Europe Market Open: UK's Labour Party secured a majority, US NFP looms

05 Jul 2024, 06:50 by Jay Woods

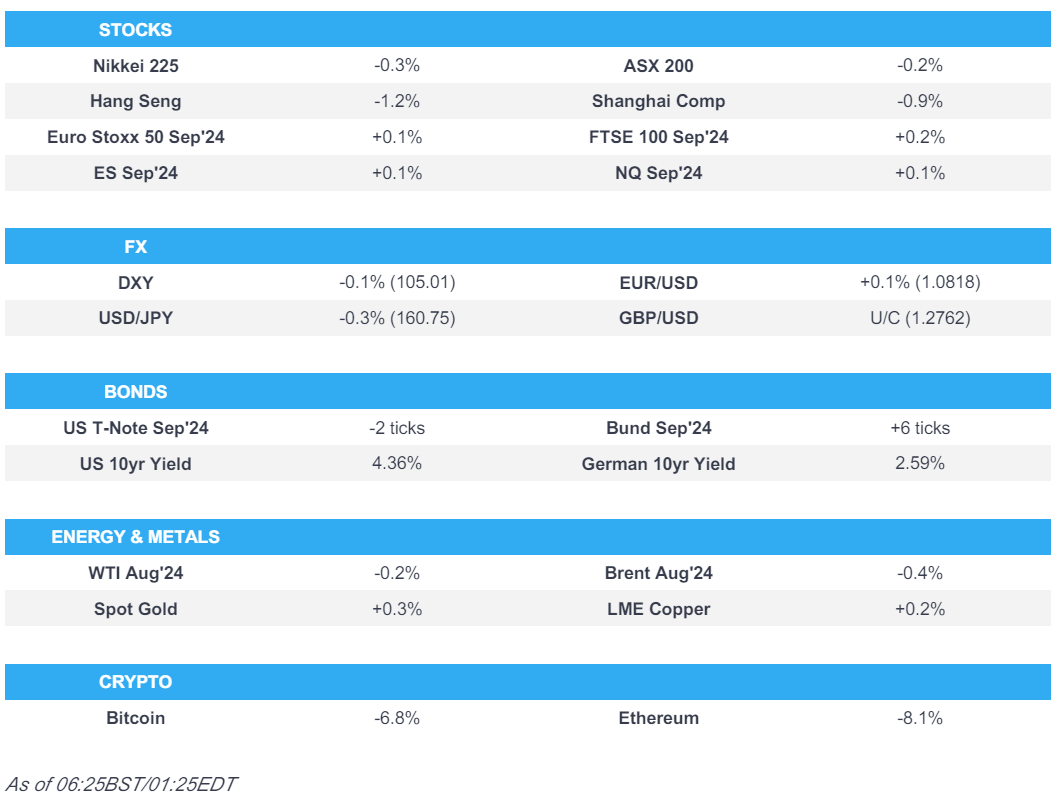

- APAC stocks traded somewhat mixed in the absence of a lead from the US owing to the Independence Day holiday.

- There was also a lack of fireworks from the UK election exit polls, with the latest results showing that the Labour Party has won a majority as expected.

- DXY briefly dipped under 105 with quiet macro newsflow ahead of NFP, GBP/USD traded flat within a tight 1.2755-72 range, and USD/JPY slid beneath the 161.00 level with early pressure seen heading into the Tokyo fix.

- European equity futures indicate a quiet open with Euro Stoxx 50 futures +0.1% after the cash market closed higher by 0.4%. FTSE 100 futures rose 0.2%.

- Bitcoin slumped to below the USD 54,500 level after failing to hold on to the USD 57,000 status earlier in the session; CoinDesk cited crypto exchange Mt. Gox moving USD 2.6bln worth of Bitcoin from its cold wallet.

- Looking ahead, highlights include German Industrial Output, Italian Retail Sales, EZ Retail Sales, US & Canadian Jobs Reports, and Comments from Fed's Williams, ECB's Lagarde & Elderson.

- Click for the Newsquawk Week Ahead.

UK Election

- UK election exit polls showed the Labour Party is set to win 410 seats for a 170-seat majority, Conservatives 131, Lib Dems 61, SNP 10, Reform 13, Greens 2. This suggested the Labour Party will win the most seats by any party since 2001 and the Conservatives are to win the fewest seats since the party was founded in 1834. The latest results show Labour has won for majority.

- UK Labour Party leader Starmer won his seat and said the people have spoken, while he added that people are ready for change and it is now time for them to deliver. Starmer said in his victory speech "country first, party second" and vowed a transformed Labour Party, while he added that he doesn't promise it will be easy and they will have to move immediately

- UK PM Sunak won his parliament seat in Richmond and Northallerton, while he conceded defeat in the general election and stated that the Labour Party has won and the British people have delivered a sobering verdict. Furthermore, Sunak said he will continue to serve as a Member of Parliament and he takes responsibility for the loss. It was separately reported that Sunak is expected to resign as Conservative party leader on Friday morning, according to Times' Shipman

- UK Reform Leader Farage won his parliament seat and said there is no enthusiasm for Labour, while he added they are coming for Labour votes and this is just the first step that will stun everyone.

- Click here for the Newsquawk analysis.

US TRADE

EQUITIES

- US stock markets were closed for Independence Day.

NOTABLE HEADLINES

- US President Biden said he 'screwed up' in the election debate but would press ahead with his re-election bid, according to FT.

APAC TRADE

EQUITIES

- APAC stocks traded somewhat mixed in the absence of a lead from the US owing to the Independence Day holiday, while there was also a lack of fireworks from the UK election exit polls which showed the Labour Party are on course for a landslide victory.

- ASX 200 was contained amid weakness in miners and the top-weighted financial sector.

- Nikkei 225 traded indecisively and initially climbed to fresh record highs but then failed to sustain the momentum as the yen began to strengthen and as participants also digested weak Household Spending data which showed a surprise contraction.

- KOSPI was boosted amid gains in index heavyweight Samsung Electronics following its preliminary Q2 earnings.

- Hang Seng and Shanghai Comp. were pressured with weakness seen in automakers after the EU confirmed it is to move ahead with planned tariffs on Chinese EVs with provisional duties effective today, while China is to continue the anti-dumping probe into EU port imports and will hold an EU brandy probe hearing on July 18th.

- US equity futures were little changed following the holiday lull stateside and as NFP data looms.

- European equity futures indicate a quiet open with Euro Stoxx 50 futures +0.1% after the cash market closed higher by 0.4% on Thursday, while FTSE 100 futures are up 0.2% following the election results.

FX

- DXY softened to test the 105.00 level to the downside with quiet macro newsflow from the US post-Independence Day, while participants now look ahead to the upcoming key US jobs data.

- EUR/USD took a breather after its recent advance above the 1.0800 level, while there were recent comments from ECB's Lagarde that officials are in no hurry to cut rates again after the June move.

- GBP/USD lacked major fireworks despite the landslide victory by the Labour Party which was widely anticipated.

- USD/JPY slid beneath the 161.00 level with early pressure seen heading into the Tokyo fix which later persisted.

- Antipodeans were mildly higher with AUD helped by cross-related flows as AUD/NZD rose above 1.1000.

- PBoC set USD/CNY mid-point at 7.1289 vs exp. 7.2704 (prev. 7.1305).

FIXED INCOME

- 10-year UST futures price action was restricted following the holiday lull and with NFP data on the horizon.

- Bund futures nursed some losses ahead of German Industrial Production and comments from ECB and Bundesbank's Nagel.

- 10-year JGB futures kept afloat following disappointing Household Spending data from Japan.

COMMODITIES

- Crude futures traded rangebound after their recent choppy performance and marginally pulled back amid optimism regarding Israel-Hamas negotiations, while Saudi Arabia reduced its premiums to Asia but raised them for North West Europe and the US.

- Qatar set August Marine crude OSP at Oman/Dubai plus USD 0.15/bbl and land crude OSP at Oman/Dubai minus USD 0.40/bbl.

- Chevron (CVX) announced it was removing non-essential personnel from its Gulf of Mexico facilities due to approaching Hurricane Beryl but noted that production from its Gulf of Mexico assets remains at normal levels. It was also reported that Shell (SHEL LN) said is evacuating all personnel at its Perdido asset due to Hurricane Beryl, according to Reuters.

- Spot gold eked slight gains with mild support seen as the dollar eventually softened during the session.

- Copper futures held on to the prior day's gains but with price action muted overnight by the mixed risk tone.

CRYPTO

- Bitcoin was pressured and eventually slumped to below the USD 54,500 level after failing to hold on to the USD 57,000 status - CoinDesk cited crypto exchange Mt. Gox moving USD 2.6bln worth of Bitcoin from its cold wallet.

NOTABLE ASIA-PAC HEADLINES

- PBoC has hundreds of billions of yuan of medium- and long-term bonds at its disposal to borrow and signed agreements with several major financial institutions regarding bond borrowing, according to Bloomberg.

- China officially sets up a special fund for revitalisation of state firms' land assets worth CNY 30bln, according to state media.

- China's MOFCOM confirmed it is to hold an EU brandy probe hearing on July 18th.

- Japanese Finance Minister Suzuki warned of inflation concerns despite recent wage rises and noted that a weak yen is pushing up costs for imports and impacting prices, while he said they are to monitor stocks and FX trends urgently.

DATA RECAP

- Japanese All Household Spending MM (May) -0.3% vs. Exp. 0.5% (Prev. -1.2%)

- Japanese All Household Spending YY (May) -1.8% vs. Exp. 0.1% (Prev. 0.5%)

GEOPOLITICAL

MIDDLE EAST

- Israeli PM Netanyahu told US President Biden he has decided to send a delegation to continue negotiations on hostages but reiterated that Israel will only end the war after achieving all of its objectives.

- US senior administration official said President Biden and Israeli PM Netanyahu walked through the draft Israel-Hamas agreement in a 30-minute call and the US believes there is a significant opening for a hostage deal, while the official stated that the Hamas response moves the process forward and could provide basis for closing a deal on hostages and ceasefire. Furthermore, the US official said outstanding issues relate to the implementation of an agreement in which there is significant work to be done and a deal is not likely to be closed in a period of days but they have had a breakthrough on the critical impasse in Israel-Hamas talks.

- Israel’s Mossad chief Barnea is travelling to Doha to resume Gaza ceasefire and hostage talks which will likely take place on Friday and will meet with Qatar’s PM in an effort to bring Israel and Hamas closer to a Gaza peace deal, according to a source cited by Reuters.

- Israeli official confirmed that the Mossad chief will lead a hostage negotiations delegation and another official said there is a real chance for a deal, while it was also stated that the proposal put forward by Hamas includes a very significant breakthrough and the official stated that they can proceed with a deal but it depends on PM Netanyahu.

- Hamas said it did not drop the condition of a ceasefire in Gaza, while it added that Israeli PM Netanyahu did not want a permanent ceasefire in Gaza and requires the movement to lay down arms, according to Al Arabiya.

- Hamas leader said they are waiting for a positive response from the Israeli side to start negotiations on the details of the deal, according to CNN.

OTHER

- Russia's Defence Ministry said it is carrying out drills involving mobile nuclear missile launchers, according to Interfax.

EU/UK

NOTABLE HEADLINES

- ECB's Lagarde said officials are in no hurry to cut rates again after June’s move and the central bank requires additional reassurance that inflation is headed back towards 2% before it cuts rates further, according to an interview with RTP.

- German coalition government agreed on a 2025 draft budget after months of negotiations, according to a government source.