RUSSIA-UKRAINE: Where we stand

- Ukraine maintains control over capital Kyiv as peace talks between Russia/Ukraine get underway on the Belarussian border.

-

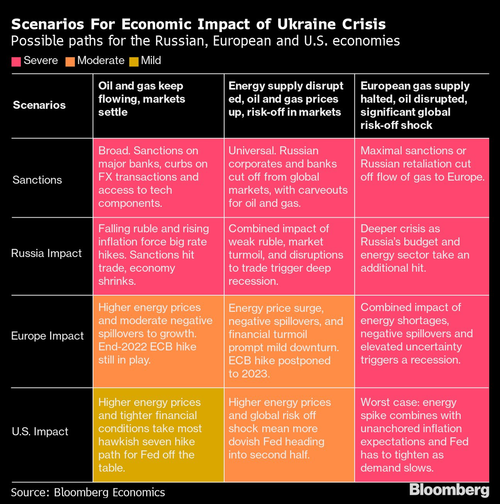

Allied partners over the weekend boosted their sanctions response, where it limited the access of a number of Russian banks to the SWIFT messaging system making it more difficult to process cross-border payments; but the West has crucially has stopped short of a ban on Russian energy imports. -

Russian President Putin placed his nation on high nuclear alert due to the West escalating sanctions. - CapEco says "The list of institutions affected has yet to be released, but when it is it’s worth watching whether Gazprombank is included (since it handles a large share of Russia’s energy exports this could have implications for energy flows).

- Also over the weekend, the US, EU, UK Canada slapped sanctions on Russia's central bank, making it difficult for the CBR to liquidate foreign assets to support the currency; Capital Economics noted that around 40% of Russia’s international reserves are held in the financial systems of the countries that have signed up to these sanctions. On Monday, the CBR hiked its key rate to 20.0% from 9.5%.

- CapEco says that key areas to watch going forward are whether the US adds the CBR to its 'Specially Designated Nationals' list, which would ban US entities from dealing with the central bank and therefore acting on its behalf, and whether the US introduces 'secondary sanctions' that would affect any foreign entity dealing with the CBR. Additionally, watch whether the CBR sanctions contain any carve-outs for sovereign debt repayments (CapEco says they likely will).

- In terms of the Russian economic impact, JPMorgan (JPM), writing ahead of the CBR's emergency rate hike today, said it expects the Russian economy to contract 20% Q/Q in Q2, and by 3.5% for the full year. JPM lowered its trend rate view of Russian growth to 1.0% (prev. 1.75%) as growing political and economic isolation will weigh on growth potential in years to come. Added that Russian inflation is expected to stand at 10% by end-year, with risks skewed to the upside.

- In Europe, defence names have been buoyed on news that Germany will raise defence spending; banks are being flogged after Russian banks were partially ejected from the SWIFT messaging system; automakers are lower amid a shortage of parts from Ukraine.

- The Russian RUB has been under pressure, falling to fresh lows; however, there has been bouts of strength, which is notable amid earlier reports that Russia had introduced mandatory FX sales for companies, where Russian companies were instructed to sell 80% of foreign exchange revenue.

Session Ahead:

- 09:00GMT - Negotiations between delegates of Russia and Ukraine, not expecting a breakthrough but we are attentive to any indications from this of subsequent high-level discussions.

- Timing TBC - EU Commission President von der Leyen, German Chancellor Scholz and French President Macron meeting.

- Timing TBC - EU Defence Ministers Meeting.

- Timing TBC - EU to debate US proposal for coordinated SPR release.

28 Feb 2022 - 09:00- EquitiesImportant- Source: Newsquawk

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts