[ROLLING ANALYSIS] US President Trump announces "no exceptions or exemptions" steel and aluminium tariffs

US TARIFFS

UPDATE:

-

Steel and aluminium tariffs: US President Trump signed proclamations to reimpose a 25% tariff on steel and aluminium imports and declared there are no exceptions or exemptions, effective March 12th. -

Additional tariffs: Trump said they are looking at tariffs on cars, pharmaceuticals and chips and will hold meetings over the next four weeks, while they will do reciprocal tariffs over the next two days. Trump also commented that tariffs on metals could go higher and he does not mind if other countries retaliate. -

Executive orders: President Trump is expected to sign executive orders on Tuesday at 15:00EST/20:00GMT.

HOW MARKETS DIGESTED THE UPDATE: APAC stocks were ultimately mixed (Japan closed). US equity futures gradually retreated. European equity futures were flat/subdued. DXY traded rangebound. 10yr UST futures traded sideways in APAC hours with a modest bearish bias heading into European trade. Crude futures remained afloat. Spot gold extended on record highs, Copper futures pulled back. Bitcoin traded indecisively overnight.

GLOBAL REACTIONS

EU:

- European Commission President von der Leyen says unjustified tariffs on the EU will not go unanswered; they will trigger firm and proportionate countermeasures.

- EU Trade Ministers are set to hold a video conference on Wednesday after Trump confirmed steel and aluminium tariffs.

- EU Trade Commissioner Sefcovic said they are looking into the possibility of stronger trade ties with Gulf-nations. On the US action, said they deeply regret this, it will be fuelling inflation. The latest US measures are lose-lose, but the EU remains committed to a mutually beneficial solution.

- Germany Chancellor Scholz aid Europe will respond 'together' to US tariffs.

- French Finance Minister Lombard said Europe will answer to US tariff moves as strongly as the position of the US and they are prepared to do whatever is necessary to be balanced, while Lombard added they are ready and noted that the national digital tax is unrelated to the trade war and will not be changed.

UK:

- "Britain is not expected to join the EU in retaliating against the US after Donald Trump announced plans to hit steel imports with 25% tariffs", according to Times' Swinford. "Senior govt sources said that retaliatory tariffs would have little impact and would ultimately serve to provoke Trump further".

- UK reportedly sought clarity on Trump tariffs in a bid to avoid steel threat and it was also reported that PM Starmer is to meet with US President Trump before the end of February, according to The Telegraph.

- UK played down the threat of US President Trump’s steel and aluminium tariffs, while Downing Street refused to say if Britain would retaliate and the industry warned that levies on exports would be ‘devastating’, according to FT.

South Korea:

- South Korean acting President said they are to prepare support for firms hit by US tariffs; to discuss response measures with Japan and the EU.

- South Korea to respond to US tariffs on steel and aluminium according to pre-arranged plans.

- South Korea will seek talks with the US on tariffs to reflect interest of Korean firms.

Australia:

- Australian PM Albanese said he had a great conversation with US President Trump and they committed to working constructively to advance Australian and American interests, while he noted that President Trump agreed to consider an exemption for Australia on steel tariffs.

Hong Kong:

- Hong Kong said US tariffs are inconsistent with WTO rules and it will file a complaint on US tariffs to the WTO, while it noted the US has completely ignored the city's status as a separate customs territory from China.

China:

- No official comments from China. US President Trump said he had spoken to Chinese President Xi since his inauguration but didn't provide further details.

Canada:

- Canada's Industry Minister said US tariffs on steel and aluminium are "totally unjustified", while he is consulting with international partners on US steel and aluminium tariffs, as well as noted that the response will be "clear and calibrated".

Analysis details (07:43)

US

WEEKEND NEWS

-

US tariff Announcement: US President Trump said they will be announcing on Monday 25% tariffs on all steel and aluminium coming into the US and he will announce reciprocal tariffs on Tuesday or Wednesday which will go into effect almost immediately. -

Trade Policy: US President Trump said on Friday that he will make an announcement in the week ahead on reciprocal trade with many countries. He added that tariffs are an option to address the deficit and auto tariffs are always on the table. -

Reciprocal tariffs: Trump said they will meet on reciprocal tariffs on Monday or Tuesday and have an announcement.

CONTEXT:

- In 2024, Canada was the top supplier of both steel and aluminium to the US, with USD 11.2bln in steel and USD 9.5bln in aluminium imports.

- For steel, other key suppliers were Mexico (USD 6.5bln), Brazil and China (USD 5.2bln each), and Taiwan (USD 3.8bln).

- For aluminium, after Canada, the largest sources were UAE (USD 1.1bln), Mexico (USD 686mln), and South Korea (USD 644mln).

PRIOR CHINA TARIFFS:

-

China: Additional 10% tariff on top of existing levies, no exclusions, came into effect at 12:01 EST on February 4th. -

Note: Trump did not clarify whether or not imports Chinese metals would face double tariffs, as he has already imposed a 10% tariff on Chinese goods.

RECENT TRUMP COMMENTARY

- Tariffs on the EU will “definitely happen”.

- Stated UK is out of line and EU is really out of line. But, noted he is "getting along well" with UK PM Starmer.

- US trade deficits with Canada, Mexico, China, and the EU are “tremendous”.

- Plans to speak with Canadian PM Trudeau & Mexico on Monday.

- Trump said he is cutting off funding to South Africa over land “confiscations” and for “treating certain classes of people very badly”.

EU

WEEKEND NEWS

-

Tariffs on EU Goods: European Commission said they have not receive any official notification regarding imposition of additional tariffs on EU goods. -

EU Retaliation: "EU will 'replicate' any tariffs imposed by US", according to the French Foreign Minister. (AFP) -

EU Tariff Offer: The EU is set to offer lower tariffs on US cars as part of a deal to avoid a trade war with US President Trump, according to a report in the FT on Friday citing sources. -

France's Stance: French Foreign Minister, said "of course we will respond to Trump's tariff announcement" and will call on the EU to respond to Trump tariffs. -

German Stance: German Chancellor Scholz said the EU could act in an hour when asked in a pre-election debate if the EU was prepared for possible US tariffs.

PRIOR REPORTS

-

Tariffs: US President Trump reportedly considering plans to impose a 10% tariff on the EU, according to The Telegraph. EU Commission President von der Leyen said that when targeted with unfair or arbitrary tariffs, the EU will respond firmly. -

Retaliation: Warned of a firm response if US imposes tariffs on Europe. (FT) -

Potential tension mitigation: "There’s a consensus in the European Union that one way to mitigate trade tensions with the US will be by increasing energy purchases." CNBC source added "there’s a realization that a trade confrontation with the EU is approaching."

CHINA

WEEKEND/MONDAY NEWS

-

Tariffs: China's retaliatory tariffs against the US took effect on February 10th and with officials also said to be building a list of US tech firms for potential probes. -

China's Retaliation: China imposed 15% tariffs on US coal & LNG, 10% tariffs on US oil, agricultural machines, and some autos; Tariffs imposed in direct response to Trump's 10% tariffs, according to the Chinese Finance Ministry. -

Chinese Probes: Chinese officials may target Broadcom (AVGO) and Synopsys (SNPS) with probes and are building a list of US tech firms for potential probes, according to WSJ. Notes: it was previously reported that China is launching an anti-trust investigation into Alphabet's (GOOGL) Google. -

Export Controls (No specific country mentioned): China imposed restrictions on tungsten, tellurium, bismuth, molybdenum and indium.

Note: China's export restrictions on tungsten, tellurium, bismuth, molybdenum, and indium could significantly impact industries reliant on advanced materials. Tungsten is critical for aerospace, defence, and industrial tools due to its hardness and high melting point. Tellurium is essential for solar panels, thermoelectrics, and steel alloys. Bismuth is used in pharmaceuticals, low-toxicity solder, and lead-free ammunition. Molybdenum strengthens steel alloys for aerospace, nuclear, and industrial applications. Indium is vital for semiconductors, touchscreens, and solar cells. Given China's dominance in these metals, the restrictions could disrupt global supply chains, particularly in technology, energy, and defence sectors.

TRUMP'S RECENT CHINA COMMENTS

-

Tariff Increases Possible: Current China tariffs are an "opening salvo", and tariffs will increase if no deal is reached. If no deal is made, tariffs will be "substantial". -

Panama Canal Warning: Trump claims China won’t be involved with the Panama Canal for long.

NO TRUMP-XI CALL:

- Call due to take place last week did not happen.

- US President Trump said he would speak to Chinese President Xi at the appropriate time and is in no rush, while he responded 'that's fine' when asked about China’s retaliatory tariffs.

PRIOR REPORTS

-

Retaliation: China plans to challenge tariffs under WTO and will take necessary countermeasures. -

Dialogue: China urged the US to engage in dialogue & cooperation and emphasised there are no winners in a trade war.

Chinese Policy Action (according to prior WSJ sources):

- Will not devalue the Yuan to help exporters.

- Plans to reinstate 'Phase One' deal as an opening bid in trade talks.

- Will offer more US investments & treat TikTok as a commercial issue.

APAC

WEEKEND NEWS

-

Australia: Australian PM Albanese said Australia will urge the US to give Australia exemption over steel tariffs. -

India: Indian PM Modi is prepared to discuss reducing import tariffs and buying more energy and defence equipment from the US when he meets with US President Trump next week, according to Indian officials cited by Bloomberg. Indian LNG buyers are said to be in talks for more US supply ahead of Indian PM Modi's trip to the US, according to Bloomberg. -

Japan: Japanese PM Ishiba expressed optimism on Sunday that Japan could avoid higher US tariffs as noted that President Trump had "recognised" Japan's huge investment in the US and the American jobs that it creates.

TARIFF PAUSES (for 30 days)

CANADA

-

Tariff Pause: US tariffs on Canada paused for 30 days to allow for economic deal negotiations. -

Canadian PM Trudeau’s Response: Had a “good call” with Trump, Canada to send 10,000 troops to secure the Northern Border, Canada will appoint a "fentanyl czar". -

Trump's Comments (Via Truth Social): "Tariffs announced on Saturday will be paused for a 30 day period to see whether or not a final Economic deal with Canada can be structured".

PRIOR REPORTS

-

Retaliation: 25% tariffs on CAD 155bln of US goods; CAD 30bln in tariffs effective Feb 4th, remainder (CAD 125bln) in 21 days. -

USMCA: Canadian PM Trudeau said the US tariffs violate the USMCA trade deal. -

Further measures: Canada considering non-tariff measures, including minerals & energy procurement. -

Transition Clause: Tariffs won’t apply to goods in transit. -

Domestic Economic Impact: Canadian official said countermeasures will impact the Canadian economy, but a plan is in place.

MEXICO

-

Tariff Pause: Tariffs on Mexico paused for 30 days to allow for economic deal negotiations. Tariffs could still be imposed if Mexico does not follow through -

Mexican President Sheinbaum's Response: Mexico will deploy 10,000 troops to its northern border to help stop fentanyl trafficking. US will increase efforts to block firearms from flowing into Mexico. Bilateral talks on trade & security to begin, led by US Secretary of State Marco Rubio. -

Trump's Comments (on Truth Social): Had a "very friendly conversation" with Sheinbaum.

PRIOR REPORTS

-

Retaliation: Ordered retaliatory tariffs against the US, will release details today (Monday 3rd February). -

Domestic Economic Impact: US tariffs will have a great economic impact on both countries. Confirmed ‘Plan B’ is underway in response to US tariffs. -

Dialogue: Stated tariffs won’t solve problems, only dialogue will. -

Prior sources: On Jan 29th, Reuters sources suggested Mexico is to apply tariff and non-tariff measures in defence, potentially ranging from 5% to 20%, on agricultural products as well as manufactured steel and aluminium. Sources added that retaliatory tariffs would initially exempt the automotive industry.

HOUSE VIEWS (Updated 10th Feb 2025)

Morgan Stanley:

- "Equity investors should consider new pressures on supply chains. There’s evidence that in recent years companies have invested in supply chain realignment to avoid rising trade and compliance costs."

- "It may be particularly challenging in sectors such as IT Hardware, Autos, and in some Consumer sectors. However, it could be a boon for the US Industrial sector,"

Goldman Sachs:

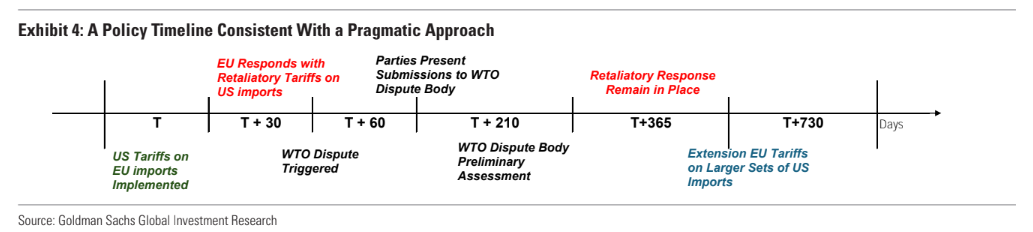

- We "expect that EU retaliation would begin by raising tariffs on US goods across a few key products equivalent to about 50% of the value of EU exports affected by US tariffs to avoid a sharp escalation."

- "we expect a similar cross-sector distribution of EU tariffs on US imports, starting with metals, agricultural products, and some transport equipment (boats and vehicles), and possibly extending to chemicals and aircraft."

- "In line with the 2018 precedent, we expect the European Commission to publish a list of additional US goods, whose value would match the full amount of EU exports affected by US tariffs, that would be subject to EU tariffs at a later stage should the US not show any cooperation."

- "In any case, we anticipate that the EU would not introduce a second round of tariffs for the next two years, or earlier in the unlikely event that the WTO Dispute Settlement Body issues a sentence sooner (Exhibit 4)."

11 Feb 2025 - 09:29- MetalsResearch Sheet- Source: Newsquawk

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts