Primer: Quarterly Refunding due Wednesday 5th February 2025 at 13:30GMT/08:30EST.

FINANCING ESTIMATES: The US Treasury announced it expects to borrow USD 815bln in privately-held net marketable debt in Q1 25, below the USD 823bln that was guided for Q1 25 in Q4 24. This is primarily due to a higher beginning-of-quarter cash balance but partially offset by lower net cash flows. The borrowing forecast assumes an end-of-March cash balance of USD 850bln, in fitting with prior guidance. For Q2 25 (April-June), US Treasury expects to borrow USD 123bln in privately-held net marketable debt, assuming end of June cash balance of USD 850bln - the drop in borrowing expectations in Q2 is familiar for the period due to the influx of cash receipts from the April tax date. Meanwhile, looking back to Q4 24, the US Treasury announced it borrowed USD 620bln, USD 74bln above its USD 546bln guidance, largely because of lower net cash flows and a higher ending cash balance. It ended Q4 24 with a cash balance of USD 722bln, above the guidance of USD 700bln.

QUARTERLY REFUNDING: The quarterly refunding announcement will take place on Wednesday, February 5th. At the prior refunding, the Treasury maintained its guidance that the "Treasury does not anticipate needing to increase nominal coupon or FRN auction sizes for at least the next several quarters." Whether this guidance is maintained will once again be the focus of the upcoming refunding. We will also get the updated buyback schedule, last quarter it said it expects to purchase up to USD 30bln for liquidity support and USD 22.5bln for cash management purposes for Q4, so we will be looking to see if these sizes are maintained or adjusted. However, one wild card in the quarters ahead will be any spending implications from US President Trump's policies, while we also have a new Treasury Secretary, Scott Bessent. However, Bank of America expects the announcement to be relatively uneventful despite the change in leadership, as they do not expect Bessent to make any significant shifts at his first quarterly refunding meeting. The desk expects the Treasury to hold nominal auction sizes constant at the Feb refunding, and expect nominal coupon auction sizes holding steady through FY25 and the first coupon increase in November 2025. Any shift in language, potentially to the "next couple quarters", or a complete removal of the language entirely, would signal an earlier increase in coupon sizes vs. BofA's November 2025 base case.

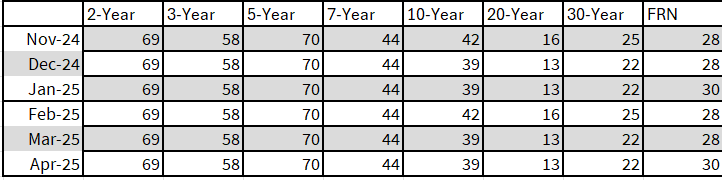

Nominal coupon and FRN financing:

Assuming the prior guidance remains true, auction sizes are likely to be left unchanged, with the upcoming supply expected to look like the image below.

TIPS

Within TIPS issuance, focus will be on whether the guidance is maintained that the "Treasury believes it would be prudent to continue with incremental increases to TIPS auction sizes in order to maintain a stable share of TIPS as a percentage of total marketable debt outstanding". In Q4, the Treasury maintained the November 10yr TIPS reopening at USD 17bln, but increased the December 5yr and January 10yr reopenings by USD 1bln each to USD 22bln and USD 20bln, respectively.

Bills

The prior refunding saw the Treasury maintain offering sizes of benchmark bills through November, but expected one or two CMBs to meet cash management needs at the time in late November. It then expected modest reductions to short-dated bill auction sizes in December, before increasing them again in January. One wildcard to be aware of is US Treasury Secretary Bessent's preference for using longer-dated bonds to meet financing needs as opposed to shorter-dated bills. WSJ highlights that Bessent, on 10th November, argued the Treasury had “distorted Treasury markets by borrowing more than USD 1 trillion in more expensive shorter-term debt compared with historical norms", adding “terming out that debt in favor of a more orthodox borrowing profile may increase longer-term interest rates and will need to be deftly handled". Nonetheless, WSJ highlights that Citi analysts argued that fiscal pressures would push Bessent to accept a T-bill share as high as 25%, while Goldman Sachs expect increases to Treasury issuance in November, bringing down the share of T-bills to 20% by end of 2026.

Looking ahead, Bloomberg write that the Treasury may be able to maintain current level of gross coupon security issuance through FY25 as auctions will provide over USD 1.74tln of net money to the government. Bloomberg expect the funding need for fiscal 2025 is about USD 2tln, and the desk suggest that T-bills outstanding will need to rise by just under USD 300bln for the fiscal year.

04 Feb 2025 - 17:00- Fixed IncomeResearch Sheet- Source: Newsquawk

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts