[UPDATED] PREVIEW: Trump-Putin Summit in Alaska on Friday 15th August 2025; Summit to begin at 15:00 EDT/20:00 BST; Trump assigned a 25% chance the meeting will not be successful

OVERVIEW

MEETING FORMAT

- US President Trump is to meet Russian President Putin in US territory at Elmendorf–Richardson Air Force Base near Anchorage, Alaska, on Friday, 15 August 2025.

- White House said US President Trump will participate in a bilateral program with the President of the Russian Federation in Alaska at 11:00AM (15:00EDT/20:00BST) and will depart Alaska at 17:45 (21:45/02:45BST).

- The Alaska summit will begin at 11:30 local time on Friday (20:30 BST/15:30 EDT), according to Russian Kremlin's Ushakov on Wednesday.

- Russian President Putin and US President Trump to have a one-on-one meeting with translators; also to have a wider meeting with delegations.

- US President Trump on Thursday said that he does not know if there will be a joint press conference with Russian President Putin after the Alaska meeting. Trump will have a press conference however the talks go.

- Russian delegation to include Russian Foreign Minister Lavrov, Advisor Ushakov, Defence Minister Belousov, Finance Minister Siluanov and Special Envoy and head of Sovereign Wealth Fund Dmitriev.

- The meeting will be the first time the Russian leader has set foot on US soil since 2015.

- Ukrainian President Zelensky is not invited to the Alaska summit.

PURPOSE:

- The meeting aims to explore ways to end Russia’s war against Ukraine.

- Russia's Kremlin said the central topic is Ukraine. The sides are to discuss trade and economic cooperation where there is "huge untapped potential".

- White House spokeswoman Leavitt described it as a “listening exercise” to hear what Putin proposes.

- "At the end of that meeting, probably the first two minutes, I'll know exactly whether or not a deal can be made," Trump said at a White House press conference.

EXPECTATIONS

- The White House downplayed expectations, describing the meeting as a listening exercise. President Trump called it a “feel‑out meeting.

-

US President Trump on Thursday assigned a 25% chance that the first meeting (Alaska) is not successful; and said he could be more sanctions if the meeting is not successful. Trump added Have economic incentives and disincentives at his disposal for the meeting; would rather not say about specifics. Incentives/sanctions are "very powerful". - There are no plans to sign documents on the outcome of the Alaska summit between Russia and the US, via Ifx citing the Kremlin; would be a mistake to predict the outcome of the talks.

- All in all, it is difficult to envision a smooth solution to the Russia-Ukraine war through this summit, with Moscow demanding Ukraine give up some territory, a red line for Kyiv.

- Analysts at Rane suggest the Friday summit "risks side-lining Ukraine, fracturing Western unity and creating space for Russia to delay sanctions, consolidate battlefield gains and promote a US-Russia framework that advances Russian strategic interests."

- Markets will likely focus on several factors: 1) the prospect of looser US sanctions on Russia, 2) how far Russia is willing to go on concessions, 3) any tangible progress towards a Russia-Ukraine ceasefire.

TRUMP'S CALL WITH EUROPEAN LEADERS ON WEDNESDAY

- US President Trump held a call with European leaders and Ukrainian President Zelensky, which he said was a very good call and "rate it a 10", while he will meet with Russian President Putin, then will call Zelensky and European leaders.

- Trump said there is a good chance of a second meeting and he would like to do a second meeting almost immediately which would include Zelensky if the first meeting goes okay, but there may not be a second meeting if he feels it is inappropriate or if he does not get the answers he wants.

- Furthermore, he said the first meeting is finding out what they are doing and a second meeting will be more productive, but warned that Russia will face consequences if the war is not stopped.

- US President Trump discussed with European leaders possible locations for a meeting between Zelensky, Trump and Putin after the Alaska summit, while locations include cities in Europe and the Middle East, according to Reuters citing sources.

-

US President Trump reportedly told those on Wednesday's call that he is willing to contribute US security guarantees for Ukraine with some conditions, via Politico citing sources; openness that helps explain the cautious European optimism. Guarantees which are seen as key by Europe and Ukraine. However, Politico caveats that Trump did not elaborate on what he meant by security guarantees, and would only make this commitment of the effort is not part of NATO.

RUSSIA'S PRE-MEETING COMMENTS

- Russian Foreign Ministry says Moscow expects Trump's visit to Russia after Alaska summit, according to Al Arabiya.

- "We have a clear position that we will present at the Alaska summit and hope to continue the dialogue".

- "We do not speculate on anything in the future and we have clear arguments and positions that we will present during the Alaska summit".

- Russian President Putin said the US is making a sincere effort to find a solution for the Ukraine crisis; US are seeking agreements that are acceptable to all, via Ifx. Peace will be strengthened if at the next stage Russia and US reach agreements in the field of strategic offensive arms control. New arms agreements with US are possible.

UKRAINE INVOLVEMENT

- President Trump said he may arrange a subsequent meeting involving Zelensky and Putin, but he dismissed Zelensky’s desire to participate directly, noting that the Ukrainian leader has “been to a lot of meetings” without ending the war.

- Zelensky criticised the summit’s bilateral format, warning that any peace deal must be approved in a national referendum and that the absence of Ukraine would render an agreement illegitimate.

RENEWED OFFENSIVE

- Ukrainian President Zelensky on August 12th posted, "We see that the Russian army is not preparing to end the war. On the contrary, they are making movements that indicate preparations for new offensive operations."

- Zelensky added that Russia is moving troops from the Sumy region to Pokrovsky, Zaporizhzhia, and is preparing for a new assault at the start of September.

- Zelensky said the current Russian push in eastern Ukraine is timed to coincide with Trump-Putin talks.

- Ukrainian President Zelensky has repeatedly stated that Ukraine will not cede land.

- Russian President Putin reportedly appears ready to test new nuclear-armed, nuclear-powered cruise missiles even as he prepares for talks with US President Trump, according to US researchers and Western security sources cited by Reuters.

- Ukraine's military says it struck Russia's port Olya in the Astrakhan region on Thursday and hit a ship with drone parts and ammo from Iran.

STANCES

RUSSIA'S POSITION

- Russian President Putin is seeking to lock in Russia’s territorial gains and prevent Ukraine from joining NATO. Reports suggest Putin may have floated a ceasefire that asks Ukraine to cede much of Donetsk and to demilitarise; however, analysts believe he remains unwilling to offer meaningful concessions.

- Bloomberg reported on August 5th that Russia's Kremlin is said to be mulling options for a concession to US President Trump that could include an air truce with Ukraine, in a bid to minimise the threat of secondary sanctions.

- US and Russia reportedly planning Ukraine deal to cement Russian territorial gains, according to Bloomberg (Aug 8th). Russia would halt its offensive in the Kherson and Zaporizhzhia regions of Ukraine along the current battle lines as part of the deal.

- Russian President Putin reportedly demands Ukraine cede Donetsk, Luhansk and Crimea, for Russia to halt the war, according to WSJ, citing Ukrainian and European officials (Aug 8th).

- Putin told Witkoff he would agree to a complete cease-fire if Ukraine agreed to withdraw forces from all of Ukraine's Eastern Donetsk region.

UKRAINE'S POSITION

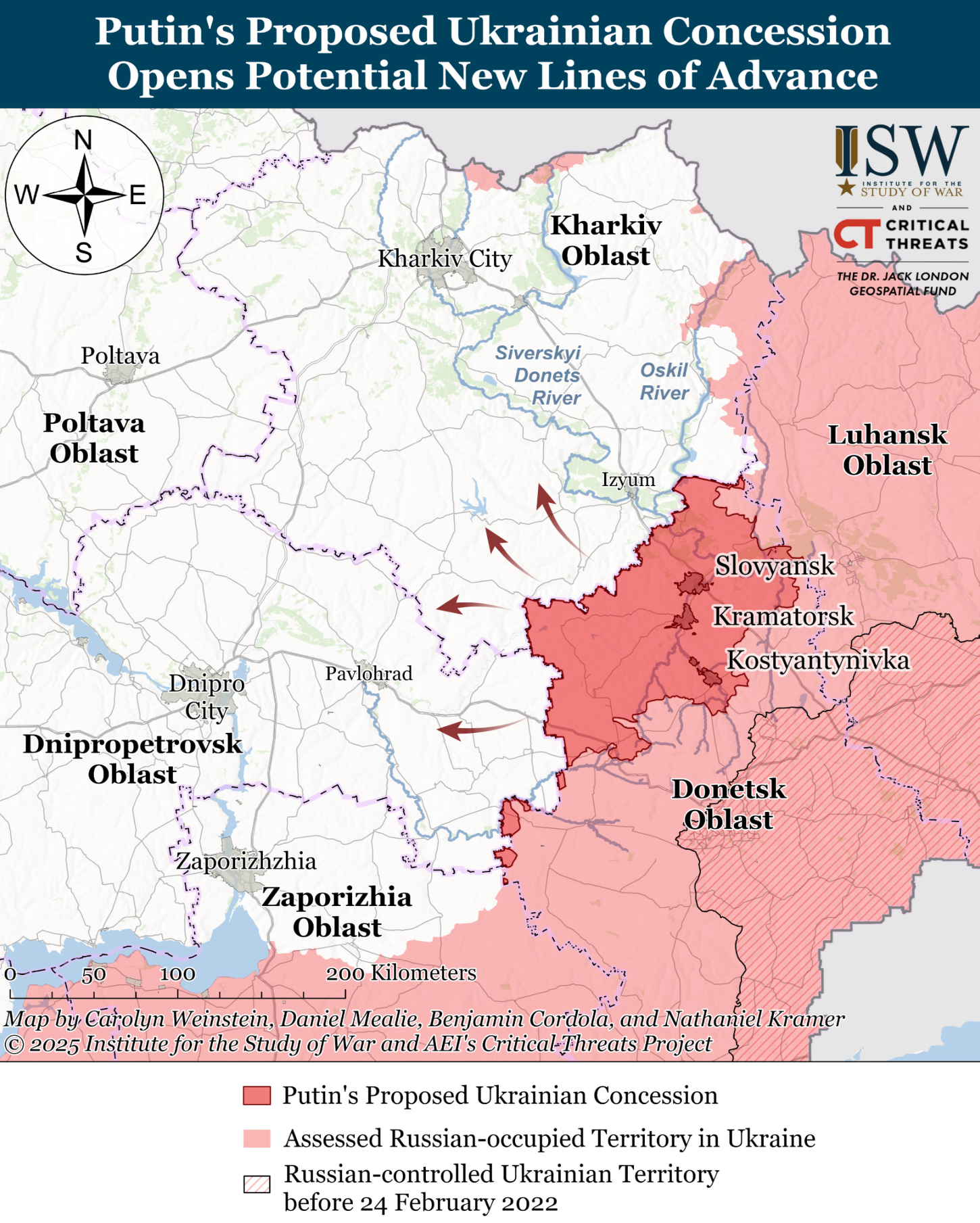

- Ukrainian President Zelensky said he understood that Russia wants Kyiv to pull out of Donbas, and will not advance in other directions in exchange. He added that Ukraine will not pull out of Donbas as such a move would open the way for Russia to attack Dnipropetrovsk, Zaporizhzhia regions, and Kharkiv.

- Zelensky added that territorial issues should be discussed after the ceasefire and along with security guarantees for Ukraine.

- In a press conference, he warned that Russia wants Ukraine to withdraw from the remaining 30% of the Donetsk region, but Ukraine’s constitution prohibits surrendering territory.

- He also emphasised that giving up Donbas would become a springboard for future invasions; he insists Ukraine will not leave its fortifications or open an avenue for a Russian offensive.

- Ukraine insists on a durable ceasefire before any discussion of territorial issues. According to Politico, Zelenskyy and European allies will use Wednesday’s call to push for a deal that demands a lasting ceasefire, meaningful security guarantees and billions in Russian reparations; they will also demand the return of 20,000 abducted children and prisoners of war.

Prior reports of softened Ukraine Stance

- Ukraine could agree to stop fighting and cede territory already held by Russia as part of a European-backed plan for peace, according to The Telegraph. (Aug 11th)

- Ukrainian President Zelensky reportedly told European leaders that they must reject any settlement proposed by Trump, which sees them giving up Ukrainian land they still hold, but that Ukrainian territory in Russia’s control could be on the table. This would mean freezing the frontline where it is and handing Russia de facto control of the territory it occupies in Luhansk, Donetsk, Zaporizhzhia, Kherson and Crimea.

- The softening of the negotiating position comes ahead of crunch talks between Donald Trump and Vladimir Putin in Alaska this Friday. “The plan can only be related to the current positions held by the militaries,” a Western official said, characterising a frantic weekend of diplomacy between Kyiv and its allies."

EU/NATO POSITION

- Germany’s chancellor Merz invited Trump, Zelensky, EU leaders and NATO Secretary‑General Rutte to a video conference on Wednesday, 13 Aug 2025, scheduled for 15:00 CET (13:00 GMT / 14:00 London), with the aim to coordinate positions, discuss further sanctions, and establish “red lines” for any peace deal. Merz’s office said the talks would address territorial claims, security guarantees and additional ways to pressure Russia (details of the call above).

- EU and NATO leaders insist that Ukraine’s sovereignty and security guarantees are non‑negotiable, while analysts caution that land‑swap proposals risk legitimising aggression.

- NATO Secretary‑General Rutte described the Alaska summit as a way to test Putin’s seriousness and stressed that Ukraine must decide its own future; he argued that only involving Ukraine and Europe will make any settlement viable.

- EU Foreign Policy Chief Kallas said on August 11th that the EU will work on a 19th package of sanctions against Russia, while she warned against concessions to Moscow.

- Germany said it will fund a USD 500mln package of military equipment and munitions for Ukraine sourced from the US, according to a NATO statement.

- Polish PM Tusk said they cannot allow the biggest powers to decide the fate of smaller countries without their participation and Russia wants to link a reduction in NATO troops in Poland to the talks about Ukraine, while he added It will be easier for Poland's opponents to "play us" if we are not united.

POTENTIAL SCENARIOS AND MARKET ANGLES

No Deal [most likely]:

- Analysts consider it likely that the summit results in no major agreement. Trump may simply gauge Putin’s intentions and then coordinate with Zelenskyy and Europe.

- Broader sentiment will likely not be too swayed by a "no deal" amid low expectations heading into the meeting, but could be net bullish for oil/nat gas (sanctions risk remains) and defence stocks, whilst EUR and EGBs may be subdued.

- That being said, if Russia is willing to go further on concessions, this may tilt risk sentiment higher.

Limited Ceasefire [possible]

- This could be seen as progress toward de‑escalation and potential easing of sanctions.

- A "limited ceasefire" could be short-term negative for oil, defence stocks, whilst stocks and EUR, equities, and EGBs could be buoyed.

- Some analysts suggest Russia could use a limited ceasefire to regroup and delay sanctions.

US-Russia Tensions Escalate [possible but not in bilateral interests]:

- A further breakdown in relations between Moscow and Washington could see risk aversion and a rise in oil prices.

- Goldman Sachs: "While lack of progress towards a ceasefire may lead renewed threats of secondary oil tariffs/sanctions, we see limited risk of large disruptions in Russia supply given the large volumes of Russian exports, the possibility for deepening price discounts to maintain demand, and likely eagerness of the key buyers, India and especially China, to continue energy cooperation with Russia."

- As a reminder, US President Trump recently ordered two nuclear submarines to "be positioned in the appropriate regions" in response to "highly provocative" comments by former Russian President Medvedev.

Land‑Swap Proposal [possible but unlikely to be accepted]:

- If Trump agrees to a ceasefire that frontloads territorial concessions, analysts warn that Ukraine and Europe will reject it. Such a deal could trigger political backlash in Ukraine and may collapse due to constitutional and public opposition.

- Short-term risk across markets amid progress toward de‑escalation and potential easing of sanctions, with energy likely to slip. However, the reaction will likely fade if/when rejected by Ukraine.

Comprehensive Framework [near-zero]:

- A sustainable peace agreement would require the involvement of Ukraine and Europe, credible security guarantees, significant aid packages and robust monitoring. Neither side currently appears willing to make the necessary concessions. Without Ukraine’s participation, any framework is likely to fail.

- Risk on, energy sold.

- Goldman Sachs "While a lasting peace agreement may potentially lead to a relaxation of US sanctions on Russian oil, we wouldn’t expect a significant short-term increase in Russian oil supply in this scenario. The reason is that Russian production, in our view, has instead been constrained by OPEC+ quota decisions, low oil investment, and a strong Ruble."

HOUSE VIEWS

-

BLOOMBERG: Bloomberg's John Authers, citing Christopher Smart of the Arbroath Group, says " European defence stocks would fly on any lopsided deal that rewards Russia’s aggression, with oil prices likely to slump on even the whiff of looser sanctions on Russian oil — and fulfilling a key Trump goal in the process. If it prompted a renewed flight from holding assets in the US, it would fulfil another administration goal by weakening the dollar. Individual companies will have to interpret what the outcome means for their operations and risk exposure... Beyond Europe, markets appear to have long since moved past the 2022 invasion, implying Friday’s meeting has little potential to trigger a significant market shift. " -

GOLDMAN SACHS: "We don’t expect the announced meeting between President Trump and President Putin, scheduled for Friday, August 15, to cause a significant shift in Russian oil supply in the key scenarios". -

ING: "If we do see some level of de-escalation, it would remove sanction risk from the oil market. This would likely drive prices lower, given the bearish fundamentals".

MAP

via Institute for the Study of War

via Institute for the Study of War15 Aug 2025 - 09:13- ForexGeopolitical- Source: Newsquawk

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts