Newsquawk Daily Asia-Pac Opening News - 23rd June 2025

- US President Trump confirmed the launch of “Operation Midnight Hammer”, which involved targeted strikes on Iranʼs nuclear facilities at Fordow, Natanz, and Isfahan.

- US President Trump warned that “many targets remain,” emphasising that the US had no desire for regime change but threatened larger future strikes if Iran failed to engage diplomatically.

- The Iranian parliament has approved the closure of the Strait of Hormuz after the US launched strikes against the countryʼs nuclear facilities. Iranʼs security body will make the final decision on whether to proceed with the plan, state television reported.

- Iranian regime sources denied any major nuclear material loss from the strikes, implying the sites had been preemptively evacuated. Iranian officials have warned that future actions could target over 20 US bases or naval assets in the region.

- IAEA Director General Rafael Grossi said craters are visible at Fordow, Natanz suffered direct hits, and tunnel entrances at Isfahan were struck. Full underground damage assessment remains pending. A special IAEA board meeting is scheduled for Monday.

- Looking ahead, highlights include Australian PMI, Japanese PMI, Supply from Australia.

SNAPSHOT

US TRADE

-

US stocks saw choppy trade amid quad-witching as participants returned from the Juneteenth market holiday, but ultimately closed lower on Friday amid fluid geopolitics alongside two notable trade updates: 1) WSJ reporting US prepares action targeting allies' chip plants in China, 2) Japan scraps US meeting after Washington demands more defence spending, via FT. -

Sectors saw mixed performance, with Energy, Staples, and Utilities gaining, while Communications and Materials saw losses. -

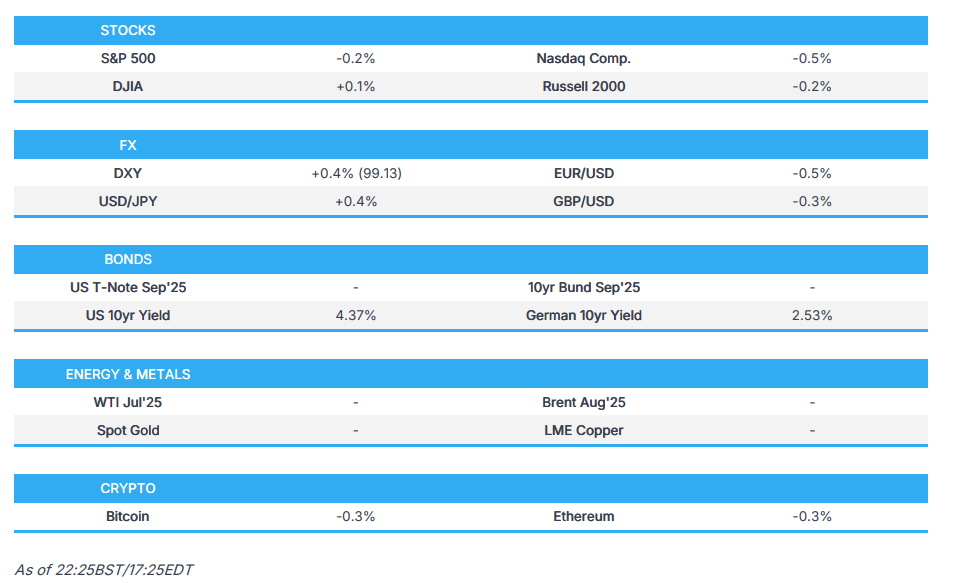

SPX -0.22% at 5,968, NDX -0.43% at 21,626, DJI +0.08% at 42,207, RUT -0.17% at 2,109 - Click here for a detailed summary.

ISRAEL-IRAN - Weekend Updates

US Strikes on Iran

-

US President Trump confirmed the launch of “Operation Midnight Hammer”, which involved targeted strikes on Iran’s nuclear facilities at Fordow, Natanz, and Isfahan. The operation used 125 aircraft, including seven B-2 bombers, alongside submarine-launched Tomahawk cruise missiles. - Fourteen GBU-57 Massive Ordnance Penetrators ("bunker busters") were deployed to penetrate deeply buried targets, notably Fordow.

-

All targets were reportedly struck between 23:40 BST (Saturday) and 00:05 BST (Sunday). Iran’s air defence systems failed to detect or intercept the incoming attacks. - Satellite imagery confirmed significant infrastructure damage at all three nuclear sites, with Fordo showing six fresh craters.

-

The IAEA reported no signs of a radiation leak. Saudi Arabia’s Nuclear and Radiological Regulatory Authority confirmed no radioactive effects were detected in Gulf states. - US President Trump warned that “many targets remain,” emphasising that the US had no desire for regime change but threatened larger future strikes if Iran failed to engage diplomatically.

-

Trump described the attack as a joint effort with Israel, saying they “worked as a team like perhaps no team has ever worked before.” -

US Secretary of State Rubio urged Iran to surrender its enriched uranium stockpiles, claiming they remain buried under Isfahan and likely were not moved before the strikes. - IAEA Director General Rafael Grossi said craters are visible at Fordow, Natanz suffered direct hits, and tunnel entrances at Isfahan were struck. Full underground damage assessment remains pending. A special IAEA board meeting is scheduled for Monday.

- Chairman of the Joint Chiefs Gen. Dan Caine stated it is “too early” to assess whether Iran’s nuclear capability was fully neutralised.

- US intelligence officials have raised concerns Iran may have relocated enriched uranium stockpiles in advance.

-

US President Trump posted on Sunday "The damage to the Nuclear sites in Iran is said to be “monumental.” The hits were hard and accurate. Great skill was shown by our military. ", he later posted " if the current Iranian Regime is unable to MAKE IRAN GREAT AGAIN, why wouldn’t there be a Regime change", and that "The GREAT B-2 pilots have just landed, safely, in Missouri."

Strait of Hormuz

- The Iranian parliament has approved the closure of the Strait of Hormuz after the US launched strikes against the country’s nuclear facilities. Iran’s security body will make the final decision on whether to proceed with the plan, state television reported.

-

US Secretary of State Rubio warned such a move would be “economic suicide” for Iran but remains a credible escalation vector. -

NOTE: Market contacts have suggested OPEC+ have not had any calls, with no talks of an emergeny meeting yet amid no signs of supply disruptions, yet.

Iranian Rhetoric

- Iran launched retaliatory missile strikes on Tel Aviv and Haifa, Israel, resulting in at least 86 reported injuries.

- Iranian officials have warned that future actions could target over 20 US bases or naval assets in the region.

- Iranian regime sources denied any major nuclear material loss from the strikes, implying the sites had been preemptively evacuated.

-

Iran’s Crisis Management HQ stated there was “no danger” to civilians near Fordow; state media reported the site had “long been evacuated.” - Iran’s President Pezeshkian warned of a “more devastating” retaliation if Israel’s bombing campaign continued.

- Supreme Leader Khamenei warned that US strikes would “result in irreparable damage” to the US.

- Iran’s Foreign Minister condemned the strikes as a violation of international law and the Nuclear Non-Proliferation Treaty.

-

The Iranian Atomic Energy Organisation called the attacks “a barbaric act” breaching international law. - A Yemeni Houthi official warned retaliation for the US attack was “only a matter of time.”

-

Hezbollah condemned the US strikes, calling them a violation of international and humanitarian law, and warned the conflict could spiral globally. - An adviser to Khamenei claimed Iran still retains its enriched uranium, indigenous nuclear knowledge, and political will, despite facility damage.

-

Iranian forces reported that Israeli airstrikes killed nine personnel — seven Revolutionary Guards and two conscripts — in Yazd province. - Iranian air defences reportedly activated in Isfahan, targeting hostile Israeli aircraft.

-

Iranian Foreign Minister Araghchi arrived in Moscow to consult with President Putin. Russia condemned the US strikes as a “flagrant violation of international law.”

Global Reactions

-

Congressional response to the strikes was mixed. Most Republicans expressed support, with Senator Ted Cruz praising the operation. However, some dissent emerged within the party, notably from Representative Marjorie Taylor Greene, who stated, “Not our fight.” Democrats strongly criticised the move; Senator Bernie Sanders labelled it “grossly unconstitutional” and accused President Trump of bypassing Congress. -

UK PM Keir Starmer backed the US strike, describing it as a response to a “grave threat.” -

The UN and EU called for de-escalation, with Secretary-General António Guterres warning of a “dangerous escalation.” -

Saudi Arabia, Oman, and India expressed concern and urged all sides to pursue diplomatic solutions. -

Israeli PM Netanyahu praised the US action, calling it a display of “awesome and righteous might” that could “change history.” -

The UN Security Council held an emergency meeting at 20:00 BST on Sunday in response to the strikes. US Ambassador Dorothy Shea defended the operation; China, Russia, and Pakistan called for an immediate ceasefire and accused the US of breaching the UN Charter. -

Gulf Arab states including Qatar, Saudi Arabia, and Kuwait condemned the US strikes, calling for restraint and diplomatic resolution. - The E3 (UK, France, Germany) released a joint statement urging Iran to return to nuclear negotiations and warning against further destabilising actions.

US Domestic Security

-

The US is on high alert for Iranian-backed terrorist attacks, especially in the 48 hours following the strike. FBI, DHS, and local law enforcement have increased security presence at places of worship in major cities including New York and Washington, DC. - The White House is monitoring potential Iranian sleeper cells inside the US.

-

DHS warned of a heightened domestic threat environment, including potential for cyberattacks or lone-wolf incidents inspired by religious rulings. -

VP Vance stated the administration is watching known terror watch list individuals who entered during the Biden era.

TRADE/TARIFFS

-

EU Economy Commissioner Dombrovskis said the EU was ready to take measures with the US if a solution could not be found, but noted that progress was being made in trade talks with Washington, according to Reuters. -

The Chinese Commerce Ministry said its Minister had held a video meeting with the EU Trade Commissioner on Thursday, during which they had held “in‑depth” talks on remedy cases such as electric vehicles, according to an official statement. -

Japan scrapped a planned US meeting after Washington demanded higher defence spending, according to FT sources on Friday. US Secretary of State Rubio and Defence Secretary Hegseth had been scheduled to meet Japan’s Defence Minister Nakatani and Foreign Minister Iwaya in Washington on 1 July. Tokyo cancelled the meeting after the US requested Japan raise its defence spending target to 3.5%, up from an earlier request of 3%. -

US President Trump said on Friday that it looks like the US would make trade deals with India and Pakistan, according to Reuters.

CENTRAL BANKS

-

BoE's Governor Bailey said "we are living in a world of much larger economic shocks which have their origins outside economic causes". -

Fed's Waller (voter) said central banks should look through tariff effects on inflation; the Fed is in position as early as July for cuts, via CNBC; The Fed has room to bring rates down and then can see what happens with inflation. The process should start slow to be sure there are no surprises and if there is a shock the Fed could pause. So far the data has been fine, with no reason to wait much longer to cut. Fed should not wait for job market to crash in order to cut rates. Don't want to wait for job market to tank before cutting rates. Tariffs will not be completely passed through, and a 10% tariff on all imports would not have much impact on overall inflation. -

Fed's Barkin (2027 voter) on Friday said he sees no rush to cut interest rates and is not ready to dismiss the inflation risk from tariffs. He stated that a spike in inflation could not be ignored if it occurred, noting that price indices remained above target. He added that there was nothing urgent in the data warranting a rate cut at this point, with the job market and consumption holding up. Barkin said firms expected to raise prices later in the year as more expensive imported goods worked into inventories. Even firms not directly impacted by tariffs see confusion over trade policy as an opportunity to raise prices for other reasons. He acknowledged having no conviction on where trade policy would ultimately settle or how it would affect prices and jobs. He added that firms remain in a wait-and-see mode on capital spending and hiring plans, according to Reuters. -

Fed’s Daly (2027 voter) on Friday said things were balanced and suggested looking more to the fall, rather than July, for a possible rate cut, in a CNBC interview. She stated that the economy and policy are currently in a good place, and concerns about tariffs on inflation were not as large as when they were first announced. Daly noted it was great news that inflation continued to decline. She said that without tariffs, the Fed would be considering rate normalisation, but they needed to continue monitoring policies going forward. There were many possibilities regarding how much of the tariffs would pass through to consumers. Daly said the fundamentals of the economy were moving to a point where an interest rate cut might become necessary. It was possible, she added, that they could get a meaningful impact on inflation—or that tariffs might not impact inflation as much as feared. She mentioned CEOs had shown cautious optimism on tariffs. Unless the labour market falters, she reiterated, the fall looked more appropriate for a rate cut. She concluded that there was a lot to be said for the view that tariffs would have a one-time effect on inflation, but it was too early to make that call now. -

The Fed’s monetary policy report stated that inflation is somewhat elevated and the job market remained in solid shape. It noted some early signs that tariffs were pushing up inflation, though it is still too early to assess the full impact of tariffs on the economy, and the effects had yet to appear in official data. The report said current Fed policy is well positioned for what lay ahead, and that financial stability remained resilient amid heightened uncertainty. It also highlighted a broad-based decline in the dollar’s foreign exchange value. Tariffs were said to have weighed on both household and business sentiment, with the slow start to 2025 attributed to tariff-related adjustments. In early April, Treasury market functioning remained orderly, but liquidity had fallen to levels last seen in early 2023. Liquidity had also materially deteriorated in equity, corporate bond, and municipal bond markets. While liquidity had improved since then, the report concluded that conditions remained highly responsive to developments in trade policy, according to Reuters.

NORTH AMERICAN DATA RECAP

- US Philly Fed Business Index (Jun) -4.0 vs. Exp. -1.0 (Prev. -4.0)

- Canadian Retail Sales MM (Apr) 0.3% vs. Exp. 0.5% (Prev. 0.8%); Ex-Autos MM (Apr) -0.3% vs. Exp. 0.2% (Prev. -0.7%, Rev. -0.8%)

- US Leading Index Chg MM (May) -0.1% vs. Exp. -0.1% (Prev. -1.0%, Rev. -1.4%)

COMMODITIES

-

The EU dropped its proposal to lower the price cap on Russian oil to USD 45, according to Bloomberg. -

Baker Hughes Rig Count: Oil -1 at 438, Natgas -2 at 111, Total -1 at 554. -

Russian President Putin on Friday said OPEC+ is increasing oil output gradually. He noted that the situation in the Middle East had led to an increase in oil prices, but the rise was not significant. He added that there was no need for OPEC+ to intervene yet, according to Reuters. -

The LME determined that it was appropriate, under current circumstances, to amend existing lending rules by introducing "front month lending rules". It had been closely monitoring large positions across multiple contracts in recent months. The exchange stated that these changes to the lending rules were temporary and would be reviewed as appropriate by the special committee, according to Reuters.

GEOPOLITICAL

ISRAEL-IRAN - Friday Headlines

-

A top general said the IDF is prepared for a prolonged campaign, according to Bloomberg. -

Iran’s Presidential Spokesman said Iran would not stop uranium enrichment for peaceful purposes, but that concessions were possible, according to CNN. -

US President Trump presided over a national security meeting on Iran at the White House, according to Reuters citing a US official. US Envoy Witkoff was in regular contact with the Iranians and was also engaging with Qatar as an intermediary. -

No progress had been made with the Iranians in the Geneva talks, according to Sky News Arabia citing Israel Hayom and a US diplomatic source. -

In a statement following talks with Iran, the E3/EU foreign ministers expressed their view that all sides should refrain from taking steps that could lead to further escalation in the region. They reiterated longstanding concerns about Iran’s expansion of its nuclear programme, stating it had no credible civilian purpose, and urged the pursuit of a negotiated solution to ensure that Iran never obtained or acquired a nuclear weapon. The ministers expressed willingness to meet again in the future, shared their support for continued discussions, and welcomed ongoing US efforts to seek a negotiated solution, according to Reuters. -

Iran's Foreign Minister said Iran saw a serious and respectful discussion taking place on Friday eith E3 and EU, and was ready to consider diplomacy once again. He stated that Iran was prepared to return to diplomatic talks as soon as Israel stopped its attacks, and that Iran would continue to exercise its legitimate right to self-defence. He added that Iran supported continued discussions with the E3 and the EU and was prepared to meet again in the near future. He reaffirmed that Iran’s nuclear programme was peaceful and monitored by the IAEA, and made it clear that Iran’s defence capabilities were not negotiable, according to Reuters. -

WSJ's Norman said the talks had clearly involved substantive discussions. The Europeans raised and discussed a range of issues and had definitely tried to float ideas aimed at moving the nuclear talks forward. However, fundamentally, there was no progress. He added that a meeting between Iran’s Foreign Minister and US Envoy Witkoff appeared no closer. Iran gave no indication that it was more willing to consider zero enrichment than before. While all parties were aware of the timeline, no date had been set for a follow-up meeting between Europe and Iran.

RUSSIA-UKRAINE

-

Russia's Kremlin said dialogue with Ukraine continues expect to agree next week on a date for the next round of talks Ukraine is unpredictable, continue "special military operation", though would prefer to reach goals by diplomatic needs, according to Reuters. -

US President Trump said on Friday Russia and Ukraine were making progress, according to Reuters.

ASIA-PAC

NOTABLE HEADLINES

-

The US is preparing to take action targeting allies’ chip plants in China, according to WSJ. A top US official told global semiconductor manufacturers that he wanted to revoke the waivers they had been using to access US technology in China.

EUROPE

EUROPEAN DATA RECAP

- EU Consumer Confid. Flash * (Jun) -15.3 vs. Exp. -14.5 (Prev. -15.2)

22 Jun 2025 - 22:30- ForexAsian Research- Source: Newsquawk

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts