Newsquawk Daily Asia-Pac Opening News - 21st July 2025

- US stocks were choppy on Friday, with early upside faded amid mixed sectoral performance. Utilities, Consumer Discretionary and Real Estate outperformed, while Energy, Healthcare and Communication lagged. The focus on Friday was largely on commentary from Fed Governor Waller, who reiterated his call for a 25bps rate cut in July (more below). Meanwhile, US data saw strong housing data while the UoM also impressed, coinciding with easing inflation expectations.

- Exit polls from Japan’s upper house election showed the ruling coalition is likely to lose its majority in the upper house with the LDP and coalition partner Komeito projected to win a combined 32 to 51 seats out of a total of 125 seats contested, according to NHK.

- Looking ahead, highlights include New Zealand CPI, UK Rightmove House Prices, PBoC Loan Prime Rates, Holiday Closure in Japan.

LOOKING AHEAD

- Highlights include New Zealand CPI, UK Rightmove House Prices, PBoC Loan Prime Rates. Holiday Closure in Japan.

- Click for the Newsquawk Week Ahead.

US TRADE

-

US stocks were choppy on Friday, with early upside faded amid mixed sectoral performance. Utilities, Consumer Discretionary and Real Estate outperformed, while Energy, Healthcare and Communication lagged. The focus on Friday was largely on commentary from Fed Governor Waller, who reiterated his call for a 25bps rate cut in July (more below). Meanwhile, US data saw strong housing data while the UoM also impressed, coinciding with easing inflation expectations. -

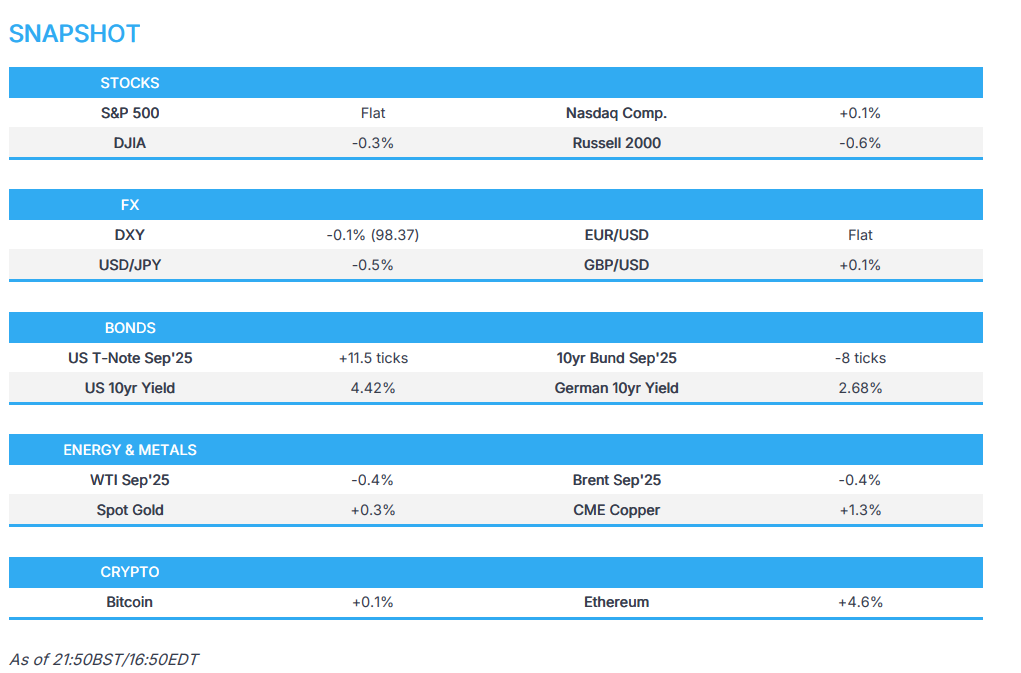

SPX -0.01% at 6,296, NDX -0.07% at 23,065, DJI -0.32% at 44,342, RUT -0.62% at 2,239. - Click here for a detailed summary.

TARIFFS/TRADE

- US Commerce Secretary Lutnick said he is confident they will get a deal done with the EU, while Lutnick said that President Trump is ‘absolutely’ going to renegotiate the USMCA.

-

EU envoys are set to meet as early as this week to formalise a retaliation plan in the event of a possible no-deal scenario with US President Trump, according to Bloomberg. -

US State Department announced visa restrictions on Brazilian judicial officials including Supreme Court Justice Moraes and his allies in court, as well as their immediate family members. It was later reported that Brazilian President Lula said US visa restrictions on Brazilian officials are another arbitrary and baseless move by the US government, while he added that interference by one country in another’s justice system is unacceptable. Furthermore, Lula said this violates the basic principles of respect and sovereignty between nations and no form of intimidation or threat from anyone will undermine Brazil’s powers and institutions' mission to preserve democracy. - Japanese PM Ishiba said he will tackle US tariff issues before the August 1st deadline and they cannot give up the negotiation bases they’ve built through US tariff talks, while he added that tariff negotiator Akazawa is to visit the US on Monday.

- Japanese tariff negotiator Akazawa said he will visit the US next week and they are making arrangements for ministerial-level tariffs talks with the US to take place next week, while he also noted that he did not discuss tariffs with US Treasury Secretary Bessent on Saturday.

NOTABLE HEADLINES

-

US Treasury Secretary Bessent reportedly advised US President Trump not to fire Fed Chair Powell and noted the Fed is already indicating it will cut rates later this year, while Bessent also warned Trump about economic and market risks over firing Powell, according to WSJ. However, US President Trump later posted “The Wall Street Journal ran a typically untruthful story today by saying that Secretary of the Treasury, Scott Bessent, explained to me that firing Jerome “Too Late” Powell, the Worst Federal Reserve Chairman in History, would be bad for the Market. Nobody had to explain that to me. I know better than anybody what’s good for the Market, and what’s good for the U.S.A. If it weren’t for me, the Market wouldn’t be at Record Highs right now, it probably would have CRASHED! So, get your information CORRECT. People don’t explain to me, I explain to them!” -

US President Trump’s administration reviewed SpaceX’s government contracts following the feud between US President Trump and Elon Musk, although officials determined that most SpaceX contracts were critical to Defense Department and NASA missions, according to WSJ.

FX

- Fitch affirmed Canada at AA+; Outlook Stable.

GEOPOLITICAL

MIDDLE EAST

- Iran and three European countries reached an agreement to resume nuclear talks, although no date has been agreed upon yet.

- Israel issued an evacuation order for Deir al-Balah in central Gaza as it prepared to extend a Gaza offensive to areas not yet reached by ground forces.

- Israel’s military said it operated to disperse a violent gathering involving Israeli citizens across the border with Syria.

-

Syrian Presidency announced an immediate and comprehensive ceasefire, while it urged all parties to commit to a ceasefire and end all hostilities in all areas immediately. Furthermore, the Syrian Interior Ministry said the city of Sweida was cleared of Bedouin tribes fighters and clashes were halted after Syrian security forces were deployed to enforce a ceasefire.

RUSSIA-UKRAINE

- Ukrainian President Zelensky said a Russian attack damaged critical infrastructure in the Sumy region, while it was separately reported that Zelensky said Kyiv sent Moscow an offer to hold talks next week.

-

Russian President Putin met with senior advisers to Iran’s Supreme Leader in the Kremlin, according to RIA. - Kremlin spokesman said Russian President Putin repeatedly spoke of his desire to bring the Ukrainian settlement to a peaceful conclusion as soon as possible but it is a long and difficult process, while Russia is ready to move fast on Ukraine peace but the main thing is to achieve the goals which have not changed.

-

Russian Defence Ministry said Russian forces took control of Bila Gora in eastern Ukraine, according to RIA.

ASIA-PAC

NOTABLE HEADLINES

-

Exit polls from Japan’s upper house election showed the ruling coalition is likely to lose its majority in the upper house with the LDP and coalition partner Komeito projected to win a combined 32 to 51 seats out of a total of 125 seats contested, according to NHK. -

Japanese PM Ishiba vowed to stay on despite the exit polls from the election and stated he "solemnly" accepts the "harsh result" but noted his focus was on trade negotiations, according to the BBC. - US President Trump and Chinese President Xi could meet ahead of or during the APEC summit in South Korea.

- China’s Industry Ministry plans a policy to ban new cars from resale in six months after their registration, while BYD and Cherry are among companies that are to hold dealers accountable for violations including the licensing of cars before they are sold.

EU/UK

NOTABLE HEADLINES

-

London Stock Exchange Group (LSEG LN) considers the launch of 24-hour trading, according to FT. -

UK pensions overhaul looms as pension minister Bell warns of a slump in retirement income, while he noted the government would revive the Pensions Commission that heralded sweeping changes under the Blair Labour government in the early 2000s and argued that reforms were only “a job half done”, according to FT. -

EU reportedly cracks down on state meddling in bank M&A as it recently issued warnings last week against meddling by the Italian and Spanish governments in banking tie-ups, according to the FT. -

EU is to force car rental companies to purchase EVs only from 2030, according to Bild.

20 Jul 2025 - 22:45- Fixed IncomeAsian Research- Source: Newswires

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts