Swiss SNB Policy Rate (Q4) 0.50% vs. Exp. 0.75% (Prev. 1.00%); "also remains willing to be active in the foreign exchange market as necessary."

Intervention/Monetary Policy

- "The SNB also remains willing to be active in the foreign exchange market as necessary." (reiteration of the Sep. announcement)

- "The SNB will continue to monitor the situation closely, and will adjust its monetary policy if necessary to ensure inflation remains within the range consistent with price stability over the medium term."

Inflation

- (on the recent prints) "Both goods and services contributed to this decline. Overall, inflation in Switzerland is still being driven mainly by domestic services."

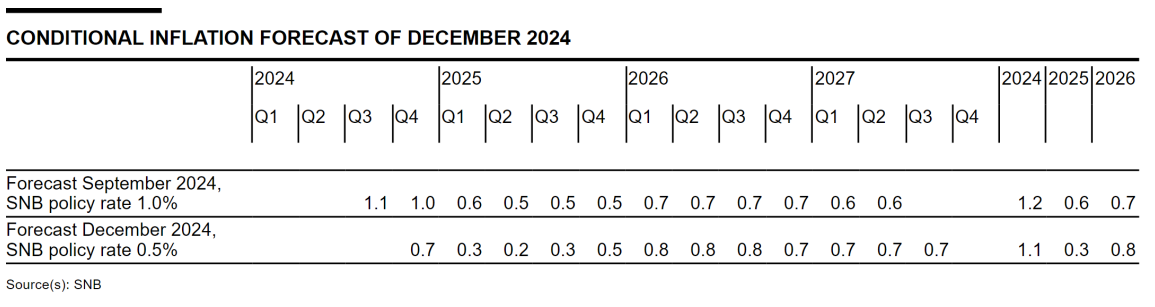

- "In the shorter term, the new conditional inflation forecast is below that of September. This above all reflects the lower-than-expected inflation in the case of oil products and food. Thanks to the policy rate cut today, there is little change in the medium term."

Growth

- Modest in Q3, as expected.

- "Growth in the services sector was again somewhat stronger, while value added in manufacturing declined. There was a further slight increase in unemployment, and employment growth was only subdued. The utilisation of overall production capacity was normal."

Reaction details (08:37)

- The larger-than-expected cut sparked immediate upside in EUR/CHF, sending it from 0.9280 to 0.9335 before extending to 0.9345.

Analysis details (08:42)

- A larger than expected cut (consensus was for 25bps, though some desks did look for 50bps) has eroded much of the SNB's policy space and brings them into the realm of the neutral rate (thought to be somewhere between 0% and 0.50%).

- As such, we now look to commentary from Schlegel with particular focus on FX intervention and whether a return to a negative policy rate is possible. Post-announcement, market pricing sees the rate potentially moving to 0% in March'25 and then negative in June'25.

- Reminder, Chairman Schlegel recently said that he can't rule out a return to negative interest rates.

12 Dec 2024 - 08:30- ForexImportant- Source: Reuters

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts