SNB cuts its Policy Rate by 25bps to 0.00%, as expected; reiterates "remains willing to be active in the foreign exchange market as necessary"

Inflation

- "Inflationary pressure has decreased compared to the previous quarter. With today’s easing of monetary policy, the SNB is countering the lower inflationary pressure."

Economy

- "The global economy continued to grow at a moderate pace in the first quarter of 2025. The global economic outlook for the coming quarters has deteriorated due to the increase in trade tensions."

- "In its baseline scenario, the SNB anticipates that growth in the global economy will weaken over the coming quarters."

- "The scenario for the global economy remains subject to high uncertainty."

- "Following the strong first quarter, growth is likely to slow again and remain rather subdued over the remainder of the year."

Sight Deposits

- Banks’ sight deposits held at the SNB will be remunerated at the SNB policy rate up to a certain threshold. The discount for sight deposits above this threshold remains unchanged at 0.25 percentage points. i.e. the bank has reintroduced tiered remuneration for sight deposits - see link for full explainer.

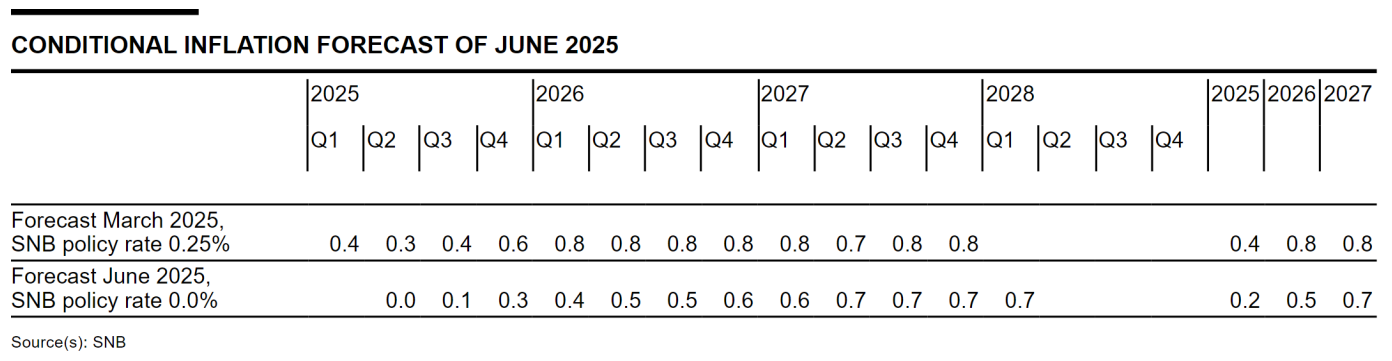

Conditional Inflation Forecast

Reaction details (08:40)

- EUR/CHF saw a knee-jerk lower from 0.9414 to 0.9387 following the SNB's decision to cut rates by 25bps given that there were outside calls for a larger 50bps reduction, which would have taken the key rate negative.

- However, a bulk of the downside in EUR/CHF was subsequently pared as the accompanying inflation projections for 2025 and 2026 were lowered, suggesting that the possibility of negative rates remains.

- On which, market pricing suggests a roughly 56% chance of negative rates by year-end (vs. circa 76% pre-release).

- We now await the SNB press conference at 09:00BST for any clues over future easing plans and how comfortable with Bank is with the prospect of a return to NIRP.

19 Jun 2025 - 08:30- ForexImportant- Source: Newswires

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts