PREVIEW: French Legislative Election; Round One 30th June & Round Two 7th July

To download the report, please click here If you would like to subscribe to receive the research sheets directly in your inbox, you can now do so under the Research Suite section of the portal. To subscribe simply check the box next to "Email these reports" under the desired category.

Summary

The most likely outcome after the two-round election is a continuation of the current political paralysis but with a reshuffle of the parliamentary makeup that would see the incumbent Ensemble/Renaissance coalition’s seats drop to 90-110 (current 245) while Rassemblement National (RN), with the support of LR, would increase to 250-280 (RN currently 89). In the National Assembly 289 seats are required for an outright majority. Political paralysis is seen as among the most market-friendly options at this point, as Macron would likely still be able to press ahead with some fiscal reform and the bringing of finances slowly in-line with EU rules. However, the expected parliamentary shift away from the centre will make it even more challenging than it currently is to pass necessary fiscal measures. The first round occurs on 30th June, results from 20:00BST/15:00ET onwards; focus at this stage will be on how many incumbent coalition MPs make it to the second round. This will provide insight into the scale of the shift away from the centre alongside the strength of RN-friendly LR. For the second round on 7th July, results from 20:00BST/15:00ET onwards. Here, the scale of RN’s success will be important with Citi highlighting that 250 seats or more will be perceived negatively by markets whereas a figure below this implies a continuation of deadlock and may be considered more positive.

Three Main Political Groups/Parties

As the European elections showed, France has seen a marked shift in its political backdrop, with an almost doubling of support for the main right-wing party RN. Following the election, a new left-wing coalition emerged, Nouveau Front Popular (NFP), which has overtaken Macron’s/Attal’s Ensemble/Renaissance coalition in the polls.

Rassemblement National (RN): Jordan Bardella

- Served as the largest single parliamentary opposition group in the existing parliament.

- Supports EU reform and is primarily focused on purchasing power, security and immigration.

- Policies generally align with interventionist/protectionist/nationalist views; previously supported tax and VAT cuts, for instance. Stance around spending cuts has moderated slightly, pledging to wait until an evaluation of public finances has occurred before making any significant changes i.e. around VAT, and to operate in-line with EU fiscal rules.

- Le Pen has pledged to work with Macron in the scenario that RN is victorious.

Nouveau Front Popular (NFP): Collective Leadership

- Formed after the snap election announcement by Macron.

- An extension of the New Ecological & Social People’s Unions (NUPES) alliance which formed in 2022 to oppose Macron and ultimately prevented Ensemble from attaining a majority.

- Focused on purchasing power and foreign policy/relations, seeks a minimum wage uplift.

Ensemble/Renaissance: Gabriel Attal

- Incumbent, allied with President Macron.

- Looking to cut spending by EUR 20bln in 2025, on-top of already announced 2024 reductions.

- Campaigning on the themes of “earning more” and “spending less”; outlined various measures to increase purchasing power, some easing of bonus/tax ceilings and job creation.

Voting System & Polls

The election is a legislative one and as such all 577 seats in the National Assembly (lower house) are involved, within this, 289 seats are required for a majority. As it stands, PM Attal leads the Ensemble coalition which has 248 seats and supports President Macron’s government but has had to rely on cross-party support to pass policies.

The election works across two rounds in each constituency, victory can occur at a constituency-level in the first round if a candidate secures over 50% of cast votes and at least 25% of all registered voters; meaning the participation rate is particularly important. If this bar is not hit, then a second round occurs where the leading candidates go forward alongside any others who attained the votes of at least 12.5% of registered voters.

As of 24th June, the Politico poll of polls showed: RN with 34%, NFP 28%, ENS 20%, LR 7%. For reference, LR here refers to the wing of the party which is not aligned with RN.

Note, projections onto second round seats are very sparse and often not representative of the final result but at their peak they had RN (plus friendly-LR) attaining around 280 seats i.e. 5 short of the majority threshold. On this it is worth noting that the extrapolation of other elections, i.e. the recent European Parliamentary elections, onto the legislative one is not generally a reliable guide into the eventual outcome.

First Round Considerations

The main points of consideration for the first round are: 1) to what extent Macron’s centrist-coalition is ‘squeezed’; 2) how well Les Republicans (LR) perform; 3) any alliance shifts or tactical partnerships.

- 1) The surge in polls for RN on the right and NFP on the left has resulted in a squeeze on Macron/Attal’s centrist coalition. Given the voting system in France, if the coalition’s candidates do not hit at least the 12.5% registered voter threshold then they cannot advance to the second round. As such, the extent of the ‘squeeze’ on polling day itself will provide insight into the theoretical maximum seats that Macron’s coalition can hang on to and by extent how significant the changes to the eventual parliamentary makeup can be.

- 2) Les Republicans (LR) are currently divided into two camps, one is led by leader Eric Ciotti and has pledged to support RN while a larger spin-off group says it will not support the main right-wing party. Their strength will provide some indication into the maximum number of seats that a RN-led coalition could hope to attain. Current polls have RN & supportive-LR at a maximum of 280 seats, just shy of the 285 majority mark. For reference, the unsupportive-LR contingent are polling at around 30-50 seats.

- 3) Two points of consideration here: firstly, if NUPES and the incumbent-Renaissance coalition decide to come to some form of agreement to prevent the right-wing taking control. Secondly, if any other right-wing parties pledge their support to RN and in particular the unsupportive-LR contingent.

Outcomes/Second Round Considerations

As it stands, the most likely outcome is another hung parliament. One that would likely place RN as the single largest entity within France. Such a scenario would see President Macron attempt to appoint a ‘friendly’ PM; however, their appointment would be constantly challenged unless Macron can secure agreement from either the NFP or RN. Essentially resulting in political paralysis on domestic policy. At this stage, Macron would not be able to dissolve the legislature for another 12-months and further out is not eligible for re-election in the 2027 Presidential vote due to him having served two consecutive terms. Within this, the results for an eventual alignment of the two strands of Les Republicans could see them potentially the ‘kingmakers’ for a RN-led right-wing government.

The next outcome in order of likelihood is that far-right RN hits the majority threshold of 289 seats, either individually or as part of an alliance that forms in between the rounds. Assuming Macron adheres to his pledge and remains President for his entire term then this outcome would result in cohabitation where Macron heads up foreign and defence-related policies while Bardella would be in charge of domestic matters.

Alternatively, NFP could draw support from those opposed to the right and who are dissatisfied with Macron’s party. Though, due to the fractious nature of the group and their pledge towards taking a collective approach to leadership it remains to be seen if it would be able to effectively function, in the relatively unlikely scenario they attained a majority; a situation that would ultimately be somewhat similar to the aforementioned scenario of a hung parliament.

Finally, there is a chance that Macron’s Ensemble/Renaissance alliance is once again the largest political group and is able to essentially continue as they were but perhaps with some heightened legitimacy. However, the extension of NUPES into NFP, a left-wing alliance, will sap support from Macron’s alliance irrespective of a possible mobilisation of the voter base against the right-wing possibility. Within this, it is of course possible that Ensemble/Renaissance emerges stronger than before and even with a majority; though, such an outcome is not probable if current polls are representative.

Market Pertinence

Since Macron’s snap decision to hold an election we have seen underperformance of French-related assets and a widening of domestic spreads vs peers. In brief, the OAT-Bund yield spread widened as high as 82bp on the 14th June, after Finance Minister Le Maire remarked that the political crisis could result in a financial one. EUR/USD has slipped from c. 1.09 on the Friday before the election was called to a low of 1.0669 since while the CAC 40 has slipped from just over 8k to a base just under 7.5k. As it stands, assets are off the above wides/lows into the first round beginning.

For reference, the current fiscal backdrop for France is a tense one: as of 2023, France had a public deficit at 5.5% of GDP with public debt standing at 111% of output; the rule for EU members is that the public deficit cannot exceed 3.0% and public debt 60% of output. As such, the EU Commission said it is putting France (alongside six other nations) into excessive deficit procedure, deadlines for adherence to be unveiled in November. For the current government, Le Maire has pledged to bring the deficit/GDP ratio into line by 2027.

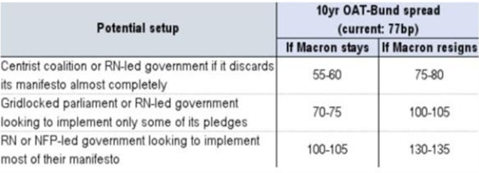

OAT-Bund (via Citi)

- On spreads, a Reuters sources piece on 16th June noted that ECB policymakers have not discussed French emergency bond purchases with no immediate plan to debate using the Transmission Protection Instrument (TPI); further, some policymakers specified that any discussion around using TPI would wait until there is a new government.

Political Paralysis

- Such an outcome is unlikely to significantly change the situation, as the current political backdrop is a hung parliament.

- The main issue from this will be even more difficulty in agreeing on spending cuts which are needed imminently in order to avoid penalties being implemented after the Excessive Deficit Procedure announcement. Such measures were expected to be very difficult to pass irrespective of the election and were thought to potentially be enough to strain/topple the current coalition.

- Given this, the lack of fiscal progress may see further pressure on French assets and a continued widening of the spread vs peers; Rabobank writes that in the scenario no party experiences a landslide victory “things won’t change significantly and Macron will still be able to implement some level of reforms/budget improvements”.

RN Majority

- S&P’s Gill writes RN policies could “further drag on public finances and they could and would be a consideration for the sovereign rating."; on 31st May, S&P downgraded France to AA- (prev. AA) with a Stable outlook citing an expected debt increase from the budget deficit overshoot. Both Fitch (AA-, Stable) & Moody’s (Aa2, Stable) have cautioned about election uncertainty on the rating.

- Rabobank surmises the scenario of cohabitation and likely policy inertia as one where we “can anticipate a worsening of France’s debt sustainability and lower economic growth”.

- Heavyweight luxury names i.e. LVMH (MC FP) somewhat shielded due to the vast majority of revenue being from overseas; however, any taxation/tariff change could weigh (likelihood of trade changes somewhat mitigated by Macron remaining President, as he would head up foreign policy in a power-sharing deal).

- Specific policies such as highway reform/nationalisation (considered by Le Pen in 2022) have pressured Eiffage (FGR FP), Getlink (GET FP) and Vinci (DG FP).

- Banks have been and likely would be pressured on increased borrowing costs; BNP Paribas (BNP FP), Credit Agricole (ACA FP) and Societe Generale (GLE FP).

- Engie (ENGI FP) is sensitive to any electricity pricing alterations (party seeks to reform/depart from European electricity pricing regulation), gov’t has a circa. 24% stake in Engie; further, Barclays’ downplays any impact to TotalEnergies (FP FP) noting that the investment case is not expected to be disrupted “regardless of who is in government”.

- Auto names & suppliers sensitive as RN seeks to overturn the ban on the sale of new ICE vehicles by 2035; e.g. Renault (RNO FP) and Forvia (EPA FP).

Ensemble/Renaissance Majority

- Benefit to public finances as incumbent Macron/Attal would be able to move ahead with pledged fiscal reform and take steps to resolve the Excessive Deficit Procedure, for instance.

- However, Rabobank cautions that spending cuts beyond those already announced would be required to resolve the procedure; though, Macron/Bardella would have a much easier time attaining this with a majority.

- Targeting a new climate renovation scheme and a buyback tax.

NFP Majority

- Banks have been and likely would be pressured on increased borrowing costs; BNP Paribas (BNP FP), Credit Agricole (ACA FP) and Societe Generale (GLE FP).

Timings

- Round One takes place on 30th June and the second round on 7th July. Exit polls will be released from 20:00BST/15:00ET on the above days once all polling stations have closed. Official results also begin to emerge at 20:00BST/15:00ET onwards, due to a number of polling stations closing several hours earlier than others and as such they begin and often complete the vote count before the media/result-ban is lifted at 20:00BST/15:00ET. However, full results are generally not available until early-Monday.

Sovereign Review Dates

- Fitch (AA-, Stable): 11th October

- Moody’s (Aa2, Stable): 25th October

- S&P (AA-, Stable): 29th November

25 Jun 2024 - 15:20- EquitiesData- Source: Newsquawk

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts