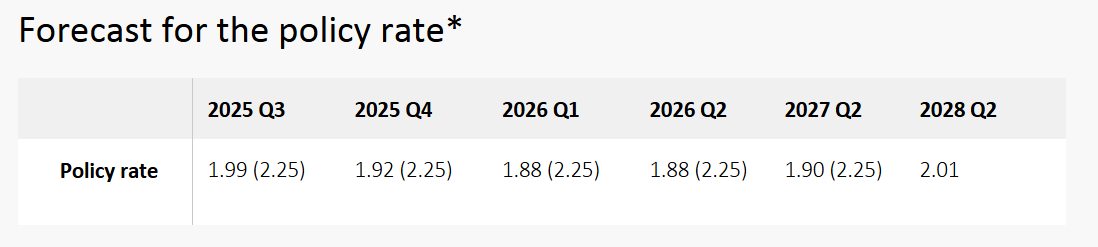

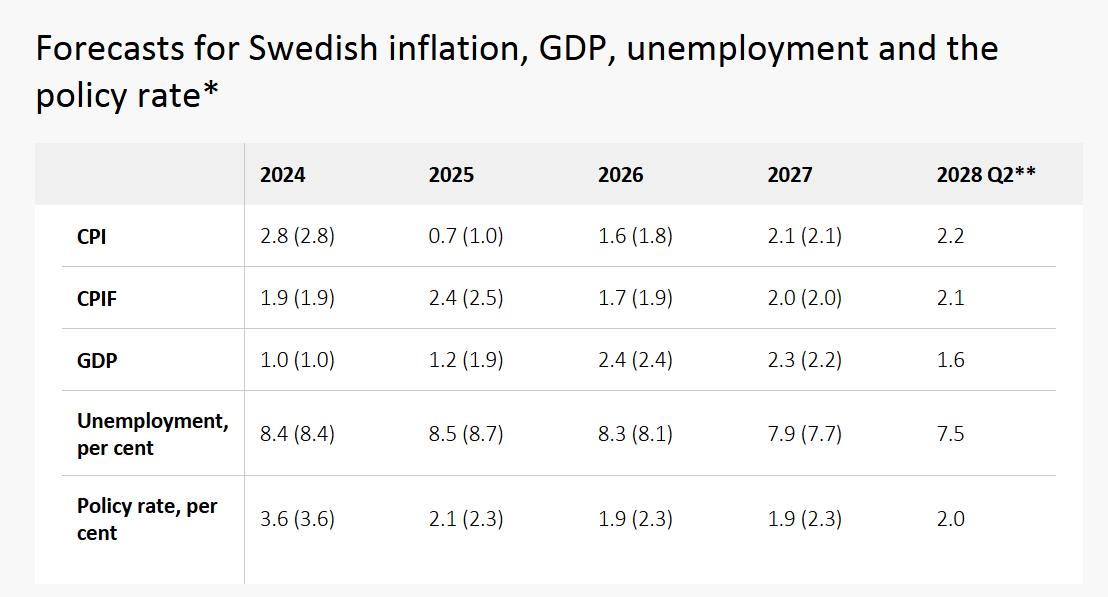

Swedish Riksbank Rate 2.0% vs. Exp. 2.0% (Prev. 2.25%); rate path entails some probability of another rate cut in 2025

- The economic recovery that began last year has lost momentum, and inflation is expected to be somewhat lower than in the previous forecast.

- The lower interest rate will stabilise inflation at the target and contribute to strengthening economic activity.

- There is still considerable uncertainty over future developments.

- There are favourable conditions for stronger economic activity in Sweden going forward, partly due to rising real wages for households.

Reaction details (08:36)

- EUR/SEK saw some upside following the RIksbank's decision to lower rates and suggestion that the base rate could be lowered further during the year, moving from 10.9729 to 11.0044. This move was faded given the uncertainty surrounding the Swedish economic outlook.

18 Jun 2025 - 08:30- Fixed IncomeData- Source: Reuters

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts