[PREVIEW] Japan Snap Election on Sunday, 8th February 2026: PM Takaichi's LDP expected to win

- Japanese PM Takaichi called a snap election for the 8th of February. Aiming to capitalise on her high approval rating and extend LDP’s slim majority in the Lower House, which would allow her to pass policy with less friction.

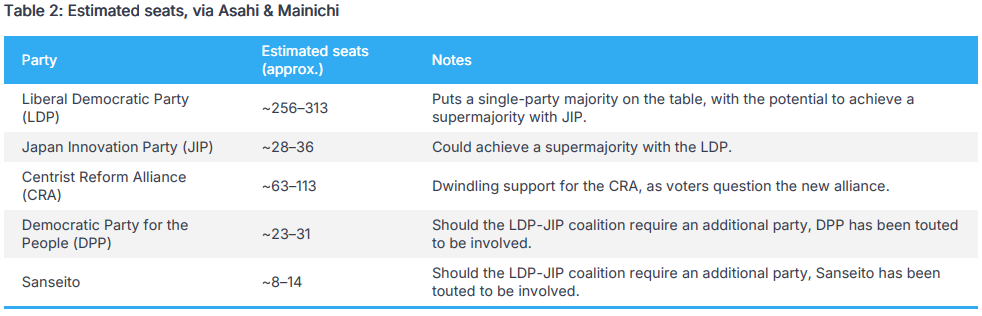

- A recent poll (Feb 2) via Asahi shows that the ruling coalition could secure more than 300 seats, far surpassing the 233 required for a simple majority; putting the LDP-JIP partnership on course to potentially secure a two-thirds 'super' majority (310 seats). Note, should the LDP-JIP secure a two-thirds majority, it can override the Upper House to pass legislation.

- Exit polls are typically released within minutes of polls closing (20:00 JST / 11:00 GMT / 06:00 EST), while a large share of single-member district results are reported within the following 2–4 hours.

- An LDP victory would, in theory, spur upside in Nikkei 225, and pressure the JPY & JGBs. Though, the near-term impact may be limited as Takaichi will likely push the current Budget through quickly, without changes.

- Election outcome aside, focus will be on the consumption tax. A pause could hit Japan’s fiscal position, with desks mixed on the impact. Mizuho cautions that “it would be wise for investors to prepare for JGB market turmoil”.

TLDR

- 2nd of February polling via Asahi showed that the ruling coalition could secure more than 300 seats, far surpassing the 233 required for a simple majority; putting the LDP-JIP partnership on course to potentially secure a two-thirds majority of 310 seats.

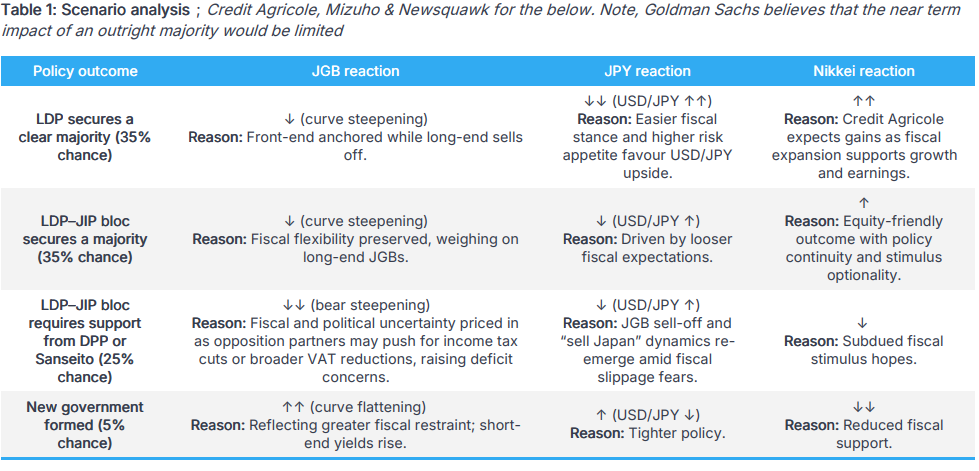

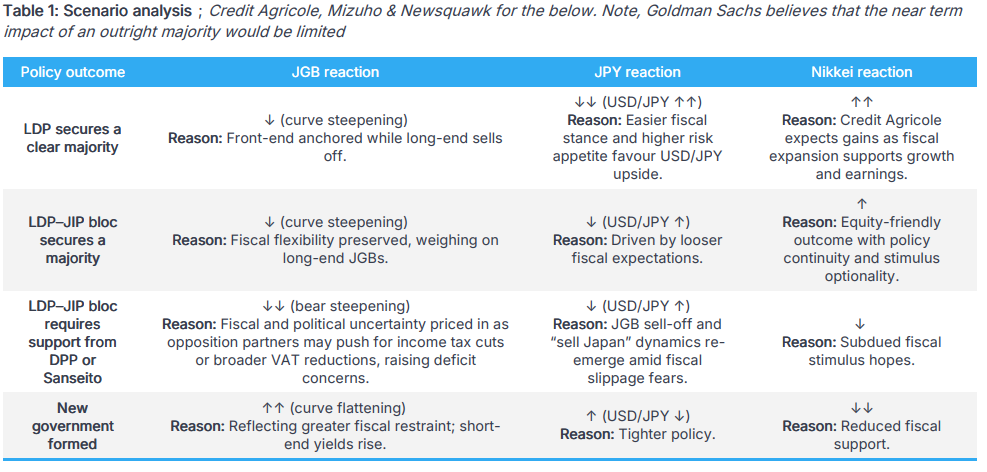

- Under a LDP victory, the immediate market reaction is expected to see a steepening of the JGB yield curve, as it would potentially give the PM scope to pursue expansionary fiscal policies. Credit Agricole expects gains in the Nikkei and USD/JPY alongside curve steepening. If the LDP-JIP bloc requires support from another party, most likely the DPP or Sanseito, fiscal and political uncertainty could be priced in, as opposition partners may push for income tax cuts or broader VAT reductions, potentially triggering a deeper sell-off in JGBs. Should the LDP lose, a new government would likely prompt a flatter yield curve and JPY strength, reflecting the prospect of greater fiscal restraint than under Takaichi and a higher tolerance for BoJ rate hikes. Credit Agricole expects this to lift short-end yields and flatten the JGB curve.

- Further out, focus will be on developments around the foodstuffs tax. Mizuho outlines two scenarios related to this. In one scenario, the bank suggests the LDP could defer or limit the tax cut to a level that can be funded without new issuance, limiting the impact on JGBs. However, should the government force through the consumption tax cut, then Mizuho suggests “it would be wise for investors to prepare for JGB market turmoil potentially exceeding that observed on 20 January, when interest rates experienced a historic surge”.

- In essence, a stronger LDP victory would give Takaichi greater scope to pursue expansionary fiscal policy. Analysts at Goldman Sachs said the near-term impact of an outright majority would be limited, as Takaichi is likely to pass the existing budget largely unchanged, with scope to lift spending in the second half of 2026. On monetary policy, recent political developments are likely to further complicate the outlook for the BoJ. Money markets currently price a roughly 53% chance of a rate hike in April and fully price in a move by July. The actual impact on the BoJ is difficult to gauge and may be limited, given the Bank’s focus on spring wage negotiations and inflation trends. But an outright Takaichi victory could weigh on the JPY, a concern raised by BoJ members at the January meeting.

Background: Takaichi calls a snap election aiming for a larger majority to aid her fiscally expansive policy agenda

On 21st October 2025, Sanae Takaichi was elected Japan’s first female prime minister, a victory that followed former PM Ishiba’s gamble to call a snap election to secure legitimacy as a new leader amid a party corruption scandal. Takaichi has the same aim: to capitalise on her high approval rating and extend her slim majority in the Lower House, which would allow her to pass policy with less friction and ease fiscal deliberations.

Takaichi is widely seen as an Abenomics-aligned conservative, advocating loose fiscal and monetary policy. Since taking office, she has pledged to tackle the rising cost of living and boost defence spending, made possible after Japan’s cabinet approved a JPY 21.3tln economic stimulus package, with about JPY 11.7tln funded by fresh debt.

Japan’s parliament (National Diet) consists of the House of Representatives (Lower House) and the House of Councillors (Upper House). The Lower House has 465 seats and the Upper House 248. At the time of dissolution, the Lower House was comprised of; LDP with 199 seats, the CDP and independents with 148, and the Japan Innovation Party with 35, with the remainder held by smaller parties. In the Upper House, the ruling coalition holds a minority, and GS expects seats to remain largely unchanged until the next Upper House election in 2028, barring a realignment. As a result, some measures would require approval from both chambers, meaning Takaichi may need to make concessions on parts of her agenda, including the Consumption Tax Act. Do note that should the LDP-JIP secure a two-thirds majority, it can override the Upper House to pass legislation.

Markets have been highly volatile since Takaichi’s appointment. Initially the so-called “Takaichi trade” occurred, with JGBs and the JPY falling while Japanese equities surged. Since then, the JPY is now near-enough unchanged (following recent rate checks/potential intervention), whilst fiscal concerns have led to considerable upside in JGB yields – notably, the 40yr yield soared to record highs. Elsewhere, the Nikkei 225 caught a bid on pro-growth policy expectations.

Intervention risks remain. In recent weeks, the JPY has been highly volatile, with USD/JPY slipping from around 159.40 to around the 153.00 mark, despite a lack of clear catalysts. On Friday the 23rd of January, it was reported that the New York Fed conducted a rate check on USD/JPY while acting as fiscal agent for the US Treasury, sharpening focus on potential intervention by Japanese and/or US authorities in the JPY and/or JGBs. Subsequently, US Treasury Secretary Bessent clarified that the United States is not currently intervening in USD/JPY.

Polling: Polls suggest LDP could secure a lone simple majority and potentially secure a two-thirds supermajority

Approval ratings for each party are discussed in more detail below, but in brief the LDP leads at about 30%, followed by the CDP on 9.9% and the Japan Innovation Party on 6.6%. Initial surveys showed waning support for the prime minister, but sentiment has since shifted to suggest the LDP is on course to win more seats, with the potential to secure a simple majority on its own. A recent Yomiuri poll showed the LDP winning around half of the 289 single-seat constituencies, while a Nikkei survey put the figure at about 40%, though the Nikkei cautioned that races are close and trends could shift as the election approaches. Polls also show the CRA struggling to gain traction, with the newly formed party expected to lose seats. Mizuho writes that Takaichi’s popularity should translate into an LDP advantage, potentially lifting its seat count enough to secure a single-party majority.

A recent poll (Feb 2) via Asahi shows that the ruling coalition could secure more than 300 seats, far surpassing the 233 required for a simple majority, putting the LDP-JIP partnership on course to potentially secure a two-thirds majority (310 seats).

Parties: LDP-JIP were the ruling coalition at the point of dissolution; main opposition parties CDP-Komeito formed the CRA, but support for them is dwindling

Liberal Democratic Party (LDP): The LDP is Japan’s dominant conservative party and a mainstay of national politics. It is currently led by Prime Minister Takaichi, who is pro-business and fiscally expansive. Her conservative stance reflects support for traditional family structures, a hawkish view on China and a cautious approach to immigration, with the latter two seen as underpinning her strong approval ratings. No major poll has put her approval below 60%, with several reporting figures above 70%. A recent Nikkei poll showed her approval dipping below 70% for the first time since October, while 56% said they did not believe her stimulus package was sufficient to address rising costs. It is interesting to note that her personal popularity has not quite translated into support for her party – approval rating for the LDP sits at around 30%, but well above every other party.

Japan Innovation Party (JIP): The JIP was invited by LDP’s Takaichi to form a coalition after the former coalition with Komeito broke down, reportedly over reforms on funding. The JIP is led by Osaka Governor Yoshimura and businessman Fujita; the Group leans further right than Komeito, and is self-branded as a reform party. Before dissolution the party held 35 seats, giving the LDP-JIP coalition a 234-seat total – recent polling via Asahi TV places the group in third place (6.6%).

Centrist Reform Alliance (CRA): After early reports that Takaichi was considering a snap election, the leaders of the CDP and Komeito formed the Centrist Reform Alliance. The newly created party has said it aims to deliver sustained wage growth and a broader distribution of the gains from economic growth, and advocates the complete abolition of taxes on foodstuffs. The merged group held 172 seats in the House of Representatives at the time of dissolution. The Economist has described its leaders, Noda and Tetsu, as “political dinosaurs”, a characterisation that could hinder appeal from younger voters. Mizuho said voters do not appear to have high expectations for the party.

Constitutional Democratic Party (CDP): The CDP is viewed as centre-left and liberal, favouring targeted spending while prioritising fiscal discipline. It holds progressive positions on social issues and takes a less confrontational approach towards China. A recent Asahi TV poll placed the CDP in second place with support of 9.9%, compared with 36.7% for the LDP. The party is led by Yoshihiko Noda, who has recently argued that the LDP’s proposed consumption tax cut is too slow, saying it could be implemented by autumn 2026.

Komeito Party: Komeito is widely seen as a centrist party, favouring targeted spending over broad fiscal expansion and emphasising debt sustainability. It focuses on social welfare and advocates strong ties with allies such as the United States and China. Recent Asahi TV polling places the party fifth, with support of 3.9%. The party is led by Saito Tetsuo.

Others: The Democratic Party for the People (DPP) is viewed as centre-right, with Asahi TV approval polling placing it fourth on 6.5%. Elsewhere, the Do it Yourself Party (Sanseito) is a nativist right-wing group that positions itself against “globalist” forces and has led debate on issues such as immigration and foreign tourism.

Voting process

Heading into the election, all 465 seats are up for grabs, which means a simple majority can be achieved by holding 233 seats. Japan uses a mixed electoral system: about 60% of members are elected in single-seat constituencies under a first-past-the-post system, with the remainder chosen via proportional representation from party lists. On polling day, voters receive two ballots – one for a district candidate and one for a party – with votes then tallied and results typically announced later in the evening or overnight.

In more detail, polls open at 07:00 JST (22:00 GMT / 17:00 EST, previous day) and close at 20:00 JST (11:00 GMT / 06:00 EST), with some rural polling stations closing earlier. Exit polls are typically released within minutes of polls closing, while a large share of single-member district results are reported within the following 2–4 hours. By around midnight JST (15:00 GMT / 10:00 EST), markets usually have a strong indication of the election outcome.

Voter concerns: Focus on rising cost-of-living and tax

Key voter concerns have centred on the cost-of-living crisis, prompting Takaichi to outline plans to end the 8% sales tax on foodstuffs, though it is unlikely to be fully abolished as it generates about JPY 5tln/yr for the government. Mizuho said the move would directly benefit the average household by roughly JPY 5.7k/month. Beyond the economy, immigration has become an increasingly salient issue, with the LDP losing support in July to the Sanseito party, which takes a hard line against immigration. Takaichi has repeatedly hinted at adopting a tougher stance, which could bolster her standing on polling day.

Calculated risk or betting madness?

Takaichi’s decision to call a snap election is widely seen as an “all or nothing” gamble, having pledged to resign if the ruling bloc loses its majority. Analysts have questioned the timing, as recent heavy snowfall could dampen voter turnout. Political analyst Murakami said low participation could hurt the LDP and be one reason Takaichi may regret the decision. Tomohiko Taniguchi, a former adviser to late prime minister Abe, said the move carries significant risk, adding that Takaichi is on “very thin ice”.

Analyst Jeffrey Kingston suggested that although it's “not a risk-free gamble”, he still expects Takaichi to win. He did note that “Komeito was a very effective election machine. About one-quarter of the seats that the LDP won in the last lower house election are owing to its collaboration with Komeito”. Other analysts, such as Kotaro Tamura, see a more favourable outcome for the PM, Tamura suggests that “she can win a landslide”, predicting the LDP to secure 270-280 seats. Credit Agricole opined that “with high approval ratings, the ruling coalition is expected to secure a stable majority and achieve victory”.

Election Outcome: LDP victory could spur an extension of the Takaichi trade, though some see limited impact

There are several potential outcomes following this election; a) LDP wins an outright majority, b) LDP wins a majority alongside their current partner JIP, c) LDP requires support from another opposition party to form a majority, d) LDP loses, most likely to the CRA. Credit Agricole assigns a 35% chance to both scenarios (a) and (b), 25% to (c) and a 5% chance of (d).

Heading into the election, the so-called “Takaichi trade” of a weaker JPY and JGBs alongside stronger equities has continued to play out. An outright majority, or an outcome that materially strengthens Takaichi’s position, may spur an extension of the trade, but ultimately be short-lived given the close proximity to the FY-end. Analysts at Mizuho said the “Takaichi trade” is likely to “gradually settle down”, noting signs that the prime minister is tempering her expansionary fiscal stance.

Under scenarios (a) and (b), the immediate market reaction is expected to spur upside in the Nikkei 225, whilst weighing on JPY/JGBs, as these outcomes would give the prime minister scope to pursue expansionary fiscal policies. Credit Agricole expects gains in the Nikkei and USD/JPY alongside curve steepening. If the LDP-JIP bloc requires support from another party, most likely the DPP or Sanseito, fiscal and political uncertainty could be priced in, as opposition partners may push for unfunded income tax cuts or broader VAT reductions, potentially triggering a deeper sell-off in JGBs. Under scenario (d), a new government would likely prompt pressure in the Nikkei 225 whilst JPY/JGBs gain, reflecting the prospect of greater fiscal restraint than under Takaichi and a higher tolerance for BoJ rate hikes. Credit Agricole expects this to lift short-end yields and flatten the JGB curve.

UBS sees scope for gains in Japanese equities if the LDP secures a single-party majority, adding that any immediate post-election selling would “present a buying opportunity for medium-term investors”. In an upside scenario, an LDP-JIP two-thirds supermajority could see the Topix reach 4,200 by December 2026, with analysts expecting the administration to pursue “unprecedented” pro-growth policies. Conversely, failure to secure a majority could complicate the passage of expansionary fiscal measures, potentially slowing growth and strengthening the JPY, which would weigh on valuations.

In essence, a stronger LDP victory would give Takaichi greater scope to pursue expansionary fiscal policy. However, analysts at GS said the near-term impact of an outright majority would be limited, as Takaichi is likely to pass the existing budget largely unchanged, with scope to lift spending in the second half of 2026. They added that if the LDP needs support from a different party beyond its current partner, the JIP, a provisional budget could include short-term upward revisions to ensure swift passage. In the event of an LDP defeat, GS expects the new government to have little time to make material changes in policy, resulting in a near-term rise in spending followed by a supplementary budget in the autumn.

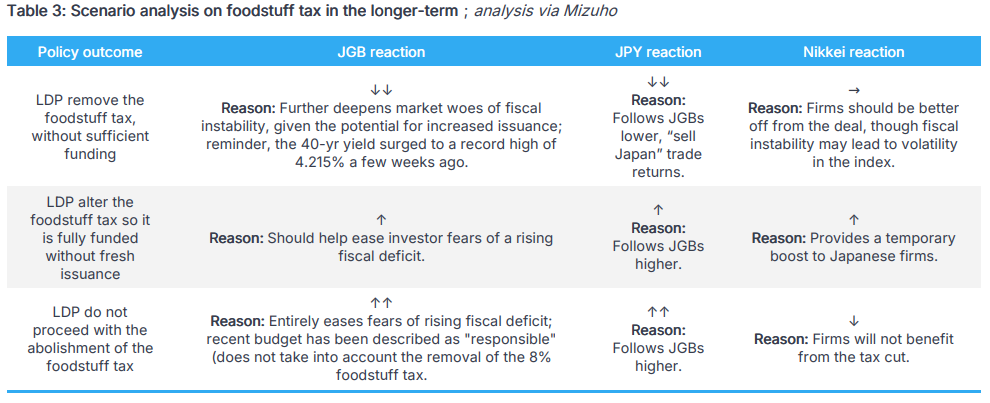

Removal of the foodstuffs tax may weigh on the fiscal landscape

While the above scenario analysis can be applied to the election outcome itself, desks remain concerned about the proximity to the fiscal year-end, which leaves limited time for deliberation, as well as uncertainty around the consumption tax and the supplementary budget.

Taking account of the stimulus package, Japan’s top economic council has forecast that the primary budget will fall into deficit this year, versus earlier projections for the first surplus in decades. The calculation does not factor in Takaichi’s plan to temporarily abolish the 8% tax on food. S&P Global warned the proposal could weaken government revenues and undermine public finances over the longer term. Mizuho described the budget as “responsible fiscal stimulus”, but said it would no longer qualify as such if the food tax were removed.

Mizuho outlines two scenarios related to the foodstuffs tax. As noted earlier, analysts have raised concerns over abolishing the 8% levy, arguing policymakers may be forced to rely on deficit-financing bonds. In one scenario, the bank suggests the LDP could defer or limit the tax cut to a level that can be funded, which would lessen the impact on JGBs. However, should the government enact its promises, then Mizuho suggests “it would be wise for investors to prepare for JGB market turmoil potentially exceeding that observed on 20 January, when interest rates experienced a historic surge”. Recently, Takaichi outlined that the abolishment would be done within FY2026, which in theory gives her until March 2027 to find funding for the policy. Mizuho adds that should the administration be able to fund the consumption tax without further issuance, the recent pressure on super-long JGBs may ease.

Political analysts suggest a January election could jeopardise passage of the FY26 budget before March, as Diet deliberations typically take place in the months leading up to the fiscal year-end. As a result, a provisional budget covering several months from April may be required.

On monetary policy, recent political developments are likely to further complicate the outlook for the BoJ. Money markets currently price a roughly 60% chance of a rate hike in April and fully price in a move by July. The actual impact on the BoJ is difficult to gauge and may be limited, given the Bank’s focus on spring wage negotiations and inflation trends. An outright Takaichi victory would give her greater scope to pursue expansionary fiscal policies and could weaken the JPY, a concern raised by BoJ members at the January meeting. Together, these factors could tilt inflation risks to the upside and prompt the BoJ to tighten faster than the expected two hikes a year. Conversely, an LDP loss could generate economic uncertainty, leading policymakers to delay tightening while assessing a supplementary budget later in the year. Analysts at GS write that risks are tilted to the upside for the BoJ, suggesting that should the JPY weakness continue to extend, policymakers may decide to bring forward a rate hike; GS currently pencils in a hike in July.

Conclusion

LDP is likely to win the election, with focus ultimately on how much it can strengthen its position in the Lower House. A two-thirds supermajority would give PM Takaichi the ability to push legislation through, without the approval of the Upper House.

There are mixed views amongst desks related to the market reaction of an LDP victory, with some seeing an extension of the Takaichi trade, whilst others see limited action in the short term. Some volatility could be expected surrounding discourse on the foodstuffs tax and/or the supplementary budget. In the case that the foodstuffs tax cut is enacted without sufficient funding, JGBs may come under considerable pressure.

04 Feb 2026 - 13:50- MetalsResearch Sheet- Source: Newsquawk

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts