Swiss SNB Policy Rate (Q3) 0.0% vs. Exp. 0.0% (Prev. 0.0%); willing to intervene in FX if needed, annual inflation forecasts maintained

FX

- Remains ready to intervene in forex markets as needed.

Economy

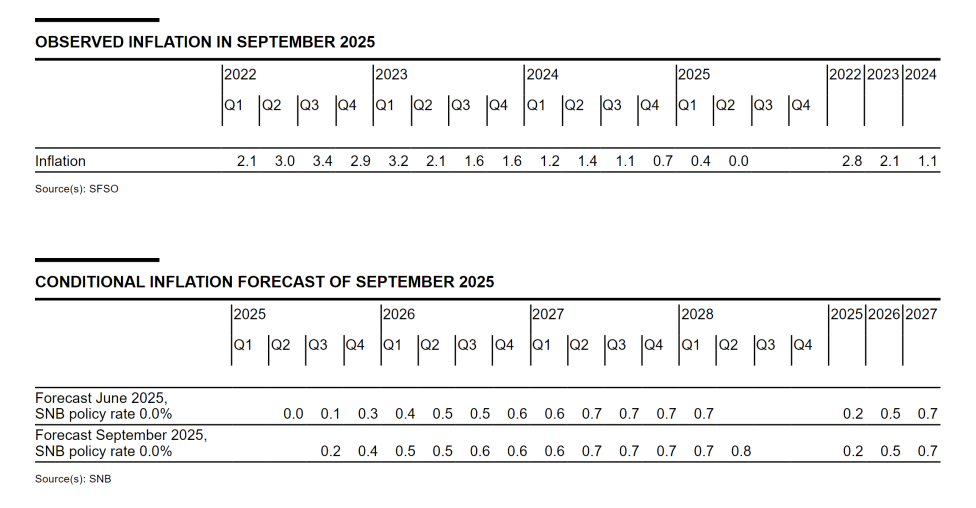

- Inflationary pressure is virtually unchanged compared to the previous quarter.

- Anticipates that growth in the global economy will be subdued over the coming quarters.

- Trade barriers could be raised further, leading to a more pronounced slowdown in the global economy.

Sight deposits

- Banks' sight deposits held at the SNB will be remunerated at the SNB policy rate up to a certain threshold.

- The discount for sight deposits above this threshold still stands at 0.25%

Forecasts

Reaction details (08:40)

- Modest strength seen in the CHF on the announcement. Specifically, EUR/CHF fell from 0.9346 to 0.9338 in the immediacy before slipping to a 0.9329 session low.

- Market pricing has moved in a hawkish direction since the announcement, with just 5bps of easing implied by end-2026 vs 10bps pre-announcement.

Analysis details (08:40)

- Overall, largely as expected from the SNB. The policy rate was maintained at the ZLB, FX guidance was reiterated, and the tiering system for sight deposits continues to be in play. While the statement does not give much away on forward guidance, the inflation forecasts were maintained for 2025, 2026 and 2027. Furthermore, the 2026 quarterly breakdown has seen incremental lifts for Q1 and Q3 in addition to a lift for Q4-2025 (likely acknowledging the slight increase seen in inflation since June). Forecasts that increase the likelihood of the SNB being at its terminal rate. One caveat to that view is the deteriorating economic outlook for Switzerland itself due to "significantly higher US tariffs", a point that may keep some prospect of easing on the table in the quarters ahead. Further insight will be sought from Chairman Schlegel at 09:00BST.

25 Sep 2025 - 08:30- Fixed IncomeImportant- Source: Reuters

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts