Newsquawk Daily European Opening News - 19th April 2024

To download the report, please click here If you would like to subscribe to receive the research sheets directly in your inbox, you can now do so under the Research Suite section of the portal. To subscribe simply check the box next to "Email these reports" under the desired category.

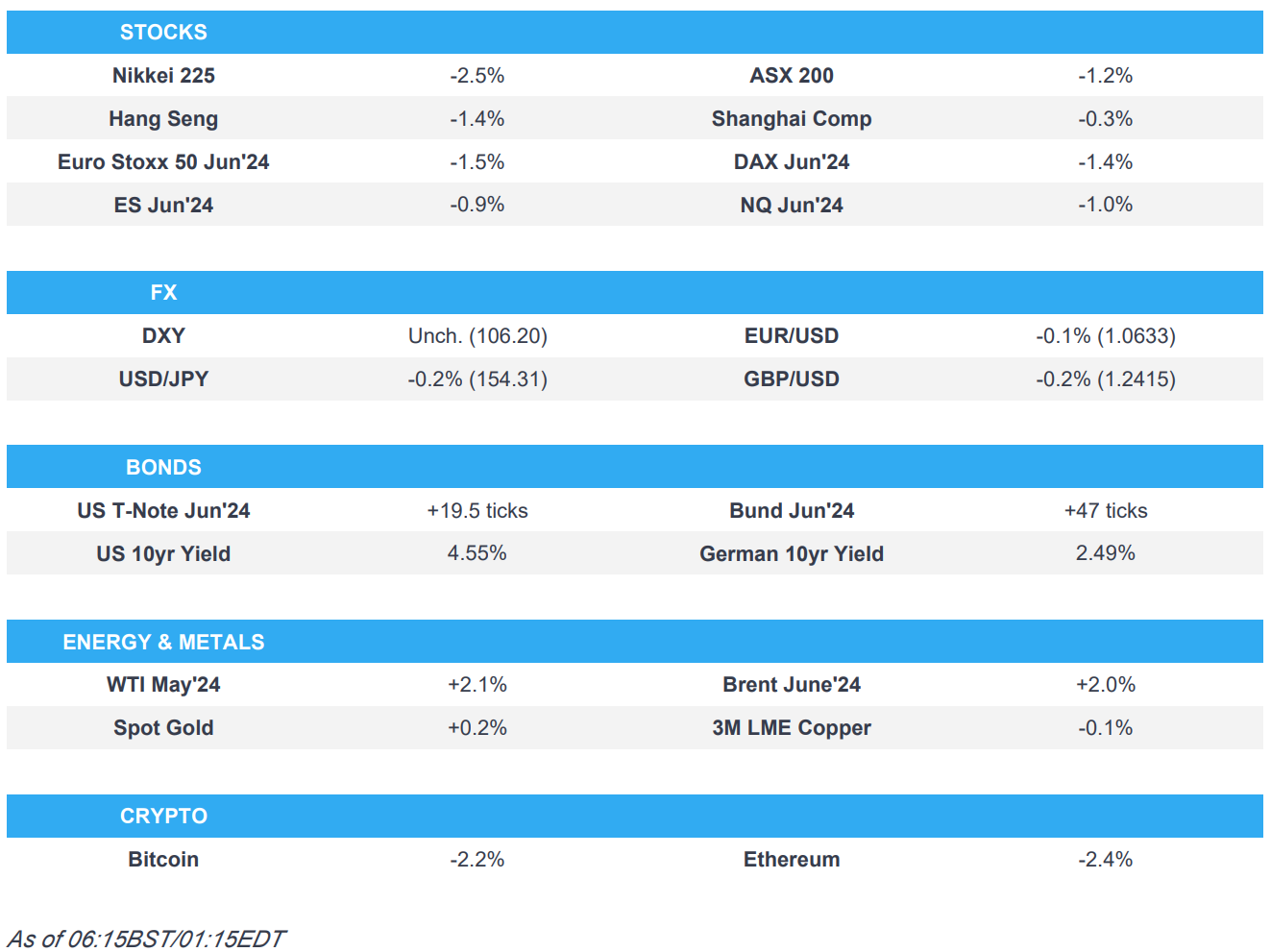

- APAC stocks were lower across the board as the initial tech-related selling stemming from Wall St was exacerbated by reports of explosions in Iran following an Israeli operation although stocks are off today's worst levels as Iran downplayed and later denied the attack.

- Israel conducted an operation against Iran which an Iranian official said was on a military airbase near Isfahan. However, Iran's press TV later denied reports of a foreign attack in Iranian cities including Isfahan.

- Iran's senior commander said the 'noise heard in Isfahan overnight was caused by air defence targeting one suspicious object', while he added 'there was no damage caused'.

- Sentiment overnight was “risk off”, but recovered from worst levels after Israel’s move seemed limited while Iran downplayed the event.

- Looking ahead, highlights include German Producer Prices, UK Retail Sales, Comments from BoE’s Ramsden & Fed's Goolsbee, Earnings from SLB, American Express & PG.

19th April 2024

SNAPSHOT

- Click here for the Newsquawk Week Ahead.

US TRADE

EQUITIES

-

US stocks were subdued and unwound their initial gains as the bearish trend continued with headwinds from Fed's Williams comments after he opened the door for potential rate hikes although they are not his current base case, while declines were led by underperformance in tech, with TSM pressured after its earnings report where it trimmed its outlook for the semiconductor industry as a whole despite decent quarterly figures and its Q2 guidance. Participants also digested the latest data releases which mostly beat expectations including a strong Philly Fed survey and hot Prices Paid with the latter at its highest since December 2023 and was near, but below, its long-run average. -

SPX -0.22% at 5,011, NDX -0.57% at 17,394, DJIA +0.06% at 37,775, RUT -0.26% at 1,942. - Click here for a detailed summary.

NOTABLE HEADLINES

-

Fed's Bostic (voter) said inflation is too high and they still have a ways to go on inflation, while the pathway to 2% will be slower than people expect and bumpy. Bostic added inflation is going where the Fed wants it to go but it is slow and he reiterated they won't be able to cut rates until towards the end of the year. Bostic separately commented that the Fed is on its path to the inflation target and he is grateful progress is being made on inflation and that the economy continues to grow. Bostic also noted that policy is currently restrictive and the Fed can be patient, while he reiterated that he sees one cut this year. -

Fed's Kashkari (non-voter) said once inflation is heading back to the 2% target, the Fed can cut rates but added that they could potentially wait until 2025 to cut rates, while he stated they need to be patient until they are convinced that inflation is falling and noted the resilience of the housing market has been a surprise, according to a Fox News interview.

APAC TRADE

EQUITIES

-

APAC stocks were lower across the board as the initial tech-related selling stemming from Wall St was exacerbated by reports of explosions in Iran following an Israeli operation although stocks are off today's worst levels as Iran downplayed and later denied the attack. -

ASX 200 was pressured with losses led by underperformance in tech and amid the bout of geopolitical-related turmoil. -

Nikkei 225 suffered intraday losses of around 3% and briefly dipped beneath the 37,000 level. -

Hang Seng and Shanghai Comp. were lower but with losses only mild compared to the regional counterparts especially the mainland which was largely unfazed by the various geopolitical headlines and disinformation. -

US equity futures extended on the prior day's tech-led declines as geopolitics took centre stage. -

European equity futures indicate a lower open with the Euro Stoxx 50 future -1.5% after the cash market closed up 0.5% on Thursday.

FX

-

DXY was ultimately flat on the day but did see some haven inflows on the initial reports about a strike in Iran. -

EUR/USD saw two-way price action and reversed an early dip to return to relatively flat territory against the buck. -

GBP/USD initially retreated beneath the 1.2400 level as the situation spooked risk appetite but later recovered. -

USD/JPY declined on havens flows but then recovered some lost ground with Iran downplaying/denying the attack. -

Antipodeans were pressured as risk appetite stumbled on the geopolitical events before partially recovering as calmness returned to markets.

FIXED INCOME

-

10-year UST futures were bid after reports of explosions in Iran triggered a broad flight to safety assets. -

Bund futures briefly rose above 132.00 before paring around half of the gains as markets later briefed a sigh of relief. -

10-year JGB futures climbed higher owing to the further geopolitical escalation and disinformation.

COMMODITIES

-

Crude futures rallied with Brent up over 4.2% at one point amid geopolitical fears but then came off their highs as traders unwound the earlier drastic moves. -

Spot gold saw a haven bid on the initial reports of explosions in Iran due to an Israeli strike which lifted prices above USD 2,400/oz but then faded most of the gains as reports suggested the Israeli operation was not as severe as some had initially feared. -

Copper futures were only marginally softer and largely weathered the jitters from the geopolitical escalation.

CRYPTO

-

Bitcoin was pressured and briefly dipped beneath the USD 60,000 level as risk appetite was spooked by the latest geopolitical developments.

NOTABLE ASIA-PAC HEADLINES

-

US House Committee is probing index funds that channelled billions of Dollars into blacklisted Chinese companies with the probe focused on BlackRock (BLK) and MSCI (MSCI), according to WSJ. - BoJ Governor Ueda said there is a chance weak Yen may affect trend inflation and if so, could lead to a policy shift.

-

Japanese Finance Minister Suzuki said FX levels reflect various factors and not just rate differentials, while he added they continue to conduct close communication with the US and Korea on FX. Suzuki said it was meaningful that the G7 confirmed excessive FX moves have a negative impact on the economy but noted there was no direct FX discussion at the G20 meeting.

DATA RECAP

- Japanese National CPI YY (Mar) 2.7% vs. Exp. 2.9% (Prev. 2.8%)

- Japanese National CPI Ex. Fresh Food YY (Mar) 2.6% vs. Exp. 2.6% (Prev. 2.8%)

- Japanese National CPI Ex. Fresh Food & Energy YY (Mar) 2.9% vs. Exp. 3.0% (Prev. 3.2%)

GEOPOLITICS

MIDDLE EAST

-

Israel conducted an operation against Iran which an Iranian official said was on a military airbase near Isfahan. However, Iran's press TV later cited informed sources denying reports of a foreign attack in Iranian cities including Isfahan, according to Reuters. -

Initial reports on social media platform X noted explosions were heard near the city of Isfahan and Natanz in Central Iran where there are nuclear facilities, while Iranian state TV noted 'big explosions' were heard near Isfahan and there were also reports of Israeli strikes in southern Syria and Israeli warplane activity in Iraq. Furthermore, Iran International noted several flights were diverted over the Iranian airspace amid reports of an Israeli attack against a site in Iran and it was also reported that Israel told the US on Thursday it planned to conduct its response against Iran in 24-48 hours. However, it was later reported the explosions in Isfahan were drones being shot down and there were no ground explosions, while a US official noted that Israel conducted a strike on Iran but did not target nuclear facilities. -

Iran's senior commander Mihandoust said 'noise heard in Isfahan overnight was caused by air defence targeting one suspicious object', while he added 'there was no damage caused', according to Reuters. -

Iranian Foreign Minister told the UN Security Council that Iran "had no other option" but to attack Israel, while he added Iran's defence and countermeasures have concluded and Israel must be compelled to stop any further military adventurism against their interests. Furthermore, he warned if there is any use of force by Israel or violation of Iran's sovereignty, Iran's response will be decisive and proper to make Israel regret its actions. -

Senior Iranian Guards Commander said Tehran could review its nuclear doctrine and that nuclear sites are in "total security", while he added "Our hands are on the trigger, Israel's nuclear facilities have been identified". Furthermore, he said they are ready to launch powerful missiles to destroy designated targets in Israel and warned if Israel dares to hit their nuclear sites, they will surely hit back. -

White House said both sides agreed on the shared objective to see Hamas defeated in Rafah during the US-Israel meeting on Rafah. -

US blocked the Palestinian request for full UN membership, while Israel's Foreign Minister said the 'shameful proposal' was rejected at the UN Security Council and he commended the US for vetoing the proposal. It was also reported that the Palestinian Presidency said it condemns the US veto of full Palestinian membership and Egypt said it regrets the inability of the UN Security Council to pass a resolution enabling Palestine to become a full member of the UN. -

US reportedly makes a fresh push for a Saudi-Israel diplomatic deal, according to WSJ. White House urges Israeli PM Netanyahu to accept commitment to Palestinian statehood in exchange for Saudi recognition and will offer Riyadh a more formal defence relationship and assistance in acquiring civilian nuclear power.

OTHER

-

Ukrainian PM Shmyhal said he welcomes progress on USD 61bln in US aid to Ukraine and is optimistic that the aid bill will soon be supported in the House, while he had important discussions with top US officials about using frozen Russian assets to benefit Ukraine and expect results this year. - German Chancellor Scholz said NATO partners could deliver a further six patriot systems to Ukraine and Germany at the front.

-

US Treasury Department says Yellen and UK Chancellor Hunt discussed ways to constrain Russia's access to goods it needs to build weapons including China's role in supplying Russia's military-industrial complex, while they also exchanged views on Chinese industrial practices that cause overcapacity. -

FBI Director Wray said Chinese government-linked hackers have burrowed into US critical infrastructure and are waiting for the right moment to deal a devastating blow, according to Reuters. -

North Korea's Deputy Foreign Minister held talks with Belarusian counterparts to improve cooperation, according to KCNA.

EU/UK

NOTABLE HEADLINES

-

ECB's Panetta said disinflation is advanced and continuing, while he added that the ECB will consider the level of restriction and that a tighter Fed is empirically a form of tightening for the Euro Area. -

ECB's Simkus said only a huge surprise could derail a cut in June and the FX rate will balance developments between the US and Europe, while he sees around three 2024 cuts in his baseline, according to CNBC. ECB's Simkus also said it is most likely that there will be several cuts, but they don't have to be precise and the ECB is not in a rush. - ECB's Vujcic said so far FX market has been very calm about the risk of Fed-ECB divergence.

19 Apr 2024 - 06:23- Fixed IncomeWeekly Research- Source: Newsquawk

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts