OPEC MOMR: 2025 & 2026 global oil demand forecasts maintained at 1.3mln BPD, supply forecasts cut to 0.8mln BPD (prev. 0.9mln BPD)

Demand

- The global oil demand growth forecast for 2025 is expected to remain at 1.3mln BPD Y/Y (prev. 1.3mln). Minor adjustments were made in 1Q25, mainly due to actual data.

- Total world oil demand is anticipated to average 105 mb/d in 2025, bolstered by strong air travel demand and healthy road mobility, including trucking, as well as healthy industrial, construction and agricultural activities in non-OECD countries.

- Global oil demand forecast for 2026 shows a robust growth of about 1.3mln BPD Y/Y (prev. 1.3mln).

Supply

- Crude oil production by countries participating in the DoC decreased by 106k BPD in April, M/M, averaging about 40.92mln BPD, as reported by available secondary sources.

- Non-DoC liquids supply (i.e., liquids supply from countries not participating in the Declaration of Cooperation) is forecast to grow by about 0.8mln BPD Y/Y in 2025 (prev. 0.9mln).

- The main growth drivers are expected to be the US, Brazil, Canada, and Argentina.

- In 2026, non-DOC supply is forecast at 0.8mln BPD (prev. 0.9mln), US, Brazil, Canada, and Argentina as the key drivers.

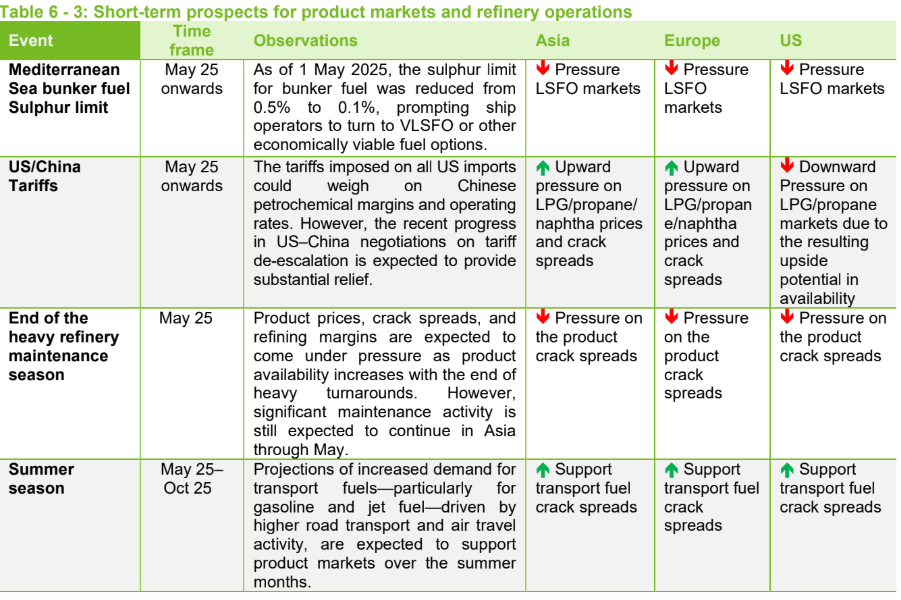

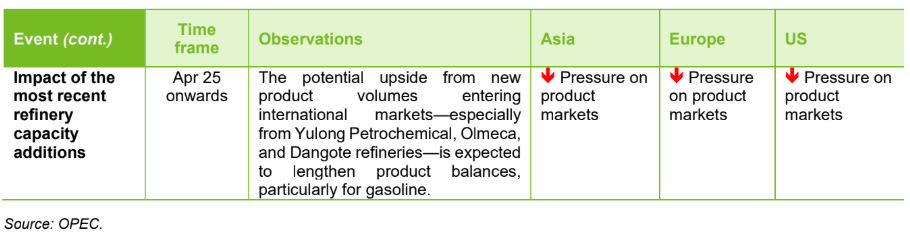

Tariffs

- Volatility persisted throughout April, exacerbated by mixed signals regarding US trade policy. Uncertainty over the full impact of the newly imposed tariffs weighed heavily on trader sentiment, keeping oil prices under sustained pressure.

- The global economy continues to show a steady growth trend despite recent tariff-related developments.

14 May 2025 - 13:00- EnergyGeopolitical- Source: OPEC

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts