US Quarterly Refunding Announcement (QRA): expects to keep coupon and FRN auction sizes steady for the next several quarters. Begun to preliminarily consider future auction size increases.

- Offering USD 125bln (prev. 125bln) of Treasury securities to refund c. USD 98.2bln (prev. 89.8bln) of privately-held Treasury notes; will raise new cash of USD 26.8bln (prev. 35.2bln).

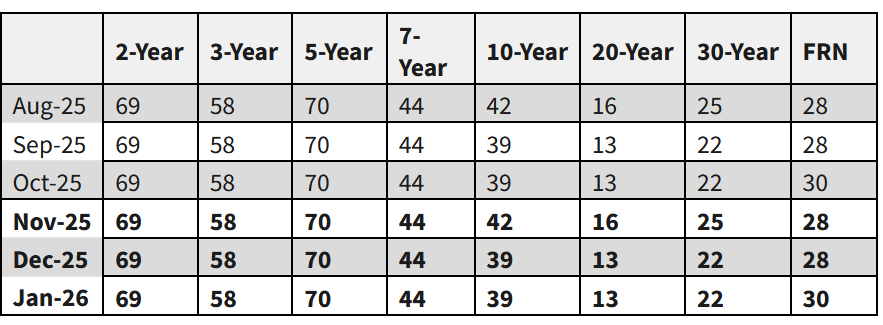

Nominal Coupon and FRN Financing

- Treasury maintains guidance that it "anticipates maintaining nominal coupon and FRN auction sizes for at least the next several quarters". Begun to preliminarily consider future auction size increases

TIPS

- Intends to maintain the 10yr re-opening at 19bln

- Intends to increase the 5yr re-opening to USD 24bln (prev. 23bln)

- Intends to maintain the new 10yr at USD 21bln.

Bills

- "... expects to maintain the offering sizes of benchmark bills into late-November"

- "...expects to implement modest reductions to short-dated bill auction sizes during the month of December. Thereafter, by the middle of January 2026, Treasury anticipates increasing bill auction sizes based on expected fiscal outflows."

Buybacks

- In both the 10- to 20-year and 20- to 30-year nominal coupon buckets, Treasury plans to conduct four operations over the refunding quarter, each for up to USD 2bln.

- Plans to conduct one liquidity support buyback of up to USD 4bln.

- Two operations in the 1- to 10-year TIPS bucket, each for up to USD 750mln, and one operation for up to USD 500mln in the 10- to 30-year TIPS bucket.

- Anticipates resuming cash management buybacks in December 2025 (paused in September)

- Expects to purchase as much as USD 38bln in off-the-run securities across buckets for liquidity support and up to USD 25bln in the 1-month to 2-year bucket for cash management purposes.

Small Value Contingency Operation

- Sometime over the next three months, Treasury intends to conduct a small-value test auction using its contingency auction system.

- This small-value test auction should not be viewed by market participants as a precursor or signal of any pending policy changes regarding Treasury’s existing auction processes.

TBAC Minutes

- "...dealers acknowledged that there is uncertainty concerning when the Federal Reserve will conduct open market operations to increase the size of its balance sheet."

- "Although rates have moved higher, Committee members emphasized that the repo market for Treasury securities has remained orderly and has functioned reasonably"

- "Dealers reiterated that the substantial length of the when-issued period is a driving force in persistent repo specialness, and they expressed favorable views on shortening the time between auction and settlement for reopenings"

Reaction details (13:47)

- Modest pressure was seen in USTs on the announcement that the Treasury has begun preliminary considerations around increases to future auction sizes; adding to the modest downside seen after ADP.

Analysis details (18:28)

Quarterly Refunding: The main development was the addition to its guidance. It maintained that it expects to keep coupon and FRN auction sizes steady for at least the next several quarters; however, it added, "Looking ahead, Treasury has begun to preliminarily consider future increases to nominal coupon and FRN auction size". Indicative of a boost to auction sizes at some point in the future, but perhaps not until H2 '26 or 2027, given the current "at least the next several quarters" guidance. Ahead of QRA, Morgan Stanley did not expect a move until February 2027.

Meanwhile, the Treasury announced it is offering USD 125bln (unchanged) of Treasury securities to refund c. USD 98.2bln of privately-held Treasury notes maturing on 15th November 2025. Raising new cash of c. USD 26.8bln. This is in the form of USD 58bln 3-year notes, USD 42bln 10-year notes, and USD 25bln in 30-year bonds next week - sizes maintained as expected. It also maintained that it plans to address any unexpected borrowing needs through changes in regular bill auction sizes and/or CMBs.

Regarding TIPS, it maintained the November 10-year TIPS reopening at USD 19bln, and the January 10-year TIPS new issue at USD 21bln, but increased the December 5-year TIPS reopening by USD 1bln to USD 24bln.

On bills, it expects to maintain offering sizes by offering sizes of benchmark bills into late-November, but expects to implement modest reductions to short-dated bill auction sizes in December. By mid-January, it expects to increase bill auction sizes based on expected fiscal outflows.

Regarding buybacks, it will conduct four operations over the quarter in both the 10-20 and 20-30 year nominal coupon buckets, each up to USD 2bln (maintained from Q3). In other buckets, it plans to conduct one liquidity support buyback of up to USD 4bln (maintained from Q3). It also plans two 1-10-year TIPS operations, each up to USD 750mln (maintained from Q3), and one for up to USD 500mln in 10-30 year TIPS (maintained from Q3). It expects to purchase as much as USD 38bln in off-the-run securities across buckets for liquidity support (maintained from Q3), but Treasury also announced it plans to resume cash management buybacks in December 2025 after pausing them in September. It plans up to USD 25bln in the 1-month to 2-year bucket for cash management purposes.

05 Nov 2025 - 13:30- ForexImportant- Source: Treasury

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts