Newsquawk Daily Asia-Pac Opening News - 18th December 2025

- US stocks were hit on Wednesday, with the Nasdaq underperforming as the tech sector was sold following reports that Oracle's (ORCL) USD 10bln Michigan data centre deal is in limbo after funding talks with Blue Owl (OWL) stalled, and although Oracle said the equity deal is still on schedule, its shares still slid c. 5%. Meanwhile, chip names were weighed on (NVDA -3.9%, AMD -5.3%) by reports that Chinese researchers completed a working EUV prototype in early 2025 and are targeting 2028 for working chips, adding more competition in the tech space and reducing the need for chips from US companies in China. Furthermore, Google (GOOGL) was reportedly set to collaborate with Meta (META) to expand software support for AI chips, with the project aiming to make TPU run well on PyTorch as an alternative to NVIDIA (NVDA).

- USD marginally gained alongside the early small upticks in US yields albeit with price action contained within a relatively narrow range ahead of US CPI data on Thursday, while there were a couple of Fed speakers including Waller who stated that the Fed is 50bps-100bps over neutral and there is no rush to cut rates given the outlook, but added that they can continue to bring the rate down. Furthermore, there was a previous report from Politico which suggested that Trump officials have privately raised doubts over Hassett being the next Fed Chair and criticised his current effectiveness as NEC Director.

- Looking ahead, highlights include Japanese Weekly Securities Flows, Australian MI Inflation Expectations, US President Trump Addresses the Nation.

LOOKING AHEAD

- Highlights include Japanese Weekly Securities Flows, Australian MI Inflation Expectations, US President Trump Addresses the Nation.

- Click for the Newsquawk Week Ahead.

US TRADE

-

US stocks were hit on Wednesday, with the Nasdaq underperforming as the tech sector was sold following reports that Oracle's (ORCL) USD 10bln Michigan data centre deal is in limbo after funding talks with Blue Owl (OWL) stalled, and although Oracle said the equity deal is still on schedule, its shares still slid c. 5%. Meanwhile, chip names were weighed on (NVDA -3.9%, AMD -5.3%) by reports that Chinese researchers completed a working EUV prototype in early 2025 and are targeting 2028 for working chips, adding more competition in the tech space and reducing the need for chips from US companies in China. Furthermore, Google (GOOGL) was reportedly set to collaborate with Meta (META) to expand software support for AI chips, with the project aiming to make TPU run well on PyTorch as an alternative to NVIDIA (NVDA). -

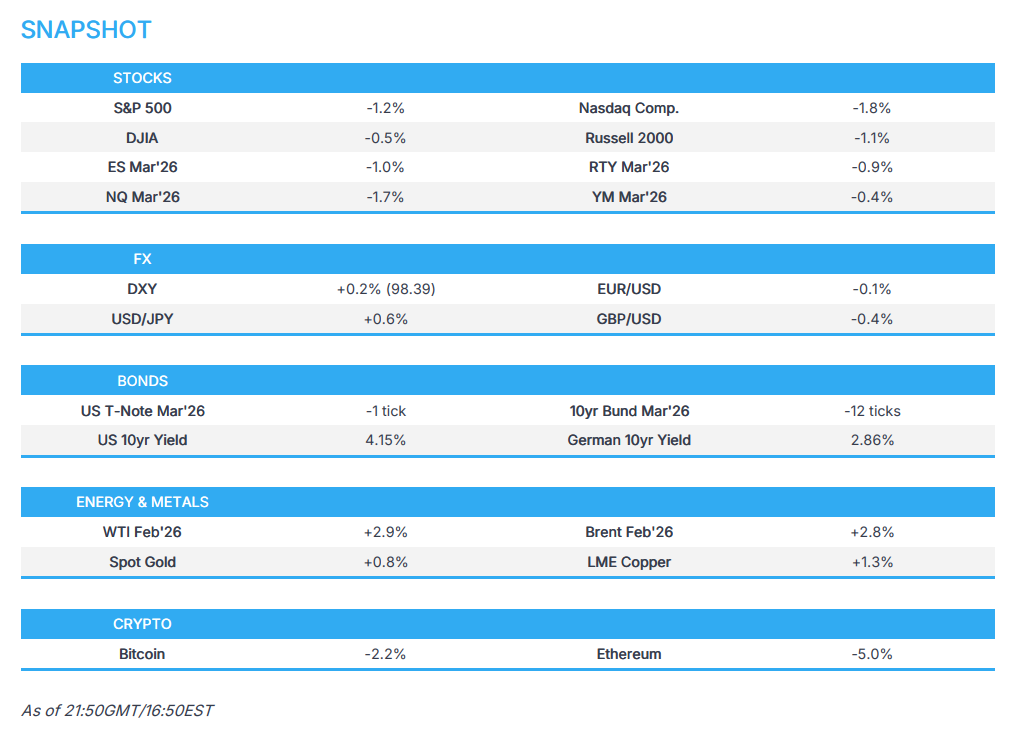

SPX -1.16% at 6,721, NDX -1.93% at 24,648, DJI -0.47% at 47,886, RUT -1.07% at 2,492. - Click here for a detailed summary.

TARIFFS/TRADE

- USTR posted a document on the implementation of certain tariff-related elements of the framework for a Switzerland trade agreement.

- French President Macron said France would strongly oppose any EU move to force a Mercosur deal through, according to a spokesperson. It was also reported that Italian PM Meloni said she is confident conditions for a Mercosur deal can be met early next year, and it would be premature to sign now.

- Brazilian President Lula said if we do not finalise the EU-Mercosur deal right now, Brazil will not sign it as long as he is President, while he added that they gave in on everything they could, and if the EU doesn't approve the trade agreement now, they will be tough on the EU.

NOTABLE HEADLINES

-

Fed's Waller (Voter & Fed Chair Candidate) said the labour market is "very soft" and current payrolls are weak, but noted that 2026 could turn out to be a better year for the economy. Waller said inflation expectations are anchored and that inflation is above target but should come down over the next few months, while he added there will not be a re-acceleration in inflation and that Inflation is under control, with the Fed to keep it under control. Furthermore, he said the Fed is 50bps-100bps over neutral, and there is no rush to cut rates given the outlook, but stated they can continue to bring the rate down, although it is unclear how much support there is for that on the Fed. - Fed's Bostic (2027 voter, retiring) said GDP growth is solid and expects that trend to continue into next year, while it is less clear what will happen on the employment side.

- US Treasury Secretary Bessent said any concern about Hasset is "absurd" and that he, along with the others, would make a good Fed chair.

- US House voted to block the move to consider an ACA healthcare subsidy extension prior to the end of 2025, while the US Senate backed the USD 901bln annual defence policy bill.

-

Oracle's (ORCL) USD 10bln Michigan data centre in limbo after Blue Owl (OWL) funding talks stall, according to FT citing sources. However, Oracle (ORCL) later said the equity deal on the Michigan data centre is still on schedule and that Related Digital chose 'the best equity partner' on the deal.

FX

-

USD marginally gained alongside the early small upticks in US yields albeit with price action contained within a relatively narrow range ahead of US CPI data on Thursday, while there were a couple of Fed speakers including Waller who stated that the Fed is 50bps-100bps over neutral and there is no rush to cut rates given the outlook, but added that they can continue to bring the rate down. Furthermore, there was a previous report from Politico which suggested that Trump officials have privately raised doubts over Hassett being the next Fed Chair and criticised his current effectiveness as NEC Director. -

EUR was little changed with the single currency unreactive to the HICP final readings for November in the morning, which did little to change the expected unchanged outcome from the ECB meeting on Thursday. -

GBP weakened in the aftermath of the softer-than-expected UK CPI data, which solidified the bets for a 25bps rate cut at Thursday's meeting. -

JPY underperformed with the currency reversing the gains from earlier in the week despite the recent mostly better-than-expected data from Japan and expectations of a looming BoJ rate hike.

FIXED INCOME

-

T-notes settled little changed amid commentary from Fed's Waller and following an average 20-year bond auction.

COMMODITIES

-

Oil prices were firmer on Wednesday amid worsening US-Venezuela relations and potential new energy sanctions on Russia from the US. - US EIA Weekly Crude Stocks w/e -1.274M vs. Exp. -1.066M (Prev. -1.812M)

GEOPOLITICAL

MIDDLE EAST

- Israeli PM Netanyahu said he has approved the country's largest ever gas deal with Egypt valued at USD 35bln.

RUSSIA-UKRAINE

- Ukrainian President Zelensky is to attend the EU summit in Brussels on Thursday.

- Ukrainian President Zelensky said Moscow clearly shows it is ready for war in 2026, while he added the US says Russia wants to end the war, but Moscow sends opposite signals. Furthermore, he said the summit in Brussels should show there is no point for Russia to continue the war because Ukraine will have the financial means to defend itself.

-

Russian President Putin said there are calls in the West to prepare for a big war and that the degree of hysteria is increasing, while he added that Russia will liberate its land by military means if Ukraine and its masters ditch dialogue. Putin separately commented that the US administration is ready for talks, and he hopes the same will happen to Europe. - Russian Defence Minister said Europe is dragging out the conflict, meaning that the military action should continue into 2026.

- Russian Kremlin said it is not expecting US envoy Witkoff to come to Moscow this week, and as soon as the US are ready, they will inform Moscow about their talks with Ukraine.

- US and Russia are to hold talks on the Ukraine war in Miami this weekend, according to Politico. US Envoy Witkoff and President Trump’s son-in-law Kushner are to represent the US, while the plans remain in flux, but if they go ahead this weekend, the administration will present the outcome of the most recent round of discussions to Russian officials, who have not shifted much on their demands.

-

US was said to ready new Russian energy sanctions in the scenario that Russia rejects a Ukraine peace deal and could potentially be announced as early as this week, according to Bloomberg sources. However, it was later reported that a White House official said US President Trump has made no decisions regarding new Russian sanctions at this time. - UK PM Starmer said on frozen Russian assets that they are issuing a license to transfer GBP 2.5bln from Chelsea Football Club sales, which have been frozen since 2023.

-

Poland is to start producing anti-personnel mines to lay along the eastern border, which are to be part of 'East Shield' on the border with Belarus and Russia, while other countries in the region are also withdrawing from the 1997 Ottawa Convention, according to Reuters sources. -

Turkish President Erdogan asked Russian President Putin to take back S-400s in a bid to boost US ties, according to Bloomberg.

OTHER

-

Venezuela's Navy are reportedly escorting vessels following the blockade threat, while Washington was aware of escorts and mulls course of action, according to NYT. - Chinese Foreign Minister Wang Yi spoke to his Venezuelan counterpart and said that China opposes all 'unilateral bullying behaviour'.

ASIA-PAC

NOTABLE HEADLINES

-

Chinese researchers are said to have completed a working EUV prototype in early 2025, while the machine has not yet produced working chips, but is targeting 2028 for working chips, according to Reuters sources. - China Vanke (2202 HK) seeks to extend the grace period for its yuan bond due December 28th to 30 trading days and asked to delay interest payments to some lenders.

- Japanese PM Takaichi aims to get cabinet approval for next fiscal year's budget on December 26th, while she stated that the budget is a step towards a strong economy and diplomacy. Furthermore, she said Japan doesn't need fiscal austerity, but proactive spending to boost competitiveness and they are planning to put together a tax reform plan on Friday, December 19th.

EU/UK

NOTABLE HEADLINES

- UK government announced that it is to re-join the EU's Erasmus+ programme in 2027, with the deal including a 30% discount compared to the default terms. UK and the EU have also set a deadline to agree on a food and drink trade deal and carbon markets linkage in 2026. Furthermore, negotiations on the electricity market integration have also been agreed.

- ECB proposed to extend Elderson's term as Vice-Chair of the Supervisory Board.

DATA RECAP

- UK CPI YY (Nov) 3.2% vs. Exp. 3.5% (Prev. 3.6%)

- UK Core CPI YY (Nov) 3.2% vs. Exp. 3.4% (Prev. 3.4%)

- UK CPI Services YY (Nov) 4.40% vs. Exp. 4.50% (Prev. 4.50%)

- German Ifo Current Conditions New (Dec) 85.6 vs. Exp. 85.8 (Prev. 85.6)

- German Ifo Business Climate New (Dec) 87.6 vs. Exp. 88.2 (Prev. 88.1)

- German Ifo Expectations New (Dec) 89.7 vs. Exp. 90.5 (Prev. 90.6)

- EU HICP Final YY (Nov) 2.1% vs. Exp. 2.2% (Prev. 2.2%)

- EU HICP-X F&E Final YY (Nov) 2.4% vs. Exp. 2.4% (Prev. 2.4%)

- EU HICP-X F,E,A&T Final YY (Nov) 2.4% vs. Exp. 2.4% (Prev. 2.4%)

17 Dec 2025 - 22:22- ForexAsian Research- Source: Newswires

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts