Newsquawk Daily Asia-Pac Opening News - 27th August 2025

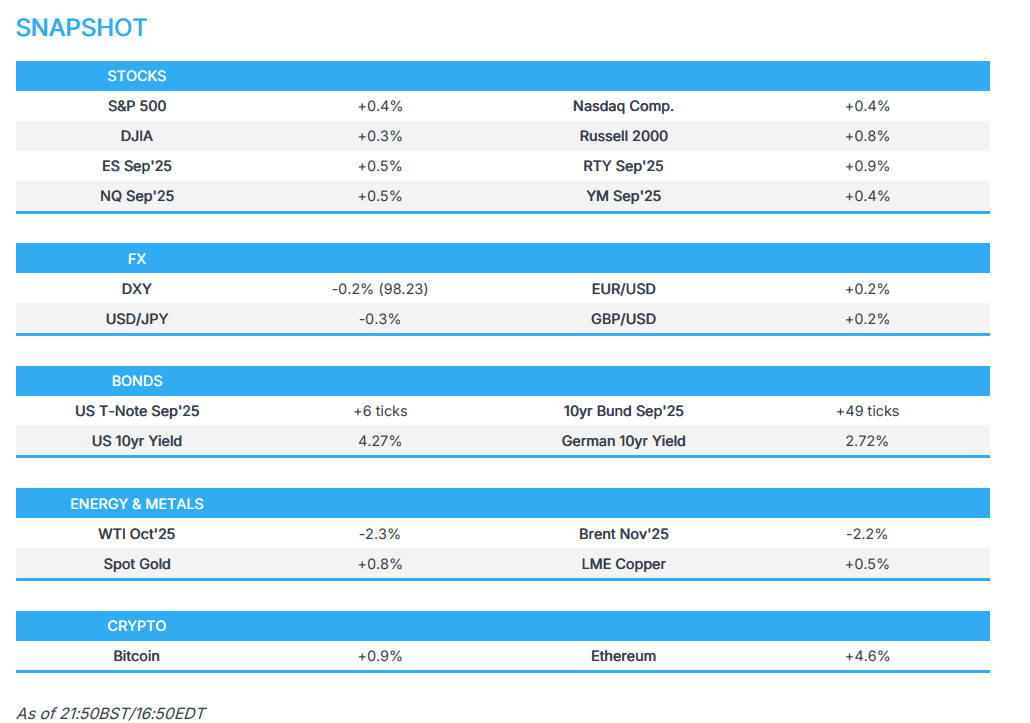

- US stocks closed higher with outperformance in Industrials, Financials and Tech, while Consumer Staples, Real Estate and Communication lagged, although there was a bout of choppiness in late trade ahead of a last-minute rally as the MSCI August 2025 Index review balance took effect, which might explain some of the volatility. Nonetheless, focus was largely on Trump vs the Fed after the US President announced he is firing Cook, albeit she refused and will challenge the decision by Trump. This saw the Dollar sold and the Treasury curve steepen on prospects of a more dovish Fed, which benefited low-yielding currencies like the Franc and Yen.

- USD was softer on the day amid ongoing Fed independence concerns after President Trump moved to fire Fed Governor Cook who will be challenging the attempt in court, while price action was contained amid summer trading conditions and a slew of data including better-than-expected Consumer Confidence and Durable Goods.

- Looking ahead, highlights include Australian MI Leading Index, Monthly CPI & Construction Work Done, Chinese Industrial Profits, Supply from Australia, Holiday Closure in India.

LOOKING AHEAD

- Highlights include Australian MI Leading Index, Monthly CPI & Construction Work Done, Chinese Industrial Profits, Supply from Australia, Holiday Closure in India.

- Click for the Newsquawk Week Ahead.

US TRADE

-

US stocks closed higher with outperformance in Industrials, Financials and Tech, while Consumer Staples, Real Estate and Communication lagged, although there was a bout of choppiness in late trade ahead of a last-minute rally as the MSCI August 2025 Index review balance took effect, which might explain some of the volatility. Nonetheless, focus was largely on Trump vs the Fed after the US President announced he is firing Cook, albeit she refused and will challenge the decision by Trump. This saw the Dollar sold and the Treasury curve steepen on prospects of a more dovish Fed, which benefited low-yielding currencies like the Franc and Yen. -

SPX +0.40% at 6,465, NDX +0.43% at 23,525, DJI +0.30% at 45,418, RUT +0.81% at 2,358. - Click here for a detailed summary.

TARIFFS/TRADE

-

US President Trump said the furniture tariff will be done pretty quickly and will be very substantial, while Trump said the EU, Japan and South Korea trade deals are done and that they kept the same deal with South Korea. It was separately reported that Trump said he is getting on very well with China and President Xi. -

Chinese Premier Li said China will promote high-quality development of service trade, and should actively expand quality service imports, while he added they must create a favourable environment for service imports and will promote the opening up of trade in services. China will also promote exports of services in emerging areas and the orderly cross-border flow of data.

NOTABLE HEADLINES

-

Fed Discount Rate Minutes stated that Federal Reserve Bank directors noted stable economic conditions, but most also cited concerns about the economic impact of tariffs and about the potential effects of recent legislative changes, especially on the healthcare sector. Some directors observed that despite continuing uncertainty, customers and businesses were cautiously proceeding with investments or other projects, and several directors noted increased pass-through of tariff-related import costs, while comments on labour market conditions were mixed, with some directors noting signs of softening in hiring and others reporting steady activity and resilience. - Fed's Barkin (2027 voter) warned US workforce growth is basically zero without immigration, while he also commented that his forecast is for a modest adjustment in interest rates, given what he expects will be little variation in economic activity over the remainder of the year but noted the forecast could change.

-

Fed spokesperson said Congress, through the Federal Reserve Act, directs that governors serve in long, fixed terms and may be removed by the President only “for cause", while long tenures and removal protections for governors serve as a vital safeguard, ensuring that monetary policy decisions are based on data, economic analysis, and the long-term interests of the American people. The spokesperson added the Federal Reserve will continue to carry out its duties as established by law and Lisa Cook has indicated through her personal attorney that she will promptly challenge this action in court. - Lawyers for Fed Governor Cook said they will file a lawsuit challenging the attempted firing by US President Trump.

-

US President Trump said if Powell gets out quickly, they will have a majority shortly on the Fed and might switch Miran to another longer-term Fed spot, while he added that interest rates must come down for housing costs. Trump said regarding the Fed statement on Cook, that he will abide by the courts, while he earlier commented that they have good people for Fed's Cook replacement and have somebody in mind. -

US President Trump is considering quickly announcing a nominee to replace Fed Governor Cook with former World Bank President Malpass a potential candidate, according to WSJ citing sources. -

The Trump administration is reviewing options for exerting more influence over the Federal Reserve’s 12 regional banks that would potentially extend its reach beyond personnel appointments in Washington, according to Bloomberg citing sources. -

US Treasury Secretary Bessent said Fed independence comes from a political arrangement and public trust is the only thing giving the Fed credibility. Bessent added we'll see a bigger capex boom from here and the Treasury is taking in record tariff revenues. -

US Commerce Secretary Lutnick said the Pentagon is thinking about taking equity stakes in defence contractors, according to CNBC. - Atlanta Fed GDPnow (Q3) revised down to 2.2% (prev. 2.3%)

DATA RECAP

- US Consumer Confidence (Aug) 97.4 vs. Exp. 96.2 (Prev. 97.2, Rev. 98.7)

- US Durable Goods (Jul) -2.8% vs. Exp. -4.0% (Prev. -9.4%)

- US Durables Ex-Transport (Jul) 1.1% vs. Exp. 0.2% (Prev. 0.2%, Rev. 0.3%)

- US Rich Fed Comp. Index (Aug) -7.0 (Prev. -20.0)

- US Rich Fed Mfg Shipments (Aug) -5.0 (Prev. -18.0)

- US Rich Fed, Services Index (Aug) 4.0 (Prev. 2.0)

- US CaseShiller 20 MM SA (Jun) -0.3% vs. Exp. -0.2% (Prev. -0.3%)

- US CaseShiller 20 YY NSA (Jun) 2.1% vs. Exp. 2.1% (Prev. 2.8%)

- US Monthly Home Price MM (Jun) -0.2% (Prev. -0.2%, Rev. -0.1%)

- US Monthly Home Price YY (Jun) 2.6% (Prev. 2.8%, Rev. 2.9%)

FX

-

USD was softer on the day amid ongoing Fed independence concerns after President Trump moved to fire Fed Governor Cook who will be challenging the attempt in court, while price action was contained amid summer trading conditions and a slew of data including better-than-expected Consumer Confidence and Durable Goods. -

EUR marginally benefitted from the slight dollar weakness but upside capped amid a lack of fresh catalysts from the bloc and political uncertainty in France. -

GBP eked modest gains, while there were comments from BoE hawk Mann who noted that a more persistent hold on the Bank Rate is appropriate right now. -

JPY was ultimately firmer albeit with price action choppy with USD/JPY fluctuating in the aftermath of the recent Fed-related headlines. -

BoC Governor Macklem said the Bank will not revisit its 2% inflation target for the monetary policy framework review next year. Macklem also stated that steep new US tariffs and the unpredictability of US policy have reduced economic efficiency and increased uncertainty, as well as noted that headwinds that limit supply could mean more upward pressure on inflation going forward.

FIXED INCOME

-

T-notes settled higher and the curve steepened after President Trump moved to fire Fed Governor Cook although questions remain on whether it is a legal move.

COMMODITIES

-

Oil prices declined throughout the US session amid potential profit taking on a lack of headline drivers, while there were comments from US President Trump who thinks oil will fall beneath the USD 60/bbl level soon. - US President Trump thinks oil prices will break below USD 60/bbl soon.

-

Russia hiked its August oil export plan by 0.2mln BPD amid refinery outages, while Russian oil export planning is uncertain due to ongoing drone strikes and repair works, according to sources cited by Reuters.

GEOPOLITICAL

MIDDLE EAST

- US envoy Witkoff said they are negotiating multiple entries into peace accords with Israel.

-

Geneva E3/EU-Iran meeting is said to have produced no conclusive result, while Iran was understood to have put some promises on the table, but they lacked detail and substance, according to WSJ's Norman. -

IAEA inspectors are back in Iran and awaiting green light from the Supreme National Security Council to resume their work, according to Amwaj media.

RUSSIA-UKRAINE

- US President Trump said he is talking about economic sanctions on Russia if there is no ceasefire.

-

US said it is prepared to provide intelligence assets and battlefield oversight to any Western security blanket for post-war Ukraine and take part in a European-led air defence shield for the country, according to FT citing EU and Ukraine officials.

ASIA-PAC

NOTABLE HEADLINES

- China's State Council issued guidelines for deep implementation of AI-plus initiatives, targeting full integration by 2027, with China to strengthen financial and fiscal support for the AI sector, fostering long-term strategic investment.

-

China’s NPC Standing Committee will hold a meeting in Beijing on September 8th-12th, according to Xinhua. -

Japanese Industry Ministry proposed a 5-year corporate tax cut scheme starting FY26 to boost domestic investment, according to Kyodo.

EU/UK

NOTABLE HEADLINES

-

BoE's Mann said research shows increased persistence in inflation but also shows a weak growth outlook, and the combination of the two makes the policymaker's job harder. Mann views that the BoE scenario outlining upside risks to inflation through inflation persistence is playing out and stated downside risk to the demand scenario remains, but is not her central case.

26 Aug 2025 - 22:33- ForexAsian Research- Source: Newswires

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts