US Quarterly Refunding: USD 125bln (prev. 125bln), to raise new cash of 14bln. 3yr 58bln (exp./prev. 58bln), 10yr 42bln (exp./prev. 42bln), 30yr 25bln (exp./prev. 25bln)

- Liquidity buyback total increases to USD 30bln (prev. 15bln)

-

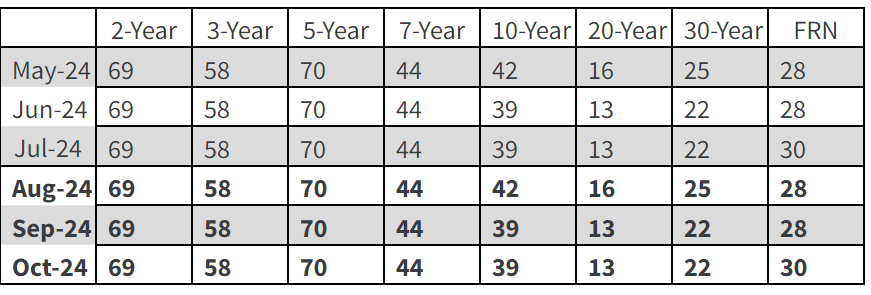

Treasury does not expect the need to increase coupon or FRN sizes for the next several quarters (reiteration). - 2yr 69bln (exp./prev. 69bln), 3yr 58bn (exp./prev. 58bln), 5yr 70bln (exp./prev.70bln), 7yr 44bln (exp./prev. 44bln), 10yr 42bln (exp./prev. 42bln), 20yr 16bln (exp./prev. 16bln), 30yr 25bln (exp./prev. 25bln), FRN’s 28bln (prev. 28bln)

Buybacks

-

Treasury plans to conduct weekly liquidity support buybacks of up to USD 4bln per operation in nominal coupon securities. In longer-maturity buckets, Treasury will conduct two operations, each up to USD 2bln, over the refunding quarter. Treasury also plans to conduct two operations, each up to USD 0.5bln, in each of the TIPS buckets. -

Based on current projected fiscal flows around the September 15th tax date, Treasury plans to conduct cash management buybacks in September 2024. Amounts purchased in cash management buybacks would temper the reductions to bill auction sizes that would otherwise occur over the same timeframe.

Treasury Secretary Report

- The Committee also discussed the potential impact of debt ceiling constraints on Treasury’s issuance strategy in FY 2025, especially limits to Treasury’s flexibility and the likelihood of increased costs to the taxpayer. The periodic occurrence of debt ceiling episodes drives elevated uncertainty in funding costs.

- Treasury communicated that dealers saw buybacks as modestly supportive of liquidity, but the limited size and already-liquid market conditions meant that it was difficult to ascertain the full impact of the program.

- While the appropriate lower bound can vary due to factors such as total T-bills outstanding, overall supply of high quality liquid assets, and the effects of money market fund reforms, among other things, the Committee felt that, currently, 15% remained a lower bound which supports healthy market functioning.

- The Committee felt that the outlook for investor demand in US Treasuries is modestly positive, though some members noted the risk of a move higher in term premium based on the deficit outlook.

Minutes

- "Committee decided to update its recommendations to Treasury, highlighting that regular and predictable coupon issuance should be prioritized, outlining a broader range of metrics to monitor, and suggesting that a Treasury bill share averaging around 20% over time appeared to provide a balanced trade-off between cost, volatility, and the need for flexibility to adapt as market conditions evolve, while a 15% share was recommended as the lower bound for proper market functioning."

- "Committee concluded that investor classes such as banks, money market funds, pension funds, and foreign investors exhibited increased demand, often for specific maturity sectors, while the demand outlook for households remained uncertain and represented a potential area for additional study."

Reaction details (13:44)

- A release which came alongside a below-expected Q2 ECI print (0.9% vs exp. 1.0%, prev. 1.2%) that sparked modest upside in USTs; thereafter, the maintenance of the auction sizes potentially resulted in the pullback in USTs to pre-ECI/Refunding levels - a bearish move on the refunding could be explained by the reduced estimate sizes on Monday, which possibly presented some downward skew to estimates for unchanged sizes in today's refunding release.

31 Jul 2024 - 13:30- Fixed IncomeImportant- Source: Newswires

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts