Newsquawk Daily Asia-Pac Opening News - 2nd May 2025

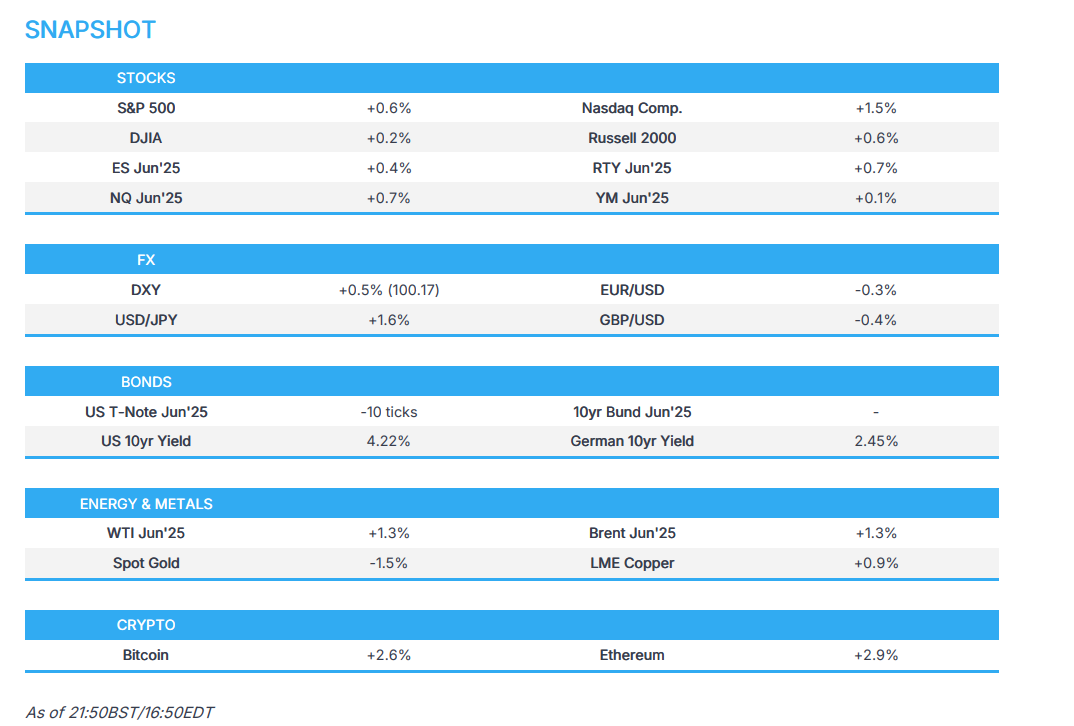

- US stocks gained with sentiment buoyed by strong mega-cap earnings from Microsoft (MSFT, +7.6%) and Meta (META, +4.2%) in which the latter raised its CapEx views despite recent market jitters over data centre demand. ISM Manufacturing PMI data also added to support as the drop in the headline was not as bad as feared and with new orders and employment rising, while prices paid rose less than expected. The report offered optimism surrounding US risk assets and the dollar extended on existing strength against all G10 peers, although US equity futures gave back some of the gains after-hours following earning releases from Amazon and Apple.

- USD benefitted amid increased US optimism following earnings from Microsoft and Meta, while participants also digested a slew of data in which ISM Manufacturing PMI printed in contraction territory but not as bad as feared. Conversely, Initial Jobless Claims climbed and Construction Spending disappointed but failed to derail the momentum of the dollar with markets now awaiting the latest NFP report on Friday.

- Looking ahead, highlights include New Zealand Building Permits, South Korean CPI, Japanese Unemployment Rate, Regional PMIs, Australian Retail Sales & PPI, Supply from Australia & Japan, Holiday Closure in Mainland China.

LOOKING AHEAD

- Highlights include New Zealand Building Permits, South Korean CPI, Japanese Unemployment Rate, Regional PMIs, Australian Retail Sales & PPI, Supply from Australia & Japan, Holiday Closure in Mainland China.

- Click for the Newsquawk Week Ahead.

US TRADE

-

US stocks gained with sentiment buoyed by strong mega-cap earnings from Microsoft (MSFT, +7.6%) and Meta (META, +4.2%) in which the latter raised its CapEx views despite recent market jitters over data centre demand. ISM Manufacturing PMI data also added to support as the drop in the headline was not as bad as feared and with new orders and employment rising, while prices paid rose less than expected. The report offered optimism surrounding US risk assets and the dollar extended on existing strength against all G10 peers, although US equity futures gave back some of the gains after-hours following earning releases from Amazon and Apple. -

SPX +0.63% at 5,604, NDX +1.10% at 19,787, DJI +0.21% at 40,753, RUT +0.60% at 1,976. - Click here for a detailed summary.

TARIFFS/TRADE

-

US Treasury Secretary Bessent said the tariff situation with China will be a multi-step process and need to see a de-escalation with China on tariffs, while he added that China needs to rebalance and if the US and China could rebalance together, that would be a big deal. Bessent said the Chinese economy is slowing down substantially and that they will likely revisit Trump's Phase 1 trade deal, as well as noted they are going to bring down China's unfair trade barriers and hold China to prior commitments. Furthermore, he said there was a meeting with the Japanese delegation today, according to FBN. - US White House Economic Adviser Hassett said he is hopeful for progress with China on trade and they have hard offers from over 20 countries, while he also stated that tariff news is expected by the end of the day.

-

US Chamber of Commerce asked Treasury Secretary Bessent, Commerce Secretary Lutnick, and USTR Greer to lift tariffs on all small business importers, according to CNBC. -

EU negotiator Sefcovic said Europe is ready to make US President Trump a EUR 50bln offer, in which Brussels wants to increase purchases of US goods by EUR 50bln to address the “problem” in the trade relationship, while he said the bloc is making “certain progress” towards striking a deal. - Mexican President Sheinbaum said she had a very good conversation with US President Trump and agreed that officials will continue to work on options to improve the trade balance.

NOTABLE HEADLINES

-

US President Trump said he just received an update from congressional leaders on the tax bill and said they are working very hard on a great big beautiful bill. Trump added that taxes will go up 68% if the big bill does not pass, while he added that things are moving along very well and they are right on schedule on the tax bill. - US President Trump said they'll be paying off debt and so much money will be taken in that they'll cut taxes.

-

US Treasury Secretary Bessent said they expect to see GDP revised and that the GDP decline may have been due to inventory stocking of imports. Bessent added that US household consumption is strong and the consumer is in great shape, while 2yr yields below FFR is a signal that the Fed should cut rates. - US President Trump said he removed Mike Waltz as National Security Adviser but nominated Waltz to be the next US Ambassador to the UN, while in the interim, Secretary of State Rubio will serve as the National Security Advisor.

-

US Special Envoy Witkoff may replace National Security Adviser Waltz, according to Politico. However, it was separately reported that Witkoff is not interested in replacing Waltz as National Security Adviser, according to Axios's Ravid citing a source familiar with the details. - US Transportation Secretary Duffy said the Trump administration will release its plan next week on how to fix air traffic infrastructure.

AFTER-MARKET EARNINGS

- Apple Inc (AAPL) Q1 2025 (USD): EPS 1.65 (exp. 1.62), Revenue 95.36bln (exp. 94.53bln), authorises USD 100bln buyback, Greater China rev. 16bln (exp. 16.97bln).

- Amazon.com Inc (AMZN) Q1 2025 (USD): EPS 1.59 (exp. 1.38), Revenue 155.7bln (exp. 154.88bln). Q2 25 revenue view 159-164bln (exp. 161.62bln).

- Airbnb (ABNB) Q1 2025 (USD): EPS 0.24 (exp. 0.23), Revenue 2.3bln (exp. 2.26bln).

- Reddit Inc (RDDT) Q1 2025 (USD): EPS 0.13 (exp. 0.01), Revenue 392.4mln (exp. 369.0mln).

DATA RECAP

- US S&P Global Manufacturing PMI Final (Apr) 50.2 (Prev. 50.7)

- US ISM Manufacturing PMI (Apr) 48.7 vs. Exp. 48.0 (Prev. 49.0)

- US ISM Manuf New Orders Idx (Apr) 47.2 (Prev. 45.2)

- US ISM Mfg Prices Paid (Apr) 69.8 vs. Exp. 70.3 (Prev. 69.4)

- US ISM Manuf Employment Idx (Apr) 46.5 (Prev. 44.7)

- US Construction Spending MM (Mar) -0.5% vs. Exp. 0.2% (Prev. 0.7%, Rev. 0.6%)

- US Initial Jobless Claims 241k vs. Exp. 224k (Prev. 222k, Rev. 223k)

- US Continued Jobless Claims 1.916M vs. Exp. 1.864M (Prev. 1.841M, Rev. 1.833M)

FX

-

USD benefitted amid increased US optimism following earnings from Microsoft and Meta, while participants also digested a slew of data in which ISM Manufacturing PMI printed in contraction territory but not as bad as feared. Conversely, Initial Jobless Claims climbed and Construction Spending disappointed but failed to derail the momentum of the dollar with markets now awaiting the latest NFP report on Friday. -

EUR was pressured by the firmer dollar with much of Europe away for the Labor Day holiday and newsflow was light although there were comments from EU's top trade negotiator Sefcovic that Europe is ready to make US President Trump a EUR 50bln offer. -

GBP gave up ground to the dollar strength and retreated beneath the 1.3300 handle in the absence of any major UK-specific catalysts. -

JPY weakened in the aftermath of the BoJ's decision to hold rates unchanged as expected at 0.5% but delayed the timing of achieving its price goal.

FIXED INCOME

-

T-notes were hit following a better-than-feared ISM Manufacturing PMI report ahead of Friday's NFP data.

COMMODITIES

-

Oil prices were buoyed by the broader risk-on sentiment in US indices and settled at highs amid Trump's warning of secondary sanctions on Iran oil purchases. -

US President Trump said they put sanctions on Iranian oil yesterday and whoever takes oil from Iran cannot do business with the US. Trump later posted that all purchases of Iranian oil, or petrochemical products must stop now and any country or person who buys any amount of oil or petrochemicals from Iran will be immediately subject to secondary sanctions. - US EIA- Nat Gas, Change Bcf w/e 107.0bcf vs. Exp. 107.0bcf (Prev. 88.0bcf).

-

Qatar Energy is in talks with Japanese LNG importers for a large, long-term supply deal, according to sources via Reuters. -

China is to seek renegotiated terms on its Venezuela oil contracts, according to Bloomberg.

GEOPOLITICAL

MIDDLE EAST

-

Israeli Prime Minister Netanyahu will hold a meeting with the Defence Minister, the Chief of Staff, and senior security officials to discuss expanding operations in Gaza, according to Amichai Stein on X. - Iran said US sanctions are not helping diplomacy but added that it will continue to engage in a result-oriented negotiation with the US.

-

Oman’s Foreign Minister said they are rescheduling the US-Iran meeting provisionally planned for May 3rd for logistical reasons. This follows reports that the fourth round of US-Iran talks which was set to take place in Rome this Saturday is likely to be postponed for next week, while the E3 meeting with Iran planned for Friday in Rome might also be postponed, according to sources cited by Axios.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said Ukraine is interested in ratifying the minerals deal with the US ASAP and said the deal is "indeed equal agreement" with the US.

01 May 2025 - 22:47- EquitiesData- Source: Newsquawk

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts