Newsquawk Daily European Opening News - 4th October 2024

- APAC stocks traded mixed amid light pertinent catalysts for the region ahead of the latest US NFP report.

- US dock workers have agreed a deal to end their current strike action.

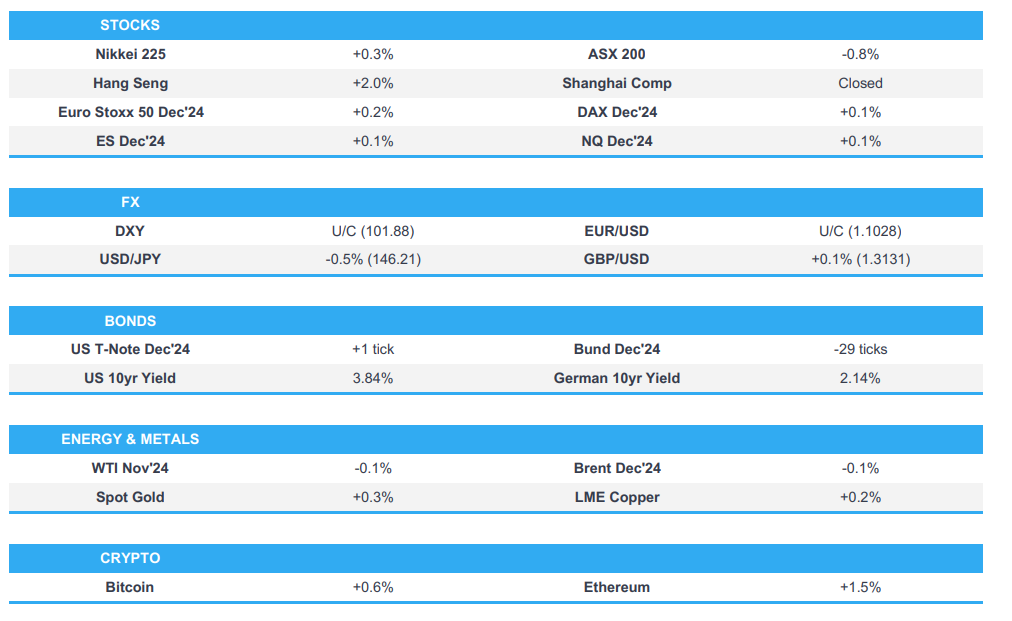

- European equity futures are indicative of a marginally positive cash open with the Euro Stoxx 50 future +0.1% after the cash market closed lower by 0.9% on Thursday.

- DXY sits just below the 102 mark, JPY outperforms major peers, EUR/USD remains on a 1.10 handle.

- Israel’s ground operation in Lebanon is expected to last no more than a few weeks, according to ABC citing security officials.

- Looking ahead, highlights include EZ/UK Construction PMIs, US NFP, Canadian Ivey PMI, BoE’s Pill, Fed’s Williams, ECB’s de Guindos & Elderson.

SNAPSHOT

US TRADE

EQUITIES

-

US stocks closed in the red in which the major indices only suffered mild losses and the small-cap Russell 2000 underperformed, while bonds were pressured and the dollar was underpinned as participants digested a slew of data releases including ISM Services PMI which printed a massive beat as the headline topped all analysts forecasts and was led by a surge in New Orders and Business Activity, while the inflationary gauge of Prices Paid climbed and the Employment component slipped into contractionary territory. The other releases were mixed as Initial Jobless Claims were higher than expected but Continued Claims printed below estimates and Challenger Layoffs also declined, although the focus now turns to the all-important US NFP report. -

SPX -0.17% at 5,700, NDX -0.05% at 19,793, DJIA -0.44% at 42,011, RUT -0.68% at 2,180. - Click here for a detailed summary.

NOTABLE HEADLINES

-

Fed's Goolsbee (2025 voter) said the dockworkers' strike was predicted and retailers have been stockpiling, while they have about 2 weeks of stuff and after that, will forecast more of an effect. Furthermore, Goolsbee said new inflation numbers are at the Fed's target and the labour market is at full employment. -

Port operators offered 62% pay increases to end the dockworkers' strike with the condition that workers return to work and agree to efficiency gains, according to WSJ. ILA announced shortly after it reached a tentative agreement with USMX on wages and that all current job actions will cease and all work covered by the master contract will resume with immediate effect.

APAC TRADE

EQUITIES

-

APAC stocks traded mixed amid light pertinent catalysts for the region heading into the weekend and the latest US NFP report. -

ASX 200 fell with almost all sectors in the red and miners leading the retreat although energy bucked the trend after the oil surge. -

Nikkei 225 traded higher owing to recent currency weakness and after PM Ishiba instructed to compile a comprehensive economic package, although the gains were limited in the absence of any major macro drivers or key data releases. -

Hang Seng outperformed in a rebound from yesterday's profit-taking with the advances spearheaded by tech strength and the energy sector was also boosted by the recent surge in oil prices. -

US equity futures (ES U/C) are steady after the prior day's flat performance and as the key BLS jobs data looms. -

European equity futures are indicative of a marginally positive cash open with the Euro Stoxx 50 future +0.1% after the cash market closed lower by 0.9% on Thursday.

FX

-

DXY held on to this week's spoils after briefly climbing above the 102.00 level on the back of strong ISM Services data. -

EUR/USD traded little changed but was off worse levels as it got some respite from the recent suffering against the dollar. -

GBP/USD proceeded sideways with price action contained following the recent underperformance that was triggered by a dovish remark from BoE Governor Bailey which dragged the pair briefly below the 1.3100 level where support eventually held. -

USD/JPY marginally pulled back from yesterday's peak after failing to sustain a brief foray into the 147.00 territory. -

Antipodeans were rangebound amid the mixed risk tone and absence of any tier-1 releases.

FIXED INCOME

-

10yr UST futures attempted to nurse some of their losses after retreating amid strong ISM Services data and the surge in oil prices. -

Bund futures remained subdued firmly beneath the 135.00 level after trickling lower throughout the prior session. -

10yr JGB futures tracked the recent losses in global peers with demand restricted amid a quiet calendar and absence of BoJ purchases.

COMMODITIES

-

Crude futures took a breather after rallying by over 5% during the previous day owing to the geopolitical tensions and comments from US President Biden who responded "We are discussing that" when asked if he would support Israel striking Iran's oil fields. -

Spot gold traded rangebound after yesterday's two-way price action and with participants awaiting the key US jobs data. -

Copper futures lacked direction amid the mixed risk appetite and the continued absence of its largest purchaser.

CRYPTO

-

Bitcoin edged mild gains overnight and briefly climbed above the USD 61,000 level.

NOTABLE ASIA-PAC HEADLINES

-

Japanese Chief Cabinet Secretary Hayashi said PM Ishiba instructed to compile a comprehensive economic package, while Hayashi added that they will compile a supplementary budget after the lower house election. -

Germany will reportedly vote against EU tariffs on Chinese EVs, according to sources via Reuters.

DATA RECAP

GEOPOLITICS

MIDDLE EAST

-

Israel's military called for the immediate evacuation of specific buildings in Beirut's southern suburbs and multiple Israeli raids were then reported in the area, while Israel also conducted a strike on the outside perimeter of Beirut Airport. Furthermore, Israel's Channel 14 reported that Hezbollah's Executive Council head Hashem Safieddine was the target of Israel's attack in Beirut and Israel's military said it killed Zahi Yasser Abdel Razak Ofi who is the head of the Hamas network in the West Bank's Tulkarm. -

Israel's Chief of Staff said they will continue to fight on all fronts, according to Al Arabiya. - Israel's Foreign Ministry said their response to Iran will take into account security and diplomatic considerations, but they will not target civilian sites.

-

Israel's ambassador to the UN said they have a lot of options when it comes to Iran and questioned how long should Western world wait when it is known that Iran is building nuclear capabilities, while the official said they have to consider all options if diplomacy fails. -

Israel’s response to the Iranian missile attack will be within a few days, according to Sky News Arabia citing Israeli media. -

Israel’s ground operation in Lebanon is expected to last no more than a few weeks, according to ABC citing security officials. -

Israel's military said it intercepted a drone in southern Israel with no injuries reported, while Islamic Resistance in Iraq said it attacked a target in southern Israel, according to a statement. -

Lebanon's Transport Minister said an Israeli strike hit Lebanon's Masnaa border crossing which cut off the road to Syria, while the official added that the strike has closed off the road used by hundreds of thousands of people to flee in recent days. - Lebanese Minister of Economy said Israeli raids destroyed factories and hit the agricultural and tourism sectors.

-

US President Biden responded that hurricanes also raise oil prices when asked if oil prices will go up if Israel attacks Iran's oil facilities and said he will not negotiate in public when asked if he is urging Israel not to attack Iran's oil facilities. It was separately reported that Biden said he doesn't think an all-out war will break out in the Middle East but added there is a lot of work to be done, while he noted that they helped Israel and will protect it. - US official said President Biden was clear that we do not support an Israeli strike on Iranian nuclear facilities.

-

US does not believe Israel has decided how to respond to Iran, including whether to hit oil facilities, according to Reuters. -

US Pentagon said Israeli preparations to target Iran will take time and US-Israeli coordination in this regard continues, according to Sky News Arabia. -

US officials have held a series of conversations with top Israeli officials in recent days, as the US and Western allies try to limit the scope of Israel’s response and prevent a broader regional conflict, according to FT citing sources. -

US State Department denied the validity of what the Lebanese Foreign Minister said that Nasrallah had agreed to a ceasefire before his assassination, according to Sky News Arabia. -

G7 draft statement called for an immediate ceasefire in Gaza and restraint from Middle East players, while it warned of uncontrollable escalation in the region and condemned in the strongest terms Iran's direct military attack against Israel, which it said constitutes a serious threat to regional stability. Furthermore, it reiterated its call for an immediate ceasefire in Gaza and the unconditional release of all hostages. -

UAE President Sheikh Mohamed bin Zayed and US National Security Advisor Sullivan discussed Lebanon and the importance of reaching a diplomatic settlement that enables civilians on both sides of the border to return home safely, according to Sky News Arabia. -

Yemen's Houthis broadcasted images of targeting a British oil ship on October 1st in the Red Sea, according to Sky News Arabia.

OTHER

-

Ukrainian drone strikes targeted a fuel depot in the Russian town of Anna in Voronezh Oblast, while the Russian emergencies ministry later announced that a fuel depot was on fire in Russia's Perm region. -

North Korean leader Kim warned North Korea will use nuclear weapons if South Korea and the US use force, while he said enemies' threats will not take away North Korea's nuclear weapons and it has irreversibly secured nuclear power, as well as the system and function for using it, according to KCNA.

04 Oct 2024 - 06:17- ForexEU Research- Source: Newsquawk

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts