Newsquawk Daily European Opening News - 13th December 2024

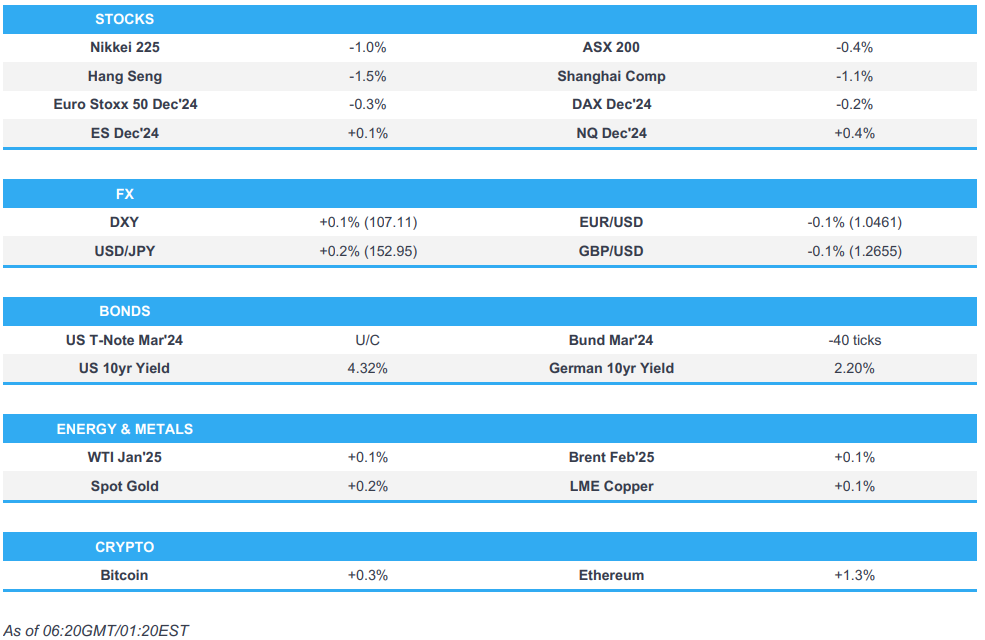

- APAC stocks traded lower across the board following a similar session on Wall Street, whilst sentiment was also hit after the Chinese Economic Work Conference

- ES and NQ traded with gains overnight as SPX and NDX constituent Broadcom (AVGO) surged 14% post-earnings

- DXY held an upward bias and extended on gains after the incursion into 107.00 territory in late US trade; USD/JPY rose above 153.00

- European equity futures are indicative of a subdued cash open with the Euro Stoxx 50 future -0.2% after cash closed +0.1% on Thursday

- Looking ahead, highlights include German Trade Balance, UK GDP, EU Industrial Production, US Import/Export Prices, and Baker Hughes Rig Count

- Click for the Newsquawk Week Ahead.

US TRADE

EQUITIES

-

US stocks saw weakness with continued underperformance in the small-cap Russell 2000 (-1.4%), as all sectors resided in the red apart from Consumer Staples and Real Estate. -

Health, Consumer Discretionary, and Communications were the laggards with the latter weighed on by Tesla (TSLA) (-1.7%) and Alphabet (GOOGL) (-1.8%), respectively, although GOOGL has seen notable gains recently. -

SPX -0.54% at 6,051, NDX -0.68% at 21,615, DJIA -0.53% at 43,914, RUT -1.38% at 2,361 - Click here for a detailed summary.

NOTABLE HEADLINES

-

Broadcom Inc (AVGO) Q4 2024 (USD): Adj. EPS 1.42 (exp. 1.39), Adj. net revenue 14.05bln (exp. 14.1bln). Semiconductor solutions revenue 8.23bln, (exp. 8.05bln). Co expects “momentum in AI connectivity to be as strong as more hyperscalers deploy Jericho3-AI”. Shares +14% after-market. -

Microsoft (MSFT) filed for debt shelf; size undisclosed, via SEC filing. Separately, Microsoft introduces Phi-4, the company's newest small language model specialising in complex reasoning -

US President-elect Trump's transition team has reportedly started to explore pathways to shrink, consolidate or eliminate the top bank regulators, according to WSJ.

APAC TRADE

EQUITIES

-

APAC stocks traded lower across the board following a similar session on Wall Street after the hot US PPI, whilst sentiment in Asia-Pacific was somewhat hampered as participants digested the disappointing release from the Chinese Economic Work Conference. -

ASX 200 was pressured by the metals sectors, namely gold miners, after the recent slide in the yellow metal as the Buck ramped up. -

Nikkei 225 pulled back further under 40,000, failed to benefit from a softer JPY and largely overlooked higher-than-expected optimism among large Japanese manufacturers from the BoJ's Tankan Survey. -

Hang Seng and Shanghai Comp were both softer as traders digested the release from the Chinese Economic Work Conference, which overall seems like a disappointment as it offered little in terms of details whilst reaffirming the recent policy shift. -

US equity futures were mixed with outperformance in ES and NQ on the back of constituent Broadcom, whose share surged 14.1% after overall positive earnings alongside a strong outlook outlined in the earnings call. -

European equity futures are indicative of a subdued cash open with the Euro Stoxx 50 future -0.2% after cash closed +0.1% on Thursday.

FX

-

DXY held an upward bias and extended on gains after the incursion into 107.00 territory in late US trade following a choppy Thursday session. Macro updates in the US are to be thin on Friday (only import/export prices are due), attention will turn towards the statement and remarks from Fed Chair Powell next Wednesday, with a 25bps rate cut largely priced in. -

EUR/USD was subdued by the Dollar in a 1.0457-80 range with no major EZ releases left for the week after yesterday's ECB. EUR/USD dipped under the 2nd Dec low (1.0459), with the 26th Nov low (1.0424) next in sight. -

GBP/USD was once again pressured by the firmer Dollar with traders looking ahead to Friday's UK GDP monthly estimates ahead of next week's deluge of releases. GBP/USD fell under its 21 DMA (1.2672), with the next level to the downside being the 4th Dec low (1.2626). -

USD/JPY was choppy as the pair initially saw some fleeting downside on the higher-than-expected optimism among large Japanese manufacturers from the BoJ's Tankan Survey. USD/JPY then rebounded with no clear driver before briefly venturing into 153.00 territory. -

Antipodeans were softer amid subdued base metals and broader risk aversion weighing on the currencies, with the Kiwi also uninspired by the lower-than-prior Manufacturing PMI. - PBoC set USD/CNY mid-point at 7.1876 vs exp. 7.2745 (prev. 7.1854)

-

RBI likely sold USD to support the INR, according to traders cited by Reuters.

FIXED INCOME

-

10yr UST futures were uneventful in sideways trade with upside capped by the poor 30-year bond auction stateside. -

Bund futures were softer amid a continuation of price action from the prior day, with the March contract finding overnight resistance just under 135.00. -

10yr JGB futures bucked the trend ahead of next week's BoJ and after recent source reports suggested the Bank is erring towards keeping rates unchanged next week instead of hiking. -

US sold USD 22bln in 30yr bonds; High Yield: 4.535% (prev. 4.608%, six-auction average 4.356%); WI: 4.523%. Tail: 1.2bps (prev. -2.2bps, six-auction avg. 0.2bps). Bid-to-Cover: 2.39x (prev. 2.64x, six-auction avg. 2.44x). Dealers: 14.4% (prev. 10.2%, six-auction avg. 14.5%). Directs: 19.1% (prev. 27.1%, six-auction avg. 17.8%). Indirects: 66.5% (prev. 62.7%, six-auction avg. 67.7%)

COMMODITIES

-

Crude futures were relatively flat trade amid a lack of newsflow, and with prices taking a breather from yesterday’s choppy price action which ultimately resulted in slightly lower settlements for both benchmarks. -

Spot gold traded slightly firmer but still under USD 2,700/oz as the yellow metal consolidated from the prior day’s slide. -

Copper futures were flat within tight ranges amid light newsflow with 3M LME copper hovering on either side of USD 9,100/t. -

Goldman Sachs said their base case is that Brent averages USD 76/bbl in 2025 given near offset between a modest 400k BPD surplus and a normalisation in currently low valuation. -

Moldovan Parliament declares state of emergency from Dec 16th amid the possible end of flow of Russian gas from Jan 1st, according to Reuters.

CRYPTO

-

Bitcoin fell back under USD 100k and remained under the level for most of the session, albeit the crypto slowly clambered off worst levels.

NOTABLE ASIA-PAC HEADLINES

-

Trump Trade Advisor Navarro warned against currency manipulation after Reuters sources suggested China is mulling a weaker CNY. -

South Korean Finance Ministry said they will deploy more market stabilising measures if volatility heightens excessively, according to Reuters. -

BoJ Dec Tankan corporate price expectations survey: Japanese firms expect consumer prices to rise 2.4% a year from now (prev. +2.4%). 3-year expectation +2.3% (prev. +2.3%); 5-year expectation +2.2% (prev. +2.2%). -

Japan's small firms are spending more of their profits on wages than their larger counterparts and may struggle to keep raising pay, casting doubt on whether wage gains are broad enough for BoJ to keep hiking rates, according to Reuters analysis. Policymakers are reportedly looking at whether small firms (which employ 70% of Japan's workforce) can continue meeting pay demands. -

REUTERS POLL: BoJ to hold key interest rate at 0.25% in December, according to 58% of economists polled (vs 44% in Nov poll)

DATA RECAP

- Japanese Tankan All Big Capex Est (Q4) 11.3% vs. Exp. 9.6% (Prev. 10.6%)

- Japanese Tankan big non-mf outlook DI (Q4) 28.0 vs. Exp. 28.0 (Prev. 28.0)

- Japanese Tankan Big Mf Outlook DI (Q4) 13.0 vs. Exp. 11.0 (Prev. 14.0)

- Japanese Tankan Big Non-Mf Idx (Q4) 33.0 vs. Exp. 32.0 (Prev. 34.0)

- Japanese Tankan Big Mf Idx (Q4) 14.0 vs. Exp. 12.0 (Prev. 13.0)

- Japanese Tankan Small Non-Mf Idx (Q4) 16.0 vs. Exp. 12.0 (Prev. 14.0)

- Japanese Tankan Sm Non-Mf Outlook DI (Q4) 8.0 vs. Exp. 10.0 (Prev. 11.0)

- Japanese Tankan All Sm Capex Est (Q4) 4.0% vs. Exp. 4.3% (Prev. 2.6%)

- Japanese Tankan Small Mf Idx (Q4) 1.0 vs. Exp. -1.0

- South Korea Import Price Growth YY (Nov) 3.0% (Prev. -2.5%)

- South Korea Export Price Growth YY (Nov) 7.0% (Prev. 2.0%)

- New Zealand Manufacturing PMI (Nov) 45.5 (Prev. 45.8)

GEOPOLITICS

MIDDLE EAST

-

White House's Kirby said Security Adviser Sullivan will travel to Doha and Cairo to continue talks to reach a ceasefire in Gaza, according to Al Jazeera.

OTHER

-

US President-elect Trump said "For the great privilege of accessing our markets, these foreign companies should hire our incredible American Workers, instead of laying them off, and sending those profits back to foreign countries", via Truth Social. -

Canada weighs export tax on uranium and oil if Trump adds tariffs, according to Bloomberg. Also mulls export tax on potash if Trump imposes tariffs.

EU/UK

NOTABLE HEADLINES

-

ECB prepared for a quarter-point rate cut at next two meetings if inflation stabilises at the 2% target and economic growth remains sluggish, Bloomberg reported. A gradual approach to lowering borrowing costs is the most appropriate path forward provided the economy develops in line with current expectations. A larger, half-point reduction remains an option in case of emergency, they said. But they stressed that such a step risks conveying an unintended sense of urgency. -

French Presidential office said the appointment of the PM was postponed until Friday morning, according to Reuters. -

Italian Economy Minister sees GDP growth of 0.7% this year and lower-than-expected growth does not change government budget framework, according to Reuters.

DATA RECAP

- UK GfK Consumer Confidence (Dec) -17.0 vs. Exp. -18.0 (Prev. -18.0)

LATAM

-

Brazil's Senate approved the main text of the bill with regulations to implement tax reform passed next year, according to Reuters. -

Brazil President Lula remains in ICU after the latest surgery on Thursday morning, according to a medical report. -

Peru Central Bank maintains reference rate at 5.00%, as expected; said future decisions will depend on inflation.

13 Dec 2024 - 06:20- MetalsEU Research- Source: Newsquawk

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts