Newsquawk Daily Asia-Pac Opening News - 10th December 2024

- US stocks ended the day lower on all major indices, with downside most notably in the NDX (-0.8%) as semiconductor weakness weighed on the tech-heavy index.

- Politburo said China's fiscal policy is to be more proactive next year, and monetary policy is to be moderately loose (prev. prudent), marking the first shift in the stance of monetary policy since 2011.

- USD opened the week on a firmer footing, with gains largely stemming from Yen weakness (higher US yields weighed) and modest EUR downside ahead of the ECB's meeting on Thursday.

- Oil prices complex was firmer to start the week with benchmarks buoyed by a couple of factors, namely the Chinese Politburo and geopolitical uncertainty in the Middle Eastern region after Syrian fighters toppled the Assad regime.

- Looking ahead, highlights include RBA Announcement, RBA Press Conference, Japanese 5-year JGB Auction.

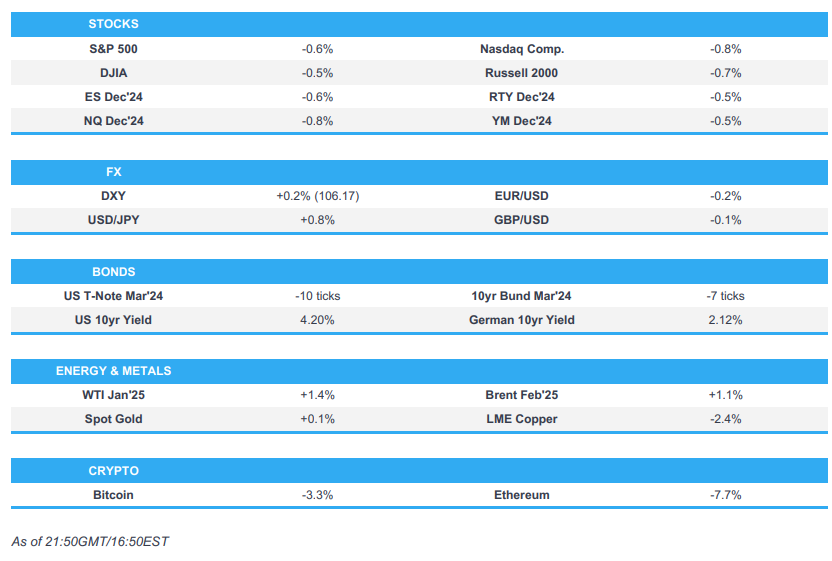

SNAPSHOT

US TRADE

-

US stocks ended the day lower on all major indices, with downside most notably in the NDX (-0.8%) as semiconductor weakness weighed on the tech-heavy index, due to China's regulators opening an investigation into NVIDIA (NVDA, -2.6%) over a violation of anti-monopoly law. - Sectors were mainly in the red, where Utilities and Financials lagged, whereas Healthcare, Real Estate and Materials outperformed.

-

SPX -0.61% at 6,053, NDX -0.84% at 21,441, DJIA -0.54% at 44,402, RUT -0.67% at 2,393 - Click here for a detailed summary.

NOTABLE HEADLINES

-

NY Fed Survey: Year-ahead inflation expected at 3% (prev. 2.9% in October), three-year ahead expected at 2.6% (prev. 2.5%), and five-year ahead expected at 2.9% (prev. 2.8%). Survey respondents see weaker year-ahead gas, rent, and food costs. November year-ahead expected home price gain steady at 3%. Respondents who are expecting better year-ahead financial situation at highest level since February 2020. Respondents 'sharply' cut expectations of future government borrowing levels. November current household financial situation perceptions steady. Respondents expect higher interest rates on savings accounts next year. (Newswires) -

Oracle Corp (ORCL) Q3 2024 (USD): Adj. EPS 1.47 (exp. 1.48), Revenue 14.06bln (exp. 14.12bln). Cloud revenue (IaaS plus SaaS) 5.9bln (exp. 6bln). Cloud Infrastructure revenue (IaaS) 2.4bln (exp. 2.42bln). Cloud Infrastructure revenue (IaaS) in constant currency +52% (exp. +50.9%). Cloud Application revenue (SaaS) 3.5bln (exp. 3.58bln). Cloud Application revenue (SaaS) in constant currency +10% (exp. +10.6%). Cloud services and license support revenue 10.81bln, +12% y/y (exp. 10.81bln). Cloud license and on-premise license revenue 1.20bln, +1.4% y/y (exp. 1.17bln). Hardware revenue 728mln, -3.7% y/y (exp. 717.8mln). Service revenue 1.33bln, -2.8% y/y (exp. 1.32bln). Adj. operating income 6.10bln, +10% y/y (exp. 6.13bln). Adj. operating margin 43% vs. 43% y/y (exp. 43.3%).

DATA RECAP

- US Wholesale Invt(y), R MM * (Oct) 0.2% vs. Exp. 0.2% (Prev. 0.2%)

- US Wholesale Sales MM * (Oct) -0.1% (Prev. 0.3%, Rev. 0.5%)

- US Employment Trends* (Nov) 109.55 (Prev. 107.66, Rev. 108.25)

FX

-

USD opened the week on a firmer footing, with gains largely stemming from Yen weakness (higher US yields weighed) and modest EUR downside ahead of the ECB's meeting on Thursday. Data releases and Fedspeak were thin to start the week, although, the latest NY Fed SCE saw the 1yr, 3yr, and 5yr inflation expectations rise, as well as respondents who expect a better year-ahead financial situation, hitting the highest level since February 2020 -

EUR incurred modest downside. Direct newsflow was sparse in the space, with EUR awaiting the upcoming ECB meeting (exp. ~83% chance of 25bps cut). However, a steeper-than-expected decline in the EU Sentix index briefly weighed on EUR/USD. -

Antipodes were the beneficiaries of Politburo's commentary, with the risk-on trade allowing AUD/USD to climb above 0.64 to a peak of 0.6471, with the 21DMA (0.6486) approaching on the upside. The Aussie will remain a key focus heading into overnight trade where the RBA is expected to keep the cash rate unchanged at 4.35% (~9% chance of a 25bps cut). -

Yuan was firmer against the Dollar as sentiment rebounded concerning stimulus measures, while the latest CPI metrics were cooler than expectations, and the PPI showed less deflation than was forecasted. The Politburo said China's fiscal policy is to be more proactive next year, and monetary policy is to be moderately loose (prev. prudent), marking the first shift in the stance of monetary policy since 2011; remarks precede the upcoming Central Economic Work Conference later this week, where the leadership will agree on the key economic targets and priorities for next year. -

JPY was weighed on by higher US yields, in addition to the risk-on sentiment filed by China's Politburo, thus, causing USD/JPY to rally above 151,

FIXED INCOME

-

T-notes sold off throughout the session with the curve bear steepening with attention turning to US CPI on Wednesday, as well as the 3, 10 and 30-year supply throughout the week.

COMMODITIES

-

Oil prices complex was firmer to start the week with benchmarks buoyed by a couple of factors, namely the Chinese Politburo and geopolitical uncertainty in the Middle Eastern region after Syrian fighters toppled the Assad regime.

GEOPOLITICAL

MIDDLE EAST

OTHER

-

China is cutting off drone supplies critical to Ukraine war, according to BloombergChina's escalating conflict with the US over trade is now extending to the drones that have become a vital part of Ukraine's defense. Manufacturers in China recently began limiting sales to the US and Europe of key components used to build unmanned aerial vehicles

ASIA-PAC

NOTABLE HEADLINES

-

China's Politburo says next year must seek progress while maintaining stability; China's fiscal policy to be more proactive next year, according to Xinhua. Will enrich and improve policy toolbox. Must stabilise foreign trade and investment. Will step up unconventional counter-cyclical adjustments. Monetary policy is to be moderately loose. To boost consumption forcefully. Will stabilise property and stock markets. -

China Market Regulator open an investigation into NVIDIA (NVDA) over suspected violation of antimonopoly law. -

Huawei suppliers to face further US limits under defence bill; firms with Huawei ties risk exclusion from Pentagon contracts, according to Bloomberg. House measure could put more pressure on Huawei supply chian.

EU/UK

-

EUROPEAN CLOSES: DAX: -0.15% at 20,354, FTSE 100: +0.52% at 8,352, CAC 40: +0.72% at 7,480, Euro Stoxx 50: +0.15% at 4,985, AEX: +0.34% at 895, IBEX 35: -0.50% at 12,012, FTSE MIB: -0.55% at 34,560, SMI: -0.09% at 11,764, PSI: +0.29% at 6,355.

09 Dec 2024 - 21:58- EquitiesData- Source: Newsquawk

Subscribe Now to Newsquawk

Click here for a 1 week free trial

Newsquawk provides audio news and commentary for over 15,000professional traders and brokers worldwide. Services include:

- Real-time audio coverage from 0630 to 2200 London time plus Asia-Pac 2200 to 1000 London time

- Teams of analysts covering equities, fixed income, FX, energy, and metals markets

- Real-time scrolling news service with instant analysis

- Daily and weekly pre-market research and calendars

- Video updates covering near-term key risk events & primary trading themes

- One-to-one chat with our expert analysts