

- Looking ahead, highlights include UK CPI, EZ Consumer Confidence, Australian PMIs, FOMC, CNB, BCB Policy Announcements, BoC Minutes, Comments from Fed Chair Powell, ECB's President Lagarde, de Cos, Lane & Schnabel, Supply from Germany.

US TRADE

EQUITIES

- US stocks were ultimately firmer after the initial tech-led weakness gradually reversed throughout the session with NVIDIA (NVDA) gaining more than 1% due to some positive takeaways from its GTC event despite the lack of major surprises, while energy was the biggest gaining sector after further upside in oil prices amid simmering geopolitical risks and the S&P 500 notched a fresh record close.

- SPX +0.56% at 5,179, NDX +0.26% at 18,032, DJI +0.83% at 39,111, RUT +0.54% at 2,036.

- Click here for a detailed summary.

NOTABLE HEADLINES

- US President Biden is to announce a grant for Intel (INTC) to expand chip production with the multibillion-dollar grant to Intel reportedly to be awarded Wednesday, according to NYT.

- US airline passenger travel will increase 6% Y/Y and set a record for March and April, according to the airline group.

APAC TRADE

EQUITIES

- APAC stocks traded cautiously and mostly rangebound ahead of the FOMC and with Japanese markets closed.

- ASX 200 struggled for direction as strength in energy was offset by losses in the tech and consumer sectors.

- KOSPI outperformed as South Korea plans to cut corporate and dividend income tax to encourage a higher shareholder return, while index heavyweight Samsung Electronics (005930 KS) rose over 5% and was helped by reports that NVIDIA looks to procure high-bandwidth memory chips from the Co.

- Hang Seng and Shanghai Comp. were indecisive as participants digested the latest earnings releases, while Prada (1913 HK) shares slipped in early trade after Gucci owner Kering (KER FP) issued a luxury sector warning amid Asia-Pacific weakness, while the mainland was kept afloat following the lack of surprises from the PBoC's benchmark LPRs which were maintained at their current levels.

- US equity futures stalled after yesterday's advances and with the FOMC on the horizon.

- European equity futures indicate a lower open with the Euro Stoxx 50 future -0.4% after the cash market closed up 0.5% on Tuesday, while CAC futures wiped out nearly all of yesterday's intraday gains after Kering warned of a 20% plunge in Q1 Gucci sales.

FX

- DXY took a breather after recent gains and with price action limited ahead of today's FOMC and dot plots.

- EUR/USD was rangebound amid light catalysts and after steadily picking itself up from yesterday's trough.

- GBP/USD lacked direction after recent price swings and as participants await UK inflation data.

- USD/JPY extended on post-BoJ advances to above 151.00 and printed a 4-month high, while JPY-crosses saw similar strength in which EUR/JPY reclaimed the 164.00 handle and reached its highest level since 2008.

- Antipodeans mirrored the non-committal tone amid the cautious mood and quiet data calendar.

- PBoC set USD/CNY mid-point at 7.0968 vs exp. 7.1967 (prev. 7.0985).

FIXED INCOME

- 10-year UST futures held on to the prior day's gains after softer-than-expected Canadian CPI data and a solid US 20-year auction, while overnight cash treasuries trade was closed owing to the holiday in Tokyo.

- Bund futures languished beneath the 132.00 level with price action uneventful ahead of German PPI data and a 30-year auction.

COMMODITIES

- Crude futures gave back some of yesterday's advances but with the pullback limited amid simmering geopolitical concerns and slightly bullish inventory data.

- US Energy Inventory Data (bbls): Crude -1.5mln (exp. +0.0mln), Gasoline -1.6mln (exp. -1.4mln), Distillate +0.5mln (exp. -0.1mln), Cushing +0.3mln.

- Russian oil loadings from its Western Ports were revised up again to 2.22mln BPD amid unplanned refinery outages, while Russian oil loadings plan from Western ports are seen 13% higher than the initial version, according to sources cited by Reuters.

- Spot gold was rangebound amid an uneventful dollar ahead of today's FOMC policy decision.

- Copper futures were little changed with prices contained amid the tentative risk environment.

- Peru copper production declined 1.2% Y/Y in January to 205,375 metric tons, according to the Mines and Energy Ministry.

CRYPTO

- Bitcoin was choppy and eventually dipped beneath the USD 61,000 level to its lowest in around three weeks.

NOTABLE ASIA-PAC HEADLINES

- Chinese Loan Prime Rate 1Y (Mar) 3.45% vs. Exp. 3.45% (Prev. 3.45%)

- Chinese Loan Prime Rate 5Y (Mar) 3.95% vs. Exp. 3.95% (Prev. 3.95%)

- PBoC reshuffled its Monetary Policy Committee which now includes China securities regulator head Wu Qing and PBoC Vice Governor Xuan Changneng, while the committee also has two new academic members, Huang Yiping from Peking University and Huang Haizhou from Tsinghua University.

- Chinese Foreign Minister Wang Yi said in a meeting with his Australian counterpart that their economies are highly complementary and have great potential, while he stressed that since relations are on the right track, they must not hesitate, deviate or turn back. Furthermore, Wang said regarding China's sovereignty, dignity and legitimate concerns, that they hope that the Australian side will continue to abide by commitments it has made, as well as respect and properly handle them.

- Australian Foreign Minister Wong said she discussed a range of shared interests with her Chinese counterpart and welcomes progress in the removal of trade impediments with China. Wong added she discussed volatility in nickel markets with China and raised concerns about human rights, including in Xinjiang, Tibet, and Hong Kong, while they will seek to manage differences with China wisely.

- China's embassy in the UK commented regarding UK Foreign Secretary Cameron's remarks on Hong Kong's new law and urged the British side to stop making groundless accusations against the legislation of Article 23, while it added that Hong Kong affairs are purely China's internal affairs and the British side is not qualified to make irresponsible remarks.

- US is said to consider sanctioning Huawei's chipmaking network which could be added to the entity list, while the companies that could be blacklisted over links with Huawei include chipmakers Qingdao Si’en, Swaysure, and Shenzhen Pensun Technology, according to Bloomberg.

GEOPOLITICS

MIDDLE EAST

- US President Biden said the war in Gaza has caused terrible suffering to the Palestinian people and they will continue to lead international efforts to deliver more humanitarian aid to the people of Gaza people, while it was also reported that Defense Secretary Austin will host his Israeli counterpart next week for a bilateral meeting.

- UK Foreign Secretary Cameron said hostages held by Hamas in Gaza must be released and the most important thing now is a pause in fighting to get hostages out and aid in. Cameron stated it is crucial to turn a pause in fighting into a permanent, sustainable ceasefire and that a ceasefire can only be achieved with conditions being fulfilled, while he added they must get Hamas leaders out of Gaza and dismantle their network to ensure a ceasefire lasts, according to a Reuters interview.

OTHER

- China's embassy in the Philippines said US Secretary of State Blinken's remarks about the South China Sea ignored facts and groundlessly accused China regarding its activities in the South China Sea. Furthermore, it stated that remarks once again threatened China with the 'so-called' US-Philippine Mutual Defence Treaty obligations which China firmly opposes, while China advises the US not to stir up trouble or take sides on the South China Sea issue.

- Taiwan's Foreign Minister said China has built "enormous" military bases on three islands surrounding Taiwan's main holding in the South China Sea, according to Reuters.

- US Air Force said it conducted a successful hypersonic weapons test, according to Reuters.

- North Korea leader Kim guided a solid fuel engine test for a new intermediate-range hypersonic missile, according to KCNA.

EU/UK

NOTABLE HEADLINES

- ECB's Kazaks said he is comfortable with the current market pricing on rates and moving at forecast meetings is "more straightforward", while he added it will take some time to get to a neutral rate.

- EU Council and Parliament provisionally agreed to renew the suspension of import duties and quotas on Ukrainian exports to the EU until June 2025, according to Reuters.