Europe Market Open: China data beat exp., DXY rangebound into a blockbuster week

18 Mar 2024, 06:35 by Newsquawk Desk

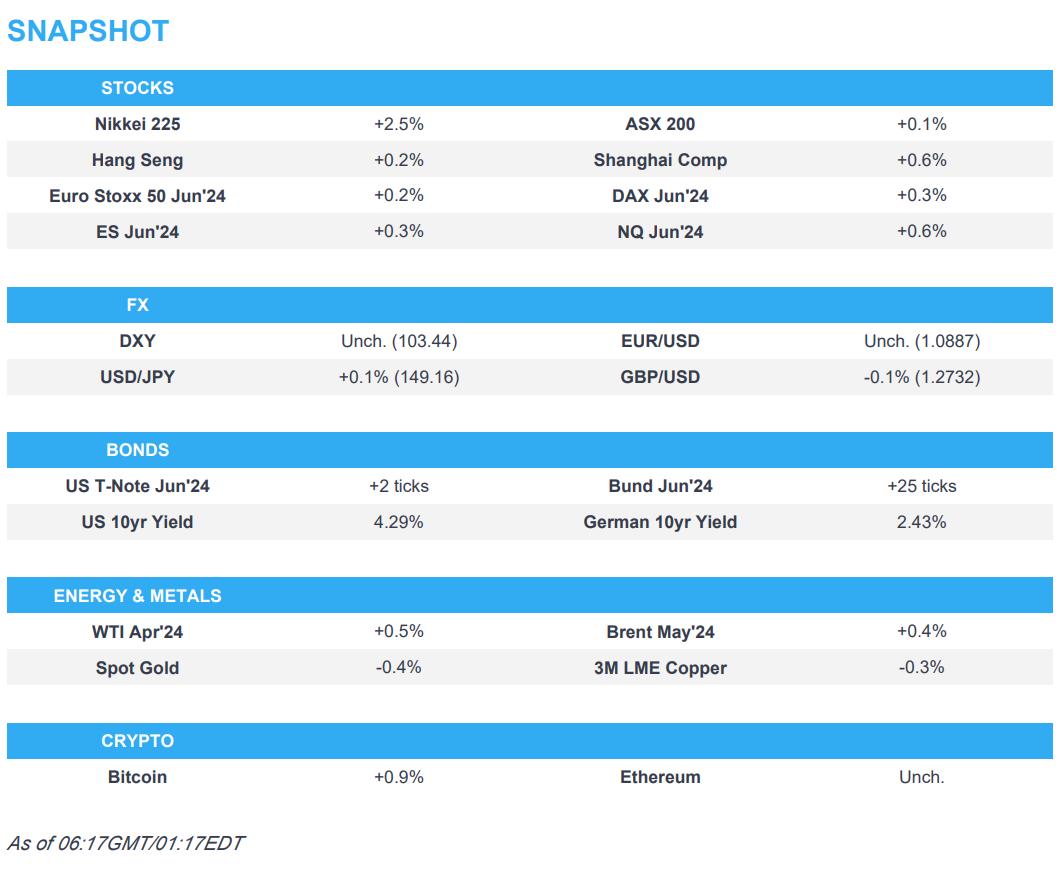

- APAC stocks were somewhat mixed as participants brace for this week's busy slate of central bank announcements.

- China released better-than-expected Industrial Production and Retail Sales data.

- European equity futures indicate a positive open with the Euro Stoxx 50 future +0.2% after the cash market closed down 0.1% on Friday.

- DXY sits in a tight range below 103.50 with other FX majors contained. USD/JPY edged marginally above 149.

- GS adjusted its Fed rate cut forecast to 3 (vs. prev. 4), JPMorgan now expects 75bps of cuts this year (vs prev. 125bps)

- Looking ahead, highlights include Norwegian GDP & EZ CPI (F).

US TRADE

EQUITIES

- US stocks were pressured on Friday in a resumption of tech-related underperformance and Treasuries also extended their selling ahead of this week's key central bank meetings. Data releases were mixed with a retreat lower in the Empire Manufacturing survey and another rise in import prices, while above-forecast industrial production was offset by another set of downward revisions, although stable consumer inflation expectations in the Michigan survey (against expectations for a slight rise) coincided with the lows seen in T-notes.

- SPX -0.65% at 5,117, NDX -1.15% at 17,808, DJIA -0.49% at 38,714, RUT +0.40% at 2,039.

- Click here for a detailed summary.

NOTABLE HEADLINES

- Goldman Sachs adjusted its Fed rate cut forecast to 3 cuts this year from a previous view of 4 cuts, while JPMorgan now expects the Fed to deliver 75bps of cuts this year vs prev. forecast of 125bps of cuts.

APAC TRADE

EQUITIES

- APAC stocks were somewhat mixed after quiet weekend newsflow and as participants brace for this week's busy slate of central bank announcements including tomorrow's crucial BoJ decision, while better-than-expected Chinese activity data had little lasting effect.

- ASX 200 traded cautiously with the index contained by underperformance in real estate and energy.

- Nikkei 225 outperformed despite weak Machinery Orders and with many anticipating a policy shift at tomorrow's BoJ announcement, while momentum in the index was helped by currency weakness and softer yields.

- Hang Seng and Shanghai Comp. were both ultimately positive after the Hang Seng pared earlier losses with the help of tech strength but with gains capped by weakness in property, while the mainland was gradually underpinned following better-than-expected Chinese Industrial Production and Retail Sales data.

- US equity futures (ES +0.3%) were composed and recouped some lost ground after Friday's losses.

- European equity futures indicate a positive open with the Euro Stoxx 50 future +0.2% after the cash market closed down 0.1% on Friday.

FX

- DXY traded in a tight range of between 103.40-103.51 after a lack of weekend macro drivers and as participants brace for the upcoming storm of key central bank updates.

- EUR/USD lacked direction with the recent ECB commentary providing little sway on the currency.

- GBP/USD price action is uneventful ahead of UK inflation data and the BoE policy meeting later this week.

- USD/JPY edged marginally higher above the 149.00 level after weak Machinery Orders data.

- Antipodeans attempted to nurse some of last week's losses although the recovery was limited with a muted reaction seen from the Chinese activity data.

- PBoC sets USD/CNY mid-point at 7.0943 vs exp. 7.1995 (prev. 7.0975)

FIXED INCOME

- 10-year UST futures lacked conviction and languished near its 2-week lows after around the 110.00 level.

- Bund futures attempted to pick themselves up from a recent trough after several ECB comments including from ECB’s de Cos who suggested they should begin cutting rates if their macroeconomic forecasts are met in the coming months, while ECB's Knot pencilled in June to start cutting rates and said where they take it from there is data dependent.

- 10-year JGB futures were underpinned after disappointing Machinery Orders and after the BoJ announced an unscheduled buying operation in which the central bank offered to buy JPY 3tln of JGBs for March 19th-21st.

COMMODITIES

- Crude futures were marginally higher after Ukraine ramped up its targeting of Russian oil facilities, while Morgan Stanley updated its price estimate with its Q3 Brent crude forecast raised to USD 90/bbl from USD 80/bbl.

- Ukraine’s SBU security service attacked three Rosneft oil refineries in Russia’s Samara region with drones. It was separately reported that a fire broke out at the Slavyansk refinery in the Krasnodar region following a drone attack, while the Syzran oil refinery reportedly experienced a fire which was put out.

- Spot gold was contained ahead of central bank policy announcements and trickled beneath USD 2150/oz.

- Copper futures were rangebound amid the somewhat mixed risk tone despite stronger-than-expected Chinese activity data.

- BHP said 30% of Australian nickel mines have shut and 30% more are under pressure on low prices, according to Reuters.

CRYPTO

- Bitcoin was choppy and briefly dipped below the USD 67,000 level before staging a gradual recovery.

NOTABLE ASIA-PAC HEADLINES

- China's NBS said with macro policy, the economy continued to recover but noted that the property market is still in the process of adjustment and stated that China can achieve this year's growth target.

- China’s Vice Commerce Minister said they are studying cutting new energy vehicle insurance premium rates and improving NEV maintenance service capabilities to reduce buyer worries, according to Yicai.

- China’s air passenger numbers rose 44.6% Y/Y to 62.48mln trips in February with international passenger traffic up 593.4% Y/Y to 81.8% of 2019 levels and domestic air passenger traffic up 35.5% Y/Y in February.

- India is to begin voting in the national elections on April 19th which will end on June 1st and India will count the votes in the national elections on June 4th.

DATA RECAP

- Chinese Industrial Production YY (Feb) 7.0% vs. Exp. 5.0% (Prev. 6.8%)

- Chinese Retail Sales YY (Feb) 5.5% vs. Exp. 5.2% (Prev. 7.4%)

- Chinese Urban Investment (YTD)YY (Feb) 4.2% vs. Exp. 3.2% (Prev. 3.0%)

- Chinese Unemployment Rate Urban Area (Feb) 5.3% (Prev. 5.1%)

- Japanese Machinery Orders MM (Jan) -1.7% vs. Exp. -1.0% (Prev. 2.7%, Rev. 1.9%)

- Japanese Machinery Orders YY (Jan) -10.9% vs. Exp. -11.2% (Prev. -0.7%)

- Singapore Non-Oil Exports MM (Feb) -4.8% vs. Exp. -0.4% (Prev. 2.3%)

- Singapore Non-Oil Exports YY (Feb) -0.1% vs. Exp. 4.7% (Prev. 16.8%)

GEOPOLITICS

MIDDLE EAST

- Israeli PM Netanyahu said US Senate Majority Leader Schumer’s speech commenting on Israeli elections was inappropriate and they will continue military pressure on Hamas. Netanyahu said Israel’s goal of eliminating Hamas battalions goes hand in hand with enabling civilians to leave Rafah.

- Israel's army announced an operation in Gaza's Al Shifa hospital, according to AFP News Agency.

- Israel’s Mossad chief Barnea was expected to resume Gaza ceasefire talks with Qatar’s PM and Egyptian officials on Sunday with the meeting a direct response to the latest proposal from Hamas and talks will focus on the remaining gaps between Israel and Hamas, according to a source briefed on the talks cited by Reuters.

- Israel is to send a delegation to Qatar for talks on achieving a hostage deal after Israeli security cabinet approval, according to Kann correspondent Amichai Stein.

- Egyptian President El-Sisi said Egypt and EU leaders agreed on rejecting any Israeli military operation in Rafah, while EU’s von der Leyen said it is critical to achieve an agreement on a ceasefire in Gaza rapidly now and that Gaza is facing famine which they cannot accept. German Chancellor Scholz said they cannot stand by and watch Palestinians starve, while he added that lasting security for Israel lies in a solution with Palestinians, meaning a two-state solution.

- A Syrian soldier was injured in an Israeli strike on the southern region, according to Syrian state TV.

- Iran and the US held secret talks on proxy attacks and a ceasefire, according to the New York Times.

- UKMTO noted an incident off Yemen’s Aden where an explosion was reported near the Master of Merchant vessel although there was no damage to the vessel and the crew were reported safe.

OTHER

- Russian President Putin won 88% of the votes in the Russian election where the opposition was banned, according to FT. Russian President Putin said Russia should be stronger and more effective and his win will allow Russia to consolidate society and shows how Russia was right to choose its current path.

- Russian President Putin commented on the French proposal for a ceasefire during the Olympics in which he stated that they are ready for talks and will proceed from Russia's interests on the front line, while he added they will think about with whom they can talk with about peace in Ukraine and he doesn't rule out setting up a 'sanitary zone' in Ukraine-controlled territories amid Ukraine attacks.

- White House commented the Russian election was not free nor fair given how Putin has imprisoned opponents and prevented others from running against him, while Ukrainian President Zelensky said there is no legitimacy in Russian imitation of elections and that Putin seeks to rule forever, according to Reuters.

- Russian air defence systems downed 35 Ukraine-launched drones over eight regions, while Russia launched 14 drones against Ukraine’s Odesa which damaged agricultural enterprises and infrastructure.

- Russia’s Foreign Ministry accused Ukraine of stepping up ‘terrorist activities’ during the Russian election to attract more aid and weapons from the West, while Russia said Ukraine dropped a shell from a drone on a polling station in the Zaporizhzhia region.

- Russian Foreign Ministry spokeswoman commented on French President Macron’s idea of a ceasefire in Ukraine during the Olympics and proposed for him to stop weapons supplies to Ukraine, according to TASS.

- Head of parliament in the breakaway Georgian region of South Ossetia said a possible inclusion into Russia is being discussed with Moscow, according to RIA.

- SpaceX is building hundreds of spy satellites under a classified contract with the US National Reconnaissance Office, according to Reuters sources.

- North Korea fired projectiles believed to be ballistic missiles which landed shortly after their firing outside of Japan’s exclusive economic zone. In relevant news, - North Korea’s leader Kim oversaw warfare drills and urged realistic preparation for combat, according to KCNA.

- US Secretary of State Blinken told South Korean President Yoon that the two countries are to consult to upgrade extended deterrence and work together on the North Korean threat, according to Yonhap.

- Japanese PM Kishida said North Korea's missile launch threatens not only the peace and stability of the region but also of the international community and Japan strongly condemns North Korea’s actions. Kishida stated that Japan lodged a stern protest against North Korea and will further advance close trilateral cooperation with the US and South Korea.

EU/UK

NOTABLE HEADLINES

- UK PM Sunak’s strategists are planning another tax-cutting budget in September ahead of an election in October or November if he can survive amid doubts about his leadership spreading in the Conservative Party, while Sunak’s government is said to be facing the same levels of economic misery that led to the Conservative Party’s defeat in 1997, according to Bloomberg citing the Misery Index.

- ECB’s de Cos said it is normal that they should begin cutting rates if their macroeconomic forecasts are met in the coming months and that June would be a good date to start, while he believes the current degree of consensus is very high and he hopes this will continue, according to an interview with Spanish newspaper El Periodico.

- ECB's Knot said the eurozone has avoided a recession and that he has pencilled in June to start cutting rates, while he added that where they take it from there will be data dependent.

- ECB's Villeroy said on Friday that they are not far from the 2% inflation target and are exiting the crisis of inflation, according to a Europe 1 radio interview.

- Fitch affirmed Germany at AAA; Outlook Stable and affirmed Malta at A+; Outlook Stable, while S&P affirmed Spain at A; Outlook Stable.

DATA RECAP

- UK Rightmove House Price Index MM (Mar) 1.5% (Prev. 0.9%)

- UK Rightmove House Price Index YY (Mar) 0.8% (Prev. 0.1%)