[ROLLING ANALYSIS] Trade/Tariff update; Risk on as US and China agree to cut reciprocal tariffs by 115ppts each

*Re-upping headline for US traders

THE LATEST

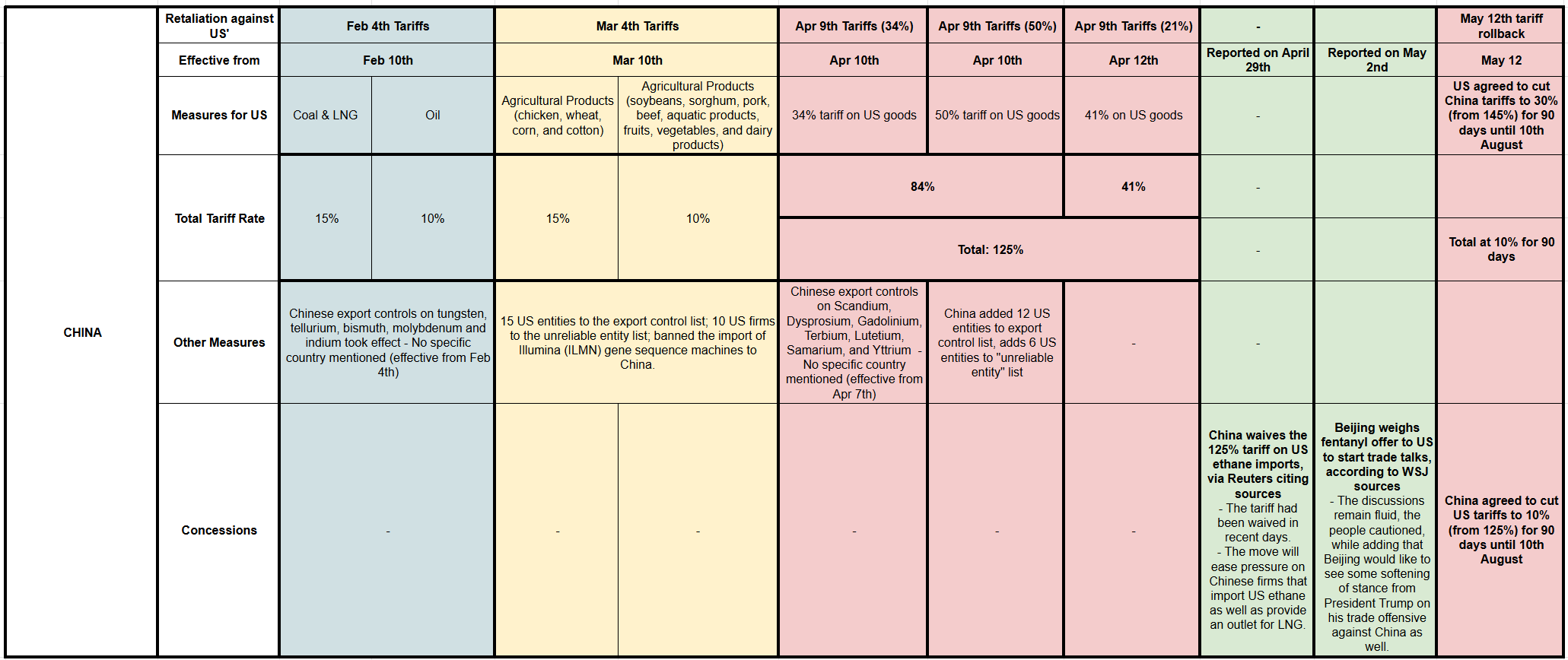

CHINA:

US-CHINA JOINT STATEMENT ON TRADE

- US to cut tariffs of Chinese goods to 30% from 145% for 90 days; China to cut tariffs on US goods to 10% from 125% for 90 days.

- US will modify the application of rate of duty on articles of China by suspending 24ppts of that rate for an initial period of 90 days.

- US will retain the remaining rate of 10% on those articles; China to retain the remaining ad valorem rate of 10% and remove modified rate.

- Talks may be undertaken on an alternating basis in China and the US ahead, or with agreement in a 3rd party.

- Committed to a process of further talks.

US STATEMENT

- US Treasury Secretary Bessent says they have come to an agreement on a 90-day pause and substantially moved down tariff levels. Both sides on reciprocal tariffs will move down by 115ppts.

- US Treasury Secretary Bessent says neither the US or China want to decouple.

- US says US and China may conduct working level consultations on relevant economic and trade issues.

- USTR Greer says both sides committed to the 90-day pause period. Effective embargo was not a sustainable practice for both sides. Final result is very good for the US and China.

-

USTR Greer says Fentanyl issue remains unchanged as it stands, on a positive track, having very constructive conversations. Constructive path forward for a positive conversation with the Chinese. - US Treasury Secretary Bessent says US would like to see China more open to US goods; US thinks there is a possibility of purchase agreements to bring bilateral trade deficit into balance; Have a good mechanism to avoid an unfortunate escalation occurring again.

- US Treasury Secretary Bessent says there was no discussion on currency with China.

CHINA'S STATEMENT

- Commerce Ministry says it is to suspend 24% of additional ad valorem tariffs for an initial period of 90 days on trade talks with the US; says it will retain the remaining additional ad valorem rate of 10%; Very good personal interactions.

- China will adopt all necessary administrative measures to suspend or remove the non-tariff countermeasures taken against the United States since April 2.

- China says two sides will establish a mechanism to continue discussions about economic and trade relations.

- Parties commit to take the actions by May 14.

- Parties will establish a mechanism to continue discussions about economic and trade relations.

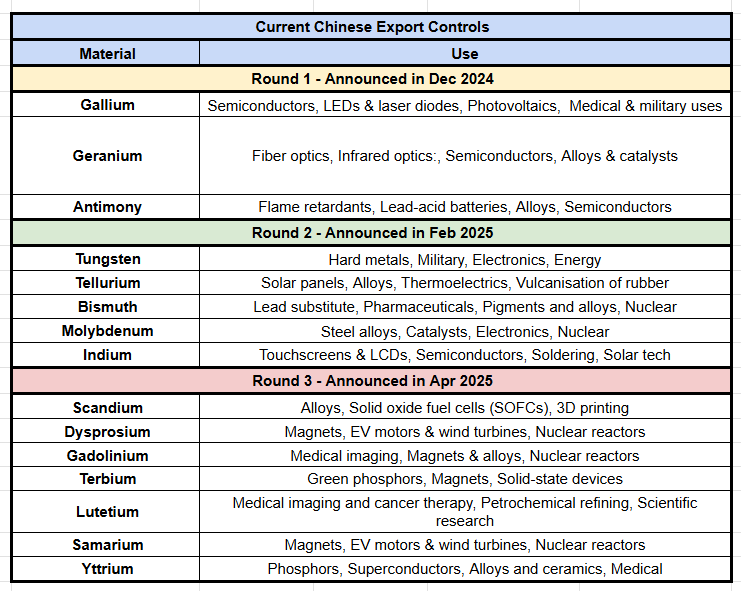

- Beijing has also agreed to pause or remove all non-tariff countermeasures imposed since April 2 - including the addition of some US firms to sanctions lists and export controls on some critical minerals.

OTHERS

- Reuters calculates that the China announcement will see them set tariffs on US goods at 10%; via the suspension of additional 24% tariffs for a 90-day period and remove the additional 91% tariffs.

- China Commerce Ministry says it held a meeting on strengthening full-chain control of strategic mineral exports.

- US Treasury Secretary Bessent the UK and Switzerland have moved to the front of the queue; EU is much slower.

- US-China trade deal does not cover "de minimis" exemptions for e-commerce firms, according to sources cited by Reuters. NOTE: The earlier announced US-China trade deal focussed on reciprocal measures as opposed to sector-specific tariffs.

MARKET REACTION: Following the US-China joint statement, which hit at 08:00BST/03:00ET, risk on reaction occurred immediately and has continued since with briefings by both sides ongoing.

Immediate Reaction

- DXY spiked higher from 100.68 to 100.89, then to 101.02 over the course of five minutes.

- USD/JPY spiked higher from 146.08 to 146.50, then to 146.73 over the course of five minutes.

- USD/CNH fell from 7.2155 to 7.1988, the stabilised

- ES Jun'25 spiked higher from 5767 to 5826, then to 5833 over the course of five minutes.

- Euro Stoxx 50 spiked higher from 5337 to 5373, then 5405 over the course of five minutes.

- UST Jun'25 fell from 110-13+ to 110-08 before stabilising.

- XAU/USD fell from USD 3278/oz to 3257, then 3250 over the course of five minutes.

- WTI Jun'25 spiked higher from USD 61.93/bbl to 62.44, then 62.49 over the course of five minutes.

25/30 minutes later

- DXY as high as 101.42

- USD/JPY as high as 147.47

- ES Jun'25 as high as 5849

- Euro Stoxx 50 as high as 5406

- XAU/USD as low as USD 3218/oz.

- WTI Jun'25 as high as USD 63.41/bbl

WEEKEND HEADLINES

- US Treasury Secretary Bessent to provide a briefing on US-China talks at 08:00BST/03:00ET, via Bloomberg.

- US President Trump said there was a very good meeting with China on Saturday and many things were discussed and much agreed to, while he stated a total reset was negotiated in a friendly but constructive manner.

- Trump also said great progress was made and they want to see for the good of both China and the US, an opening up of China to American business.

- USTR Greer said differences are not as great as previously thought, and Treasury Secretary Bessent said he looks forward to sharing details on Monday morning.

- Chinese Vice Premier He Lifeng said trade talks were constructive and they made substantive progress, while both sides reached an important consensus and agreed to establish a China-US trade consultation mechanism with a joint statement to be issued on May 12th.

- Furthermore, Chinese Vice Premier He Lifeng said the atmosphere was candid, in-depth and constructive, and noted that the nature of relations is mutual win-win, and they are going to provide more certainty and stability in the world economy.

-

Chinese Vice Commerce Minister Li Chenggang said any deal to be reached will be in China’s development interest and that they reached an important consensus with the two sides to have regular contact, while Li added that they are not in a position to release more substance on what they agreed on and declined to answer when asked about the timing of the statement but said it will be good news for the world.

BROADER TARIFFS

- White House Economic Adviser Hassett said the Chinese are ‘very, very eager’ to engage in trade talks and rebalance trade relations with the US, while he added that more trade deals could be coming as soon as this week.

- White House Economic Adviser Hassett said Commerce Secretary Lutnick briefed him about 24 deals that Lutnick and USTR Greer are working on, according to Fox News Sunday Morning.

- US President Trump’s administration opened a Section 232 investigation on whether imports of aircraft, engines and components are a threat to national security, while the Commerce Department is also investigating the impact of imported medium-duty and heavy-duty trucks on national security.

PHARMA

- US President Tump posted that he will sign an executive order on Monday at 09:00EDT with prescription drug and pharmaceutical prices to be reduced almost immediately by 30%-80% and the US is to pay the same price as the nation that pays the lowest price anywhere in the world."

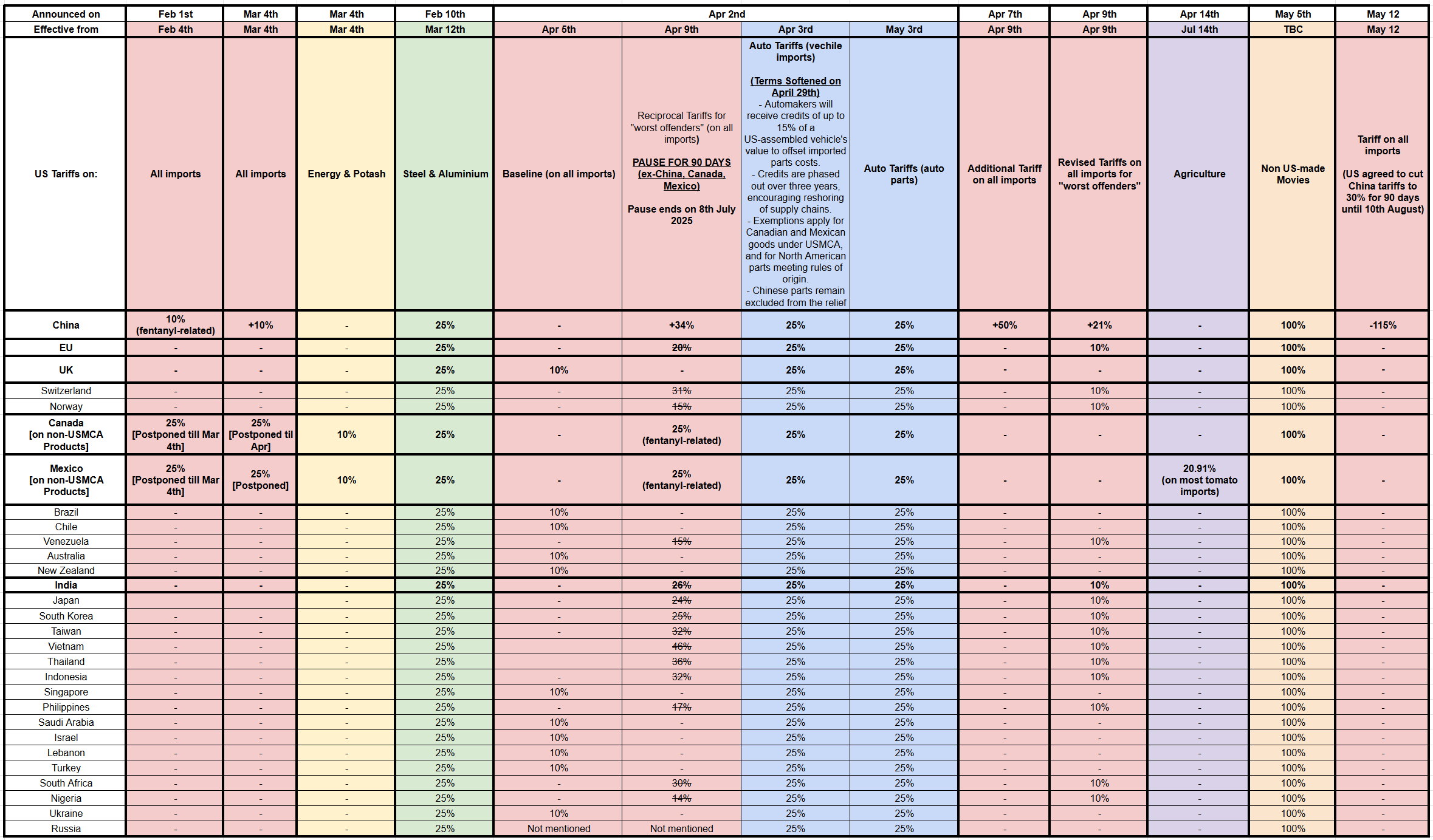

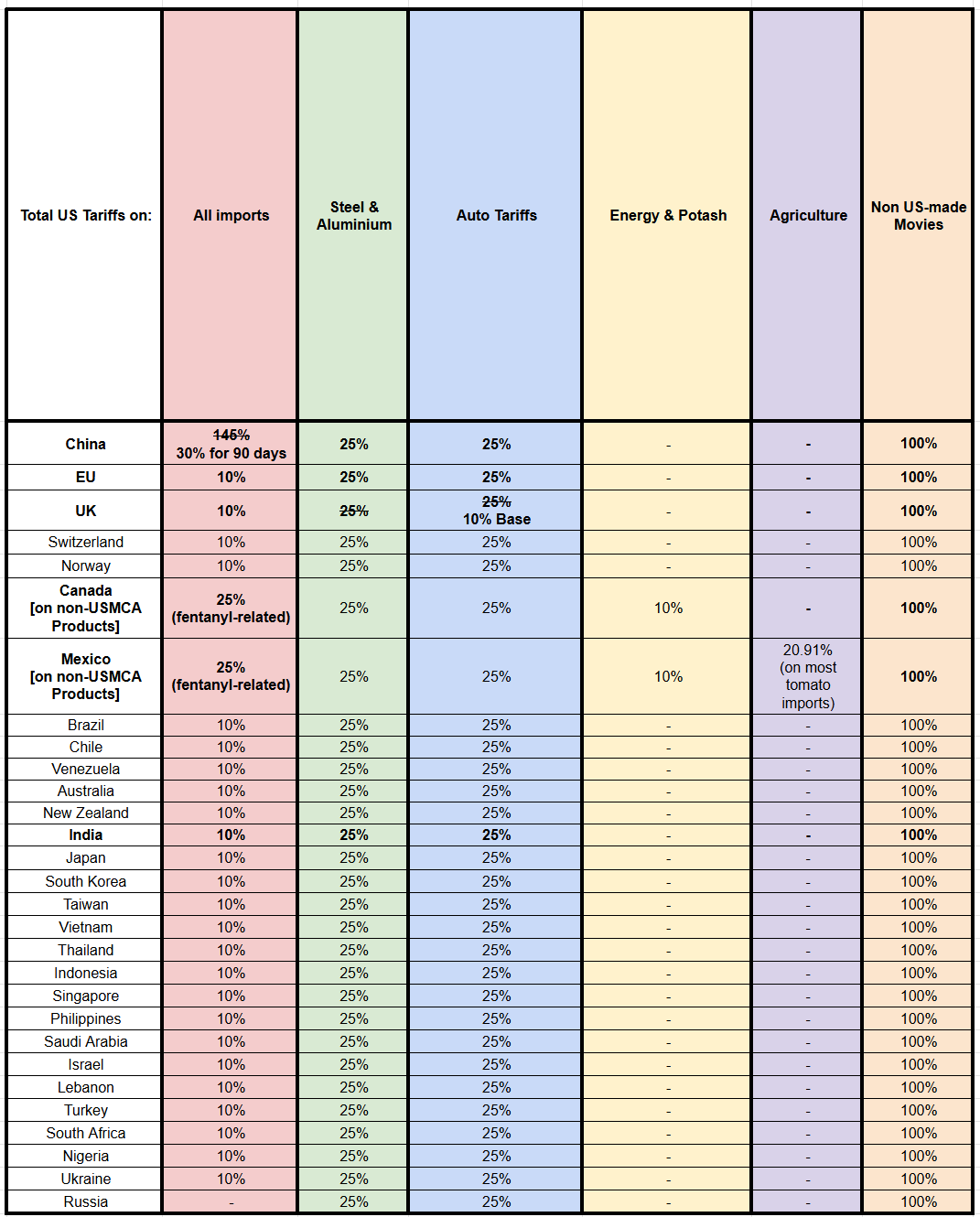

TARIFF BREAKDOWN [UPDATED]

TARIFF TIMELINE [UPDATED]

-

February 1st - Trump signed an executive order to impose 10% tariffs on all imports from China and 25% on imports from Mexico and Canada starting Feb 4th. -

February 3rd - Trump agreed to a 30-day pause on tariffs against Canada and Mexico. -

February 4th - US additional 10% tariff on China on top of existing levies came into effect. Chinese export controls on tungsten, tellurium, bismuth, molybdenum and indium took effect (no specific countries mentioned). -

February 10th - Chinese tariffs against the US took effect (15% tariffs on US coal & LNG, 10% tariffs on US oil). -

February 13th - Trump signed his plan for reciprocal tariffs, albeit delayed the implementation. -

March 4th - Tariff pause on Mexico and Canada expired; Additional 10% tariffs on China went into effect on top of Feb 4th tariffs. Canada announced retaliatory tariffs over 21 days, Mexico said it will also respond with retaliatory tariffs. -

March 5th - Trump allowed a one-month exemption on Mexico and Canada tariffs of US automakers following talks with Ford (F), General Motors (GM) and Stellantis (STLAM IM/STLAP FP) -

March 6th - Trump postponed the initial 25% tariffs on several imports from Mexico and some imports from Canada for a month. In response, Canada suspended its second wave of retaliatory tariffs. -

March 10th - China's retaliatory tariffs on certain US agricultural imports (15% on US chicken, wheat, corn, and cotton; 10% on US soybeans, sorghum, pork, beef, aquatic products, fruits, vegetables, and dairy products) went into effect; announced on March 4th in response to the extra 10% US tariff on top of Feb 4th tariffs. -

March 11th - Trump threatened 50% tariffs on Canada, although he later backed down from this threat after Ontario's Premier announced they are suspending the 25% surcharge on exports of electricity. Trump separately suggested tariffs may go higher than 25% but did not specify which tariffs. -

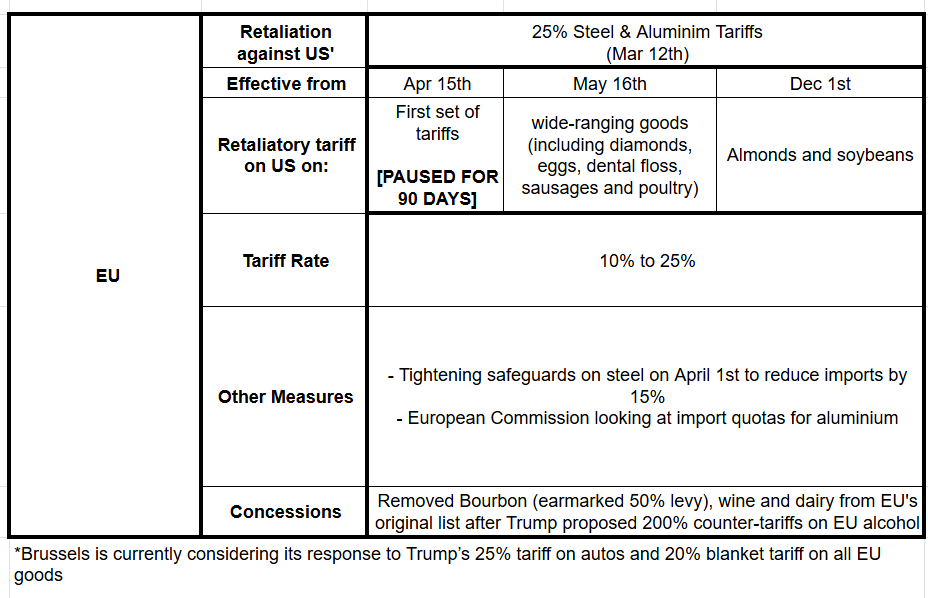

March 12th - 25% tariff on steel and aluminium imports came into effect, with "no exceptions or exemptions"; European Commission launched countermeasures on US imports while it is putting forward a package of new countermeasures. -

April 1st - Completion of the US trade policy review. -

April 2nd - US Liberation Day; Baseline Tariff on 10% announces + retaliatory tariffs for worst offenders. -

April 4th - China announced 34% reciprocal tariffs against US' "Liberation Day" levies; China announced further export controls on rare metals. -

April 5th - Deadline for US-China TikTok deal; European Commission expected to finalised its proposed response to the US. -

April 7th - EU Commission proposed 25% tariff on US goods to take effect from May 16th and some on Dec 1st. -

April 7th - US President Trump threatened an additional 50% levy on China on top of the post-"Liberation Day" 54% tariff. -

April 9th - EU members vote on countermeasures to US steel and aluminium tariffs; reciprocal tariffs came into effect alongside 104% tariff on China. -

April 10th - China's 84% levy on US goods came into effect -

April 10th - EU suspended retaliation to US steel and aluminium tariffs for 90 days. -

April 11th - China raised 84% levy against the US to 125%. -

April 11th - US exemption announced for semiconductors. -

April 12/13th - White House clarifies chip tariffs are decoupled from reciprocal tariffs; Trump warned no country would be getting "off the hook". -

April 24th - US-South Korea trade talks at 08:00EDT/13:00BST. -

April 30th - Japanese Economic Minister Akazawa plans to visit the US for tariff talks. -

May 1st - UK deadline for consultation on potential retaliatory tariffs. -

May 2nd - De Minimis trade loophole ends. -

May 6th - UK reached free trade agreement with India; India to cut tariffs on 90% of UK imports, with 85% of those becoming tariff-free within decade; India to halve whisky and gin tariffs for UK imports to 75%, cut auto tariffs to 10% under a quota. -

May 6th - US and Canada had "constructive" talks. -

May 8th - UK/US trade agreement announced. -

May 9th - Chinese Vice Premier He Lifeng to visit Switzerland (May 9th-12th). -

May 10th/11th - US Treasury Secretary Bessent met with the Chinese trade team on Saturday in Switzerland. -

May 12th - Chinese Vice Premier in France for economic and financial dialogue (May 12-16th). - May 12th - US agrees to cut China tariffs to 30% (from 145%) and China agrees to cut US tariffs to 10% (from 125%).

-

May 19th - EU-UK summit in London. -

May - Potential US semiconductor tariffs. -

May/June - Potential US pharmaceutical tariffs. -

July 8th - 90-day tariff lowering for "worst offenders" expires. -

July 14th - US tariffs on Mexican agriculture goes into effect. - August 10th - US-China tariff relief expires.

12 May 2025 - 11:50- ForexGeopolitical- Source: Newsquawk

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts