SNB cuts its Policy Rate by 25bps as expected to 1.00%; prepared to intervene in the FX market as necessary; Further cuts in the SNB policy rate may become necessary in the coming quarters to ensure price stability over the medium term.

INFLATION FORECASTS

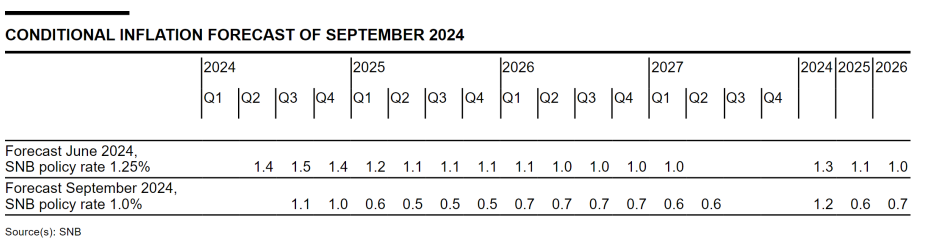

- 2024 1.2% (prev. 1.3%)

- 2025 0.6% (prev. 1.1%)

- 2026 0.7% (prev. 1.0%)

- The stronger Swiss franc, the lower oil price and electricity price cuts announced for next January have contributed to the downward revision.

- The forecast is based on the assumption that the SNB policy rate is 1.0% over the entire forecast horizon. Without today’s rate cut, the conditional inflation forecast would have been even lower.

- The stronger decline in inflation also means that weaker second-round effects are expected in the medium term. The new forecast is within the range of price stability over the entire forecast horizon

GROWTH FORECASTS

- 2024 1.0% (prev. 1.0%)

- 2025 1.5% (prev. 1.5%)

Reaction details (08:43)

- The 25bps rate cut to 1.00% saw markets unwind the circa. 40% implied probability of a larger 50bps cut and as such the Franc appreciated with EUR/CHF falling from 0.9492 to 0.9436 in an immediate reaction. A move which swiftly and almost entirely pared as the statement made clear that they are willing to intervene in the FX market as necessary which, alongside the significant cuts to their inflation forecasts and language that further cuts could be necessary to ensure price stability, weighed on the CHF.

- As the dust settles, EUR/CHF is holding around 0.9470 ahead of Jordan.

26 Sep 2024 - 08:30- EnergyImportant- Source: SNB

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts