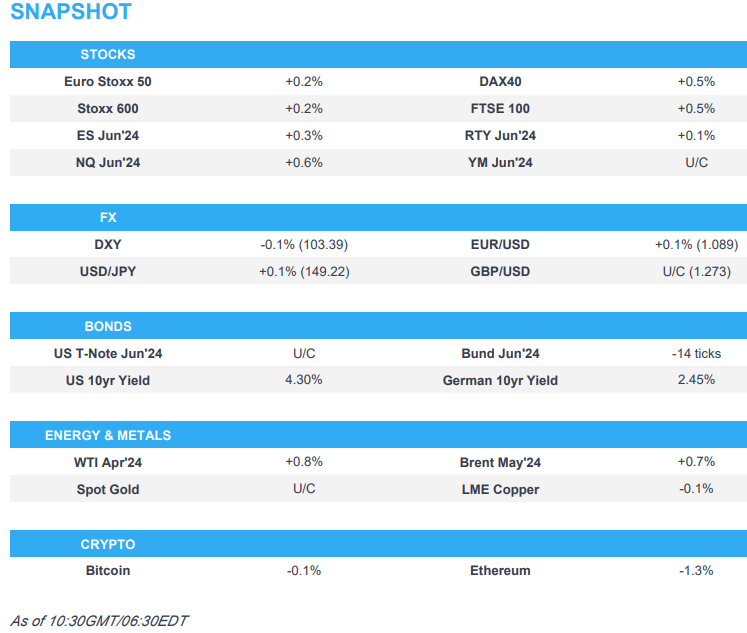

US Market Open: Equities firmer amid the constructive risk tone, JPY softer and Crude bid as geopols remains in focus

18 Mar 2024, 10:55 by Newsquawk Desk

- Equities are in the green amid a constructive risk tone; Nvidia gains pre-market ahead of its GTC

- Dollar is flat, JPY is modestly softer and back on a 149 handle ahead of BoJ on Tuesday

- Bonds are incrementally weaker, though with price action contained

- Crude is firmer following constructive Chinese activity data and heightening geopolitical tensions

- Looking ahead, comments from Nvidia CEO Huang

EUROPEAN TRADE

EQUITIES

- European bourses are mostly firmer, though with clear underperformance in the SMI (-0.6%), which is hampered by losses in Logitech (-7.5%).

- European sectors are mixed; Real Estate takes the top spot, whilst Telecoms is found at the foot of the pile.

- US equity futures (ES +0.3%, NQ +0.6%, RTY +0.2%) are entirely in the green, with clear outperformance in the NQ; Google (+2.5%) benefits from Apple/Gemini related news and Nvidia (+2.1%) gains ahead of its GTC.

- Click here and here for the sessions European pre-market equity newsflow, including earnings.

- Click here for more details.

FX

- Contained trade for DXY within tight parameters of 103.36-51 with markets in "wait-and-see" mode ahead of a slew of risk-events (Fed, BoJ, RBA, BoE, PMIs).

- EUR is touch firmer vs. the USD but in quiet newsflow with the pair running out of steam ahead ahead of Friday's 1.0899 peak and the psych 1.09 mark.

- GBP is flat vs. the Dollar and marginally softer vs. the EUR. UK newsflow over the weekend has been non-incremental ahead of a busy week of UK updates including, CPI, PMIs, Retail Sales and the BoE policy announcement. For now, Cable is stuck within Friday's 1.2725-59 range.

- JPY is a touch softer vs. the USD with USD/JPY back on a 149 handle. However, conviction in price action is likely to be limited ahead of the BoJ tomorrow, trading within a 149.32-148.92 range.

- Antipodeans are both firmer vs. the USD alongside the favourable risk environment. AUD/USD went as high as 0.6574 but unable to test Friday's peak of 0.6582. NZD/USD also edging higher but still shy of the 0.61 mark.

- PBoC sets USD/CNY mid-point at 7.0943 vs exp. 7.1995 (prev. 7.0975)

- Click here for more details.

- Click here for Major FX Option Expiries

FIXED INCOME

- USTs are incrementally softer given the modestly constructive risk tone after China's activity data while the US looks to the Nvidia keynote this evening and then the FOMC on Wednesday.

- A contained start for Bunds ahead of a blockbuster week, including policy announcements from the Fed, BoJ and the BoE. Currently holds around 131.70 and garners support at 131.60 (1st March) and resistance at 132.78.

- Gilts are similarly contained and slightly closer to the unchanged mark than EGB peers, perhaps given the relative underperformance seen in Gilts during the second half of last week; currently holds around 98.30.

- Click here for more details.

COMMODITIES

- A firm session for the crude complex following constructive Chinese activity data coupled with a weekend of geopolitical headlines, including Ukraine ramping up its targeting of Russian oil facilities; Brent currently holds just above USD 86.00/bbl.

- Subdued trade for precious metals with the market on standby ahead of this week's major risk events; XAU trades within a tight range (2,146.15-2,157.60/oz).

- Base metals are mostly subdued despite the constructive Chinese activity data overnight but following the notable run higher in prices last week.

- Ukraine’s SBU security service attacked three Rosneft oil refineries in Russia’s Samara region with drones. It was separately reported that a fire broke out at the Slavyansk refinery in the Krasnodar region following a drone attack, while the Syzran oil refinery reportedly experienced a fire which was put out.

- BHP said 30% of Australian nickel mines have shut and 30% more are under pressure on low prices, according to Reuters.

- China's NDRC maintained retail gasoline and diesel prices as of March 19th.

- Click here for more details.

NOTABLE EUROPEAN HEADLINES

- EU is reportedly mulling joining the US in reviewing risks of Chinese legacy chips, according to Bloomberg sources; flagging potential risks to national security and supply chains.

- UK PM Sunak’s strategists are planning another tax-cutting budget in September ahead of an election in October or November if he can survive amid doubts about his leadership spreading in the Conservative Party, while Sunak’s government is said to be facing the same levels of economic misery that led to the Conservative Party’s defeat in 1997, according to Bloomberg citing the Misery Index.

- ECB’s de Cos said it is normal that they should begin cutting rates if their macroeconomic forecasts are met in the coming months and that June would be a good date to start, while he believes the current degree of consensus is very high and he hopes this will continue, according to an interview with Spanish newspaper El Periodico.

- ECB's Knot said the eurozone has avoided a recession and that he has pencilled in June to start cutting rates, while he added that where they take it from there will be data dependent.

- Fitch affirmed Germany at AAA; Outlook Stable and affirmed Malta at A+; Outlook Stable, while S&P affirmed Spain at A; Outlook Stable.

DATA RECAP

- EU HICP Final MM (Feb) 0.6% vs. Exp. 0.6% (Prev. -0.4%); HICP-X F&E Final YY (Feb) 3.3% vs. Exp. 3.3% (Prev. 3.3%); HICP-X F, E, A, T Final MM (Feb) 0.7% vs. Exp. 0.7% (Prev. 0.7%); HICP-X F,E,A&T Final YY (Feb) 3.1% vs. Exp. 3.1% (Prev. 3.1%); HICP Final YY (Feb) 2.6% vs. Exp. 2.6% (Prev. 2.6%); Eurostat Trade NSA, Eur (Jan) 11.4B EU (Prev. 16.8B EU); HICP-X F&E MM (Feb) 0.6% (Prev. -0.6%) Unrevised

- UK Rightmove House Price Index MM (Mar) 1.5% (Prev. 0.9%); Rightmove House Price Index YY (Mar) 0.8% (Prev. 0.1%)

- Norwegian GDP Month Mainland (Jan) 0.4% (Prev. -0.1%); GDP Month (Jan) 0.0% (Prev. 0.5%)

NOTABLE US HEADLINES

- Goldman Sachs adjusted its Fed rate cut forecast to 3 cuts this year from a previous view of 4 cuts, while JPMorgan now expects the Fed to deliver 75bps of cuts this year vs prev. forecast of 125bps of cuts.

- DoJ is weighing antitrust probe of US Steel (X) takeover, via Politico.

- Nasdaq says investigation issues with connectivity; says orders went using Rash fix engine will not be acknowledge at this time; continues to investigate matching engine issues which are affecting connectivity to the exchange.

- Apple (AAPL) is in talks to let Google (GOOG) Gemini power iPhone AI features and is also in discussions with OpenAI regarding a deal, according to Bloomberg. Google +3.5% pre-market

- Meta (META) Federal officials are investigating Co. over its role in selling illegal drugs, via WSJ.

- Tesla (TSLA) Plans to raise prices for Model Y in Europe and Middle East regions by about EUR 2k. Tesla +3.1% pre-market

GEOPOLITICS

MIDDLE EAST

- Israeli official says they will offer in Qatar a truce for 6 weeks in exchange for the release of 40 detainees, according to Reuters; the official estimated that negotiations could take at least two weeks

- Israeli PM Netanyahu said US Senate Majority Leader Schumer’s speech commenting on Israeli elections was inappropriate and they will continue military pressure on Hamas. Netanyahu said Israel’s goal of eliminating Hamas battalions goes hand in hand with enabling civilians to leave Rafah.

- Israel’s Mossad chief Barnea was expected to resume Gaza ceasefire talks with Qatar’s PM and Egyptian officials on Sunday with the meeting a direct response to the latest proposal from Hamas and talks will focus on the remaining gaps between Israel and Hamas, according to a source briefed on the talks cited by Reuters.

- Israel is to send a delegation to Qatar for talks on achieving a hostage deal after Israeli security cabinet approval, according to Kann correspondent Amichai Stein.

- Egyptian President El-Sisi said Egypt and EU leaders agreed on rejecting any Israeli military operation in Rafah, while EU’s von der Leyen said it is critical to achieve an agreement on a ceasefire in Gaza rapidly now and that Gaza is facing famine which they cannot accept. German Chancellor Scholz said they cannot stand by and watch Palestinians starve, while he added that lasting security for Israel lies in a solution with Palestinians, meaning a two-state solution.

- A Syrian soldier was injured in an Israeli strike on the southern region, according to Syrian state TV.

- Iran and the US held secret talks on proxy attacks and a ceasefire, according to the New York Times.

- UKMTO noted an incident off Yemen’s Aden where an explosion was reported near the Master of Merchant vessel although there was no damage to the vessel and the crew were reported safe.

- US offical says Houthis are unable to continue escalation, US can always escalate against the Houthis

OTHER

- Russian President Putin won 88% of the votes in the Russian election where the opposition was banned, according to FT. Russian President Putin said Russia should be stronger and more effective and his win will allow Russia to consolidate society and shows how Russia was right to choose its current path.

- Russian President Putin commented on the French proposal for a ceasefire during the Olympics in which he stated that they are ready for talks and will proceed from Russia's interests on the front line, while he added they will think about with whom they can talk with about peace in Ukraine and he doesn't rule out setting up a 'sanitary zone' in Ukraine-controlled territories amid Ukraine attacks.

- White House commented the Russian election was not free nor fair given how Putin has imprisoned opponents and prevented others from running against him, while Ukrainian President Zelensky said there is no legitimacy in Russian imitation of elections and that Putin seeks to rule forever, according to Reuters.

- Russian air defence systems downed 35 Ukraine-launched drones over eight regions, while Russia launched 14 drones against Ukraine’s Odesa which damaged agricultural enterprises and infrastructure.

- Russia’s Foreign Ministry accused Ukraine of stepping up ‘terrorist activities’ during the Russian election to attract more aid and weapons from the West, while Russia said Ukraine dropped a shell from a drone on a polling station in the Zaporizhzhia region.

- Russian Foreign Ministry spokeswoman commented on French President Macron’s idea of a ceasefire in Ukraine during the Olympics and proposed for him to stop weapons supplies to Ukraine, according to TASS.

- Head of parliament in the breakaway Georgian region of South Ossetia said a possible inclusion into Russia is being discussed with Moscow, according to RIA.

- SpaceX is building hundreds of spy satellites under a classified contract with the US National Reconnaissance Office, according to Reuters sources.

- North Korea fired projectiles believed to be ballistic missiles which landed shortly after their firing outside of Japan’s exclusive economic zone. In relevant news, - North Korea’s leader Kim oversaw warfare drills and urged realistic preparation for combat, according to KCNA.

- US Secretary of State Blinken told South Korean President Yoon that the two countries are to consult to upgrade extended deterrence and work together on the North Korean threat, according to Yonhap.

- Japanese PM Kishida said North Korea's missile launch threatens not only the peace and stability of the region but also of the international community and Japan strongly condemns North Korea’s actions. Kishida stated that Japan lodged a stern protest against North Korea and will further advance close trilateral cooperation with the US and South Korea.

CRYPTO

- Bitcoin holds just above USD 68k after volatile price action over the weekend; Ethereum (-1.1%) is lower and around USD 3.5k.

- AI-related coins: Nvidia CEO Huang is set to speak on AI at 20:00 GMT / 16:00 EDT.

APAC TRADE

- APAC stocks were somewhat mixed after quiet weekend newsflow and as participants brace for this week's busy slate of central bank announcements including tomorrow's crucial BoJ decision, while better-than-expected Chinese activity data had little lasting effect.

- ASX 200 traded cautiously with the index contained by underperformance in real estate and energy.

- Nikkei 225 outperformed despite weak Machinery Orders and with many anticipating a policy shift at tomorrow's BoJ announcement, while momentum in the index was helped by currency weakness and softer yields.

- Hang Seng and Shanghai Comp. were both ultimately positive after the Hang Seng pared earlier losses with the help of tech strength but with gains capped by weakness in property, while the mainland was gradually underpinned following better-than-expected Chinese Industrial Production and Retail Sales data.

NOTABLE ASIA-PAC HEADLINES

- China's NBS said with macro policy, the economy continued to recover but noted that the property market is still in the process of adjustment and stated that China can achieve this year's growth target.

- China’s Vice Commerce Minister said they are studying cutting new energy vehicle insurance premium rates and improving NEV maintenance service capabilities to reduce buyer worries, according to Yicai.

- China’s air passenger numbers rose 44.6% Y/Y to 62.48mln trips in February with international passenger traffic up 593.4% Y/Y to 81.8% of 2019 levels and domestic air passenger traffic up 35.5% Y/Y in February.

- India is to begin voting in the national elections on April 19th which will end on June 1st and India will count the votes in the national elections on June 4th.

- China’s strong factory output and investment growth at the start of the year raised doubts over how soon policymakers will step up support still needed to boost demand and reach an ambitious growth target, according to Bloomberg

DATA RECAP

- Chinese Industrial Production YY (Feb) 7.0% vs. Exp. 5.0% (Prev. 6.8%); Retail Sales YY (Feb) 5.5% vs. Exp. 5.2% (Prev. 7.4%); Urban Investment (YTD)YY (Feb) 4.2% vs. Exp. 3.2% (Prev. 3.0%); Unemployment Rate Urban Area (Feb) 5.3% (Prev. 5.1%)

- Japanese Machinery Orders MM (Jan) -1.7% vs. Exp. -1.0% (Prev. 2.7%, Rev. 1.9%); Machinery Orders YY (Jan) -10.9% vs. Exp. -11.2% (Prev. -0.7%)

- Singapore Non-Oil Exports MM (Feb) -4.8% vs. Exp. -0.4% (Prev. 2.3%); Non-Oil Exports YY (Feb) -0.1% vs. Exp. 4.7% (Prev. 16.8%)